Sakorn Sukkasemsakorn

By Jason Ye

As we kick off the second half of 2023, we wanted to review some of the key developments from the first half of the year in the clean energy space and review the results of the S&P Global Clean Energy Index Series rebalance from April.

Key Developments

Government Spending in Clean Energy Space Continues in 2023

In May 2023, two new programs were announced by the U.S. government to support clean and affordable energy, as part of the Inflation Reduction Act. These two programs, with a combined amount of almost USD 11 billion in grants and loan opportunities, will bring clean energy to rural energy and utility providers.1

Global Investment in Clean Energy Keeps Rising

Based on the International Energy Agency’s latest World Energy Investment 2023 report, global investment in clean energy continues to rise and is projected to reach USD 1.7 trillion in 2023. The difference between the investment in clean energy and fossil fuels has continued to increase, meaning we continue to see more capital invested in the clean energy space than ever before.2

Renewable-Generated Electric Power Surpassed Coal-Fired for First Time in the U.S.

Data for 2022 announced by the U.S. Energy Information Administration shows that renewable sources, including solar, wind, hydro, biomass and geothermal energy, generated 21% of the electric power in the U.S., surpassing the 20% from coal for the first time in history.

The largest source of U.S. electricity generation comes from natural gas which accounts for 39%. Among the renewables, wind and solar continue to be the two major drivers of growth.3

The G7 Agreed on Joint Targets for the Expansion of Renewable Energies for the First Time

The G7 (Canada, France, Germany, Italy, Japan, the U.K. and the U.S.) ministers met in Sapporo, Japan in April to discuss climate, energy and environmental issues. At the meeting, the G7 countries agreed to collectively increase the offshore wind capacity of 150GW and increase solar photovoltaics to more than 1TW by 2030.4

April Rebalance

Launched in 2007, the S&P Global Clean Energy Index has been the benchmark to measure clean energy-related companies’ performance over the past 16 years.

In April 2021, we also launched the S&P Global Clean Energy Select Index, which is designed to measure the 30 largest companies in global clean energy businesses that are listed on developed market exchanges.

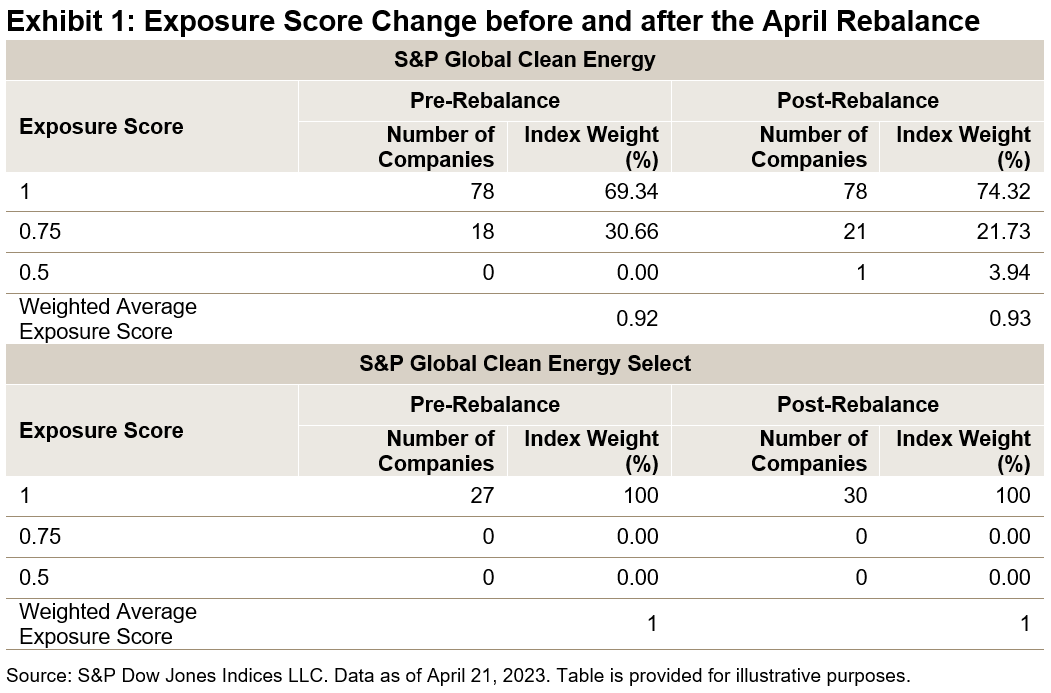

Both the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index went through a semi-annual rebalance on April 21, 2023. In the index methodology, we assign companies to four buckets of exposure scores from 0 to 1 with an increment of 0.25 to measure their purity of exposure toward the clean energy business.

Exhibit 1 shows the change of exposure before and after the April rebalance. We can see that for the S&P Global Clean Energy Index post-rebalance, we have three more companies with an exposure score of 0.75 and one company with an exposure score of 0.5 being added to the index.

The weighted average exposure score of the index improved slightly from 0.92 to 0.93. The S&P Global Clean Energy Select Index, on the other hand, selects 30 companies with an exposure score of 1 listed in the developed market exchanges.

S&P Global Clean Energy Index Performance in H1 2023

After outperforming the S&P Global BMI in 2022, both the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index underperformed during the first half of 2023.

The S&P Global Clean Energy Select Index was down 2.74% and the S&P Global Clean Energy Index was down 7% in USD total return terms. There was significant dispersion seen among constituents.

Some of the performance draggers include SunPower (SPWR) (-45.65%), Enphase Energy (ENPH) (-36.79%) and Sunrun (RUN) (-25.65%), while Cia Energetica (up 34.32%), Chubu Electric Power (OTCPK:CHUEF)) (up 31.31%) and First Solar (FSLR) (up 26.9%) contributed positively to the performance.

The energy transition is a long-term megatrend, and S&P Global Clean Energy Index series continues to gauge the performance in the clean energy space.

2Overview and key findings – World Energy Investment 2023 – Analysis – IEA

3Renewable generation surpassed coal and nuclear in the U.S. electric power sector in 2022

4G7 Hiroshima Leaders' Communiqué | The White House

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures, please visit www.spdji.com/terms-of-use.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.