After attending an e-capital summit at EarthX focused on connecting capital allocators and innovative firms, one can see that the efforts of the energy transition are multi-generational. It's a rather large tent with timelines that are decades long in nature.

During the summit, an opportunity to attend a “Fuels of the Future” presentation emerged. As noted in the video below, Toyota, in partnership with Chevron, has rolled out a renewable gasoline product offering. This is an entirely new frontier type of collaboration and offering. Chevron (CVX) had already been addressing renewable fuels in the heavy-duty transportation space. At Toyota North America (TM) headquarters, I listened to Chevron executives and visited with a top scientist. I was already sold on hybrids as a smart middle path alongside renewable fuels, and had mentioned the light-duty space in an earlier video. Understanding the “how” is about operationalizing the approach. This initiative will be unfolding over time. The hybrid, which uses gasoline and batteries (but much fewer), meets the majority of consumers where they are. (We need not subsidize this either, my opinion, nor can we afford it. Just ask Germany.)

Here are a couple of takeaways from a Financial Times online event as well:

- Renewable gasoline can provide a way of reducing the emissions of the 1.3 billion cars on our roads globally. Estimates point to the potential of 40%-50% reductions in carbon intensity compared to conventional gasoline.

- Renewable gasoline is not an alternative to electric vehicles, it's just another option to get the carbon reductions we need. Other options such as hydrogen-fueled cars also exist, and they will also experience speed bumps on the way to market, and may not be available in the timescale needed.

Basically, as the Toyota scientist mentioned, we do not know what solution will be the winners in the future. Best to be diversified.

This is part of the discussion below.

Interview about multiple events and energy transition approaches (Concept Elemental, Jennifer Warren)

The Market

Over the last year, from several extremely intelligent, in-the-trenches leaders, the idea that “the market” trumps has continued to ring true. The intentions behind the recent EPA new vehicle emissions announcement are to promote faster adoption of EVs, believing in a 60% market share by 2030. The economics and physics of the earth's resources do not support this target. With rollouts such as Toyota's and Chevron's, market-based approaches will continue to merge.

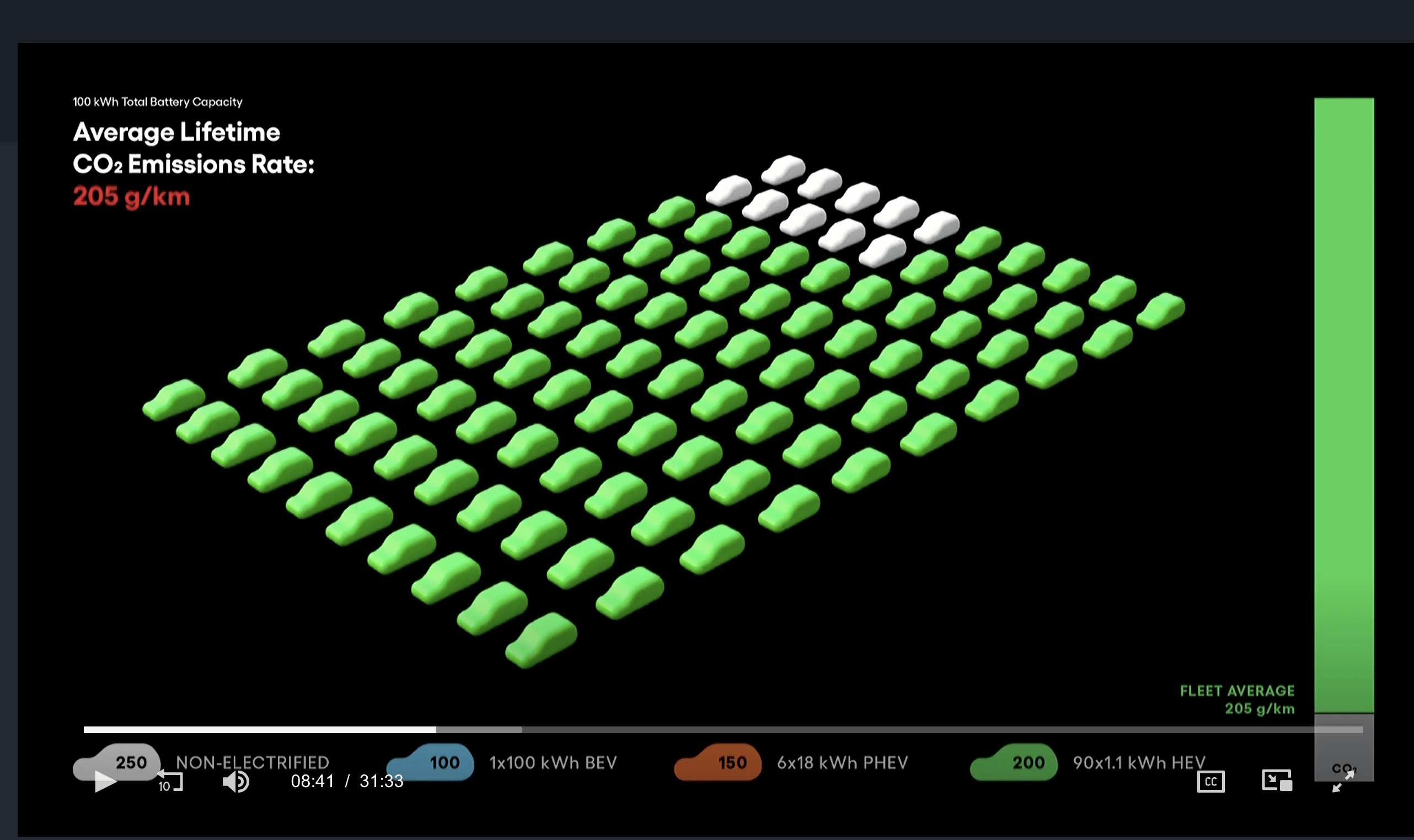

Hybrid Pathway (Toyota)

Essentially, the electric vehicle and its many variants is a solution to help decarbonize the atmosphere. However, projections suggest 10-20 years of challenges related to minerals' supply chains and the infrastructure required to have a truly green profile. This has been noted by scientists and geologists with which I have associated in the last two years-plus, simply learning about the economics, physics and resource requirements of changes to the energy mix. But the EV solution is alive and will continue, with winners and losers and scale also an imperative. Musk knows this well with Tesla's (TSLA) position.

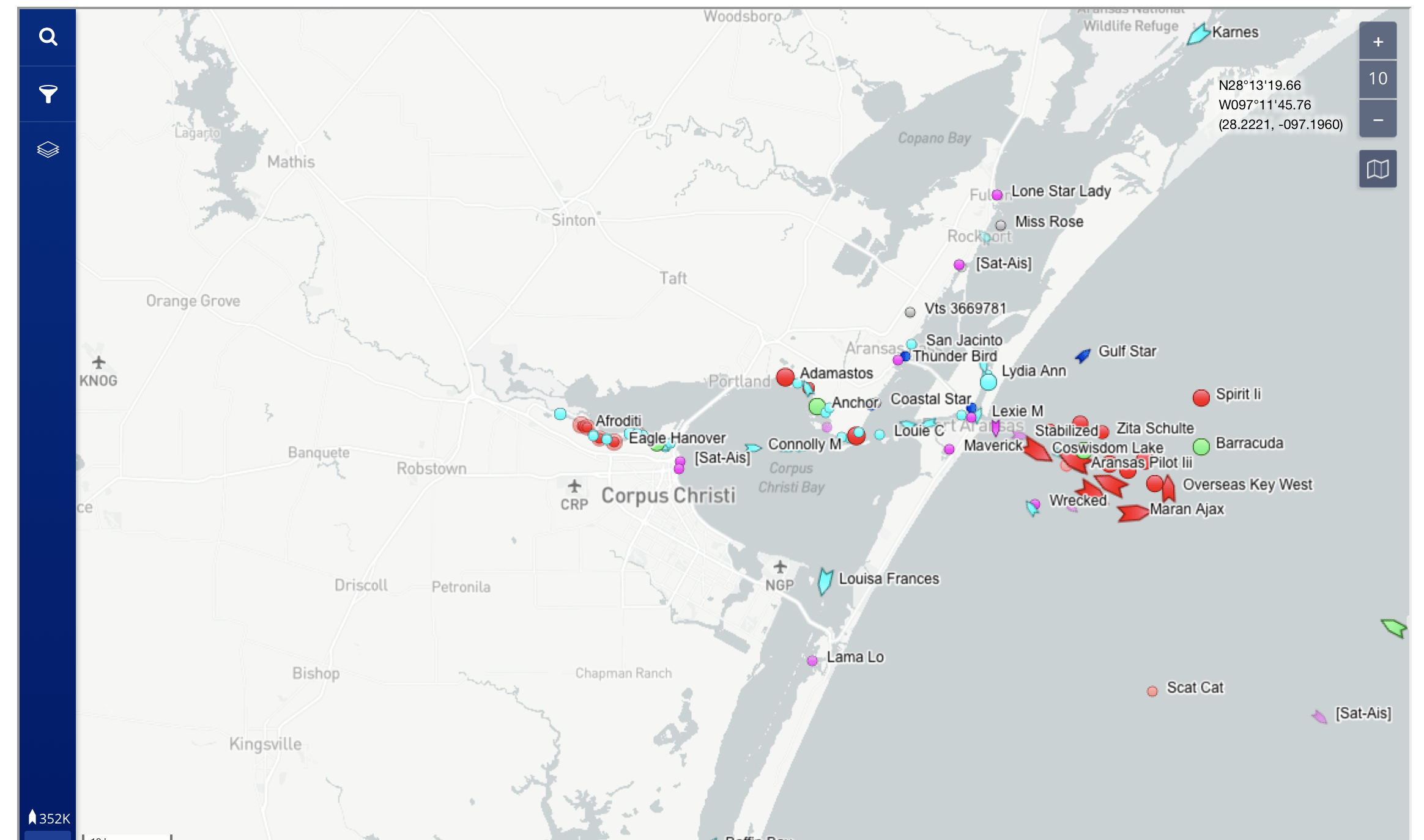

The market is also working in oil and gas. At a Texas energy symposium, the Port of Corpus Christi relayed that once the crude oil export ban was lifted in late 2015, they have now become the No. 1 one US crude oil gateway, shipping out 2.3 million barrels a day. They're the second biggest LNG export port, with plans to expand that potential.

Port of Corpus Christi vessel traffic (Port of Corpus Christi)

Additionally, I learned that hydrogen hubs are economic without the Inflation Reduction Act subsidies. Texas and the Gulf Coast are ramping up CCS (carbon capture and store) and hydrogen initiatives. The oil and gas industry are naturally aligned with these new (and old) technologies and methods. Asian customers like the U.S. crude brand. Terrific amounts of work have gone into this effort.

The Prize Of The Permian: Influencer Pioneer Natural Resources (PXD)

I've stated that resource efficiency and capital efficiency were the drivers in my initiatives. In the case of Ukraine, I learned that the government there is focused on energy efficiency and energy savings, alongside the imperative of energy security. This speaks to the need for country-specific pathways and knowledge-resource sharing. They are harnessing just that, within a war-torn context, driven by urgency, need and survival. Advanced economies, heavily driving decarbonization efforts, also will find their own country-specific approaches based upon market dynamics and government policies.

Energy Drive: Efficiency, Scale And Collaboration (Video Interview)

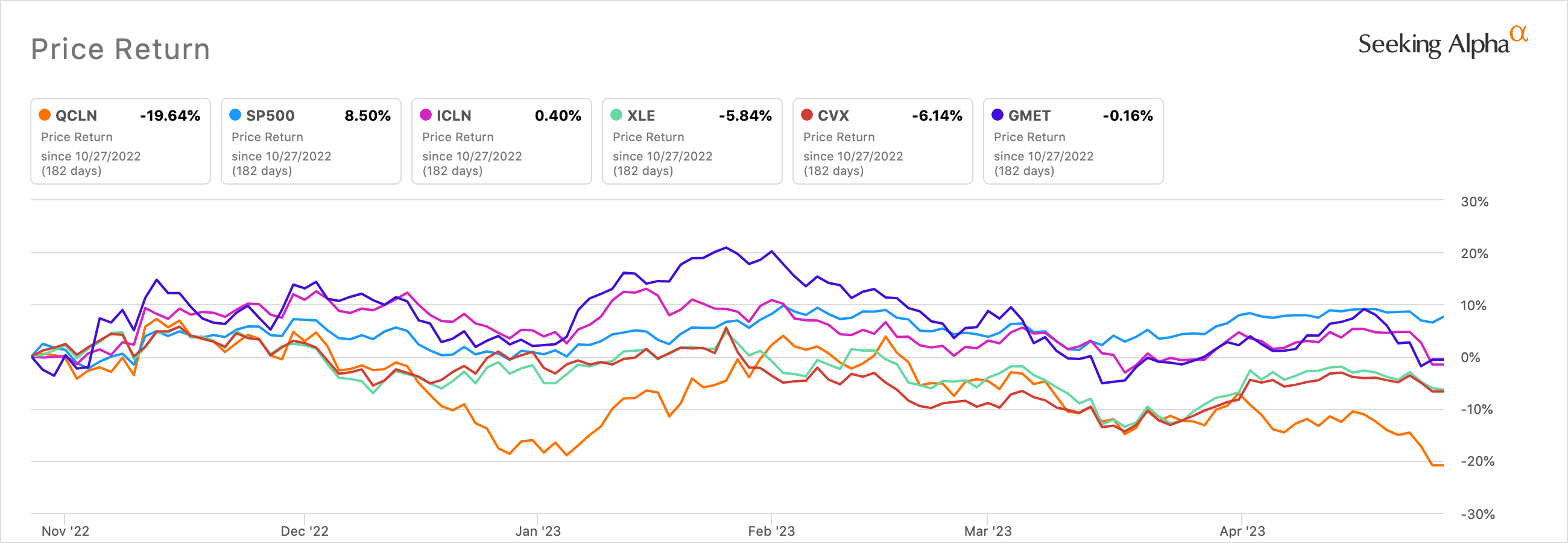

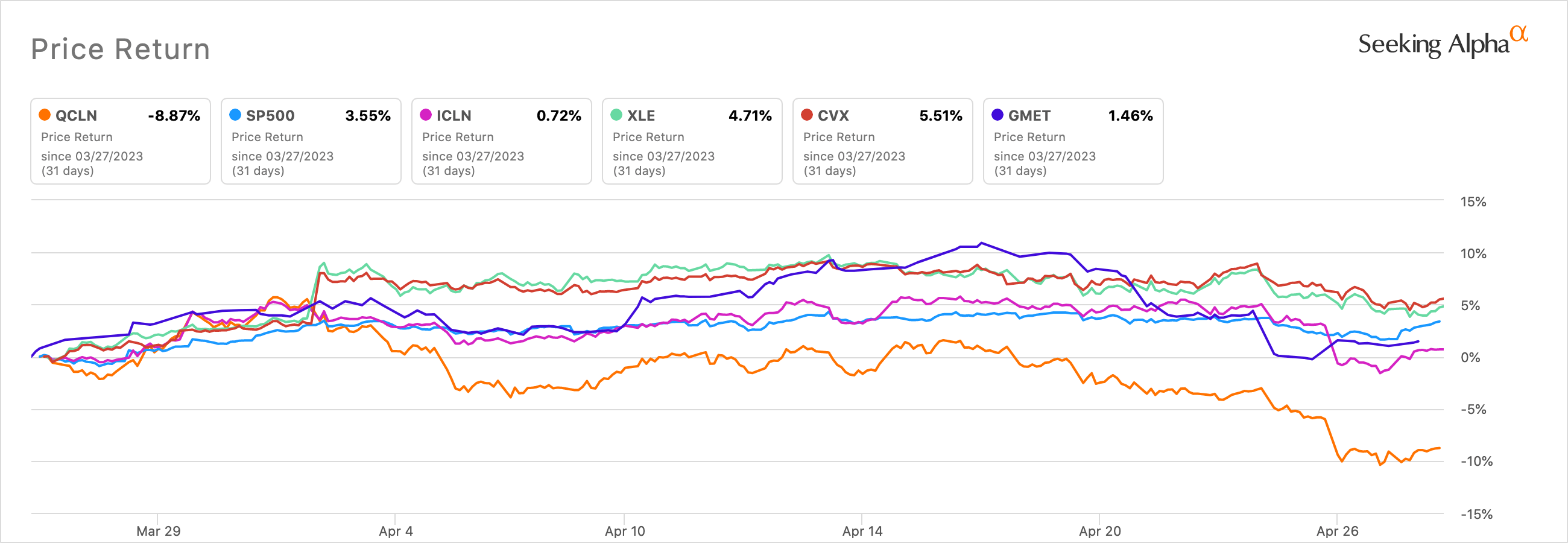

The market has been moving in interesting ways, owing to the after-effects of the pandemic and interest rates rises. Below is a one-month and one-year view of various ways to play energy, further described in the video.

Energy, Clean Tech and Minerals (Seeking Alpha)

Energy, Clean tech and Minerals (Seeking Alpha)

Finally…

Many hours and days were spent with innovators, leaders, capital allocators and everyone in between over the last 10 days. An earth-full of ideas and initiatives were absorbed. There were those at the summit that had some very good taxonomies, or ideas as to how to achieve an ideal sustainable world. The task ahead will require many diverse approaches; it's not binary – green or brown, blue or amber. The market and Mother Nature will ultimately decide – though probably not in that order.

Ps. Texas Million-Dollar Miles offers context and background about the energy transition in Texas with its diverse energy resources.