Bloomberg reported that: Hedge Funds Place Biggest Ever Short on Benchmark Treasuries.

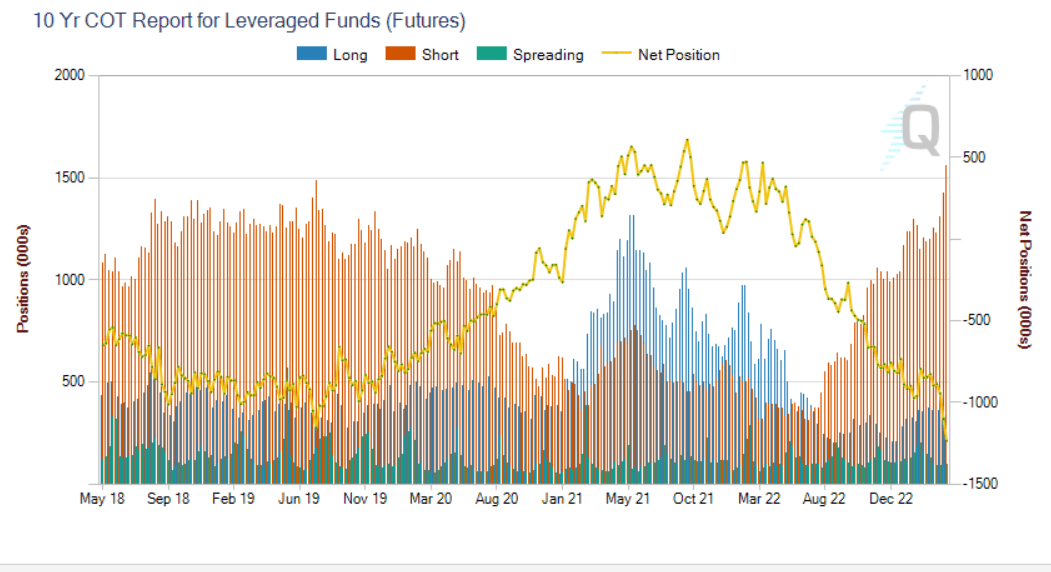

The short position is specifically on the 10-Year Treasury Bond futures. Here is the chart that illustrates “the big short”:

CME

This 5-year chart is based on the weekly position reporting by the leveraged funds (or hedge funds) and released as the Commitments of Traders report.

The chart illustrates the following:

- Hedge funds were heavily short (red bar) Treasury Bond futures from 2018 to March 2020 (Covid), with net short positions around 1M,

- Hedge funds turned not long Treasury Bond futures from 2021 until June 2022

- Hedge funds started aggressively shorting 10 Treasury Bond futures in June 2022, as well as covering the long positions, leading to the record net short position last week at over 1.2M contracts net short.

Let’s state the obvious first. Hedge funds were net long Treasury Bond futures through 2021 and the first half of 2022 – despite the inflationary spike, despite the ending of QE and starting of QT, and despite the well telegraphed Fed’s hiking policy. That was the terrible trade as long-term interest rate sharply spiked in 2022. Hedge funds were deeply wrong on this trade.

So, given that hedge funds were wrong on Treasuries recently, should we even try to analyze why are hedge funds net short Treasuries now – when we are in an imminent recession, and inflation is sticky but still expected to fall? Is this possibly a contrarian sign to buy Treasuries?

Why the big short in Treasuries?

Recession avoided?

Bloomberg is trying to make sense of this trade, and questions whether the hedge funds possibly bet on the possibility that US avoids a recession – “the slump can be dogged”.

Recent positioning data suggests leveraged investors are about as confident as the central bank is that a slump be dodged even as the past year’s inflation-fighting policy tightening bites on activity.

Bloomberg also quotes Damien McColough, head of fixed-income research at Westpac Banking Corp. in Sydney. “On the face of it, this big short doesn’t reflect the view that there will be a near-term recession.”

The basis trade?

Bloomberg acknowledges that the big short in Treasuries could be just a basis trade “when hedge funds buy cash Treasuries and short the underlying futures”, quoting James Wilson, a senior portfolio manager at Jamieson Coote Bonds in Melbourne.

Is this correct, the big short in Treasuries does not send the signal relevant to the macro environment.

Market clearing?

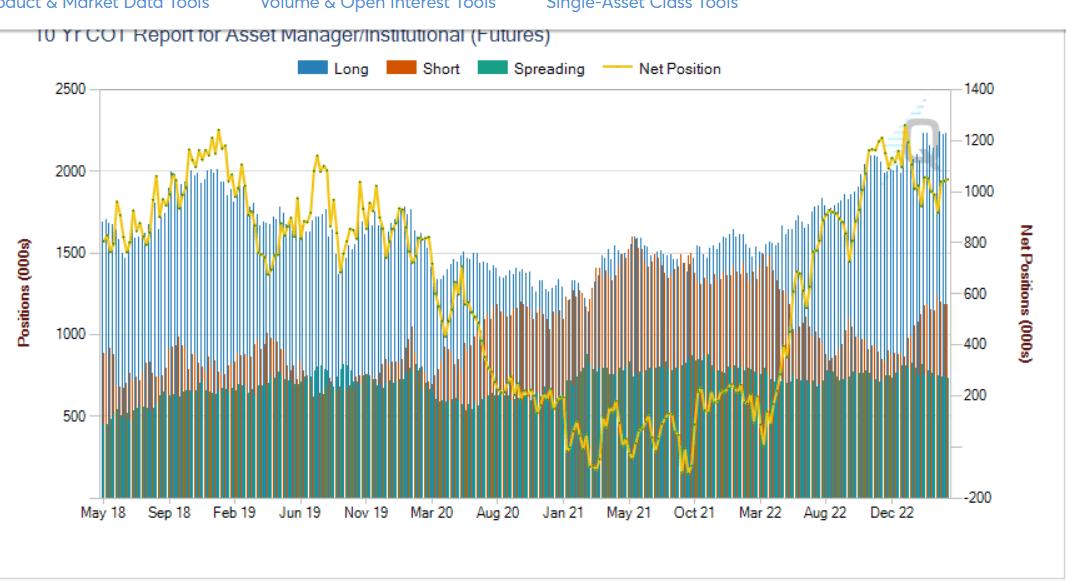

Bloomberg also notices that the asset managers, these are large non-leveraged funds, have been recently building a large net long position in US Treasury Bond futures. Here is the chart:

CME

The net position of asset managers is the mirror image of the net position of leveraged funds, which could imply that the record net short position in US Treasuries by hedge funds is just due to the market clearing in the futures markets.

Thus, the record net short position by hedge funds does not provide a signal for a broader macro environment.

Further analysis

Let’s review how to estimate the 10-Year Treasury Bond yield:

Nominal Yield = Real Yield + Inflation Expectations + Credit Risk

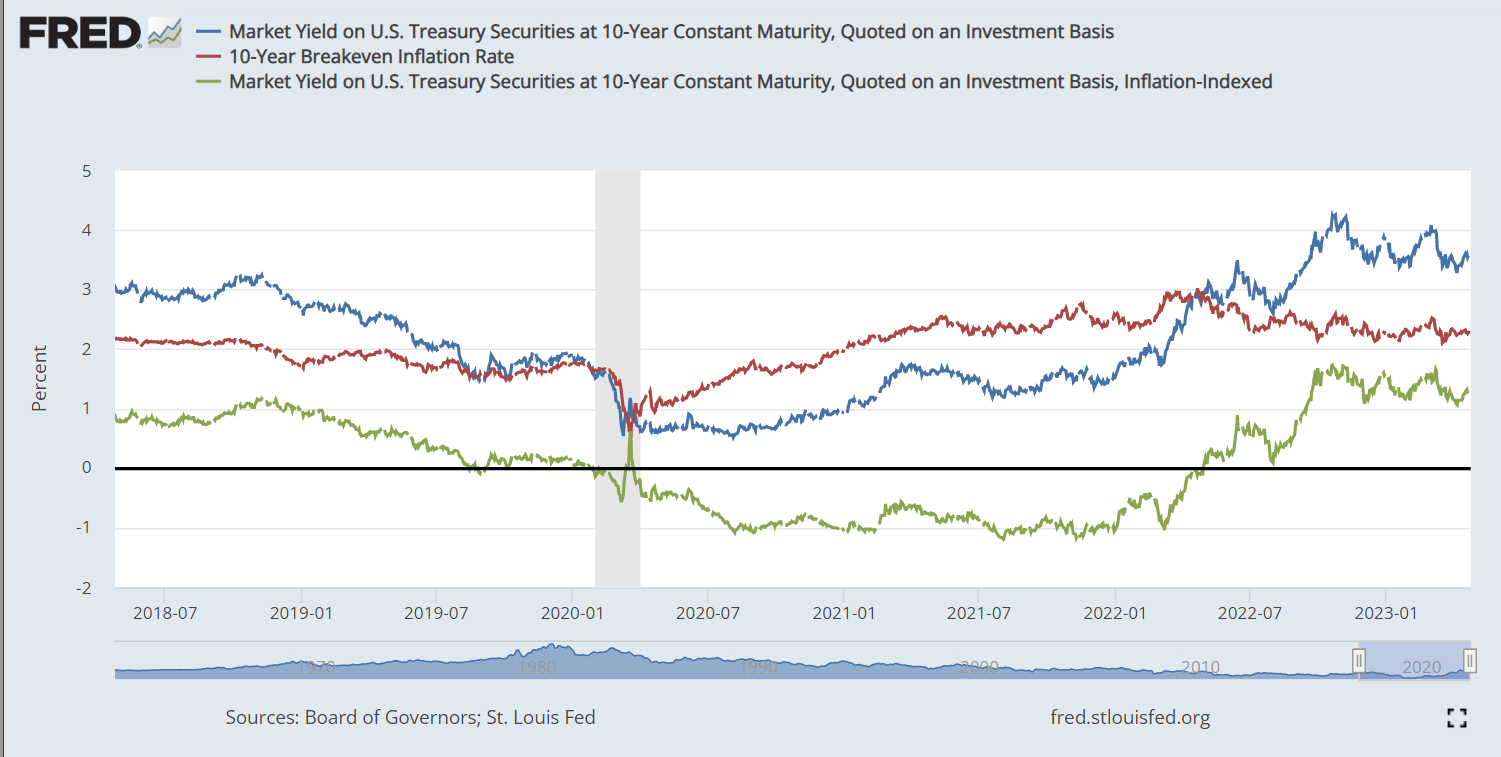

Here is chart that shows the nominal yield (blue), the real yield (green) and inflation expectations (red) over the last 5 years.

FRED

Real yield

The real yield is heavily influenced by the Fed’s balance sheet activity. It was deeply negative as the Fed was expanding the balance sheet via QE from March 2020 (Covid) until March 2023 when the QE ended. The real yield increased and turned positive as the Fed implemented the balance sheet contraction or the QT.

Thus, the heavy bet on higher interest rates could be the bet on the accelerated QT program by the Fed. Given that the economy is already slowing, and inflation has peaked, this is very unlikely to happen.

Inflation expectations

Long term inflation expectations should be anchored at around 2%, with the acceptable range of 1.75-2.75%. This is the foundation of the Fed’s 2% inflation target. Thus, the net short position by hedge funds could also be the bet on the de-anchoring of inflation expectations or the runaway inflation.

There is some validity to this argument, based on recent statements by top Wall Street firms. Jamie Dimon, CEO of JPMorgan (JPM) recently stated:

Less predictable geopolitics, in general, and a complex adjustment to relationships with China are probably leading to higher military spending and a realignment of global economic and military alliances. Higher fiscal spending, higher debt to gross domestic product, higher investment spend in general (including climate spending), higher energy costs and the inflationary effect of trade adjustments all lead me to believe that we may have gone from a savings glut to scarce capital and may be headed to higher inflation and higher interest rates than in the immediate past.

BlackRock (BLK), the largest asset manager, shares Dimon’s outlook:

We remain underweight nominal long-term bonds: We think markets are underappreciating the persistence of high inflation and investors likely demanding a higher term premium.

However, these arguments are for elevated inflation, not the runaway inflation, which implies a more neutral stance on Treasuries, not the record short.

Credit Risk

The US Treasury Bond is risk free, it’s the safest asset in the world. When there is a crisis anywhere in the world investors buy Treasuries in a “flight to safety”. Given that the US Dollar is the global reserve currency, the US government (and the Fed) can “print” the USD to pay the interest on Treasuries, without causing inflation.

However, the US government has the debt ceiling, which when reached must be increased. Normally, this is only a technicality.

However, we are currently at the debt ceiling, and given the political divide in the US Congress, there could be a small chance that the US defaults.

Perhaps, the hedge funds see the probability of US default much higher, and the record short position in Treasury Bond futures reflects that. Essentially, the record net short position in US Treasury Bond futures could reflect the bet on the US credit downgrade due to the debt ceiling event.

Implications

Investors can track the performance of the 10-year T-Bond futures prices with the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) – the chart below shows the perfect positive correlation between the two.

Data by YCharts

In my view, the nominal yield on 10-Year Treasury Bond will remain in the 3-4% range. Thus, my position on TLT is neutral.

We are in (or entering) a recession, and the real rates and the inflation expectations should stabilize. Normally, in recessions the inflation expectations fall, and in deep recessions the real yields also fall, which would make the Treasury Bond more of a buy in the current situation.

However, I agree that inflation will be sticky, which will keep inflation expectations elevated and prevent the Fed from implementing another QE. Thus, I am not bullish on TLT.

With respect to the potential US default, I assume that the debt ceiling will be increased, but I am not recommending buying Treasury Bills or Bonds until it’s actually lifted. Let’s wait.

With respect to the record net short positions by hedge funds, I view it simply as the market clearing, or possibly a basis trade, with no implications on the broader macro picture.

However, I do consider the possibility that the speculators could attempt to “play” the US debt ceiling event, so I do expect an increased volatility across asset classes this summer.

Treasury Bond ETFs Strengthen on Recession Risks, Easing Fed Outlook

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.