On March 17, 2023, we had the pleasure of speaking with Trevor Greetham, Head of Multi Asset at Royal London Asset Management

.

Royal London is the largest customer-owned life insurance company in the United Kingdom. There are about 2 million pension customers. The asset management division is managing $177 billion in assets, measured in U.S. dollars, with $100–$120 billion in multi-asset, giving a sense that when Trevor is talking about different positioning, he is talking about a very large portfolio.

Inflation to Become “Spikeflation”

Almost everyone is offering different views on the global inflation picture in 2023, emphasizing the contrast from a decade after the global financial crisis of 2008–2009 to where we are today. Trevor believes a range of macro drivers, including deglobalization, limited fossil fuel supply as we transition to net zero and a more uncertain geopolitical backdrop, suggests we are in a more inflation-prone world versus the last four decades.

The Bank of England (BOE) shares the focus on getting inflation back to a range of around 2%, but, during 2022, inflation in the UK spiked to roughly 11.5%—an overshoot of 9.5%. The rate of inflation is likely to drop smartly, but Trevor expects to see more of these episodes with inflation spiking and then falling back, a phenomenon he calls “spikeflation.”

The three big inflation spike periods in the UK from 1900 to the present day (and Trevor noted the global picture looks quite similar) are World War I, World War II and the 1970s. Headline inflation did drop back after each of these periods, but aggregate price levels exited anything from two to four times higher than they started.

Hedging Strategy for Inflation

If there are to be inflation spikes, one must employ strategies with the potential to hedge this impact on a given portfolio. While Trevor emphasized a multi-asset approach, including commercial real estate, which can see rents rising with inflation over time, his main emphasis when it came to inflation hedging was commodities. Commodities have historically offered some of their strongest returns when the environment is characterized by the aforementioned inflation spikes, and it’s notable that during these actual spikes, it can be difficult to see strong returns from either stocks or bonds.

In fact, we see in figure 1 that inflation spikes have been associated with some of the worst stock and bond returns we have seen over a very long period of time, with 2022 a case in point.

- Figure 1 displays the yearly total returns of the U.S. 10-Year Treasury and the S& 500 Index, going back to 1928 and extending forward almost 100 years to 2022.

- The left-side scatter plot shows stock and bond returns in nominal terms. There are only four years when both the S& 500 Index and the U.S. 10-Year Treasury had negative returns—1931, 1941, 1969 and 2022. On the left side, notably, 2022 corresponded to the lowest point for Treasuries on the vertical axis.

- The right-side scatter plot shows the same data but in real terms, subtracting inflation from both stock and bond returns. Besides seeing more of the dots pulled below the horizontal axis, indicating a negative real return for bonds, one can also see far more dots (14 now) in the quadrant that represents a negative real return for the S& 500 Index and the 10-Year Treasury. Most, if not all, of these 14 years were characterized by the tendency of “inflation spiking” that Trevor was referencing in our conversation.

Figure 1: Scatter Plot of Returns for S& 500 Index and U.S. 10-Year Treasury Note

Commodity Allocation Strategy

We delved more deeply into the way in which Trevor believes commodity exposure should be implemented. There was a focus on diversification and the established benchmark of the Bloomberg Commodity Index (BCOM). The BCOM, roughly speaking, splits into three groupings, about one-third energy exposure, one-third agriculture exposure and one-third metals exposure.

It’s always an interesting discussion to contrast how different investors look at different benchmarks. Many European investors are precluded from even considering the S& GSCI Index (GSCI), as it doesn’t meet the diversification rules specified within the UCITS framework. Relative to the BCOM, the GSCI is going to be much more heavily influenced by movements in energy prices. Trevor was also noting some of his views on gold and how it can be a bit more “currency-like” than “commodity-like” in its behavior. For example, an environment where the U.S. Federal Reserve is cutting rates and the U.S. dollar weakens would create an interesting tailwind for gold, whereas industrial commodities could struggle.

U.S. Federal Reserve Policy, Interest Rates and Cycles

Trevor related central bank actions to driving a car. There are certain inputs drivers see, including through the windows or from the gauges, like the speedometer, and most typically, there are meant to be many quite small “course corrections” and not much slamming on the brake or the accelerator. Notably, he related the debacle in the UK that was the very short Prime Minister tenure of Liz Truss where, on the one side, the BOE was trying to tap the brakes to moderate inflation, while on the other side, the government was saying they would be cutting taxes and ramping up deficit spending, thereby slamming the accelerator. We know a car cannot be safely driven this way, and in markets, we saw stresses erupt within the liability-driven investment (LDI) strategies employed by UK pension funds.

Now, if we take away one key thing about Trevor’s perspective on markets, it is a deep appreciation of history and how the current period relates to different past periods. We mentioned already that, in his view, the last 40 years represent something anomalous, meaning that inflation was actually much lower than it should normally be, leading to longer business cycles. While one cannot state with certainty whether or not we head back toward something that looks like that, Trevor did remind us that, per the National Bureau of Economic Research (NBER), looking back to the 1860s, the average business cycle length is closer to five years. Higher, more volatile inflation could lead us back toward shorter business cycles because the central banks will have to hike or slash interest rates more forcefully—and by the time they know that they have done enough, they have usually done too much and “over-corrected” the course of the economy, leading to more “booms” and “busts.”

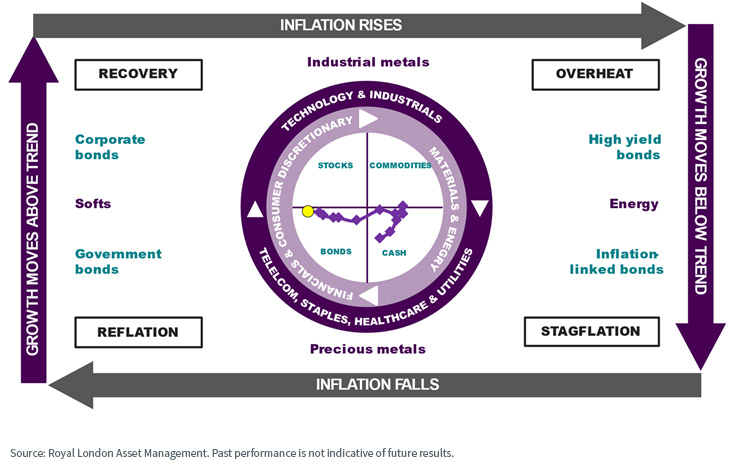

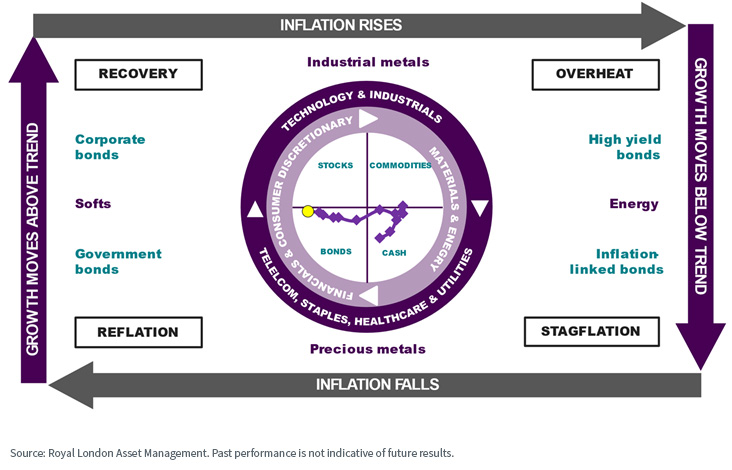

To conceptualize the cycle, Trevor noted an image of an “Investment Clock,” which is shown in figure 2:

- Trevor sees four distinct phases of the global business cycle, depending on the strength of economic growth and the direction of inflation, the big arrows that form the boundaries of figure 2.

- In theory, the cycle moves around clockwise, from reflation to recovery and then on to overheat and stagflation.

- The up-down direction on the Clock captures cyclicality. In a strong economy, stocks and commodities do better than bonds and cash, while technology and industrial sectors outperform defensives.

- Left-right is inflation sensitivity. Commodities and cash do better than financial assets when inflation is rising, while resource sectors tend to beat financials and consumer sectors.

- The Investment Clock is clearly densely packed with information. The trail shown in figure 2 represents monthly readings of Trevor’s proprietary global growth and inflation indicators. We note that the yellow dot represents the latest estimate, with the fall in inflation more certain, while the near-term direction of the economy is less clear.

Figure 2: Investment Clock

Current Environment and Different Regional Views

Trevor also shared views on different regional equity markets. Broadly, he thinks of the UK and Europe as “value”-oriented regions. On the other hand, the U.S. represents a more expensive “growth”-oriented region. Perhaps his most interesting comment was that China might be recovering, and if we go into a regime where the U.S. Federal Reserve is lowering its policy rate and the U.S. dollar is weakening, this could be a much more interesting time to consider China as well as emerging market stocks for “defensive” uncorrelated positioning.

Conclusion: A Masterclass on Global, Multi-Asset Portfolio Management

We highly recommend that any investor interested in gaining perspective on different asset classes and how to think about a broad, multi-asset portfolio listen to this discussion.

Listen to the full conversation below:

Looking to Diversify? Look No Further than This Multi-Asset ETF

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.