The safe haven characteristics of the Japanese yen may once again come to the fore if we see the U.S. experience a recession, and the Invesco CurrencyShares Japanese Yen Trust (NYSEARCA:FXY) would be set to rise significantly. The yen has a strong history of appreciating during periods of U.S. recession, in stark contrast to most other currencies. As well as benefitting from being a large net creditor, this safe-haven status reflects the limited potential for Japanese bond yields to fall from already-low levels.

While U.S. recessions lead to falling bond yields in the U.S. and, typically, the rest of the developed world, the limited scope for interest rate cuts in Japan causes a relative tightening in Japanese monetary policy, driving up the yen. This time around, the yen is also starting from a position of extreme undervaluation, which adds to potential upside for the FXY and should limit downside in the event that the avoids recession and maintains current policy rates.

The FXY ETF

The FXY holds Japanese yen in a deposit account held by JPMorgan Chase (JPM) and charges a 0.4% expense fee. As overnight interest rates in Japan have been negative over the past 7 years, the FXY has actually lost 0.5% annually relative to the USDJPY exchange rate. Overall the fund has lost over 5% annually since the yen peaked in 2011, but an inverse head and shoulders pattern now looks to be in play, suggesting a significant reversal. Down trendline resistance comes in around $71 dollars, and a break above here could see gains accelerate.

FXY ETF (Bloomberg)

The US-Japan Monetary Policy Divergence Has Begun To Reverse

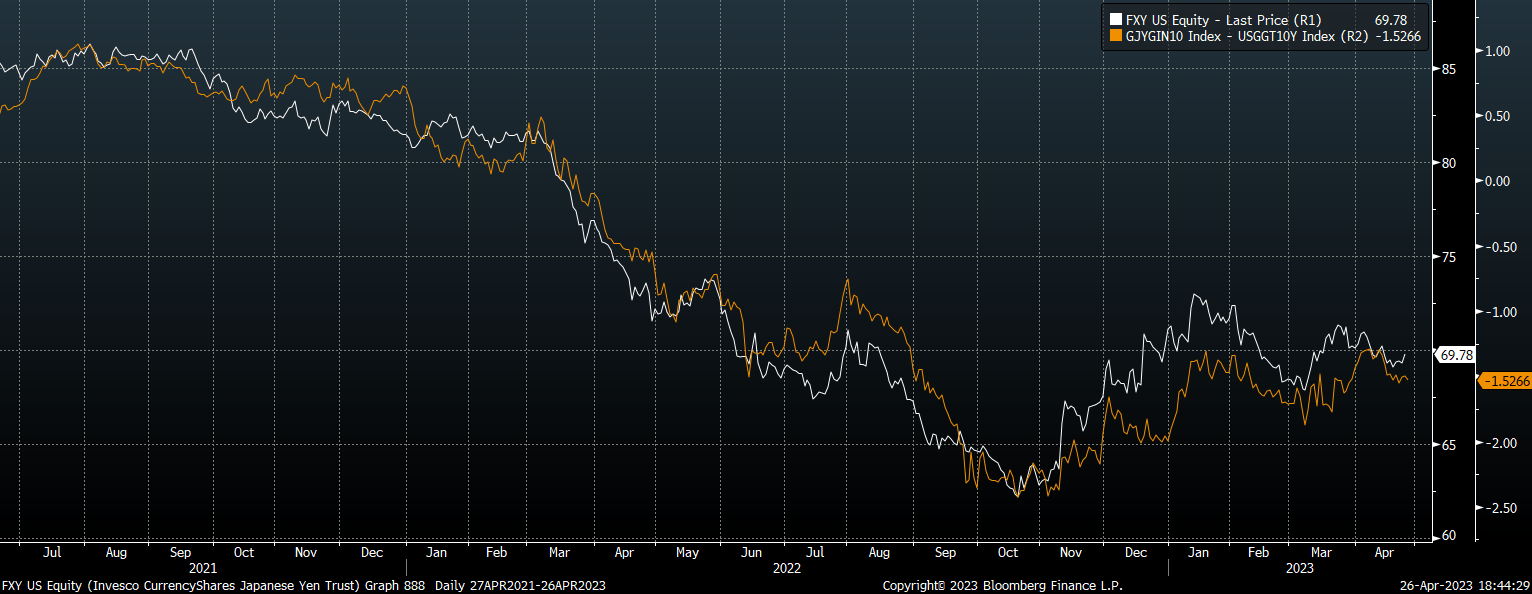

I last wrote about the FXY in June 2022 (in “The Yen: A Perfect Storm And An Opportunity”), and despite weakening a further 10% to 42-year lows, it has since recovered its losses. The yen's weakness over the past few years has reflected the divergence in monetary policy between the Fed and the Bank of Japan, which has now begun to reverse. The Japanese yen is driven predominantly by changes in real yield spreads between Japan and the U.S. The chart below shows the close correlation between the FXY and the spread of Japan and US 10-year inflation-linked bond yields. The yen tends to appreciate when either interest rate expectations rise or inflation expectations fall in Japan relative to the U.S.

FXY Vs Spread of Japan over US 10-Year Inflation-Linked Bond Yields (Bloomberg)

Although U.S. real yields remain significantly higher than those in Japan, the spread has moved almost a full percent in Japan's favor as U.S. bond yields have fallen, and Japan bond yields have risen. This marks a major relative policy reversal between the two central banks over the course of just a few months. In December last year, the BoJ voted to allow 10-year bond yields to rise to a limit of 0.5% from its previous 0.25%, reflecting a surprise de facto hike. In contrast, the stress in the U.S. regional banking system last month saw markets shift from pricing in further hikes this year to now pricing in interest rate cuts.

A U.S. Recession Would Accelerate The Policy Reversal

If we see the U.S. enter a deep recession, this monetary policy divergence is likely to widen. If we look at the Great Recession as an example, and also the early stages of the Covid recession, inflation expectations fell in both the U.S. and Japan, putting upside pressure on real yields. However, U.S. bond yields fell much more sharply as Japanese yields were already near zero. The same scenario is highly likely to play out again if the U.S. enters a full-blown recession, driving up the yen.

Furthermore, the BoJ's monetary policy stance is actually pro-cyclical in nature, meaning that when inflation expectations rise, public demand for bonds falls and so the BoJ must raise its bond purchases, further increasing the money supply fueling inflation. However, if we see a sharp drop in inflation and a plunge in Japanese bond yields, it is conceivable that the BoJ could be forced to effectively tighten policy by selling bonds to prevent yields falling below their 0.5% floor. This would drive a further wedge between monetary policy between the two countries, driving the yen and FXY higher.

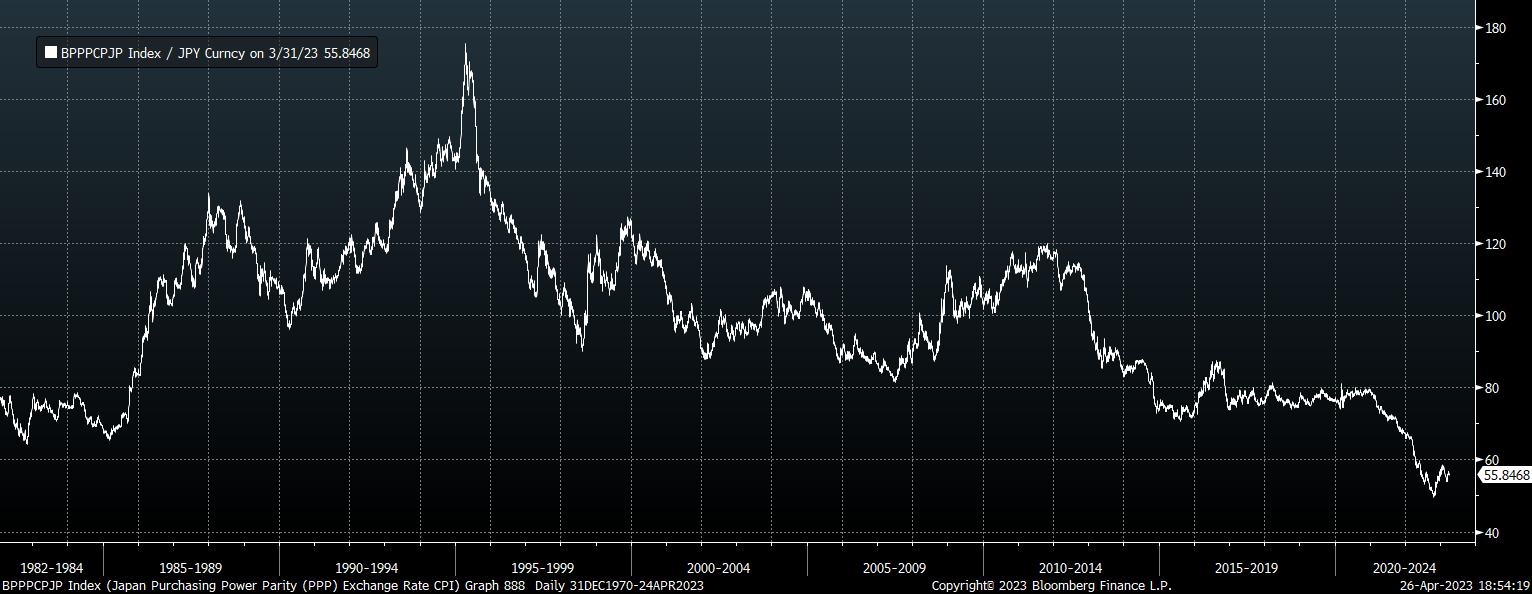

Undervaluation Adds To Upside Potential And Limits Downside Risk

Even if we avoid a deep U.S. recession and a plunge in relative bond yields, the FXY should still experience strong fundamental upside pressures due to its extreme degree of undervaluation in real effective terms. The yen is almost 50% undervalued compared to the U.S. dollar based on average price levels in the two countries as measured by the OECD's purchasing power parity metrics. At such undervalued levels, investors and consumers are likely to take advantage of the undervalued currency by purchasing assets and goods and services, placing steady upside pressure on the currency over the long term. This degree of undervaluation also suggests there is limited scope for further weakness.

USD/JPY Real Exchange Rate. Fair Value = 100 (Bloomberg, OECD)

Risk-Reward Is Favorable Relative To Bonds

If the yen is to appreciate significantly over the coming months it is highly likely to be the result of a large drop in U.S. bond yields, in which case, why not just recommend U.S. bonds instead? Bonds pay interest and depending on the maturity are much more volatile than the yen, suggesting a greater upside in the event of a recession.

However, there is also a greater downside risk. The longer the bond maturity, the greater the risk of loss if recession is avoided and interest rates remain at current levels. Furthermore, there is also a risk that a reversal of Fed policy in response to a U.S. recession could raise long-term inflation expectations as investors realize that the recession response will result in both monetary and fiscal expansion. While this would be bearish for bonds, it would be bullish for the yen and the Invesco CurrencyShares® Japanese Yen Trust ETF.

Editor's Note: This article was submitted as part of Seeking Alpha's Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Japanese Yen ETFs See More Volatile Moves