Philippines joined EM Asia policy rate’s liftoff with a hawkish hike. South Africa stepped up rate hikes, even though inflation is still within the target.

Em Asia Policy Liftoff

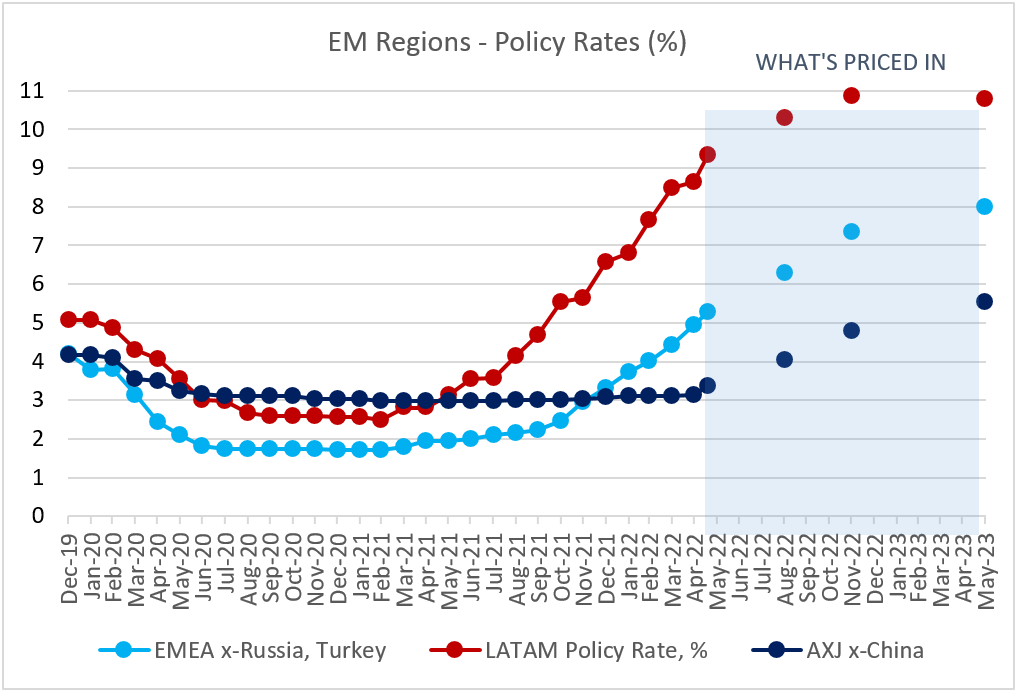

A hawkish liftoff in EM Asia continued this morning, with the Philippine central bank (BSP) delivering a hawkish 25bps rate hike in both the overnight borrowing rate and the standing overnight deposit rate (only the former was expected). The BSP responded to higher price pressures that pushed headline inflation outside the official target range, making it the third regional central bank in a row (together with India and Malaysia) to surprise the market on the hawkish side. The market now prices in a fairly brisk tightening cycle in EM Asia (see chart below), with around 200bps of rate hikes expected in the next year or so. One thing we keep an eye on is policy divergence between China and the rest of Asia – would more aggressive rate hikes outside of China help to de-anchor Asia FX from the Chinese renminbi’s weakness going forward?

Latam Policy Rates – Peak In Sight?

EM Asia started to tighten in earnest more than a year after the inaugural rate hikes in LATAM. The latter is still in the midst of the tightening cycle – Brazil, Mexico, Chile, Peru, and Uruguay raised their policy rates this month – but all good things eventually come to an end. Even rate hikes. “We the market” are now seeing policy rates in LATAM peaking by November (see chart below), leaving most countries with stronger policy cushions, somewhat better than expected growth (2022 GDP projections have been grinding higher in the LATAM for some time now), and maybe an upside surprise or two in fiscal performance.

Emea Rate Hikes – Too Slow?

As regards EMEA, the policy direction is right (tightening), but the speed of hikes might be too slow for the kind of inflation pressures the region is facing right now. Fortunately, this does not apply to South Africa’s super-credible central bank, which delivered expected +50bps today (a step up compared to the previous rate-setting meeting) without too much drama, and while headline inflation is still within the target. The South African rand loved every minute of it, rallying the most among major EM currencies (139bps against the U.S. Dollar, as of 10:05am ET, according to Bloomberg LP). Stay tuned!

Chart at a Glance: EM Policy Rates – Peak Still Far Away

Source: VanEck Research; Bloomberg LP