Trevor Williams/DigitalVision via Getty Images

The iShares MSCI Japan ETF (NYSEARCA:EWJ) is a way to play the Japanese market, dominated by the sogo shosha and other industrial and financial companies. Japan is a peculiar market, and the profiles of its companies are such that local revenue is really quite important, as is China. With the BoJ continuing its ultra-dovish stance, where markets expected convergence, even if only partially, with the rest of the hawkish western monetary authorities, the conditions for Japanese business should actually be quite stable and probably even show growth. The still relatively recent reopening should not be discounted either. Here we give our comments on Japan, based on our extensive coverage, and why the EWJ looks pretty well positioned.

On Japan and Global Economies

Japan is peculiar due to its demographic situation, which has given the economy deflationary tendencies since the 90s. Inflation in Japan never reached high levels when using core figures, excluding gas and oil which got very expensive mid-2022 and despite the depreciation of the Yen as the dollar and other currencies benefited from higher rates. A depreciated Yen should have introduced imported inflation but it wasn’t exaggerated as Japanese consumption tends to face inwards, especially with core figures.

Lately, while figures are technically above expectation, they are still very low relative to the typical 2% target for western economies, where the 2% baseline level is needed to deal with stickiness of wages. Supply chain issues are also rapidly easing, with shortages becoming gluts in many key industries. With the economic woes of Europe, reported across all companies that have wallet share there, competition for products is declining, and key bottlenecks like logistics are also now loosened. Finally, Japanese corporate culture requires a commitment by companies to job security among personnel in Japanese offices, and in exchange wage inflation is almost nonexistent in Japan, even historically. We are not surprised that the BoJ is maintaining a dovish stance in light of all this, especially as the dangers of a wage-price spiral in Japan are structurally very limited.

There is also the matter of China. With Japanese markets benefiting primarily from Japanese and Chinese wallet share, a weak year for China in 2022 could reverse into a strong 2023 as Beijing moves firmly forward with plans to reopen the economy, realizing that mortality from COVID-19 is an acceptable loss given the convergence of dangers, including demographic dangers but also geopolitical pressures coming from the more tense set of global relations. While a recovery of China will reintroduce some inflationary tendencies into the market, a dovish policy keeps businesses in Japan efficiently capitalized for them to deal with the China reversal, as well as to benefit from a dovish support for the consumer.

Bottom Line with EWJ

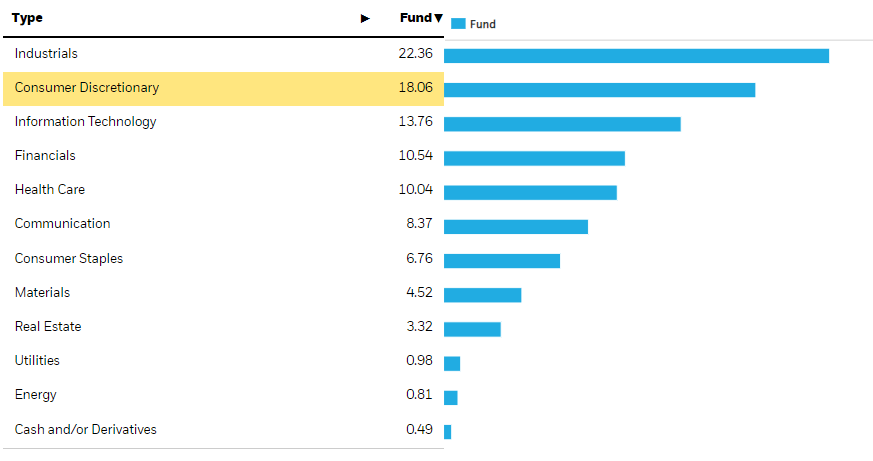

The EWJ breakdown shows that it is primarily exposed to industrial companies, which can include car companies dominating the consumer discretionary category, and financials.

Sectors EWJ (iShares.com)

Industrial businesses and consumer discretionary businesses within the EWJ are substantially exposed to China – between 10-20%. They have operating leverage, and also there is now less competition for inputs due to a struggling Europe. They have been more depressed in 2022 on supply side issues but also on Chinese demand shortfalls, with 2023 being much more promising for them.

Financials are mostly Japan exposed, and while higher rates typically creates a wedge between savings and lending rates for a while to benefit lenders, usually there is a catch-up, and we are beginning to see that in the US in net interest margins. A return of Chinese prosperity should also unlock loan growth in Japan, or at least limit pressures against loans growth, as demonstrated by DCM performance in companies like Nomura (NMR); and also hopefully in the retail businesses, reflected in growing net interest income, or at least limited declines.

The price to earnings for the EWJ is pretty low at 12.6x TTM, and seems to not account for the expectation that China should provide growth to the Japanese economy as it rebounds.

There are risks in the success of the Chinese rebound. One of the reasons for COVID-zero was the low vaccination rates among the elderly, and questionably efficacy of the Chinese vaccine. They may have to respond to mortality spikes if they happen to a sufficient degree.

Nonetheless, China had such a depressed year that some degree of rebound seems almost inevitable, and a dovish BoJ policy keeps the local consumer strong where other economies have to suffer through much higher rates, and a much higher danger of inflation. We rate EWJ a buy.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.