iShares Core MSCI Total International Stock ETF (NASDAQ:IXUS) is an exchange-traded fund that offers exposure to “a broad range of international developed and emerging market companies”, ex-U.S., with a focus on global diversification and cost efficiency. The expense ratio of the fund is 0.09%, as stated in the prospectus. As of January 7, 2022, IXUS had $32.75 billion of assets under management.

It is important to note that IXUS has many holdings; 4,295 as of January 6, 2022. The larger the number of holdings (i.e., the more diversified), the more likely a fund is to track broader indices. In other words, IXUS is more likely to represent a source of “beta” rather than offer “alpha” (or potential for out-performance). Nevertheless, IXUS does not invest in U.S. stocks; it invests abroad, which is an implicit FX hedge, and offers some escape from U.S. markets (most specifically for U.S. investors).

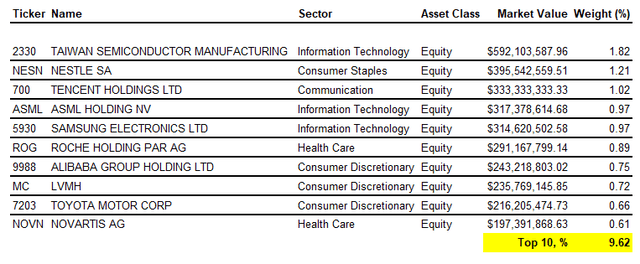

IXUS' benchmark index, the MSCI ACWI ex USA IMI Index (ACWI stands for All Country World Index) had 6,722 constituents as of December 31, 2021. Nevertheless, the largest holdings within IXUS reflect the largest of its chosen benchmark index (whose performance it seeks to replicate). We can therefore safely use the indicative data provided from the most recent factsheet to gauge the valuation of IXUS.

(Produced by the author using data from iShares)

As of December 31, 2021, IXUS' benchmark carried a trailing price/earnings ratio of 16.86x, a forward price/earnings ratio of 14.32x (i.e., a forward earnings yield of 6.98%, which is relatively high), and a price/book ratio of 1.87x (relatively cheap-looking). These figures also imply a forward return on equity of about 13% (forward earnings vs. book value). This is reasonable, although not high (plenty of top U.S. equity funds offer ROEs of more than 20%, but the funds also trade at much higher valuations).

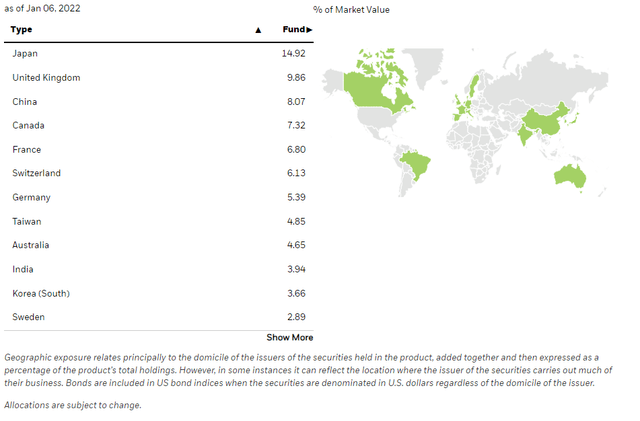

Top geographic exposures include certain markets that are generally less expensive than U.S. markets: Japan and the United Kingdom are, for example, top exposures. Japanese and U.K. stocks are often associated with “value”, due to their cheaper valuations, and under-performance relative to growth stocks.

(iShares)

It is not clear that these markets will rebound, although a tightening of U.S. monetary policy (as expected) in 2022 could put pressure on the discounted cash-flow valuations of tech stocks, thus making ‘value markets' more appealing. In any case, IXUS might be “safer” should monetary policy tightening exceed expectations, and so independent of valuation, IXUS could still represent a reasonable addition to a broader equity portfolio.

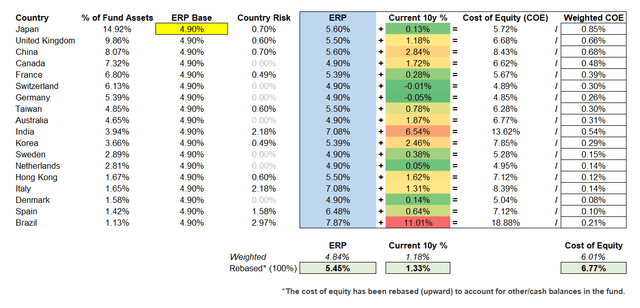

Professor Damodaran recently posted an updated mature market equity risk premium as of January 1, 2022, of 4.90%, as well as updated estimates of country risk premiums, which are important in this case, as we need to produce a weighted cost of equity for IXUS. That is, owing to all the geographic exposures of the fund outside the United States.

(Author's Calculations: ERP data from Professor Damodaran; and government bond yields, as risk-free rates, from World Government Bonds.)

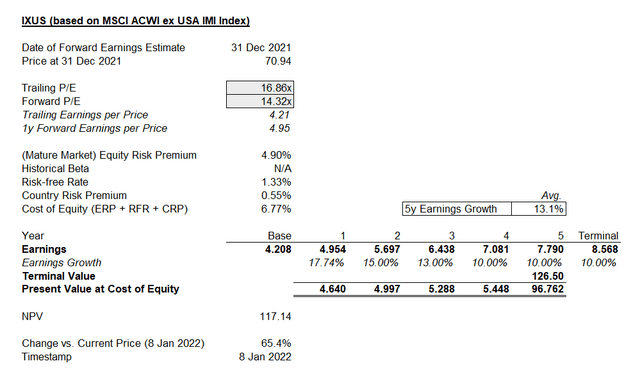

According to my calculations, the fair cost of equity for IXUS is 6.77%. This is the return we should be demanding. In combination with prior data presented, I also defer to Morningstar analyst estimates that indicate the potential for forward three- to five-year average earnings growth rates at 13.89% (as of January 2022). I work this into the short-term valuation gauge below, ultimately coming to an average of about 13.1% to year five.

(Author's Calculations)

Upside of 65% of implied, based on our current cost of equity estimates, which suggests that the fund is undervalued. Put in a more realistic way, it means that implied returns are above 6.77% per year; to solve for fair value, we are looking at returns of approximately 10.78% per annum, if we expect the implied “elevated” risk premium to hold. Alternatively, if the long-run ERP were 6.77% to value terminal year earnings in year five, the implied IRR would be well over 15% based on the same earnings projections.

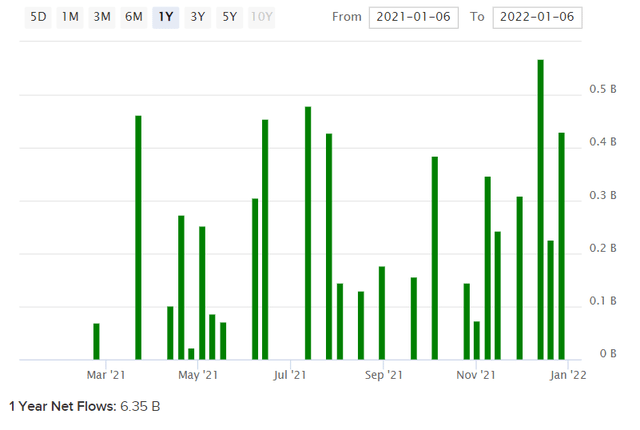

It is safer to assume that flows into international stocks, that seem to be trading at relatively inexpensive valuations, will remain about as steady as in the past. That is, “at best”, given that inflows into IXUS have been strong. Based on the data below, one-year trailing inflows were positive by +6.35 billion USD for IXUS alone.

And yet, the risk premium implicitly seems elevated. I would therefore expect the cost of equity to hold at a higher rate, but the potential for returns of over 10% per year for the next few years is still in prospect. This is also supported by an underlying forward ROE of 13% (i.e., if the price/book ratio were constant, next-year returns would in theory be 13%).

Also, the forward earnings yield of just under 7% at the present market price for IXUS is quite high, considering that the fund-weighted 10-year yield (weighted by geographic exposures) is just 1.33% by my calculations. International stocks actually look pretty cheap, and would seem capable of withstanding higher interest rates globally if other central banks followed suit (post U.S. tightening).

I would remain cautiously bullish on international stocks; given relatively modest underlying returns on equity, a large position is not favorable. But earnings projections and an implicitly reasonable cost of equity would seem to support IXUS' valuation. Given IXUS will tend to correlate with broader markets, this would also help to support a bullish view on equities as an asset class more broadly.