baona

Last month, Goldman Sachs reiterated its bullishness on commodities, including crude oil, when it noted that inventories were dropping quickly. Oil bulls also got some good news last week when OPEC+ announced an unexpected production cut of 1.16M bpd, and Russia agreed to maintain a 500k bpd reduction which it had initially implemented in February.

When the war in Ukraine began, oil prices soared to more than $120/bbl as markets feared a global supply crunch caused by the withdrawal of Russian supply. But those fears clearly failed to materialize as the price of WTI has trended downward for most of the last year and now trades at levels lower than when the war began. The war may be impacting crude prices in ways many investors may not have anticipated. In this article, we’ll discuss the reasons for oil’s fall and major risks that continue to overhang global markets.

The Bull Case

Goldman’s inventory thesis is just one of many that are frequently mentioned in forecasts calling for a new crude oil bull market. It should also be noted that last March the firm predicted a $120/bbl price for Brent during H2 2022 due to a “structural supply deficit,” and that was followed by an October call for a Brent price of $104/bbl during the remainder of 2022 and $110/bbl in 2023. This was in response to a 2M bpd production cut made by OPEC+ last fall.

Granted, the price of crude is extremely hard to forecast, and nobody could have foreseen how the Ukrainian conflict was going to play out. And Goldman is by no means the only firm reiterating the bull case as many media organizations are still touting the China reopening as a possible catalyst for a new surge in crude prices. Others, meanwhile, point to India and its energy needs as a possible driver for growing crude demand.

But what many fail to take into account is how geopolitical turmoil caused by the war is actually impacting the market for crude oil.

Opening Moves

The initial start of the war understandably caused many resource prices to be bid up substantially. After all, no one knew how things would play out. But since then, prices have eased noticeably as the worst-case scenarios failed to develop. The war has since bogged down into what looks likely to be a grueling long-term conflict for both sides.

The fall in crude prices was largely attributed to the implementation of a cap on the price of Russian crude by the G7 countries. The $60/barrel cap was aimed at stopping any Russian crude from being sold for more than that price; the measure would prevent $60-plus barrels from being shipped using G7 or EU tankers, credit institutions, and insurance companies. This was in addition to the exodus of Western oil majors from Russia as they largely abandoned their projects in the country, an example being Exxon Mobil Corporation (XOM) withdrawing from the Sakhalin-1 Project in Far Eastern Russia.

Given the gravity of the Ukrainian conflict, these measures, along with all the other sanctions, were inevitable and understandable. Western governments hoped that the removal of Western refining capacity and know-how would eventually cripple the Russian oil industry. They were playing the cards they held, and, as one would expect, Russia responded by playing its cards: turning to its Asian allies.

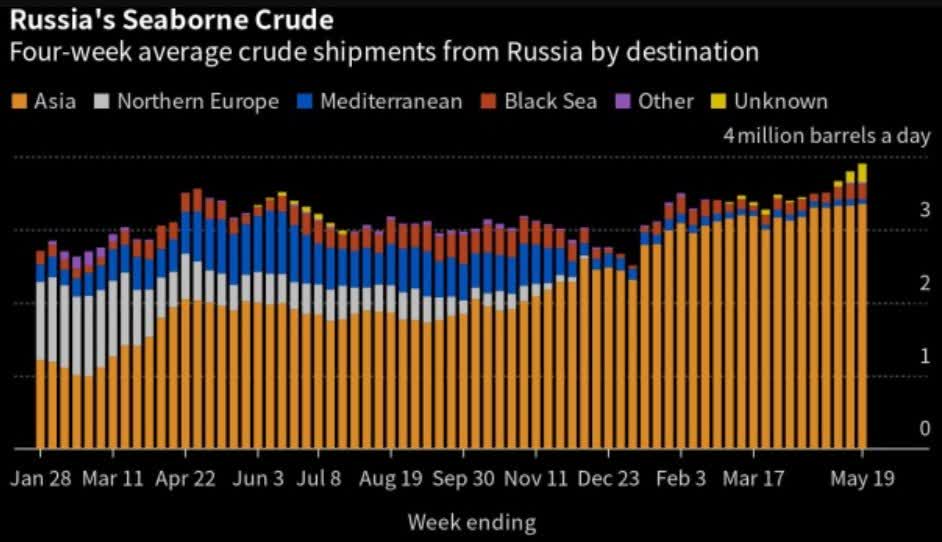

Russia’s moves have allowed several of its oilfields, including Sakhalin-1, to return to peak production and, as can be seen in the graph below, most of the Russian crude previously bound for North American and European markets is now being re-routed to Asia.

Bloomberg.com

Russian Response

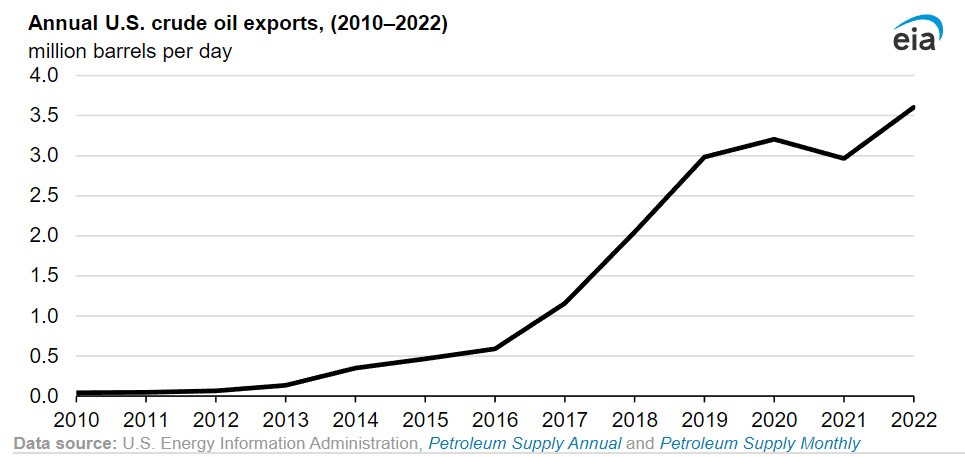

At first glance, this may appear to be a wash as Europe would presumably replace Russian crude with Middle Eastern oil, buying Middle Eastern barrels that would have previously been ear-marked for Asia. But that view assumes static production levels whereby the amount of crude demanded and supplied is fixed and only the destination of that production changes, but that is obviously not the case. Last year’s high crude prices incentivized a lot of increased US production and, as can be seen in the exhibit below, a lot of that increased production was exported. That’s not to mention production growth in Guyana and West Africa.

eia.gov

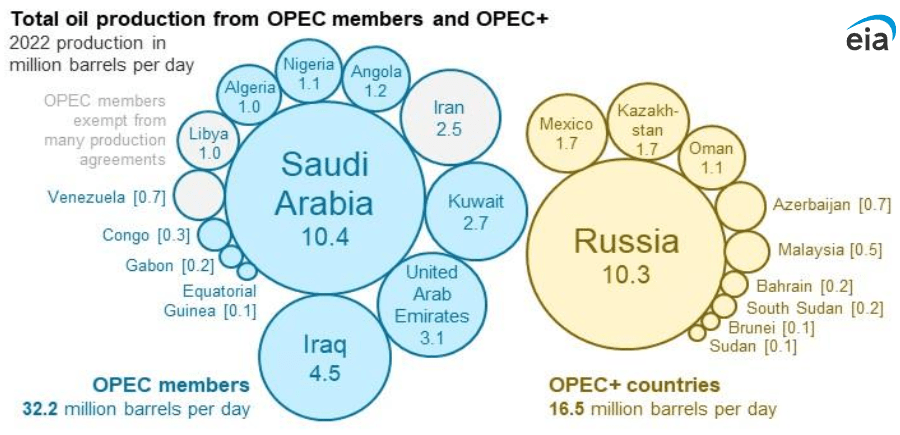

This has contributed to falling crude prices, and it has forced OPEC+ to announce some fairly steep production cuts. Both Saudi Arabia and Russia, OPEC+’s two largest producers, have committed to cutting millions of barrels of production in recent months in order to stabilize crude prices. However, even if these cuts are fully carried out, their impact may be blunted by increased production from non-OPEC+ producing nations; the cartel doesn’t even account for half of the world’s 101M bpd of liquid fuels production.

eia.gov

But that is if those cuts are carried out. Russia has a war to pay for and the sorry state of its economy and military leads one to believe that it may be in need of selling every barrel it can. That might be why the chart above indicates an increase in the levels of Russian seaborne crude. That increase has occurred even after Russia pledged to cut production by 500k bpd in early February, cuts that were slated to begin in March. However, Moscow has not demonstrated a firm willingness to carry those out those reductions and that is evidenced by Russia recently surpassing Saudi to become China’s largest oil supplier.

Takeaway

The United States Oil Fund, LP ETF (NYSEARCA:USO) is a very good tool for investors wishing to gain exposure to changes in the price of West Texas Intermediate crude oil; however, given the corner into which Russia has painted itself, it is increasingly likely that production cuts pledged by the OPEC+ nations will not have the same impact as in previous years. Given its funding needs, Russia is likely to continue producing all-out and this will likely weigh down crude prices in the months to come.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.