Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 11th, 2023.

The New America High-Income Fund (NYSE:HYB) is focused on high-yield bond exposure. The fund is currently trading at a deep discount to its last reported net asset value. HYB cut its distribution earlier in the year because they look to cover the distribution to shareholders through the income generated on the underlying portfolio. That generally means more distribution adjustments relative to other closed-end funds that keep paying distributions if it’s being covered or not.

This is a leveraged fund, and we’ve seen borrowing costs rise. Therefore, that’s why we’ve seen a decline in the portfolio’s net investment income and why the distribution was cut.

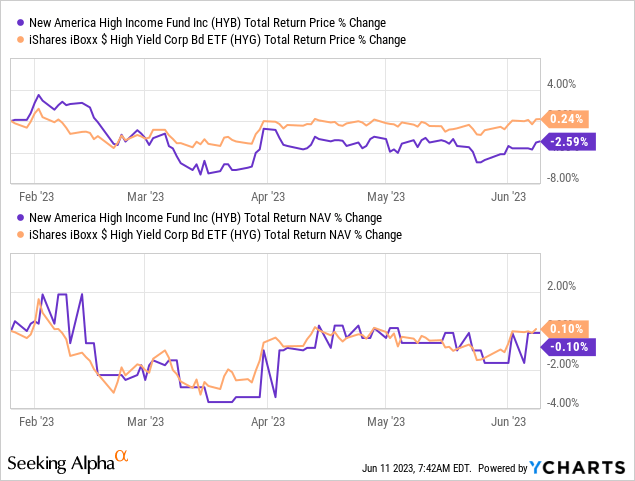

Since our last update earlier in the year, HYB has been essentially flat on a total NAV return basis and dipped some on a total share price basis. I’ve also included the passively managed and non-leveraged iShares iBoxx High Yield Corp Bond ETF (HYG) to provide some context. During this time, the total NAV return performance has been quite comparable.

YCharts

The Basics

- 1-Year Z-score: -1.29.

- Discount: -15.66% (based on 6/2 NAV).

- Distribution Yield: 7.29%.

- Expense Ratio: 1.34%.

- Leverage: 33.57%.

- Managed Assets: $266.09 million.

- Structure: Perpetual.

HYB’s investment objective is “to provide high current income while seeking to preserve stockholders’ capital.” They do this through investing in “a portfolio of “high yield” fixed-income securities, commonly known as “junk bonds.” The Fund invests primarily in “high yield” fixed-income securities rated in the lower categories by established rating agencies, consisting principally of fixed income securities rated “BB” or lower by Standard & Poor’s Corporation (“S&P”) or “Ba” or lower by Moody’s Investors Service, Inc. (“Moody’s”), and subject to applicable bank credit facility requirements, non-rated securities deemed by the Investment Adviser to be of comparable quality.”

The fund’s expense ratio is fairly normal with high-yield bond fund peers, even with HYB being a fairly small fund. When including leverage expenses, the fund’s total expense ratio climbs to 2.48%. With a few more rate hikes from the Fed since the reporting date of December 31st, 2022, the leverage expenses would have climbed further.

They did not hedge their leverage with interest rate swaps or futures, as we’ve seen with some other funds. The rate for borrowings is based on a spread above SOFR. As of this latest report, the borrowings were approximately 5.32%. Hedging comes with its own costs, but in this case, we’ve seen hedging work out incredibly well for other funds in the last year.

Performance – Attractive Discount

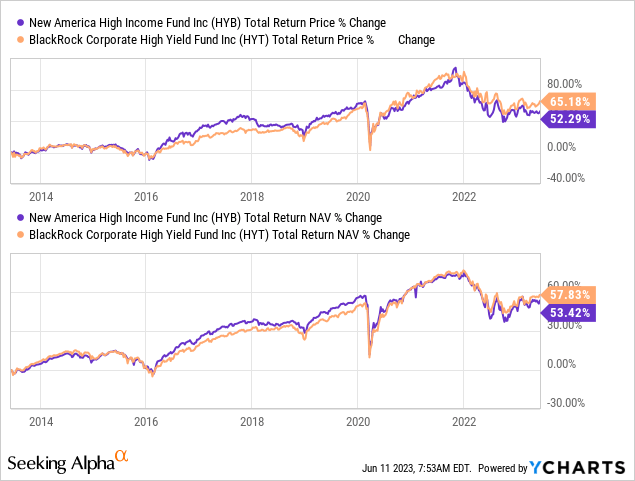

This fund was hit by interest rates not only on its rising costs of borrowings but through bond prices falling on its underlying portfolio. This wasn’t something that was specific to HYB on its own. One of the high-yield bond funds in the CEF space I consider to be the gold standard is the BlackRock Corporate High Yield Fund (HYT). On a total NAV return basis, the fund has put up competitive results in the last decade.

YCharts

Both of these funds would stand to benefit from interest rates being cut. However, the downside that would be the reason that rates would be cut would presumably be due to a recession. A recession would have the negative consequence of seeing higher defaults on the underlying portfolios. Both funds are concentrated on below-investment-grade debt, so both are more sensitive to overall economic conditions.

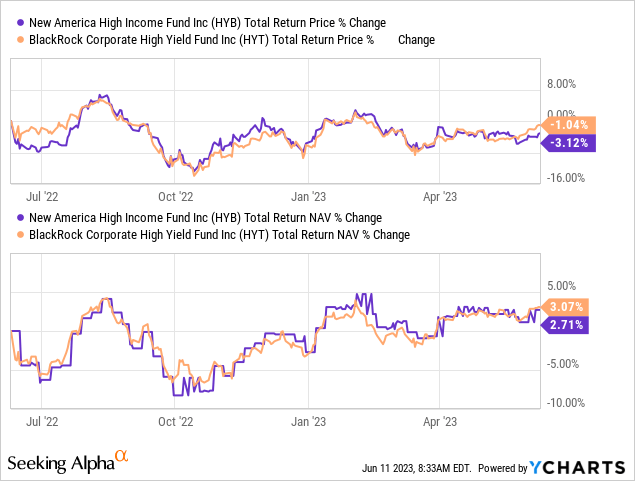

In the last year, HYB and HYT have similarly performed quite closely. That’s interesting to note because HYB wasn’t hedged against higher interest rates. HYT had incorporated swaps and futures contracts in an effort to reduce the negative impact. Still, that didn’t see a material impact at the end of the day, where HYT’s performance was materially better.

YCharts

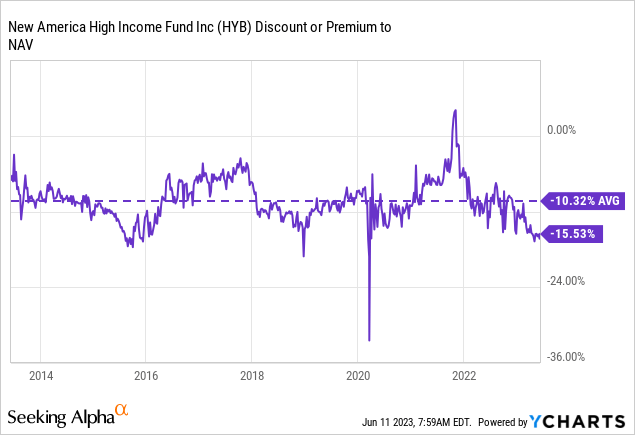

That said, one thing that’s benefitting HYB over HYT is the current valuation. HYT is trading at a fairly attractive discount, but HYB has it beat currently at a deep discount. However, both funds are trading at discounts below their longer-term average. HYB reports NAV weekly, so this latest discount is based on the last reported NAV. Based on that, the fund is trading near an all-time wide discount, excluding the COVID drop.

YCharts

Distribution – Attractive Monthly Payout

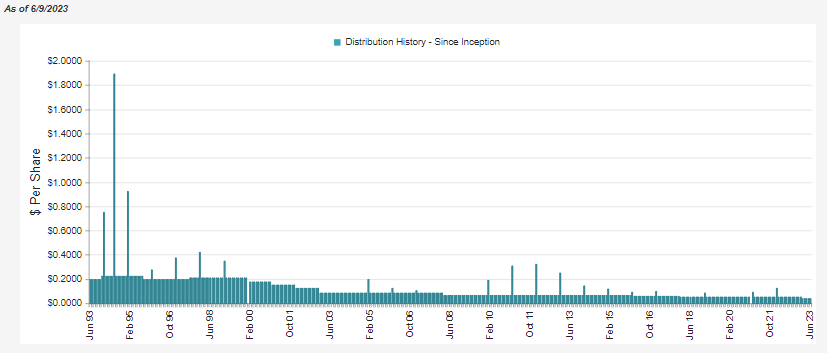

Based on the latest monthly distribution of $0.04 per month, that works out to a current distribution rate of 7.29%. On an NAV basis, we see a distribution rate of 6.16%. The fund has quite a long history, and during that time, the fund has adjusted lower on several occasions.

HYB Distribution History (CEFConnect)

The latest decrease was to start off this year due to rising borrowing costs reducing the net investment income that the fund was earning.

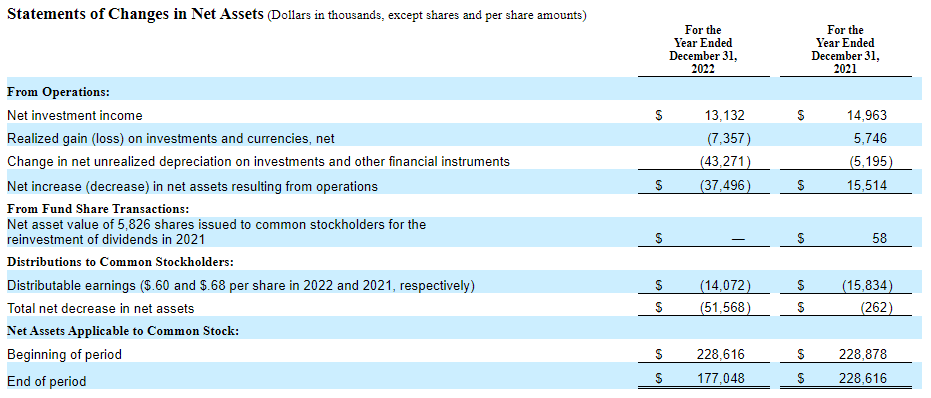

HYB Annual Report (New America)

On a per-share basis, the fund’s NII went from $0.64 to $0.56 in the latest year. That would mean that the current annual $0.48 is being covered, but that also doesn’t factor in NII likely taking a hit further.

First, interest rates were ramped up at an aggressive pace, so most of this latest report isn’t seeing the full effect yet. Secondly, there were even further interest rate increases since this report that likely would see NII decrease once again. With that said, seeing another distribution cut at some point is a fairly high possibility. If we get some interest rate cuts and the portfolio doesn’t see too much underlying damage due to defaults, then we could see this trend reverse.

HYB’s Portfolio

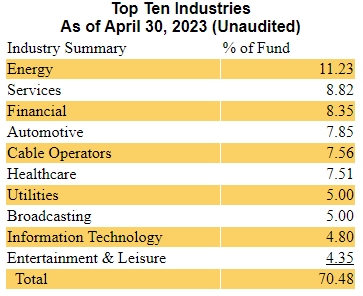

The fund’s portfolio is concentrated most heavily in the energy industry, but they still have a fair bit of diversification too. The overall weightings to each industry are quite similar to what we’ve seen previously in the fund. So while we’ve seen a portfolio turnover of 37.82% in the last year, it didn’t seem they shifted the portfolio too dramatically. The top ten industry exposure had previously made up around 70% of the fund, which is similar to what we have seen more recently.

HYB Top Ten Industries (New America)

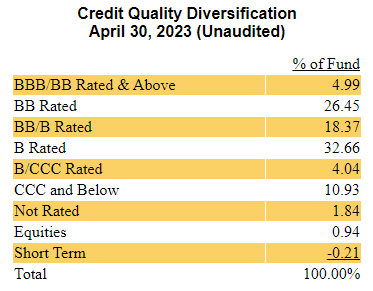

The credit quality of the portfolio has the fund mostly allocated to single B-rated securities. However, the fund also carries a fair bit to CCC and below. CCC debt is only just above being in default already. It’s the riskiest part of the credit market to invest in.

I would like to see this allocation reduced, but that’s also the area where you are going to get the highest yields. The area of the market where it can still make sense to invest with leverage so you get a decent spread. That said, the fund had previously listed an allocation of 10.87% in this same category previously.

HYB Sector Allocation (New America)

This also isn’t that unusual to see CEFs positioned in this lowest tranche of debt. HYT has allocated even more to CCC rated and below, at nearly 14%.

One way they offset investing in the riskiest area on the credit quality spectrum is by holding hundreds of securities. CEFConnect puts the total number of holdings for HYB at 452 total. For some further context, HYT holds a whopping 1158 positions.

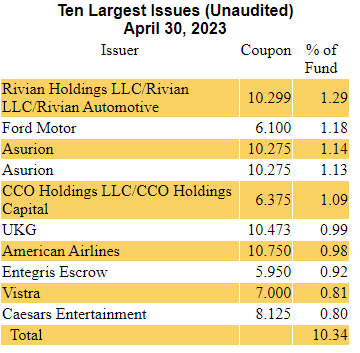

The top ten names only represent around 10% of the portfolio. Those weightings also drop quite quickly as we get toward number 10. So each individual position carries very limited overall sway on the fund on its own. The top ten also show us the sorts of coupons they are collecting on these underlying holdings.

HYB Top Ten Holdings (New America)

Most of these top ten names are the same as we saw previously. The one name missing was the former largest holding, which was iHeartCommunications. That let Rivian’s (RIVN) debt position rise to the top. However, this RIVN position isn’t a bond but a floating rate note. Previously, it was paying a 7.177% coupon and has now ramped up to 10.299%.

While that’s beneficial to the fund to offset some of the damage from higher borrowing costs, it can also be a negative. At some point, interest rates can become too high, which can put some companies in a position where they can’t afford their senior loan debt anymore. That doesn’t appear to be a problem for RIVN at this point. That said, the RIVN position is unrated and is a 144A security, meaning it was for qualified institutional buyers.

Conclusion

HYB is a fairly straightforward high-yield bond fund. They offer some exposure to floating rate notes, but it isn’t a substantial focus on the portfolio. Higher interest rates hit the fund in both the fund’s borrowing costs rising and the underlying portfolio declining in value. This fund could benefit from lower interest rates whenever that might happen. They didn’t hedge against rising interest rates, but didn’t see a meaningful underperformance relative to HYT, which did hedge. The fund’s current discount makes it an attractive name to consider if an investor is looking for high-yield exposure.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.