Investment thesis

Rambus (NASDAQ:RMBS) has strongly performed on a YTD basis (+42.74%) many are concerned that the stock might be too expensive especially after the recent rally. In this analysis, you are going to see that on a relative basis compared to its peers, RMBS still trades at a discount despite strong catalysts and rock-solid fundamentals. The firm potential is in my view underappreciated. I initiate coverage on RMBS with a Buy rating and a target price of $59 representing a 16% potential upside.

Company presentation

Founded in 1990, and headquartered in Sunnyvale, California RMBS is a technology licensing company specialized in the design and development of high-speed memory interfaces, security, cryptography, and semiconductor intellectual property. RMBS’s products and services are used in a variety of industries, including data centers, automotive, consumer electronics, and mobile. RMBS is a fabless semiconductor manufacturer. This precision is important as it means that the company designs and sells semiconductors but doesn’t possess a fabrication plant to manufacture them. Instead, it relies on outsourcing its chip fabrication to third-party foundries. This allows them to focus solely on the design and sales aspects of the semiconductor industry, without the need for significant capital investments required for operating their fabrication plants.

The firm is specialized in 3 segments namely:

– Memory Interface chips

Memory interface chips are like bridges that connect the brain of a computer or electronic device (the CPU) to its memory. They help transfer data quickly and efficiently between the two, which is important for the device to work properly. Different types of memory require different types of bridges, and the faster and more efficient the bridge, the better the device will perform.

Made for high speed, reliability, and power efficiency, RMBS is specialized in the production of DDR3, DDR4, and DDR5 DIMM to enhance speed and performance. This segment represents close to 75% of the firm’s revenues.

– Interface IP

Interface IP is like a pre-made set of building blocks that electronic designers can use to create different parts of a computer or other electronic device. These building blocks are designed to help connect different parts of the device, like the part that connects the device to the internet, or the part that helps the device store information in its memory. Using these pre-made building blocks saves time and money, and makes it easier to create new electronic devices.

– Security IP

Security IP refers to semiconductor intellectual property that provides pre-designed and verified building blocks for the development of secure electronic systems. These building blocks are designed to protect against various types of cyber threats and attacks, such as hacking, data theft, and unauthorized access.

Note that RMBS IT segment also includes a range of digital and analog circuits, including memory and serial interfaces, power management, and sensor technology.

Positioning

In terms of market presence, with over 33 years of experience in semiconductor interconnect technology, RMBS is considered as a pioneer in this space. As a video game fan, I have been surprised to learn that RMBS has notably developed RAM for the Nintento64 and for the PS3.

Rambus RAM for Nintendo 64 (Wikipedia)

RMBS operates in a wide range of industries, including automotive, consumer electronics, data center, and mobile. Note that data center-related products represent 75% of the firm revenues. RMBS also has a strong presence in the automotive industry, with its technology being used in a range of advanced driver assistance systems (ADAS) and autonomous vehicles.

The firm benefit from strong competitive advantages and has a deep expertise in memory interfaces and security, a strong IP portfolio, and close partnerships with leading semiconductor and system companies of international renown such as Apple (AAPL), Advanced Micro Devices (AMD), Broadcom (AVGO), Amazon (AMZN), and Alphabet (GOOG).

RMBS’s memory interface solutions are among the fastest and most efficient in the industry, with patented signaling and circuitry technologies that help to optimize memory performance and energy efficiency which has become nowadays a key subject. RMBS’s security and cryptography solutions are designed to be flexible and scalable, with embedded security technologies that can be customized for a range of applications.

RMBS’s IP portfolio includes over 1000 patents and patent applications, covering a range of semiconductor technologies and applications.

AI and Data Center as Key Drivers

The firm is benefiting from major catalysts and trends that will support its growth. In my opinion, surge in AI solutions and datacenter related needs will be crucial in the upcoming years.

You surely heard about OpenAI’s search engine: ChatGPT, Google’s counterattack with Bard… AI is expected to change the shape of many industries. Its adoption seems to be gaining pace and this is just the beginning.

What does this surge in AI solutions mean for the semiconductor industry and how is AI benefiting semiconductor companies like RMBS?

The emergence of new technologies such as AI represents new opportunities for the semiconductor industry, particularly in the DRAM segment where RMBS operates.

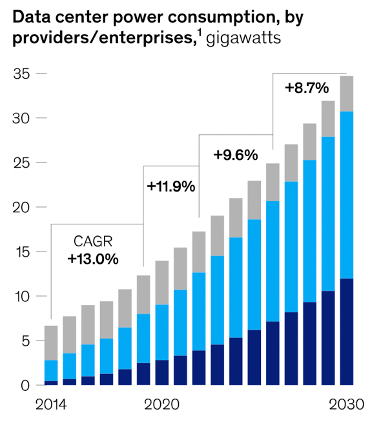

The growth potential of AI in the semiconductor industry is supported by statistics, as reported by McKinsey.

According to the consulting firm:

In the US market alone, demand—measured by power consumption to reflect the number of servers a data center can house—is expected to reach 35 gigawatts by 2030, up from 17 GW in 2022

Note that the United States accounts for roughly 40 percent of the global market.

McKinsey

Furthermore, according to the U.S. Chamber of Commerce Foundation:

90% of the world’s data has been produced in just the last two years

This shows that the need for Data centers and efficient products are of a crucial necessity.

I expect RMBS to strongly benefit from this knowing that 75% of its revenues are data center related.

Thus, as more and more data are generated and the calculation power needs increase, RMBS should capture a substantial share of this growth.

RMBS management team is well aware of this opportunity. In the last Q4 earning call, CEO Luc Seraphin mentioned AI as a major growth driver for the company. As an example, the company is collaborating with IBM on developing new memory solutions for AI, particularly for use in AI accelerators. This partnership seeks to develop hybrid memory solutions that combine the high bandwidth of DRAM with the high capacity of flash memory to enable faster and more efficient AI processing.

RMBS’ innovative products provide increased bandwidth, capacity, and security, making it a compelling player. The company’s expertise and ability to address the market need for flash memory (DDR5) which is known for being efficient whether in terms of energy efficiency or terms of power, will be key for its development and represent in my view a secular growth opportunity.

Financials

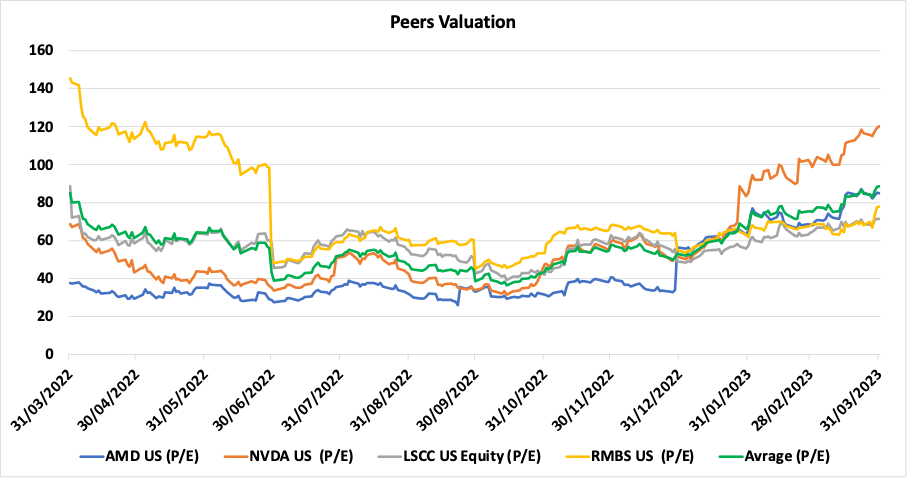

The iShares Semiconductor ETF (SOXX) has particularly well performed on a YTD basis (+28%), and RMBS has also printed a very strong performance (+42.74%). Many are concerned about the expensive valuation, especially after the recent rally. In my view, valuation is not that expensive when looking at the firm peers.

This is visible on the graph below where RMBS P/E stands at 78 vs 89 for the peer average implying a 14% discount.

Bloomberg

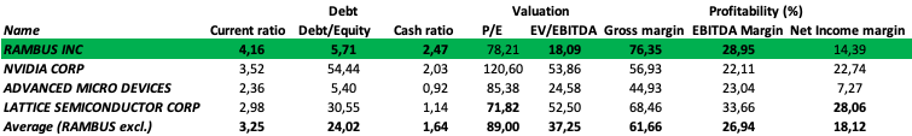

Is this discount justified by worse fundamentals? Not at all

Bloomberg

Whether in terms of financial sanity, valuation, and profitability, RMBS stands on or close to the top of its peer groups.

Thus, also when looking at the firm fundamentals, the stock seems to be underappreciated.

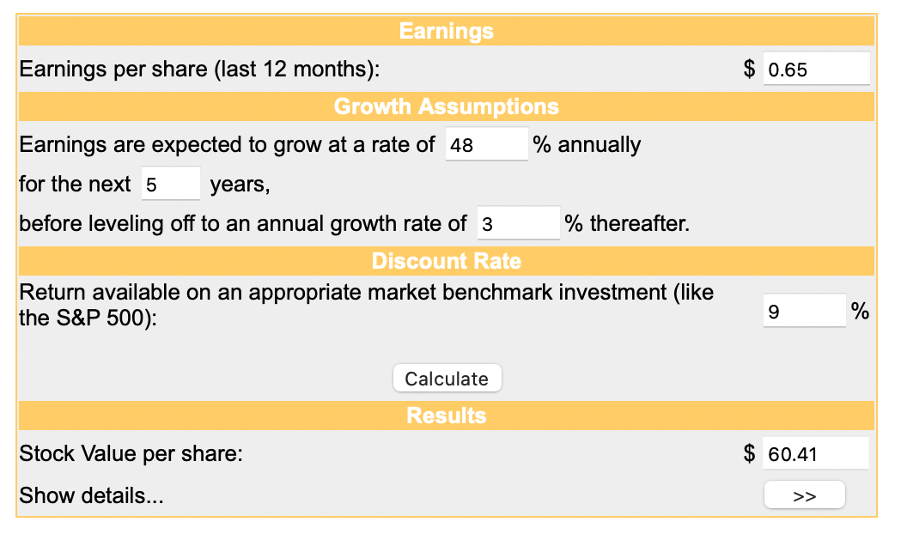

When computing my calculation, I started from a trailing 12-month EPS of $0.65, I choose as I usually do a 3% perpetual growth rate based on the average US GDP Growth rate during the last 10 years. I expect earnings to grow by 50% for the next 5 years taking into account the consensus 200% EPS growth expectation for 2023 and the data center growth of approximately 10% for the upcoming 5 years. I combined this with a WACC of 9%. With such assumptions, we reach a target price of $60.41 representing an 18% upside potential.

Moneychimp

After aggregating these two assumptions and computing the average of these, I expect a 16% upside potential for RMBS for the year 2023, representing a $60.41 target price.

Risks

RMBS risks are various and can be enumerated as follows:

- Recession leading to an economic slowdown and a weaker need for RMBS components

- Tough competition

- Expiration of patents and incapacity to find new others

- Higher interest rates pressuring valuation

Conclusion

RMBS potential is in my view underappreciated and the firm is wrongly considered as being too expensive. Secular growth opportunities have a price. Should, the recent rally worry you, waiting for a pullback could be a wise decision. In any cases, I believe that the ongoing shift to the cloud, along with the widespread advancement of AI across data centers, 5G, automotive, and IoT, has led to an exponential growth in data usage and tremendous demands on data infrastructure. Ideally positioned to address this challenge, RMBS will be able to fully seize this chance to benefit from both these trends and the underlying needs for its innovative products, especially in the DDR5 segment. I target a 16% upside for 2023 and initiate on RMBS stock with a Buy rating and a target price of $60.41.

Popular ETF’s of Semiconductors ETF List (1/5): Overview

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.