NetEase (NASDAQ:NTES), originally an early internet company operating a popular domain in the late 90s, today is a sprawling technology company operating in a diverse range of industries. Primarily though, it is a game development company now with almost 80% of the revenue generated by the broader gaming segment. Recent regulatory concerns caused a significant drop in stock price, followed by a recovery which saw all losses erased. The recovery may not be fully justified, but fundamentally the company is doing well and has a broad array of successful games as well as a strong pipeline for the future.

Q4

For the quarter, revenue was up 7% YoY to $3.8 billion, while total revenue for the year also rose 7% to $14.6 billion. The games segment outperformed the average slightly, up 9% annually and Q4 up 10% YoY in terms of revenue, the gains being attributed to the launch of Justice Mobile and continued success of Eggy Party. Youdao, which offers educational and translation focused services, was only up 2% YoY for the quarter, which is related to the ongoing reduction in smart devices sales dating back to Q3 as part of a deliberate strategy to improve profits longer term. The music segment meanwhile experienced a 13% FY revenue decline while profitability improved leading to the first full year net profit, and the innovative businesses and others segment saw a 9% increase for the year.

The Gaming Pipeline

NetEase has a mix of mobile and PC/Console games but the majority of revenue comes from mobile with about 77% of the revenue share. Some of the more successful existing titles the company owns across both mobile and console include popular battle royale Naraka Bladepoint, the popular casual mobile game Eggy Party and MMORPG Fantasy Westward Journey. The pipeline of upcoming titles also holds a lot of promise, with a mobile version of Naraka Bladepoint due around Q2, Where Winds Meet, an open world martial arts game due later this year as well as She Diao Condor Hero, another martial arts game based on a popular Chinese novel.

Another strong option for growth is expansion into the international market which the company is has been undertaking rapidly, developing titles for the international audience and establishing two new international studios recently, World’s Untold and BulletFarm. These studios are working on developing AAA titles, boasting talent behind the Mass Effect and Call of Duty series respectively. If even one of these new studios can develop a hit, it would provide a strong catalyst for growth as well as valuable diversification both into western markets and the PC/console revenue split. Existing western titles include Lord of The Rings: Rise to War and Harry Potter Magic Awakened as well as a couple of Marvel games.

NetEase Q4 earnings

NetEase games span many genres and they are not overly reliant on a single title like some gaming companies nowadays can be, so if the current strategy to further extend into western markets works then the company will prove very attractive to investors looking for a gaming stock with some safety.

Gaming Regulations

In December, NetEase was one of many Chinese stocks rattled by new draft rules announced intended to curb gaming time and spend by consumers. The draft rules targeted things like daily login bonuses, and rewards that incentivised in-game purchases, mechanisms that are fairly ubiquitous in the mobile gaming industry, as well as NetEase’s own games. Since then, there has been apparent backtracking, with one prominent regulator being dismissed and the proposed regulations being removed from the National Press and Publication Administration’s website. Accordingly, the initial dip has since been erased, with the stock currently trading around the same price as before the announcement. However, there remains considerable uncertainty about what the next steps will be and what the final regulations will entail, with some degree of restrictions presumably still likely. The real concern here is that in the medium term more news comes out about pending regulation and causes a renewed selloff.

Alternatively, one reason to think positively about the direction things are headed on the regulatory front is that China has broadly come under some pressure recently by international investors, causing the State Council to release an action plan to drive foreign investment. This is sometimes how things have played out with the CCP in recent years, regulatory pressure ratchets up when the government feels the economy is performing well, and lessens when it is not. From this perspective, although seemingly counterintuitive, Chinese stocks that have regulatory concerns may benefit from Chinese economic woes.

Youdao

Youdao (NYSE:DAO) is a mixed bag in terms of outlook. Providing educational services like an online dictionary, language learning apps and even AI tutors, the subsidiary is both exposed to and utilising the current wave of AI disruption. On one hand, online marketing services grew revenue to a record RMB474.1 million using AI and translation fees attained 100% YoY growth as seen below.

Bill Pang, Q4 call:

Our existing LLM features, particularly AI bots, continue to receive user acclaim, contributing to more than 100% year-on-year growth in the translation substitution fees for three consecutive quarters.

On the other hand, there are compelling reasons to think that both current and future LLM models pose a threat to educational and specifically translation service businesses. LLMs are already almost universally good at translating things, especially in widely spoken languages like English and Chinese. It would be expected then that even non-specialised LLMs being widespread should increase the supply of these types of services (even if suboptimal) at low cost, decreasing the market for these types of companies.

Comparative Valuation

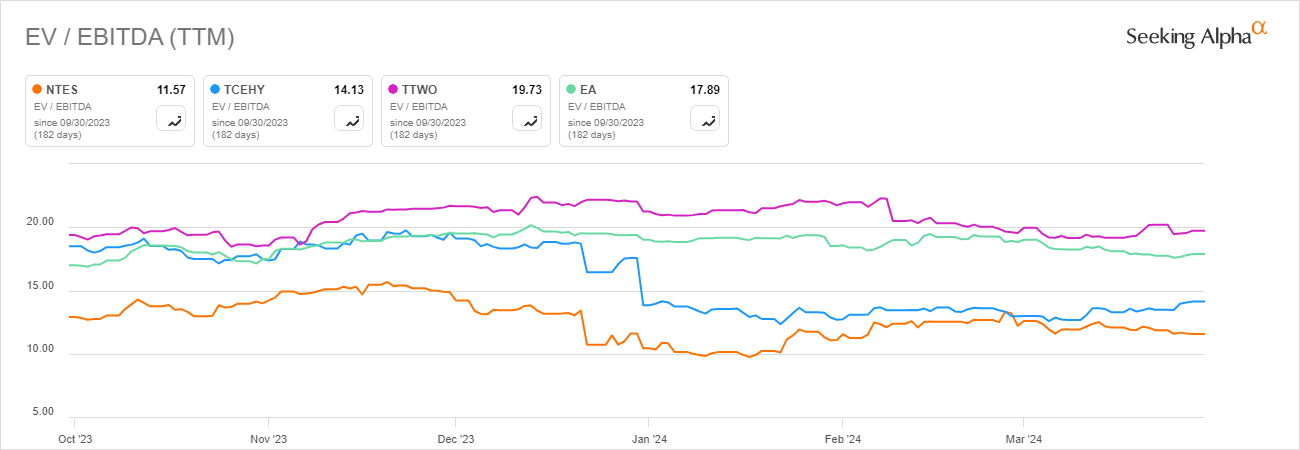

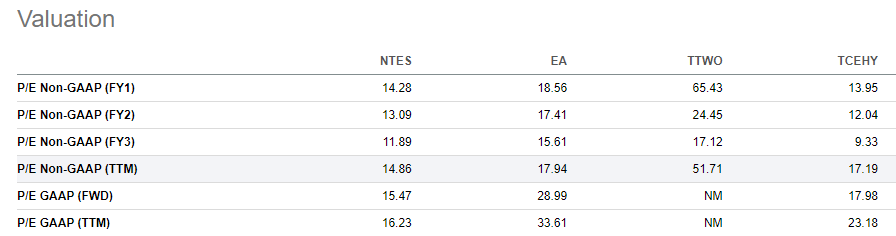

NetEase trades at quite low multiples compared to other gaming companies, as seen below it has an EV/EBITDA of 11.57, lower than the peers selected. Among the group NetEase also has the lowest P/E on both a trailing and forward basis. Of course, the lower valuation of Chinese stocks partially explains this which will likely continue for the foreseeable future.

Seeking Alpha

Seeking Alpha

Risks

First and foremost, as already addressed further regulatory risk is easily the most pressing concern and is enough to heavily weigh on my view at this price.

Failure to further expand into the international gaming market would also be problematic, there are important differences between games that are successful in China compared to the west. Either the new studios abroad could fail, or games that are successful domestically may not be abroad for cultural or other reasons.

The encroachment of AI capabilities on the translation and online learning services that Youdao provides is also an imminent and quite high probability risk, albeit relatively low level given the percentages of total revenue involved.

Conclusion

NetEase has an impressive track record of hit games as well as a very promising line up of upcoming titles, with the potential for much more expansion into western markets. However, the regulatory risk, while seemingly reduced in severity, is by no means erased even though the stock is trading as if it is. This raises questions about entering at this price in my view, in the medium term if there is more of a price correction a re-evaluation may be warranted.