One of the most repeated misquotes has been, “Reports of my death have been greatly exaggerated.” Samuel Clemens, aka Mark Twain, may not have uttered these words, but they continue to live on as part of his vast legacy. Meanwhile, the reports of the demise of the U.S. dollar as the world’s reserve currency may not be exaggerated, given the geopolitical shift over the past year.

A reserve currency is a foreign exchange instrument held in significant quantities by central banks, governments, monetary authorities, and supranational institutions as part of their foreign currency reserves. Reserve currencies are critical for cross-border international transactions, international investments, and all aspects of the global economy. Since the end of WW I, the U.S. dollar has been the leading global reserve currency.

France held the world reserve currency from 1720 to 1815, and Britain took over from 1815 to 1920.

The U.S. created the Federal Reserve System in late 1913 and emerged as the supreme power after the First World War. Today, reserve currency status reflects the faith and credit of the government issuing the legal tender. While the U.S. backed the dollar with gold when it became the world’s reserve currency, it abandoned the gold standard in 1971, making it a fiat currency.

The U.S. remains the world’s leading economy and military power, but China is nipping at its heels, and the rise of China will likely usher in the fall of the dollar’s dominance. The Invesco DB US Dollar Index Bullish Fund (NYSEARCA:UUP) moves higher with the dollar index and could be moving much lower over the coming months and years.

Markets reflect the economic and geopolitical landscapes

Worldwide economics and political events can drive markets higher or lower. In February 2022, the handshake between Chinese President Xi and Russian President Putin on a massive trade agreement and “no-limits” alliance changed the world’s power balance. Less than one month later, Russian troops crossed the Ukrainian border, launching the first major war on European soil since World War II.

While the U.S., European NATO allies, Canada, Japan, Australia, and other partners lined up in opposition to Russia’s aggression, Russia, China, North Korea, Iran, and their allies created a bifurcation of the world’s nuclear powers. A growing number of countries have remained on the sidelines. Meanwhile, China remains committed to reunification with Taiwan, another issue that divides the world’s nuclear powers.

History will look back at the February 2022 Xi-Putin handshake as a watershed event that changed the world, increasing the odds of WW III. Moreover, China’s rise as an economic and military power threatens U.S. dominance in the worldwide financial markets. China’s rise is bearish for the U.S. dollar as the world’s second-leading economy and most populous country challenges the U.S. for the global leadership role.

A blow-off rally in the dollar index ran out of steam

The kneejerk reaction to Russia’s invasion of Ukraine was a rush to safety. Historically, the dollar, the world’s reserve currency, has been that haven. Meanwhile, rising U.S. interest rates only turbocharged the dollar’s rise as rate differentials impact the value of one currency versus another.

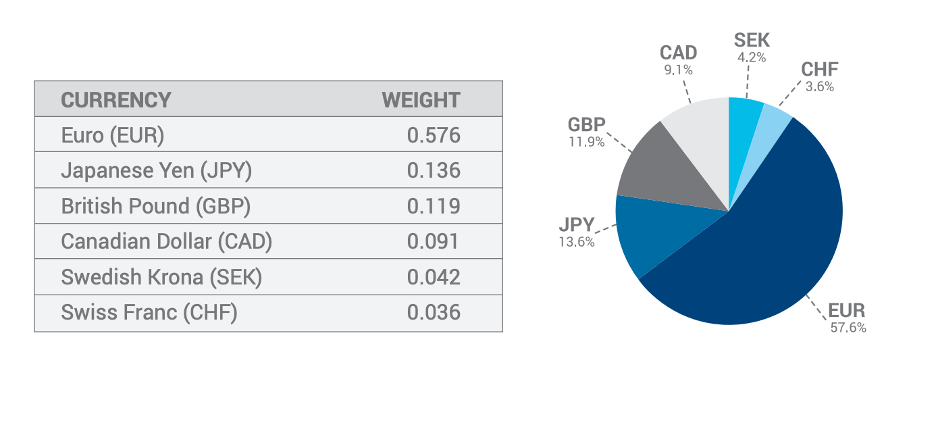

The dollar index measures the U.S. currency against the other leading world reserve currencies. The Chinese and Russian currencies are not freely convertible and do not possess reserve currency status. The dollar index’s construction reflects a dominant exposure to the Euro:

Composition of the U.S. Dollar Index Futures Contract (ICE)

The chart highlights the index’s 57.6% exposure to the Euro currency and the other components. The dollar index measures the U.S. dollar against a small group of reserve currencies; a changing world limits the importance of the index on the global landscape, making it complete regarding world trade.

Meanwhile, the rally that took the index to a two-decade high in September 2022 ran out of upside steam.

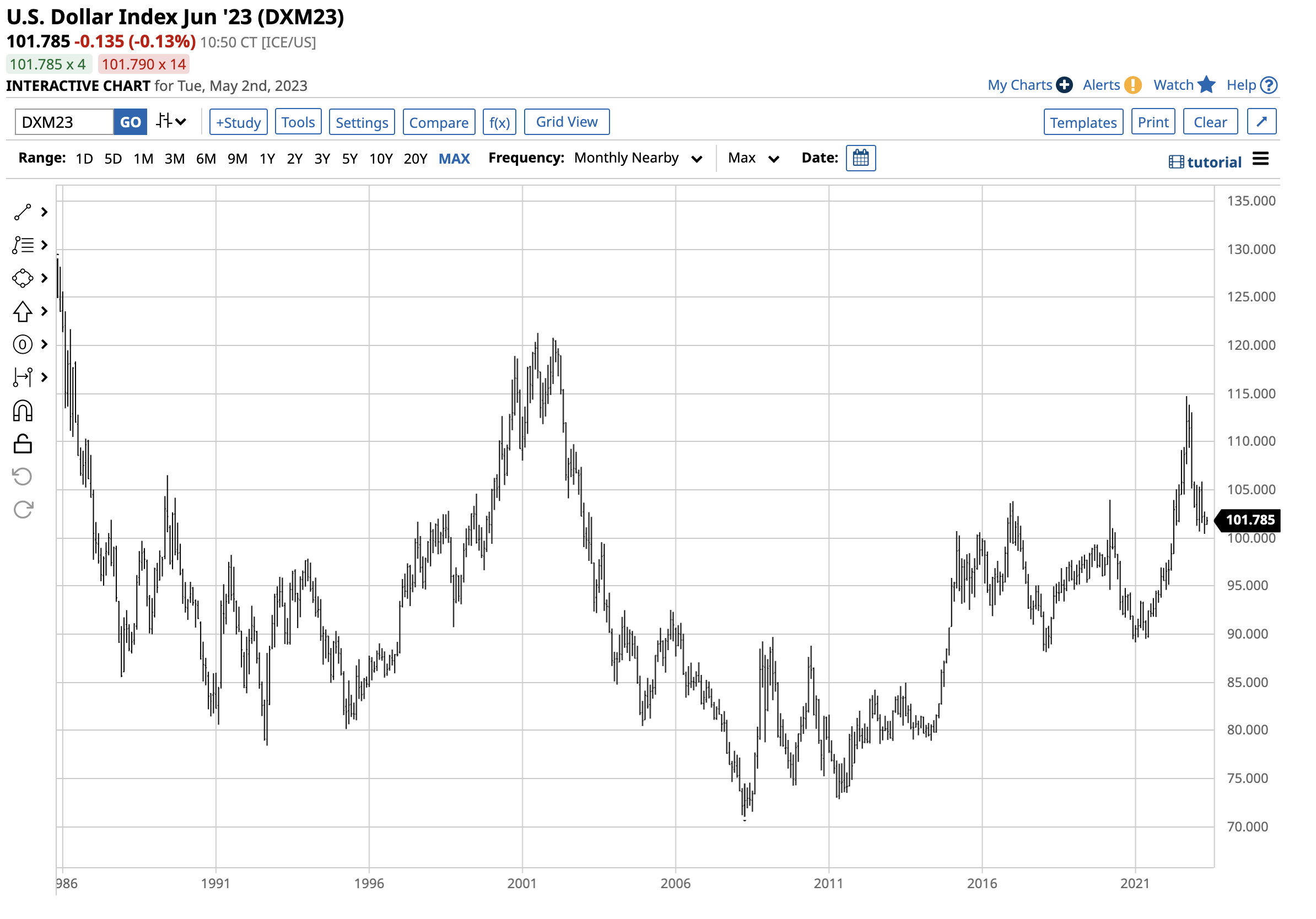

Chart of the U.S. Dollar Index Futures Contract (Barchart)

The long-term chart highlights the rally to 114.745, the highest level since May 2002. The dollar index turned lower, falling to 100.420 in April 2023. The 100 level is a psychological level, but it holds no technical significance. The trend in the index was lower at the end of April.

China and its allies conspire to devalue the dollar

Reuters recently reported the Chinese yuan became the most widely used currency for cross-border transactions in China in March 2023, overtaking the U.S. dollar for the first time. The yuan’s share was 48.4% compared with 46.7% for the U.S. currency.

In a recent development, Saudi Arabia is in active talks with Beijing to sell crude oil to China for yuan. Meanwhile, the United Arab Emirates is diversifying its foreign policy objectives, increasing non-oil trade with Russia by 95% in 2022. Despite U.S. and NATO sanctions, the UAE has become a critical storage and re-export hub for Russian petroleum.

The most telling comment came from President Xi’s recent meeting with Vladimir Putin in Moscow. As he departed, he told the Russian leader, “Change is coming that hasn’t happened in 100 years.”

Sanctions on Russia have caused countries to back away from the United States and the U.S. dollar, eroding its global position. In a recent Bloomberg report, Stephen Jen and Joana Freire of Eurizon SLJ Capital reveal that in 2022, the U.S. dollar’s market share of global reserves plunged ten times its average speed of the past twenty years.

Even Elon Musk is chirping in on the dollar’s demise, tweeting, “If you weaponize currency enough times, other countries will stop using it.” The bottom line is that one of the perhaps unintended consequences of sanctions on Russia is playing right into Beijing’s hands as China’s economy is on a path to grow larger than the U.S.’s and President Xi’s plans for global economic and military dominance take shape. The dollar is a victim of the shift in the worldwide landscape.

Meanwhile, French President Macron’s recent visit to China and comments illustrate cracks could develop in the U.S.-European alliance as Europe realizes Chinese economic and military dominance is on the horizon.

A weakening dollar will have dramatic impacts on markets

The debt ceiling crisis facing the U.S. is another noose around the dollar’s neck, as a default could cause the dollar to plunge. A weak dollar may support the profits of multinational U.S. companies, but it would cause a spike in inflationary pressures, causing interest rates to continue to rise. A weak dollar has supported stock and commodity prices, but a plunging U.S. currency could add fuel to Goldman Sachs’ forecast for a “commodity supercycle.” Goldman’s thesis is that underinvestment in raw material markets will create shortages, causing prices to rise. A deep decline in the dollar could turbocharge price increases.

Commodities are global assets, and the war in Ukraine has caused supply-side logistical issues beyond the Fed and other central banks’ monetary policy reach. A falling dollar will only exacerbate the recent trends. Stocks, bonds, commodities, cryptocurrencies, real estate, and other markets would all experience significant price volatility if the dollar is on an express train to the downside. When it comes to the bond market, a falling dollar, debt ceiling default, and China’s rise could cause other countries to shun the U.S. government bond market, leading to a steep decline.

Short UUP. Long Gold

I do not view the 100 level in the dollar index as a critical technical support level. The January 2021 89.165 low is the crucial support, which is over 10% below the current level in the index. Moreover, since the dollar index is more a mirage than reality on the global financial landscape, the dollar’s value could drop alongside the other index components. However, since the U.S. dollar is the center of the traditional reserve currency universe, the index would likely fall as the U.S. dominance declines and power transfers from Washington, DC, to Beijing.

Given the recent trends, I am bearish on the dollar and the dollar index and bullish on gold. Gold is the hard currency central banks, governments, monetary authorities, and supranational institutions validate through extensive holdings. Over the past years, countries have been net buyers, with China and Russia leading the way, increasing their reserves.

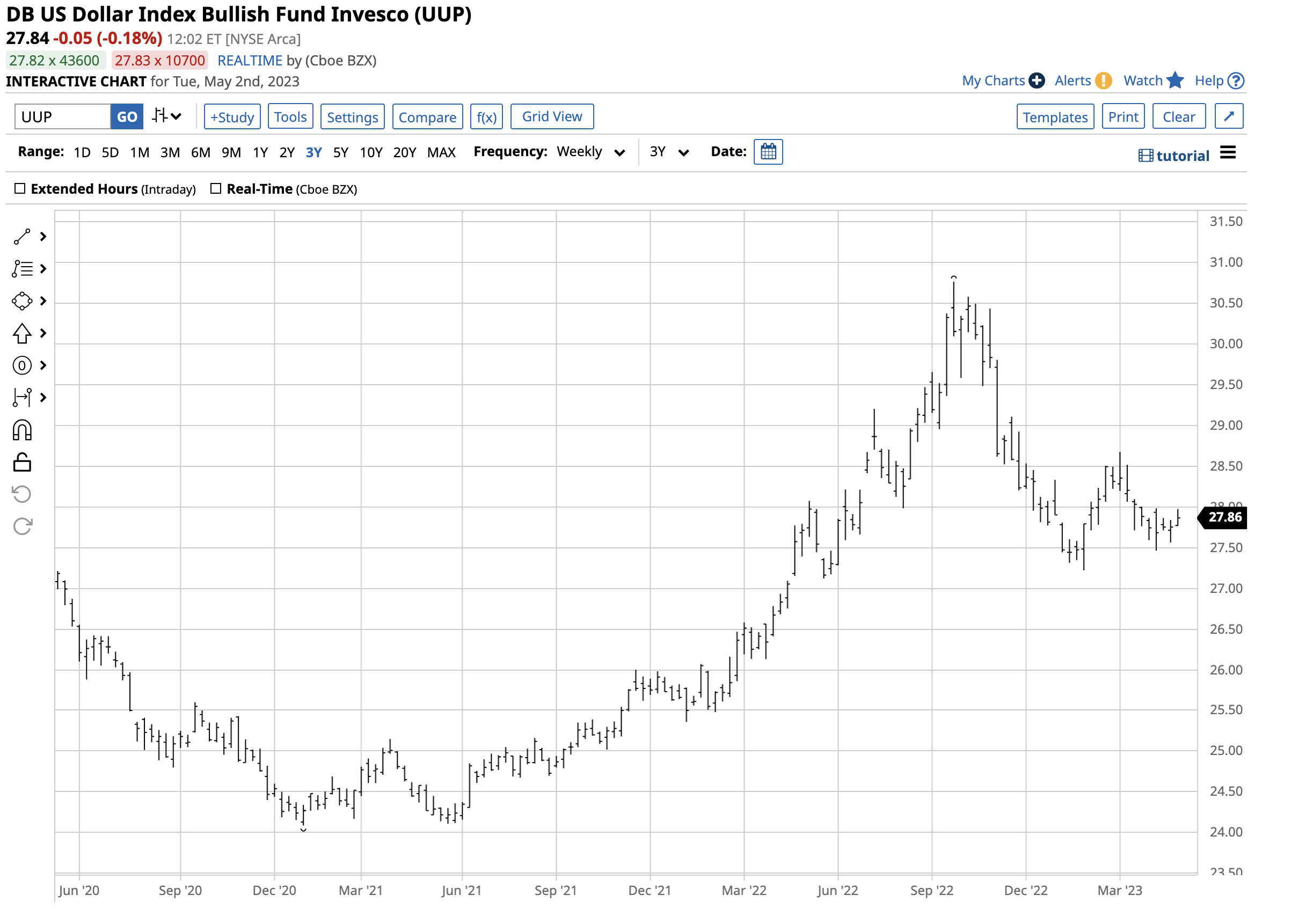

The most direct route for a short position in the dollar index is via the ICE dollar index futures or futures options. The Invesco DB US Dollar Index Bullish Fund is the most liquid dollar index ETF product. At $27.84 per share on May 2, UUP had just over $1 billion in assets under management. UUP trades an average of over 2.26 million shares daily and charges a 0.77% management fee.

The dollar index dropped 12.5% from 114.745 in September 2022 to the most recent 100.420 low in April 2023.

Chart of the UUP Bullish Dollar Index ETF Product (Barchart)

The chart illustrates the decline in UUP from $30.76 to $27.22 per share, or 11.5%. The UUP’s drawback is that it only trades when the U.S. stock market operates, while the international currency markets trade around the clock.

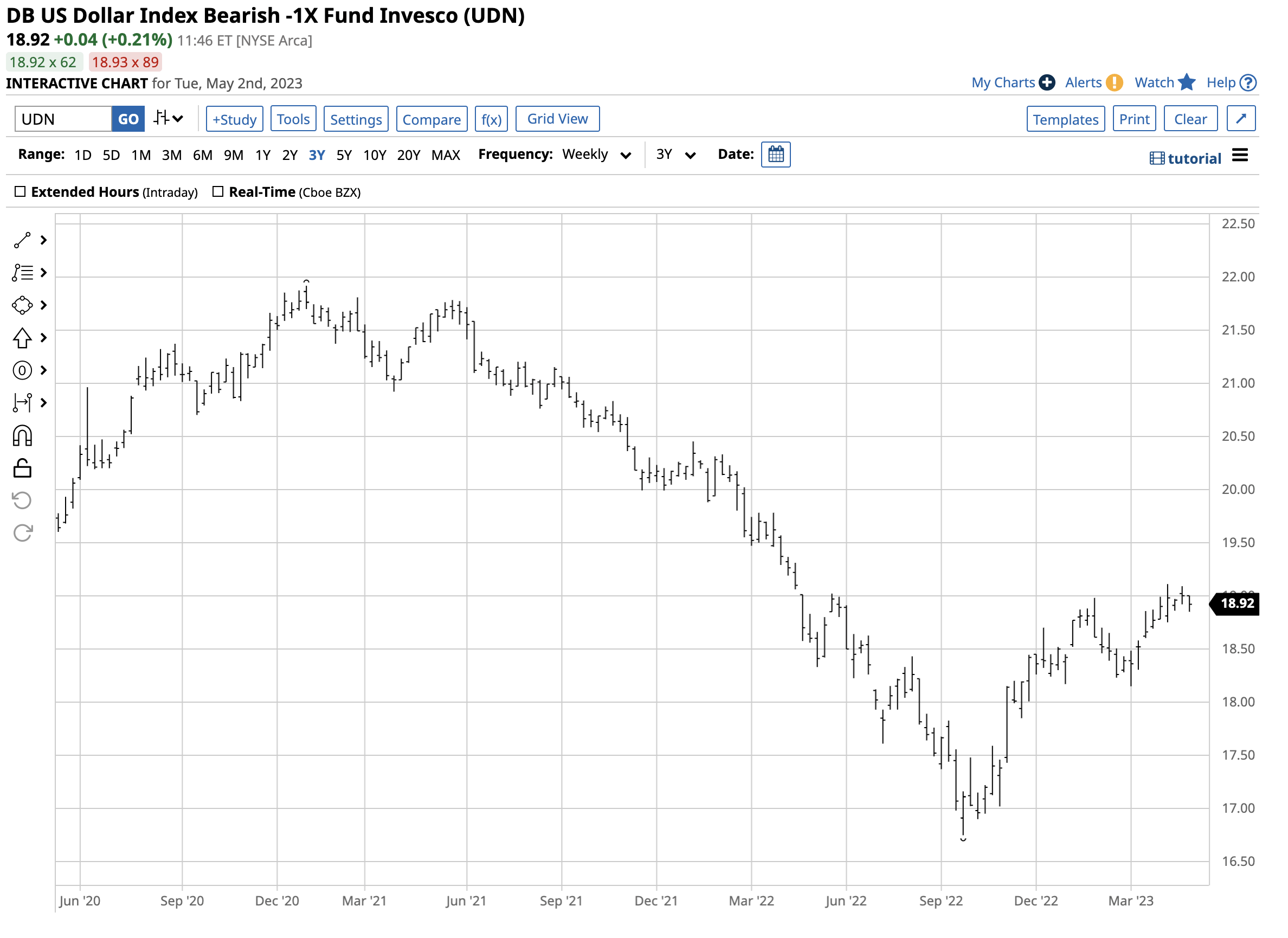

Invesco offers a bearish dollar index ETF (UDN), which is less liquid than UUP. At $18.92 per share, UDN had $86.9 million in assets under management. UDN trades an average of 147,543 shares daily and charges the same 0.77% management fee. While the more liquid UUP fell 11.5%, UDN did a better job tracking the dollar index on the downside.

Chart of the UDN Bearish Dollar Index ETF Product (Barchart)

UDN rose from $16.75 to $19.11 per share as the dollar index fell, a 14.1% increase.

A short position in UUP or a long position in UDN could be the optimal approach to positioning for a falling dollar index. However, gold is within striking distance of its nominal all-time peak at the $2,072 per ounce level. With gold hovering around the $2,020 level on May 2, the precious metal with a long history as the ultimate hard currency could be the best bet for a falling U.S. dollar. Gold tends to rally when the dollar weakens, and time will tell if the precious yellow metal will make a parabolic move if the dollar’s position as the world’s reserve currency is ending.

A sudden change in U.S. economic and political policies may be the only hope for the dollar’s position on the global landscape. However, the events since February 2022, and the pending debt ceiling crisis and level of national debt, have pushed a snowball down a dangerous slope that is expanding and picking up steam with no soft landing zone in sight.

Original Post>

U.S. Dollar ETFs Retreat on Rising Risk Appetite

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.