Eloi_Omella/E+ via Getty Images

The iShares MSCI Japan ETF (NYSEARCA:EWJ) shows a very representative slice of the Japanese economy. What a lot of these stocks have in common is that they have a pretty substantial wallet share in China, especially the large allocation to industrial players. We think the next leg of the Japanese story will follow the deltas that come with China reopening its economy and trying to shore up its housing sector. Things can’t get all that much worse for China than where they are now, so even if the reopening and other government interventions aren’t sure to be effective, there should be some push for both the Yen and Japanese export. The problem with EWJ is the large consumer discretionary exposure and high multiple. The global economy is still a little weak, so these less resilient exposures aren’t appreciated.

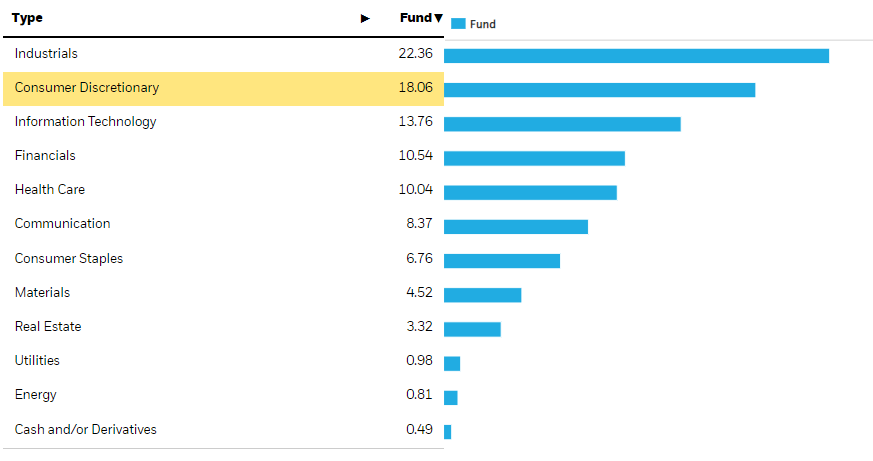

EWJ Breakdown

The ETF is pretty large with 237 holdings, and the top holdings end up being pretty irrelevant to overall ETF performance, but the sectoral exposures tell us a lot.

Sectoral Exposures (iShares.com)

The discretionary exposures are substantially car companies, of which Japan has many. Industrials vary, but many are the trading conglomerates that Japan is known for, like Hitachi, Ltd. (OTCPK:HTHIY) and Mitsui (OTCPK:MITSY) that do everything under the sun like energy, HVAC, elevators, automotive systems, and parts and construction.

The China Issue

Both these sectors, which together account for 40% of the ETF, have in common a very large exposure to Chinese business. The typical trading house has about 10-20% China exposure, and many of the automotive companies have between 10-20% China exposure as well. Even the IT exposures like Keyence (OTCPK:KYCCF) have over 15% exposure to China.

Speaking broadly about the Japanese economy, 22% of their export is with China as of 2020, so before any shortfalls in Chinese demand, but still consistent with the figures from some of these selected companies.

China is reopening their economy by allowing isolation at home, and other measures clearly aimed at cooling unrest and catching up to the rest of the world in dealing with COVID-19. Additionally, they are implementing a lot of respite for lenders and developers in order to keep indebted property players afloat. Banks are going to have to grow their NPL balances to support the ailing housing sector, facing both immediate issues but also longer-term demographic problems. Where imports and exports have massively contracted as of now, these measures, even if still built on central planning principles, should get the economy going and signal to stakeholders that supply chains aren’t going to be locked down constantly, preserving their economic position as an outsourced manufacturing base.

A recovery in Chinese activity should see a pickup in Japanese exports to China and the Japanese Yen. With a relatively outsized exposure to China, Japan generally should see improved economic data, especially in industrial segments. EWJ, which has seen a 17% YTD decline, should also see some positive increment, although the valuation concerns us. The dividend yield on the ETF is at 2.56%, and the comprehensive multiple is 37x in PE. There’s not that much margin of safety on the valuation side, and the Japanese exposures are expensive to maintain, with expense ratios at 0.5% for the overall portfolio.

Japan offers some very cheap, idiosyncratic exposures with exceptionally healthy balance sheets. We think it’s a waste to do an ETF of Japan, just because simple stock selection goes such a long way. Nonetheless, the reopening of China should help a host of exposures, including those we’d rank as high conviction.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.