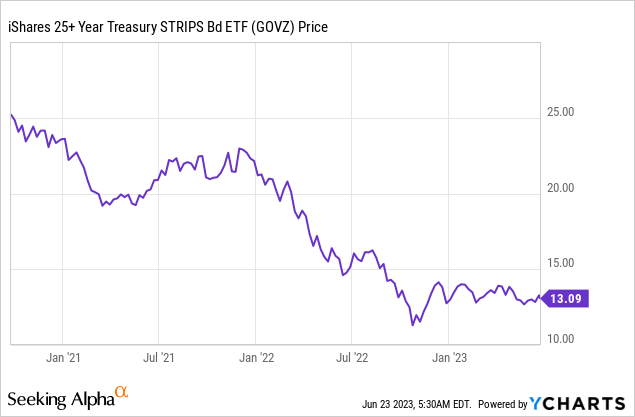

The iShares 25+ Year Treasury STRIPS Bond ETF (BATS:GOVZ) is a long duration ETF containing STRIPs, which are basically just broken down Treasuries where each coupon is its own zero coupon bond. GOVZ is sensitive to interest rate changes, particularly in the long-term, which are harder to call. Linked to inflation rates and the real demand for money, it’s tough to call this multivariate problem in the long term, but we think that AI progress could keep structural inflation lower due to higher levels of unemployment and lower levels of employment at which inflation progresses rapidly – or it could increase productive possibilities which would also be deflationary. Still, it’s tough to call, but GOVZ being priced down a lot by the short term changes in rate expectations as well implies somewhat of a conservative price.

GOVZ Breakdown

STRIPs are derived from Treasuries, so credit scores are about as high as they could possibly get at AAA ratings. The effective duration is 26.7 years, so the duration is really high. This explains the sensitivity of the ETF to changes in rate expectations that took place this year. Future spot rates are the ones that have a bigger impact on the value of STRIPs because they occur in the future, where their discounting effects are compounded.

Data by YCharts

The yield to maturity here is consistent with the duration of the bond, and it tells you how the market is pricing longer-term structural interest rates at 3.8%, which is higher than the rates we’d been seeing over the last decade which had never exceeded 2.5%.

Comments

Ultimately, whether GOVZ makes sense to buy right now depends on how expectations for these long-term rates will evolve. There are several factors which could affect long term rates, such as lessened frictional and structural unemployment and higher structural inflation. Higher structural inflation can come from deglobalisation or resource scarcity, which are somewhat valid concerns, especially since major points of economic disintegration still haven’t come to pass. Dissociation with Russia is primarily a European problem, although it became everyone’s problem due to hoarding of oil and also the fertiliser issue, which is not a small one, but something like a decoupling with China would be a much bigger issue for everyone on the whole. Thankfully, the risks of that are quite small. Then there are things like the energy transition, which is a major reason for belligerent oil prices and underinvestment in some heavy industries. So these are factors that justify the lowered price of GOVZ.

As for less frictional and structural unemployment, that seems less likely now with the rise of AI. Being able to add value is getting tougher, and people have limits that in many cases are already not enough to contribute to the economy, which is why ideas like UBI float around. While the co-pilot model is likely the future, you still need less people to carry out the same activity when you have a co-pilot, considering just the example of coding. The complexity comes in understanding whether there will be more activities to do once you have AI help, which could be an offset. Then there’s the fact that AI can have supply side effects, as the internet had, and industrialisation before that. This could be deflationary in a very good way.

Long-term rates are tough to call, but GOVZ is very sensitive to those expectations. Problematically, the biggest factors that could cause those long-term rates to revalue is geopolitical volatility. So GOVZ, which is effectively a Treasury, ends up being unsafe against geopolitical and structural risks. In that respect, GOVZ fails in the typical, knee-jerk function expected of bonds, which is to defend against risk. Still, we think that there are factors that are going to drive long-term inflation down, although it’s not unambiguous. It’s tough to call, so we’re staying out, but GOVZ doesn’t look bad anymore at these depressed levels, and the 0.15% expense ratio is relatively low.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.