Introduction

It was only a matter of time.

With the two leading cryptocurrencies (Bitcoin (BTC-USD) and Ethereum (ETH-USD)) posting annualized returns exceeding 90%1, investors have taken notice. Today feels like the late 1990s, when investors could get early exposure to the internet. Of course, experienced investors (especially those who lived through the bursting of the technology bubble in the early 2000s) realize such opportunities also come with significant risks. The first month of 2022 demonstrates just how quickly investor sentiment can change, with major cryptocurrencies falling more than 30%. Balancing these concerns, with perhaps a little FOMO (fear of missing out), investors are trying to figure out how to fit cryptocurrencies within a broader portfolio. In this article, we discuss the case for cryptocurrency and examine how one might position cryptocurrency within a total portfolio.

Currencies provide a medium of exchange, as well as a measure to track credits and debits. Today, currencies allow people to store the fruits of their labor, borrow against it and exchange it for goods and services produced by others. A long while back, physical coins were the dominant medium of exchange (see Eichengreen 2019). Although we still use metal coins today for small transactions, the value of a government-issued coin is no longer determined by its metallic content, but instead, by the government that backs it, making the value of a fiat currency dependent on the faith in that government.

What are cryptocurrencies?

Cryptocurrencies are digital coins that are not backed by governments or metallic value. They are digital constructs that have agreed-upon value by their user base. As an example, at the time of this writing, those selling and buying Bitcoins agree that the price is near 38,000 USD per bitcoin. One of the major determinants of value, besides having a user base that adopts the medium of exchange, is the outstanding supply or scarcity of the currency. For example, increasing the money supply can cause inflation, or debasement of the currency. Given cryptocurrencies are digital constructs, a major concern is the production of additional coins or the copying of existing currencies that can dilute existing ones. Historically, gold has been the standard for allaying dilution concerns, as gold is not easily copied like one might copy a file or print another dollar. Gold is in limited supply, and there is a cost to mine it. Some cryptocurrencies, on the other hand, control their coin supply with algorithms. They deal with counterfeiting issues using innovative blockchain technology, cryptography and decentralized validation of transactions.

Blockchain technology powers cryptocurrencies

Cryptocurrencies, and their potential use in supporting decentralized applications, derive from the blockchain technology on which they are built. A blockchain is essentially a distributed database recording all digital transactions that have taken place in the currency.

Conventional transaction records are maintained by central entities like banks. For example, if you take a check to your bank to cash it, your bank must verify that the person who wrote the check has sufficient funds in their account before the bank will officially credit the deposit in your account. This amounts to two banks verifying and updating separate ledgers. This process can be quite inefficient. For example, when I recently I deposited a cashier’s check, my bank informed me that it may take up to 12 days before the money is available. These sorts of transactions can clear in minutes in some cryptocurrencies.

Blockchain technology allows the ledger to be decentralized, making the comparison of multiple ledgers unnecessary. When someone transacts in a cryptocurrency, the transaction is posted and then verified by independent agents who do work to validate that the transaction is legitimate. The transaction is then represented digitally in a block – which also includes the history of prior transactions for the coin and is ultimately appended to the chain – creating an indelible history of the transaction that anyone can inspect.

The method for verifying transactions and maintaining a secure ledger is quite important. Verifiers, known as miners, verify cryptocurrency transactions for a fee (they are paid in the cryptocurrency). Currently, this decentralized verification happens under two different approaches: proof of work and proof of stake. Proof of work (see Back 2002) requires miners to find a solution to a difficult mathematical problem. The first miner with the answer posts it, and then other miners in the network verify the answer. This mechanism is used by bitcoin and some other cryptocurrencies. In proof of stake (King and Nadal 2012), the status of the blockchain is verified by cryptocurrency owners. Ethereum, the second-largest cryptocurrency by market capitalization, is shifting to proof-of-stake transaction verification. According to Ethereum.org, validators will stake 32 ether to participate in ether transaction validation. Miners receive a reward for participating in the validation step. However, they also risk losing some or all of their stake if they fail to do their job.

The future value of cryptocurrencies will depend on their adoption

The return that one achieves from investing in cryptocurrency will indirectly depend on its adoption, which will be linked to potential use cases and public trust. We view cryptocurrencies today as a speculative investment in the adoption of this new technology rather than a functioning currency. Professional investors have varied opinions on the penetration of cryptocurrency into the global economy. At one extreme, there are investors who think of cryptocurrency as a modern-day tulip bulb event. As an example, Berezin et al. (2021) take a negative view on the future of Bitcoin, citing various concerns including transaction inefficiency. At the other extreme are investors who think decentralized finance, powered by digital currencies, will displace centralized finance. Forecasting adoption and resulting prices for different adoption levels is extremely difficult. Respected economists have varied opinions. This lack of consensus manifests itself in the price volatility.

Several articles have attempted to price and forecast future cryptocurrency prices. One approach used to forecast the price of Bitcoin is to view it as a gold substitute. Someone who views Bitcoin as storage of value like gold can assess Bitcoin based on the addressable market of gold. For example, Joshi et al. (2021) forecast a Bitcoin price of around $120,000, based on Bitcoin taking 25% of the $13 trillion anti-fiat money market. Hougan and Lawant (2021) examine four additional models to value cryptocurrencies, including the equation of exchange from monetary economics, M=P*Q/V,2 to estimate the nominal value3 of each Bitcoin. In the end, these authors suggest the examined models fall short in their ability to price and forecast cryptocurrency. They note that forecasting cryptocurrencies is as difficult as pricing commodities and fiat currencies, which are notoriously challenging to forecast.

Before investing in cryptocurrencies, we think investors should consider the potential use cases of the coin or platform in which they are investing. The potential applications of cryptocurrencies have progressed beyond storage of value or a medium of exchange.

Below are several use cases that investors might use to support investment in cryptocurrency:

- Broad adoption of cryptocurrency globally

- A hedge against debasement of fiat currencies

- Storage of value

- Facilitation of faster payments domestically and internationally

- Broad adoption of decentralized finance applications such as peer-to-peer lending, tokenization of assets and other applications

- Other use cases that are currently unknown. Consider that someone in the 1980s with a strong command of the Commodore 64 (one of the first and most popular home computers) might not have considered that one day she’d be ordering an Uber from a smartphone.

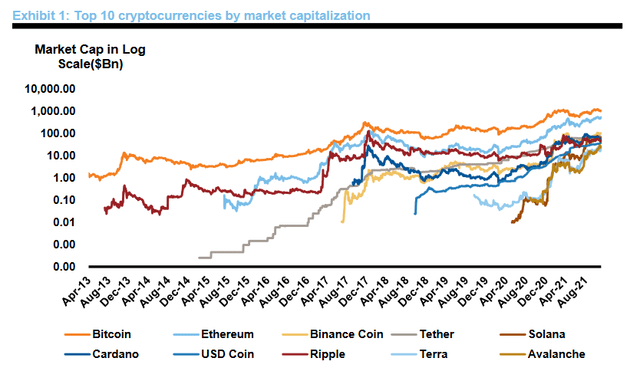

Cryptocurrencies now exceed $1.3 trillion in market capitalization. Exhibit 1 shows the top 10 cryptocurrencies by market capitalization through time in log scale.

Exhibit 1: Top 10 Cryptocurrencies By Market Capitalization (Author)

Bitcoin leads the pack

Today, Bitcoin is the leading cryptocurrency by market value. Bitcoin can be sent anywhere in the world with considerable speed. Hougan and Lawant (2021) reference a transaction of over $1.0 billion that took less than 10 minutes to clear4. However, Bitcoin is unlikely to be adopted for everyday transactions for several reasons. The first is that energy consumption to validate transactions is an issue with Bitcoin5. Due to the proof-of-work method used to validate transactions, energy consumption is a concern for high volumes of transactions. A second concern for U.S. citizens is that Bitcoin is treated as property. Each time Bitcoin is sold, the seller must report realized gains. Using Bitcoin for everyday transactions would create an exhausting tax return. This is why we, like others, see Bitcoin’s primary use case as facilitating large transactions such as money wires and storage of value outside of a fiat currency. This is also why Bitcoin is sometimes referred to as digital gold.

What is Ethereum?

Ethereum is the second-largest cryptocurrency by market capitalization. Whereas Bitcoin’s blockchain platform is geared toward secure transactions, with limited other uses, Ethereum’s platform offers a range of decentralized exchange applications. The Ethereum platform allows assets, loans and contracts to be encapsulated into smart contracts that are executed on the platform using standardized protocols. As an example, digital art, loan covenants and even rules-based rebalancing investment strategies can be tokenized and managed on the platform. Other blockchain platforms supporting DeFi applications are pulling market share from Ethereum (see Panigirtzoglou 2021). We anticipate the list of applications will continue to broaden over time on flexible platforms like Ethereum.

What are stablecoins? How can they help with price volatility?

A noted issue with cryptocurrencies as a medium of exchange is their price fluctuations relative to fiat currencies. Stablecoins have been introduced to address price volatility. Stablecoins peg their value to a target fiat currency or asset such as gold. These coins allow users to transact on cryptocurrency platforms while mitigating the risk of price fluctuations between the coin and their base currency. However, there are other underlying risks that come with pegging prices to another asset. Ensuring that a cryptocurrency holds its value relative to its underlying target requires careful management and collateralization. See Rubenstein (2021) and Eichengreen (2019) for some of the management concerns and risks underlying stablecoins. Stablecoin examples include: Tether (USDT-USD), USDC (USDC-USD), Dai (DAI-USD), Ampleforth (FORTH-USD) and Empty Set Dollar.

What are Central Bank Digital Currencies (CBDCs)?

Central banks are also experimenting with digital currencies, known as Central Bank Digital Currencies (CBDCs). In the U.S., CBDCs are an active area of discussion between the Federal Reserve and other bodies of government. As of this time, the Federal Reserve’s position appears to be that they will not hold accounts for retail clients but will instead have commercial banks or other financial service providers manage individuals’ accounts. Ultimately, the use of CBDCs may be limited to a specific set of users (see Duffie 2019) such as banks.

What are some risks of investing in cryptocurrency?

While there are many potential and emerging use cases that may improve adoption of cryptocurrencies, investors would be wise to consider systemic and coin-specific risks. Some of the key risks include:

- Regulatory risks. Cryptocurrencies face major legal and regulatory risks. While some countries with unstable currencies could meaningfully benefit from cryptocurrency, there are other governments that do not want competing currencies in circulation. Additionally, governments are concerned about cryptocurrencies facilitating money laundering. As of September 2021, China has banned the use of cryptocurrency. A flurry of articles in early 2022 indicate that Russia is also deliberating on what it will allow with cryptocurrency.

- Fraud is another risk faced by cryptocurrencies. With lack of regulatory oversight in digital asset markets, fraudulent activity is more likely. This is evidenced by a recent U.S. Federal Trade Commission report, which notes an increase in scammers luring people into bogus investment opportunities. Losses of around $80 million related to scamming activity in digital asset markets have been reported between October 2020 and May 20216.

- Theft from hacking is a risk with cryptocurrency.Bitcoin and other cryptocurrencies accounted for 80% of total attempted digital thefts during 2011-20207. Investors who keep their currency on digital currency exchanges that don’t provide cold storage wallets (storage that is not connected to the internet, such as a USB drive) are the most susceptible to hacks. However, more and more financial institutions now provide cold storage custody services for clients.

- Transaction processing speed and electricity consumption is another potential risk that could prevent broad growth of some cryptocurrencies. For example, currently each Bitcoin transaction requires 500,000 times more energy than that needed to process a digital transaction on the Visa network8. While technological innovations such as using proof-of-stake rather than proof-of-work may alleviate this issue, environmentally conscious investors may shun the idea of currencies that compete with essential energy requirements. Moreover, central banks are working to improve transaction speed in fiat currency9.

- Cryptocurrency-specific risks are quite meaningful. Lansky (2021) summarizes that around a third of newly launched crypto coins don’t survive beyond the first year. He summarizes data that shows a newly launched cryptocurrency has only a 30% chance of surviving five years. Most investors would consider a 70% chance of total loss over a period of five years as quite high.

- Enhancements to centralized systems are an additional threat to cryptocurrencies. Fast payment systems are being developed that will speed up centralized banking transaction speeds (see Duffie 2019). While this wouldn’t invalidate the anti-fiat currency wealth storage use case, it would remove the transaction speed advantage of cryptocurrencies.

Investing in cryptocurrencies

Diversified options

We believe investors seeking cryptocurrency exposure have several diversified options, including:

- Broad diversified long exposure. Holding a diversified basket of cryptocurrency provides exposure to an emerging payment and DeFi application system. We believe investors should hold a diversified basket of currencies that mimics some sort of market capitalization weighting, as opposed to a single cryptocurrency. Glas (2019) finds that naïve equal weight diversification of a broad basket of digital assets hasn’t worked well historically. A value weighted approach would have done better, but this does lead to more concentration risk. For example, today, Bitcoin is just under 50% of the cryptocurrency market capitalization. Investors can gain exposure by buying cryptocurrencies directly. However, we expect to see more and more cryptocurrency wrapped products. Bitcoin-specific exposure via futures management can be accessed in an ETF as of October 2021. Research on how to weight among cryptocurrencies is not well studied.

- Specific cryptocurrency exposures that align with use cases the investor sees most prolific or disruptive. Investors can either choose cryptocurrencies that align with use cases they see most promising or hire active cryptocurrency managers with the expertise to size specific cryptocurrency exposures. Investors can also gain specific exposures through listed companies and private capital investments. Venture capital and angel investors are experts in screening nascent technologies, where large potential returns and risks exist.

- Exploitation of mispricing in cryptocurrencies. Though the market cap of cryptocurrencies has grown exponentially over the last decade, several researchers like Tran and Leirvik (2020) and Yahyee et al. (2020) find that cryptocurrency markets remain inefficient. We believe these inefficiencies create opportunity for investors with the right skills. In particular, hedge funds with access to leverage are well-suited to exploit market inefficiencies, such as the one referenced here10, where profits could be made by going long Bitcoin and shorting futures contracts. Exposure to cryptocurrency hedge fund strategies should have the benefit of low correlation to long cryptocurrency positions.

How much exposure should investors have to cryptocurrency?

As investors ponder investment in cryptocurrency, a natural question that arises is how much exposure a portfolio should have to cryptocurrency? Investors should consider the following criteria as they evaluate cryptocurrency investments:

- Investments should align the portfolio to the financial goal.

- Total portfolio risk and diversification need to be considered alongside return potential.

- Market capitalization or economic footprint is a useful guide in sizing asset allocation decisions.

Let’s look at how these criteria can be used to inform cryptocurrency investments. Investors build portfolios to solve financial problems. Some examples include building a retirement nest egg, financial independence, hedging pension liabilities and generating perpetual nonprofit spending. As investors consider cryptocurrency, they’ll want to consider how it can shift the portfolio to better meet their financial goals11. Now, there are various ways that an exposure might improve the distribution of outcomes relative to a financial goal. For example, long-duration fixed income is a great hedge against the cost of future spending in scenarios where interest rates fall.

Similarly, cryptocurrencies have the potential to protect against currency debasement caused by excessive government spending and debt issuance. While these types of hedging features are important, we observe that pretty much all financial problems benefit from more efficient, less-volatile real portfolio growth. Given this, our discussion focuses on the potential for cryptocurrency to improve long-term portfolio growth.

Do cryptocurrencies improve portfolio diversification?

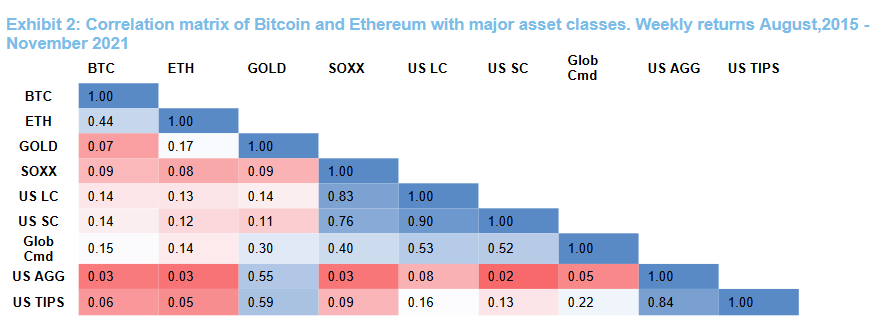

To get a sense of how cryptocurrencies can improve portfolio diversification, let’s first examine the correlation of the largest cryptocurrencies with other major asset classes. Exhibit 2 shows that there is very little correlation between the two largest cryptocurrencies and other assets. However, Ethereum and Bitcoin have a historical correlation of .44, indicating that there is more co-movement among cryptocurrencies than between cryptocurrencies and other asset classes. However, we have less confidence in correlation measured over relatively short periods than over longer periods, such as with stocks and bonds.

Exhibit 2: Correlation Matrix Of Bitcoin And Ethereum With Major Asset Classes. Weekly Returns August 2015 – November 2021 (Author)

BTC=Bitcoin. ETH=Ethereum. SOXX=iShares Semiconductor ETF. US LC=U.S. Large Cap: Russell 1000® Index. US SC=U.S. Small Cap: Russell 2000® Index. Glob Comd=Global Commodities: Bloomberg Commodity Index. US AGG=U.S. Aggregate: Bloomberg U.S. Aggregate Bond Index. US Tips=U.S. Treasury Inflation-Protected Securities. Returns represent past performance and are not a guarantee of future performance.

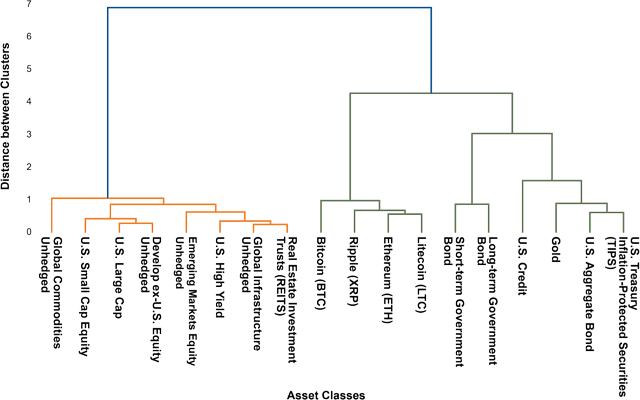

Another way to analyze the similarity of cryptocurrencies to other asset classes and to themselves is to run a clustering algorithm on a common return history. Cluster analysis is a statistical method for organizing items into groups, or clusters, based on their similarity – in this case, return patterns. Exhibit 3 shows the results of a hierarchical clustering analysis. We can see that cryptocurrencies form a separate cluster and, interestingly, show more similarity to investment grade fixed income than risky assets. Based on an analysis of correlation and clustering, it’s clear cryptocurrencies bring unique new exposures to a portfolio of common asset classes.

Exhibit 3: A hierarchical clustering of asset classes and cryptocurrencies using monthly data from June 2016 – May 2021 (Author)

Note, however, that the historical diversification benefits of cryptocurrencies didn’t come for free.

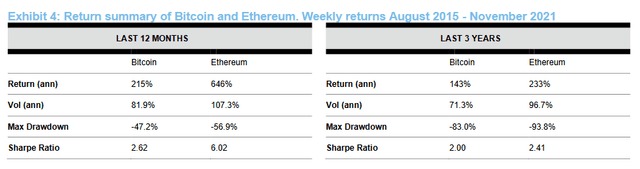

Cryptocurrency allocations would have exposed a portfolio to extreme volatility and tail risks. Over the past three years, Bitcoin and Ethereum have had annualized volatility of around 70%, with drawdowns exceeding 80% (see Exhibit 4, below). While both Bitcoin and Ethereum have recovered from drawdowns, other minted cryptocurrencies ceased to exist, meaning an investor would have lost all money invested in those coins. Such volatility combined with the potential of total loss dictates that any allocation to cryptocurrencies should be supported by sound risk management practices. While broad diversification to cryptocurrencies can help alleviate coin-specific risk, cryptocurrencies are still quite volatile. So far, this significant volatility has been compensated with outsized returns in some surviving cryptocurrencies. Hougan and Lawant (2021) have analyzed the improvement in return and Sharpe ratio for varied exposures to Bitcoin. They found that an allocation of just 2.5% to Bitcoin increased the baseline portfolio’s Sharpe ratio by 0.21, and the return by 23.9%. Clearly, even a small allocation to such a high-growth investment would have meaningfully shifted portfolio performance.

Exhibit 4: Return Summary Of Bitcoin And Ethereum. Weekly Returns August 2015 – November 2021 (Author)

Importantly, historical returns and Sharpe ratios are not the same as future expectations. While cryptocurrencies may continue to perform, we believe it would be imprudent to base allocation decisions entirely on observed histories.

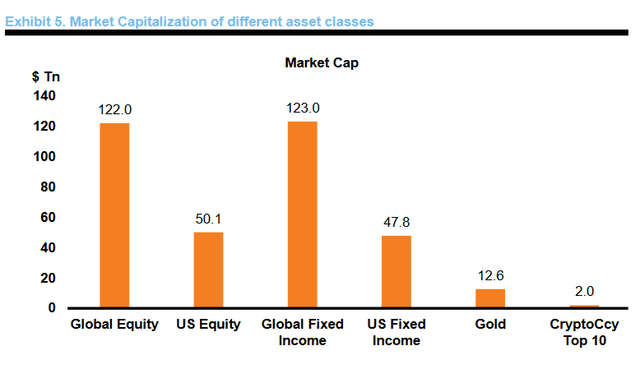

How does crypto’s market cap compare to other asset classes?

Examining the relative market capitalization of cryptocurrency relative to other assets can be informative when there is not a lot on which to base allocation decisions. Exhibit 5 plots the summed market capitalization of the top 10 crypto currencies against other asset classes.

Exhibit 5. Market Capitalization Of Different Asset Classes (Author)

Source: Coinmarketcap as of Jan. 31, 2022; SIFMA – Equity as of 2021 3Q, Fixed Income as of 2021 1Q; Gold market cap uses above-ground stocks estimate by end-2020 from World Gold Council.

Consider that gold, a well-established store of value, is under 5% of the summed market capitalization of stocks, bonds and gold. The market capitalization of the top 10 crypto currencies is less than 1% of the summed market capitalization of stocks, bonds, gold and cryptocurrencies. Similar to decisions regarding concentrating wealth in a single stock, sector or region, the size of the market can be used to inform the size of allocation decisions.

Cryptocurrencies are in such an early stage of adoption that it’s difficult to assess as a prospective investment. At present, we don’t have capital market assumptions that can be used for portfolio construction. Given this, we believe it’s imprudent to apply typical quantitative portfolio construction techniques, as they are likely to provide a false sense of security. Instead, we believe investors will have to bootstrap their approach to sizing cryptocurrency allocations, considering the following guidelines:

- Put no more money in cryptocurrency than what they are willing to lose.

- View a position in cryptocurrency as a speculative investment in greater adoption of decentralized finance applications and anti-fiat money wealth storage.

- Diversify exposure across various cryptocurrencies.

- Extend exposure to holding listed companies, private companies and hedge funds operating in the crypto space, in addition to coins.

Looking through the rear-view mirror, even a small allocation of 1-2% to Bitcoin since its inception or even the past 5 years would have meaningfully improved a 60% equity/40% fixed income portfolio in terms of return and Sharpe ratio. This can lead to FOMO for investors who did not participate in past returns. Investors should take care to not let FOMO impact cryptocurrency investment decisions. Rather, we believe cryptocurrencies should be carefully incorporated into one’s allocation if it improves attainment of the financial goal in a manner that aligns the portfolio with the investor’s goals.

Conclusion

Cryptocurrencies are a nascent investment opportunity, where there are still large risks to broader adoption. This doesn’t mean investors should completely avoid cryptocurrencies. Rather, we believe an investor should size the allocation to what they are willing to lose. Moreover, investors can ameliorate some risk by diversifying across different currencies, investing in companies that are developing technologies that extend use cases, and by seeking exposure to crypto hedge fund strategies.

______

1 Bitcoin, the largest coin by market share has gone from $250 per coin to $64000 per coin over the period of 2015 to 2021.

2 P*Q (Price*Quantity) is the level of nominal expenditures in the economy, V is the velocity of money or the average frequency at which money is spent and M is the nominal supply of money needed in the economy.

3 Value of each Bitcoin would be M/No. of Bitcoins outstanding.

4 We note that money wires from bank to bank are efficient.

5Bitcoin Uses More Electricity Than Many Countries. How Is That Possible?, NY Times

6Cryptocurrency buzz drives record investment scam losses, FTC.gov

7These are the largest cyber thefts of the past decade—and 80% of them involve Bitcoin, Fortune

8Bitcoin’s energy usage, explained, Forbes

10The ‘Risk-Free’ Crypto Trade Is Back In a Big Way, Bloomberg

11 To date, retail investors have been large adopters of cryptocurrencies. It occurs to the authors that some of these retail investors are drawn to cryptocurrencies for their

potential to make immediate wealth transformations-essentially, the winning lottery ticket outcome.

Literature Cited

Al-Yahyaee, K.H., Mensi, W., Ko, H.U., Yoon, S.M. and Kang, S.H., 2020. Why cryptocurrency markets are inefficient: The impact of liquidity and volatility. The North American Journal of Economics and Finance, 52, p.101168.

Back, A., 2002. Hashcash – a denial of service counter-measure.

Berezin, P. , Kermadjian, M., Aradski,M., Laskey,L., Bilyk,P., Antoine,F., Evans,G., Savary,M.,2021. Bitcoin: A Solution In Search Of A Problem. BCA Research.

Duffie, D. 2019. Digital Currencies and Fast Payment Systems: Disruption is Coming. For presentation to the Asian Monetary Policy Forum May, 2019.

Eichengreen, B., 2019. From commodity to fiat and now to crypto: what does history tell us? (No. w25426). National Bureau of Economic Research.

Glas, T.N., 2019. Investments in Cryptocurrencies: Handle with Care!. The Journal of Alternative Investments, 22(1), pp.96-113.

Hougan, M. and Lawant, D., 2021. Cryptoassets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals. CFA Institute Research Foundation.

Joshi,D.,Shennawy,M.E.,Savary,M.,Robis,R.,2021.Why Cryptocurrencies Are Here To Stay And Bitcoin Is Worth $120,000. BCA Research.

King, S. and Nadal, S., 2012. Ppcoin: Peer-to-peer crypto-currency with proof-of-stake. self-published paper, August, 19(1). Lansky, J., 2019. Cryptocurrency Survival Analysis. The Journal of Alternative Investments, 22(3), pp.55-64.

Le Tran, V. and Leirvik, T., 2020. Efficiency in the markets of crypto-currencies. Finance Research Letters, 35, p.101382.

Rubestein, Marc. 2021. Reinventing The Financial System.

Panigirtzoglou N, Inkinen M., Poddar N. and Agarwal E. 2021 Flows & Liquidity How high is DeFi growth? JP Morgan, Global Markets.

Definitions

Fiat currency is money that is not backed by a physical commodity like gold or silver, but instead backed by the government that issued it.

Modern-day tulip event, or tulip mania, refers to a speculative frenzy in 17th century Holland when Dutch investors purchased tulips, pushing their prices to unprecedented highs.

Important Information

These views are subject to change at any time based upon market or other conditions and are current as January 2022. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The illustrations contained in this article are hypothetical and not meant to represent an actual investment strategy. The analysis does not reflect fees or other expenses.

Investments that are allocated across multiple types of securities may be exposed to a variety of risks based on the asset classes, investment styles, market sectors, and size of companies preferred by the investment managers. Investors should consider how the combined risks impact their total investment portfolio and understand that different risks can lead to varying financial consequences, including loss of principal.

Diversification and strategic asset allocation do not assure a profit or guarantee against loss in declining markets. Please remember that all investments carry some level of risk. There are no assurances that the objectives stated in this material will be met.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates, with a significant minority stake held by funds managed by Reverence Capital Partners. Russell Investments’ employees and Hamilton Lane Advisors, LLC also hold minority, non-controlling, ownership stakes.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

Russell Investments Financial Services, LLC, member FINRA, part of Russell Investments.

Copyright © Russell Investments 2022. All rights reserved. This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.