SVXY is an ETF that shorts the VIX volatility index. In other words, when volatility falls, SVXY aims to profit. In that sense, SVXY is an alternative way to participate in an S&P 500 rally, similar to leveraged ETFs. VIX has traded in a range from 20-30 for a while. But there’s a potential change in that range, and that makes SVXY one to watch. Hold rated for now.

SVXY: An ETF That Aims To Profit From Falling Volatility (BATS:SVXY)

When people ask me what I think of the “S&P,” I usually respond with “which one?” There are so many ETF varieties of the S&P 500, be it through sectors, industries, concentrated versions, style tilts and more. ProShares Short VIX Short-Term Futures ETF (BATS:SVXY) is part of the “more.” I’ve used it in the past as a surrogate for owning outright equity exposure in my portfolio. It has its drawbacks, primarily the usual risks that come with volatility ETFs and other forms of leverage. It is primarily intended for daily or short-term use, though in my experience, it need not always be kept on so short a leash. But certainly, any investor research volatility ETFs or ETFs that aim to get more for $1 of investment than a typical equity fund investment should familiarize themselves with the risks embedded here.

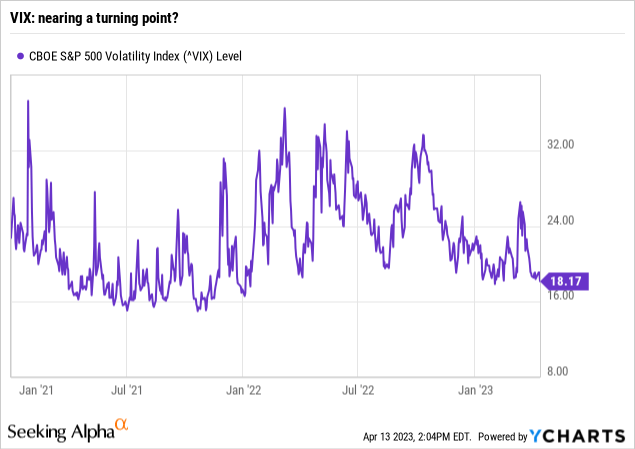

With that said, I think this is fascinating time to be looking at SVXY. That has everything to do with the VIX volatility index, which has spent the past nearly all of 2021, 2022 and 2023 to date in a very dedicated range. That range has been from a low of 20 to a high of 30. See the first chart below.

That is significant because historically, a VIX above 30 has often led to market chaos, for brief periods of time. See the chart below for the recent history of the VIX, which essentially gauges the expected volatility of the S&P 500 over the next 30 days. VIX was a professionals-only tool for decades. But fortunately, like nearly every former “sacred cow” in that arena, any investor who puts in the effort to understand VIX, ETFs and how those 2 come together, can greatly expand their opportunity set.

How does SVXY do it?

SVXY does not aim to short the VIX in a 1:1 fashion. There are other ETFs that do that, as well as 2X and 3X levered S&P 500 ETFs. I am not a big fan of leverage, other than in small bites, i.e. position sizes in my portfolio. Put and call options? Fine. Small positions in ETFs like SVXY? Fair game. But 3X anything is not in my playbook.

So, what I like about SVXY is that in the realm of taking an S&P 500 upswing and trying to profit from it, it doesn’t try to do too much. It aims to deliver 1/2 of the decline in the VIX. As a quick review, a rising VIX usually coincides with a falling S&P 500, and a falling VIX usually occurs amid a rising S&P 500 environment.

SVXY gets there by taking short positions in VIX futures that amount to 50% of the ETF’s assets, using the next 2 months contracts (so, I’m writing this in April, and so SVXY is short April and May VIX futures). It backs that short position with essentially a 100% cash position.

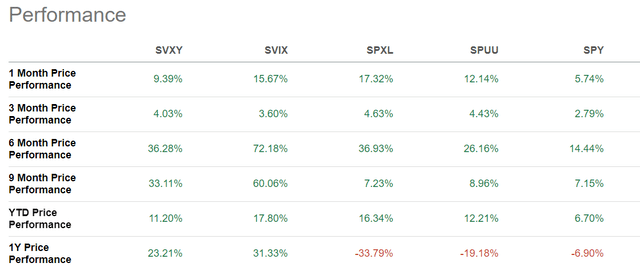

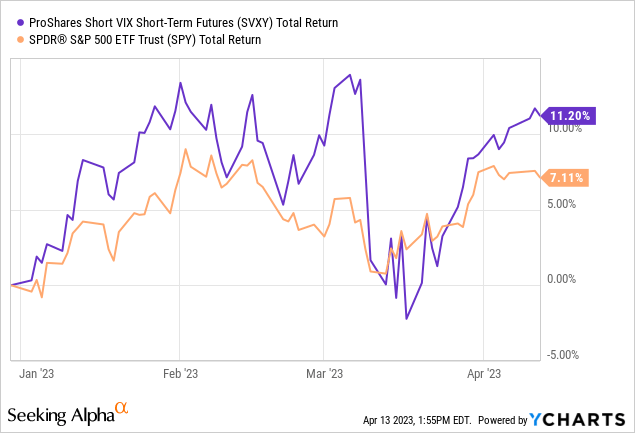

Past performance, as shown above for SVXY and some of its peers (including SPY, leveraged S&P 500 ETFs and a full 1x short VIX ETF), can be tricky to analyze, given the math inherent in shorting, and the way the VIX tends to hop around. However, I do point out that SVXY has a recent history of doing what it says it does. Its 50% short VIX position was enough to outperform the S&P 500 this year to the upside, and over the past 12 months, it made money in a down S&P 500 market.

Furthermore, ProShares is a leader in this type of ETF, and at $300mm, it has grown to a decent size for most investors to at least take a look at SVXY. In addition, the short-term nature of this ETF is reflected in the fact that over $130mm in dollar volume trades on a typical day. That’s nearly 1/2 the AUM, a figure way higher than most ETFs.

As a long-time believer in “playing offense and defense at the same time,” in my portfolios, SVXY is a valuable part of my ongoing watchlist, even if I only own it occasionally. And, while I am still ultra-skeptical of the S&P 500’s potential to truly break out toward its all time high, about 15% above recent levels, I try to always be ready for anything, any time. ‘

To that end, with the VIX having recently dipped below the bottom of that 20-30 trading range, I’m watching SVXY for its potential to itself break out to new high ground. All the while, forcing it to prove that it is not simply teasing such a move. I rate SVXY a Hold, but a move into the low $70s could change my mind.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.