Indonesia trades at a discount to other emerging Asian countries. Indonesia has a strong domestic economy and demographics, which are both often overlooked. Indonesia has ample potential to boost its exports this decade. Indonesian equities may continue to outperform the MSCI Emerging Markets Index.

IDX: Alternative Option To Access Southeast Asia At Discount

Opportunity Overview

Equities in Indonesia are relatively attractive, given that many companies are trading at a discount to regional peers. This article provides an overview of the VanEck Indonesia Index ETF (NYSEARCA:IDX), which may be worth investing in even though it has historically underperformed one of the other main Indonesia-focused ETFs. Indonesia’s discount to other Southeast Asian equity markets is very intriguing, given that it has the long-term potential to be a leading regional powerhouse due to the combination of resources, demographics, and manufacturing capabilities. Equities are still relatively cheap, even after the market outperformed emerging markets in 2022.

Vehicles in Indonesia

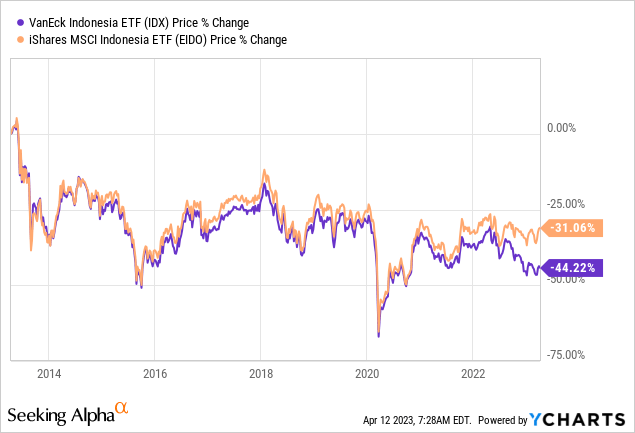

I previously covered the iShares MSCI Indonesia ETF (EIDO), which has outperformed the Van Eck Indonesia ETF in the past twelve months, and also on a 10-year historical basis. While there are many differences between the two ETFs, two of the key differences include the following:

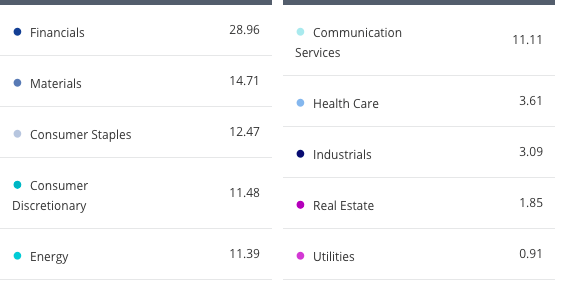

- Financials: The Van Eck Indonesia ETF has a lower weighting in financials

- Performance: This ETF has underperformed its benchmark index in the past twelve months.

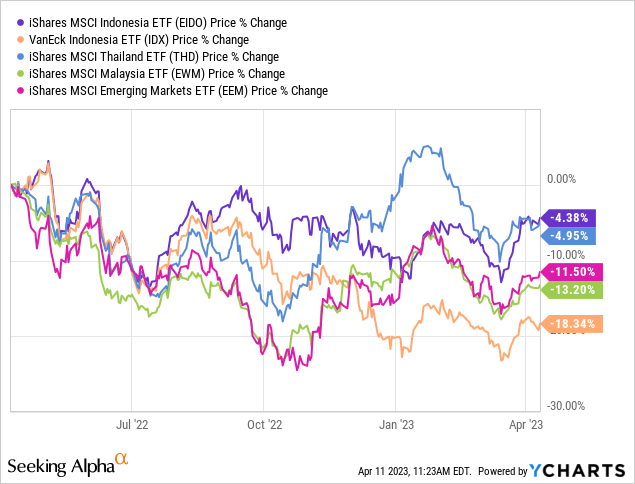

Relative Performance

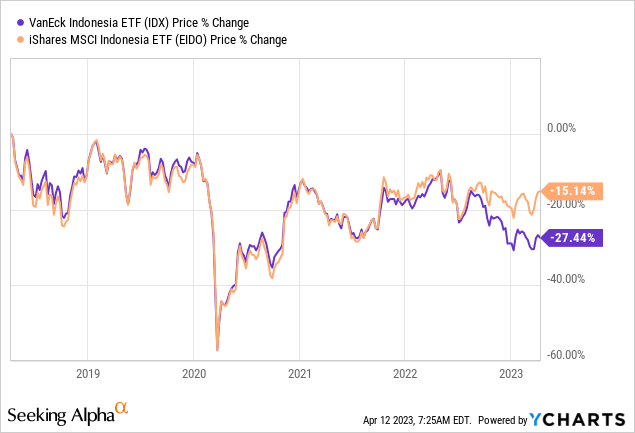

Indonesian equities performed very well during 2022, while the MSCI Emerging Markets Index declined by 19.7%. Indonesia outperformed the MSCI Emerging Markets index and other countries like Malaysia and Thailand. However, the VanEck Indonesia ETF underperformed the iShares MSCI Indonesia ETF (which more closely tracks the index) by around 14 percentage points in the past 12 months.

Economic Differences

Indonesia differs from its regional peers in many ways and may be better positioned to weather an economic crisis. For example, the country’s trade-to-GDP ratio is only around 40%, which is much lower than that of other regional peer countries.

| Country | Trade as a % of GDP |

| Thailand | 116% |

| Malaysia | 130% |

| Indonesia | 40% |

| Singapore | 338% |

Source: Macrotrends

Indonesia is unique to other regional peers, as it has a strong manufacturing base and can benefit from higher commodity prices. Some of its top exports include oil and gas, palm oil, rubber, and certain electric appliances. Indonesia has benefited from rising oil and gas exports and stronger export growth in markets like China and Japan. It is also the world’s largest exporter of thermal coal, palm oil, and refined tin and has deposits of other commodities like coal, nickel, bauxite, and copper.

Most importantly, it is the world’s 4th most populous country, with a population of over 270 million and a median age of 29.4. The country has a strong manufacturing industry, which contributes to around 20% of the GDP despite the country’s relatively lower exports. There is ample room for Indonesia to expand its manufacturing industries and increase exports to other regional regions like the EU and other regions.

Discount to S.E Asia

Indonesia trades at a significant discount to emerging Asia on a price/earnings basis and offers a relatively attractive dividend yield.

| Index | P/E | P/B | Dividend Yield |

| MSCI Indonesia | 13.47 | 2.38 | 3.85% |

| MSCI Thailand | 21.50 | 1.96 | 2.69% |

| MSCI Malaysia | 16.00 | 1.36 | 4.01% |

| MSCI Philippines | 18.35 | 1.87 | 1.98% |

ETF Overview

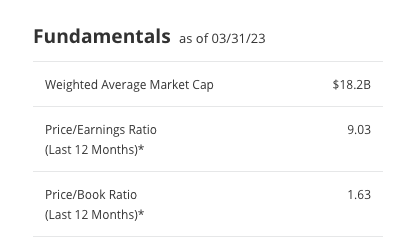

This ETF is a relatively unique way to access Indonesia’s stock market at a slight discount. This ETF trades at a slight discount to the MSCI Emerging Markets Index and MSCI Indonesia ETF and offers a relatively higher yield of 3.6% at the moment.

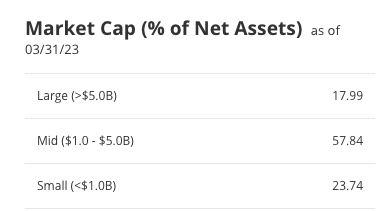

One of the reasons that this ETF trades at a discount is that it invests more in small and mid-cap equities.

Comparison to Other ETFs

If you are considering investing in this ETF or the iShares MSCI Indonesia ETF, one of the main differences to consider includes the difference in exposure to larger financial companies. The VanEck Indonesia ETF has a lower weighting in financials (28.96% vs. 46.6%), so this is a better choice if you want less exposure to both large caps and banks.

Because this ETF invests heavily in themes like energy and materials, it has the tendency to underperform in the short term when these industries experience short-term pullbacks.

Most of this ETF’s underperformance has occurred during the past twelve months. If you think there will be additional rate hikes in Indonesia (which began in 2022), then the iShares MSCI Indonesia ETF is probably a better bet due to its stronger exposure to financials. Indonesia’s inflation rate recently fell below 5%, so there will not likely be additional rate hikes in the short term.

However, the VanEck Indonesia ETF is a better bet if you want to bet on cyclical out-of-favor names and access the market at a single-digit PE ratio. However, this ETF is slightly overweight consumer names. On a long-term basis, I would bet on the VanEck Indonesia ETF underperforming. However, 2023 looks like a strategic time to bet on this ETF outperforming in the short term.

The 2022 underperformance is also unique when you examine the 10-year performance of both ETFs.

Risks and Final Thoughts

Growth Potential: Indonesia is one market that may be overlooked, largely because of its ability to boost its manufacturing output and export to more countries. The ADB projects that Indonesia’s economy will expand by 4.8-5% in 2023 and 2024. PWC’s The World in 2050 report lists Indonesia as the world’s 4th largest country.

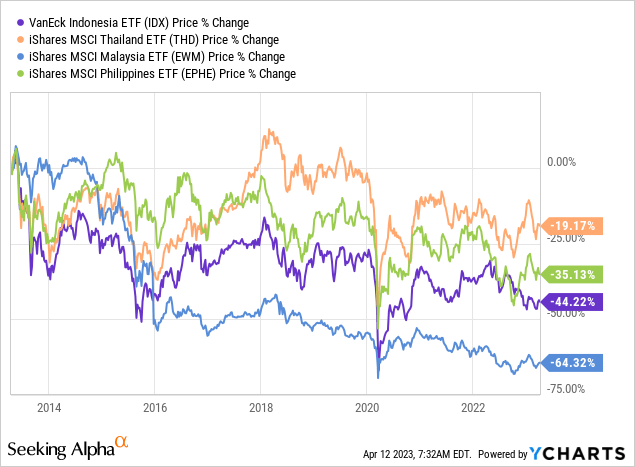

Regional Peers: Indonesia has been a relative underperformer in the past decade but appears like a relatively safe bet due to its favorable growth prospects and discount to regional peers.

Valuation: Indonesia still trades at a premium to MSCI Emerging Markets, and there are plenty of other markets that trade at a historical discount. Emerging markets like Brazil, Colombia, and Chile all appear to be bargains at the moment.

| Index | P/E | P/B |

| VanEck Indonesia ETF | 9.03 | 1.63 |

| MSCI Brazil Index | 5.07 | 1.41 |

| MSCI Colombia Index | 5.20 | 0.86 |

| MSCI Chile Index | 5.00 | 1.25 |

Source: MSCI/VanEck latest data

ETF risks: The main risk with this ETF is that it invests more of its assets in energy and basic materials companies and has a lower weighting in banking and large caps. This fact could cause short-term underperformance, as seen in 2022. The fund’s assets are also currently below $30 million.

Export Markets Risks: Indonesia is heavily exposed to growth in China and the United States ( 32.5% of total exports).

Public Debt: Indonesia’s Original Postublic-debt/" rel="noreferrer noopener" target="_blank">public debt has increased substantially since 2019, but still remains below that of most emerging markets. However, increased sovereign defaults in emerging markets could cause Indonesian equities to perform poorly in 2023-2024.

The top three most accessible options for US investors that want to gain exposure to Indonesia on US exchanges include the following:

- VanEck Indonesia ETF

- iShares MSCI Indonesia ETF

- Telekomunikasi Indonesia (TLK)

Other ADRS are listed on the OTC markets and most brokerages charge higher ($7+) fees to invest in these stocks. You can reduce your exposure to the banking industry by investing in the VanEck Indonesia ETF and Telekomunikasi Indonesia.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.