Like it or not, the alternative energy revolution is proceeding at breakneck speed and will continue to drive some key segments of the broad equity market in the coming months and years.

Chief among these segments are companies that produce the rare earth elements that are needed to drive alt energy technologies like electric vehicles (EVs), wind turbines, storage batteries and solar panels.

The global market for rare earth metals is projected to grow at a compound annual growth rate of at least 7% over the next eight years, according to a Transparency Market Research study. The expanding demand for these metals is being led by “considerable initiatives by governments” globally to utilize the latest mining, processing and refining methods to extract rare earth elements.

Moreover, double-digit growth from the wind, solar and EV sectors are also expected to substantially contribute to the growth.

Leading the charge in rare earth metal is demand for neodymium-praseodymium (NdPr) oxide, the strongest permanent magnet material ever discovered and is widely used in the $25 billion global magnet market. It’s also widely used in applications, including hard drives and speakers, but is especially used in high-performance motors-including hybrid and battery electric vehicles-as well as for generators. (The metal is primarily mined in China, India, the U.S. and Brazil.)

Rare earths like neodymium also play a pivotal role in the booming wind turbine market. And with this market widely expected to continue its mushroom growth in the years ahead, the companies that mine them will reap substantial benefits along with those who invest in them. (Per one recent industry research report, the neodymium segment alone is estimated to surpass a valuation of $7.3 billion by 2030.)

A pivotal demand driver for neodymium are their use in permanent magnet motors for facilitating electricity generation in wind turbines. To that end, there’s a developing trend in that industry to move away from securing supplies of the metal from China, the world’s main source of that metal.

According to a recent Mining.com article, wind turbine producer Siemens Gamesa (OTCPK:GCTAY) plans to reduce its dependence on China and diversify in certain “critical parts of its supply chain,” which the company said would “add a few percentage points” to prices for its finished product.

Siemens is nearly 100% reliant on China for rare earths and permanent magnets, according to the article, both of which are heavily used in the wind turbine production process. On that score, the firm recently signed a deal with Australia’s Arafura Rare Earths to obtain 200 tons of the rare earths per year needed for the permanent magnets its uses.

Supply is also expected to be an issue globally for rare earth magnets in the coming years, with NdPr oxide projected to be undersupplied by 90,000 tons by 2040 “due to a lack of new primary and secondary supply sources from 2023 onward,” according to an Adamas Intelligence report.

Collectively, these developments will likely keep rare earth metals prices buoyant in the coming years. One way to gain some exposure to this sector is via the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX). Per the fund’s prospectus, REMX “is intended to track the overall performance of companies involved in producing, refining and recycling of rare earth and strategic metals and minerals,” including tungsten, cobalt, lithium and others mentioned in this article.

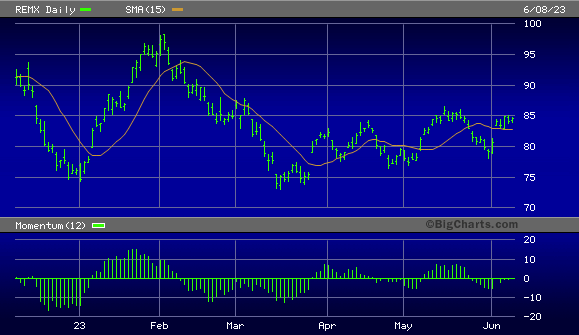

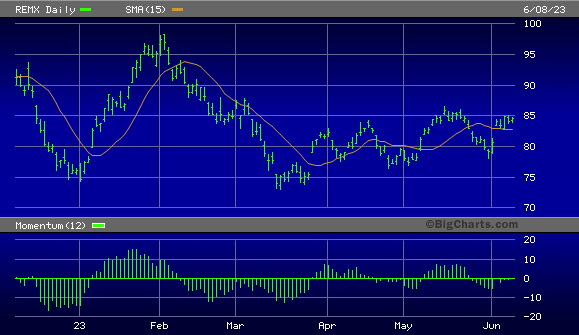

BigCharts

To that end, I’m initiating coverage of REMX starting with a “buy” rating on this fund. This ETF is coming off a weak performance in Q1, which was in part due to the impact of global EV sales being lower owing to the expiration of various subsidies in China in Europe (as well as the negative impact of higher interest rates), thereby diminishing the demand for some rare earth metals.

But as one major NdPr producer, MP Materials (MP) (a holding in REMX), pointed out in its latest earnings call, EV sales in China “appear to be rebounding strongly since March.” Further, with China’s rare earth industry expected to be “unprofitable at current prices,” it should boost demand for non-Chinese rare earth producers and subsequently lift the industry as a whole.

And that in turn should be good news REMX.

Neo Performance Materials: In The Right Part Of The Value Chain

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.