This article series aims at evaluating ETFs (exchange-traded funds) regarding the relative past performance of their strategies and metrics of their current portfolios. Reviews with updated data are posted when necessary.

SLYV strategy and portfolio

SPDR S&P 600 Small Cap Value ETF (NYSEARCA:SLYV) started investing operations on 9/25/2000 and tracks the S&P SmallCap 600 Value Index. It has a portfolio of 463 stocks, an expense ratio of 0.15% and a 12-month distribution yield of 2.14%. Dividends are paid quarterly.

As described by S&P Dow Jones Indices methodology, S&P 600 constituents are categorized based on their value and growth potential, evaluated using three valuation ratios and three growth metrics. The valuation ratios are book value to price, earnings to price and sales to price. By definition, 33% of S&P 600 constituents exclusively belongs to value style, 33% exclusively belongs to growth style and 34% belongs to both styles. The value style subset is considered the S&P 600 Value Index, rebalanced yearly, and is capital-weighted, with an adjustment for constituents belonging to both styles. For instance, a company with a higher value rank than its growth rank is given a higher weight in the Value Index than in the Growth Index

SLYV is cheaper than its parent index, represented hereafter by S&P SmallCap 600 (IJR), regarding usual valuation ratios, as reported in the next table. Nonetheless, the difference is smaller than expected from a fund focused on value.

| SLYV | IJR | |

| Price/Earnings TTM | 11.71 | 13.23 |

| Price/Book | 1.23 | 1.64 |

| Price/Sales | 0.63 | 0.91 |

| Price/Cash Flow | 6.71 | 8.56 |

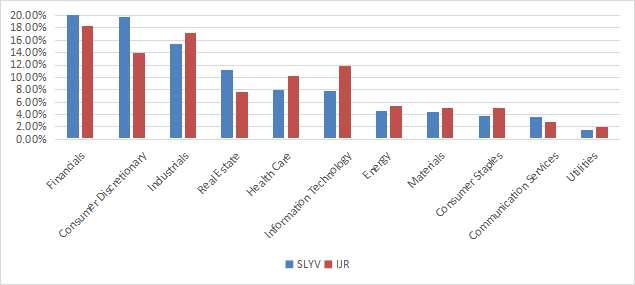

The two heaviest sectors are financials and consumer discretionary, almost on par with 20% and 19.7% of asset value, respectively. They are followed by industrials (15.5%) and real estate (11.3%). Other sectors are below 8%. Compared to the S&P 600 index, SLYV overweights mostly consumer discretionary and real estate, and it significantly underweights technology. Except for these 3 sectors, the value ETF is quite close to its parent index regarding the sector breakdown, as reported on the next chart. It may partly explain why valuation ratios are quite close.

SLYV Sector breakdown (chart: author; data: SSGA and iShares)

The top 10 holdings, listed below with valuation ratios, represent 8% of asset value, and the heaviest position weighs less than 1%. The fund is well-diversified across holdings and risks related to individual companies are very low.

| Ticker | Name | Weight (%) | P/E TTM | P/E fwd | P/Sales TTM | P/Book | P/Net Free Cash Flow | Yield% |

| MTH | Meritage Homes Corp. | 0.94 | 5.64 | 6.32 | 0.70 | 1.02 | 4.68 | 0.88 |

| NSIT | Insight Enterprises, Inc. | 0.91 | 20.00 | 15.25 | 0.55 | 3.41 | 7.74 | 0 |

| DXC | DXC Technology Co. | 0.87 | N/A | 6.41 | 0.31 | 1.32 | 5.85 | 0 |

| RDN | Radian Group Inc. | 0.84 | 6.23 | 7.33 | 3.39 | 0.98 | 17.03 | 3.52 |

| OGN | Organon & Co. | 0.78 | 4.97 | 3.32 | 0.61 | N/A | 25.00 | 7.65 |

| GPI | Group 1 Automotive, Inc. | 0.77 | 5.75 | 5.80 | 0.21 | 1.37 | 45.34 | 0.69 |

| LNC | Lincoln National Corp. | 0.76 | N/A | 3.01 | 0.21 | 0.76 | 5.00 | 8.40 |

| EPRT | Essential Properties Realty Trust, Inc. | 0.73 | 19.04 | 19.17 | 10.50 | 1.25 | N/A | 4.97 |

| BXMT | Blackstone Mortgage Trust, Inc. | 0.73 | 17.61 | 6.85 | 1.77 | 0.78 | 65.51 | 12.28 |

| JBT | John Bean Technologies Corp. | 0.69 | 5.93 | 25.63 | 1.70 | 2.43 | 65.66 | 0.39 |

Performance

Since October 2000, the difference between SLYV and IJR in return and risk metrics is not significant: 18 bps in annualized return, 3.3 percentage points in maximum drawdown and 69 bps in historical volatility (measured as standard deviation of monthly returns). Their risk-adjusted performances are identical (Sharpe Ratio).

| Total Return | Annual Return | Drawdown | Sharpe Ratio | Volatility | |

| SLYV | 527.82% | 8.28% | -61.49% | 0.43 | 20.22% |

| IJR | 551.65% | 8.46% | -58.15% | 0.43 | 19.53% |

The next chart compares SLYV total return in the last 12 months to IJR and 4 small-cap value ETFs:

- iShares Russell 2000 Value ETF (IWN), reviewed here

- Dimensional US Small Cap Value ETF (DFSV), reviewed here

- Vanguard Small-Cap Value Index Fund (VBR)

- Avantis U.S. Small Cap Value ETF (AVUV)

SLYV is lagging its competitors except IWN. It is slightly ahead of the small-cap benchmark IJR, but once again, the difference is hardly significant.

SLYV vs. Competitors, total return in the last 12 months (Seeking Alpha)

Comparing SLYV with my value benchmark

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

The Dashboard List is a list of 80 stocks in the S&P 1500 index, updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. After this filter, the 10 companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: energy with materials and communication with technology. Real estate is excluded because these valuation metrics don't work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares SLYV performance since inception with the Dashboard List model, with a tweak: here the list is reconstituted once a year to make it comparable with a passive index.

| Total Return | Annual Return | Drawdown | Sharpe Ratio | Volatility | |

| SLYV | 527.82% | 8.28% | -61.49% | 0.43 | 20.22% |

| Dashboard List (annual) | 1091.53% | 11.33% | -55.88% | 0.62 | 17.41% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The Dashboard List beats SLYV by 3 percentage points in annualized return and shows a lower risk in drawdown and volatility. A note of caution: ETF performance is real and the list is simulated.

Some fundamental shortcomings

Most value ETFs have two shortcomings in my opinion, and SLYV is no exception. The first one is to classify all stocks on the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously, they are not: my monthly dashboard here shows how 3 median valuation ratios may differ across sectors now and in historical averages. A consequence is to overweight sectors where valuation ratios are naturally cheaper, especially financials. Some other sectors are disadvantaged: those with large intangible assets like technology. Companies with large intangible assets are those with a business model based on massive R&D, or a strong branding, or large user databases, or operating in a field where competition is limited by an expensive entry ticket. All these elements are not correctly reflected by metrics.

I like the idea of combining the size factor with various value metrics like SLYV does. Among them, the price/book ratio (P/B) is the historical value factor from the Fama-French three-factor model. However, historical data show that a large group of companies with low P/B has a higher volatility and deeper drawdowns in price. The next table shows the return and risk metrics of the cheapest 25% of the S&P 500 (i.e. 125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/2000 and 1/1/2023 with elements in equal weight.

| Annual Return | Drawdown | Sharpe Ratio | Volatility | |

| Cheapest 25% in P/B | 8.54% | -81.55% | 0.35 | 37.06% |

| Cheapest 25% in P/E | 10.71% | -73.62% | 0.48 | 25.01% |

| Cheapest 25% in P/S | 12.82% | -76.16% | 0.47 | 34.83% |

| Cheapest 25% in P/FCF | 15.32% | -74.77% | 0.61 | 27.03% |

Data calculated with Portfolio123

This explains why I use P/FCF and not P/B in the Dashboard List model.

Takeaway

SPDR S&P 600 Small Cap Value ETF is invested in over 400 stocks of the S&P 600 index with a tilt to value over growth. The portfolio is well-diversified across sectors and holdings. No sector weighs more than 20% of asset value and no stock weighs more than 1%. The sector breakdown, valuation ratios and historical performance are not much different from the parent index S&P 600. SLYV may be useful in a tactical allocation strategy switching between growth and value styles, or between small and large cap segments, depending on relative strength indicators and market conditions. Nonetheless, it doesn't show significant excess return or risk reduction over the small cap benchmark in its 23-year history. Like most value ETFs, it has two weaknesses: ranking stocks regardless of their industries and relying too much on the price/book ratio.