Almost three years ago, I recommended buying Sabine Royalty Trust (NYSE:SBR) for an expected strong recovery from the pandemic. The stock essentially tripled in just two years. However, back in September and in December, I recommended selling Sabine Royalty Trust due to its high cyclicality and the fact that the energy sector seemed to have passed the peak of its cycle. Since those two articles, the stock has declined 17%. This correction may lead some investors to conclude that the stock has become reasonably valued. However, such a conclusion is highly risky. The stock remains richly valued from a long-term perspective while the energy industry is going through an unprecedented transition from fossil fuels to clean energy sources. Therefore, investors should avoid Sabine Royalty Trust around its current price.

Business Overview

Sabine Royalty Trust is an oil and gas trust that was founded in 1982, in Dallas, Texas. The company holds royalty and mineral interests in various producing oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas.

Just like all the oil and gas producers, Sabine Royalty Trust has greatly benefited from the invasion of Russia in Ukraine, which led the U.S. and European Union to impose strict sanctions on Russia. These sanctions tightened the global oil and gas markets to the extreme last year, as Russia was producing approximately 10% of global oil output and one-third of natural gas consumed in the European Union before the sanctions. Indeed, shortly after the implementation of sanctions, the prices of oil and gas soared to 13-year highs. As a result, Sabine Royalty Trust more than doubled its total annual distribution, from $3.97 in 2021 to an all-time high of $8.65 in 2022. The distribution of the company in 2022 was more than double the distribution of $4.03 in 2013 and 2014, when the price of oil was hovering around $100.

However, the oil and gas markets have finally absorbed the impact of the Ukrainian crisis. First of all, the price of natural gas has plunged this year, mostly due to exceptionally low demand amid an abnormally warm winter in the U.S. and Europe. In addition, after the initial shock caused by the sanctions, Russia has found ways to boost its production, as it has increased its sales of crude oil to China, India, and a few other countries. In fact, Russia was recently reported to be on the cusp of surpassing Saudi Arabia as the biggest oil supplier to China. As a result, the global oil market has become better supplied and hence the price of oil has plunged nearly 50% off its peak, which was posted early last year, shortly after the onset of the Ukrainian crisis.

OPEC has exhausted its means to support the price of oil. To be sure, the cartel has implemented several production cuts in order to provide a solid floor to the price of oil. In addition, Saudi Arabia recently threatened those who short the price of oil that they will incur severe losses if they continue shorting the price of oil. However, I believe this threat clearly signals that Saudi Arabia is afraid of a further decline in the price of oil. If Saudi Arabia were confident in the solid fundamentals of the oil market, it would not need to threaten traders, in my opinion.

It is also important to note that the entire world has greatly accelerated its transition from fossil fuels to renewable energy sources. According to a recent report of the International Energy Administration (IEA), 2023 will be the first year in which the global investment in clean energy sources will surpass the global investment in fossil fuels by about $0.7 trillion. More precisely, about $1.7 trillion is expected to be invested in clean energy sources, whereas only $1.0 trillion is expected to be invested in fossil fuels. Five years ago, the ratio of investment in clean technologies to investment in fossil fuels was around 1:1, but now this ratio has soared to 1.7. This secular trend undoubtedly does not bode well for the prices of oil and gas in the upcoming years.

Distribution

Due to the natural decline of oil and gas fields, the production of Sabine Royalty Trust tends to decrease in the long run. To be fair, when the trust was founded in 1982, it was expected to have a lifetime of about a decade. As the trust is still producing meaningful amounts of oil and gas, four decades after its initiation, it is evident that the trust has surpassed the initial expectations by an impressive margin. Nevertheless, a decrease in the production of Sabine Royalty Trust is inevitable in the long run, as the trust cannot expand into new areas, unlike the well-known oil majors. Therefore, all else being equal, the distribution of Sabine Royalty Trust is likely to decrease in the long run. The outlook is even worse if the secular shift from fossil fuels to clean energy sources is taken into account.

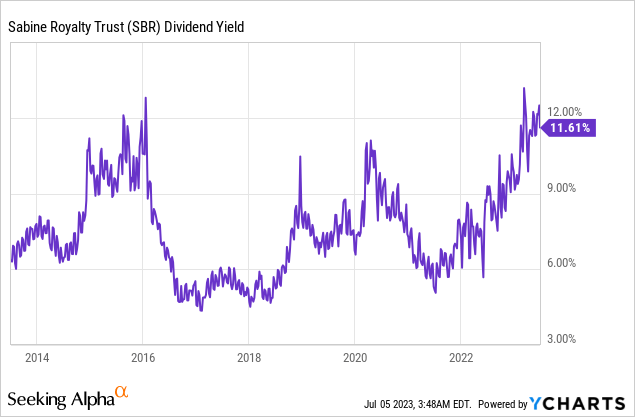

Due to the risk that results from its long-term declining output, Sabine Royalty Trust has always offered an above-average distribution yield.

Data by YCharts

During 2013-2019, Sabine Royalty Trust offered an average annual distribution of $3.13. This is a reliable figure for the long-term potential of the trust, as this 7-year period was normal in reference to the prices of oil and gas. The recent years have been dramatically volatile, as the prices of oil and gas collapsed in 2020 due to the pandemic and soared in 2021 and 2022 thanks to the recovery from the pandemic and the Ukrainian crisis. Whenever the price of oil returns to normal levels, one can reasonably expect the annual distribution of Sabine Royalty Trust to revert to about $3.13. At the current stock price, this distribution corresponds to a 4.8% yield. This yield is much lower than the historical average yield of the stock, and hence, the stock price of Sabine Royalty Trust is likely to decrease significantly off its current level to result in a normal (close to the historical average) yield.

Based on its monthly distributions in the last 12 months, Sabine Royalty Trust has offered a distribution yield of 12.5%, based on its current stock price. However, the trust is not likely to offer such high distributions anytime soon due to the sharp correction of commodity prices. In fact, the latest monthly distribution of the trust corresponds to an annualized yield of only 6.0%. While this yield may seem high to most investors, it is not adequate to compensate investors for the risk related to the long-term decline of the production of the trust.

Final Thoughts

Sabine Royalty Trust has exhibited impressive business performance throughout its lifetime, as it has exceeded the initial expectations for its duration by a wide margin. However, the distributions of the trust are strongly tied to the cycles of the prices of oil and gas. The oil and gas industry seems to have passed the peak of its cycle for good, and its outlook is negative due to the accelerated transition of the entire world from fossil fuels to renewable energy sources. While fossil fuels will remain the primary energy source for years, the transition to clean technologies is likely to impact the prices of oil and gas in the upcoming years. Therefore, while no one can exclude a short-term bounce of Sabine Royalty Trust (it is impossible to predict the path of stock prices in the short run), the stock remains risky from a long-term point of view.