Toa55/iStock via Getty Images

Introduction:

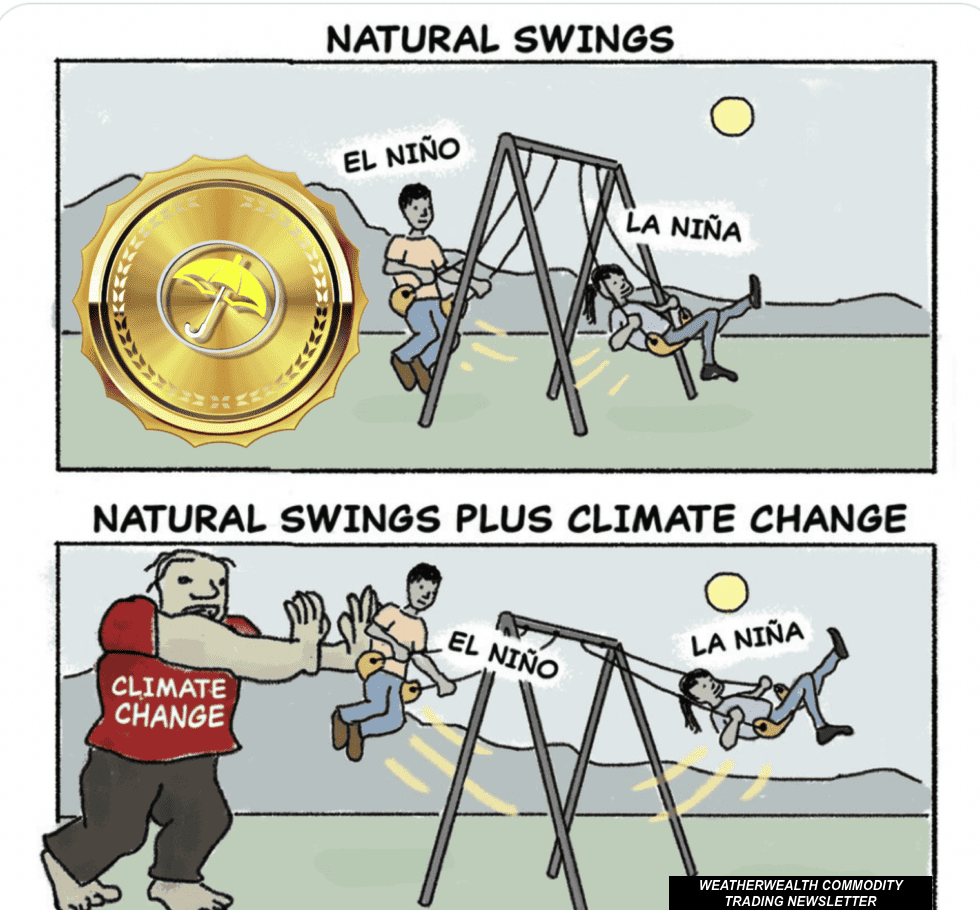

Historic fires from Canada to Europe; the warmest global ocean temperatures in thousands of years; cities like Phoenix, Arizona witnessing 21 straight days above 110 degrees; a once-in-a-one-hundred-year tropical storm in southern California. These are just a few of the dozens of weather extremes brought on by a combination of both El Nino and a warming planet. Interestingly enough, summer weather patterns tend to have a normal to cool summer during El Nino events. Hence, many of these once-in-a-lifetime weather events have been brought on by climate change in my opinion.

Record global ocean temperatures from climate change, not El Nino (WeatherWealth newsletter)

Nevertheless, extreme weather does result in potential investing opportunities. My report below touches on just a few of the industries most affected.

EL NINO AND CLIMATE CHANGE (WEATHERWEALTH NEWSLETTER)

Which industries does El Nino most affect?

El Niño weather conditions can have varying impacts on different commodity sectors. Here are some of the sectors typically most adversely affected during El Niño years:

- Agriculture – El Niño often brings heavy rains and flooding to parts of South America, which can damage crops like soybeans, corn, wheat, rice, coffee, and sugarcane. Food production and crop yields tend to decline in affected regions.

- Energy – El Niño winters tend to be warmer than average in the US, decreasing demand for heating oil and natural gas. Milder winters can also reduce electricity demand. This drop in energy demand can negatively impact the oil, natural gas, and power sectors.

- Metals & Mining – Heavy rains from El Niño can disrupt mining operations for commodities like coal, copper, iron ore, and gold in countries like Indonesia, Chile, Peru, and Australia. This can constrain output and drive prices higher.

- Palm Oil – Production of palm oil in Southeast Asia, especially in Malaysia and Indonesia, tends to fall during El Niño events due to reduced rainfall and drought conditions. Supply disruptions can lead to higher prices.

- Fish meal – El Niño conditions often drive anchovy populations away from the coast of Peru, resulting in reduced catches of this fish that is processed into fish meal and fish oil. This can impact the global supply of fish meal for animal feed.

Which, countries, commodities, and equities may El Nino effect the most?

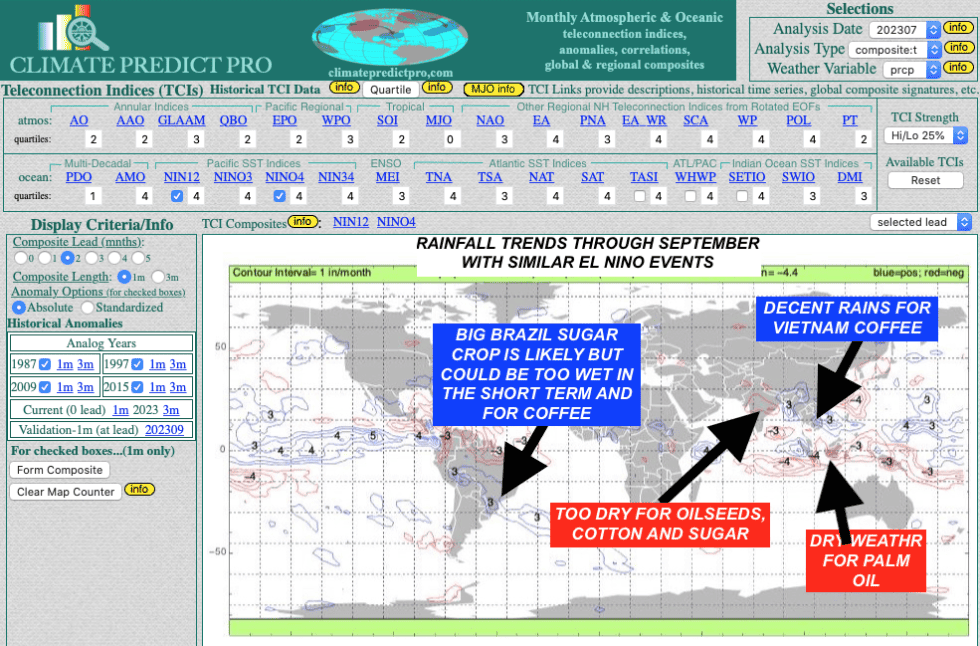

A) Weak Indian Monsoon for oilseeds, sugar, wheat, oilseeds, rice, and possibly cotton

The Indian Monsoon has a $3 trillion impact on India’s economy (WeatherWealth newsletter)

B) Australia’s and Argentina’s developing drought for wheat

C) China’s historic heat waves and mixed floods and droughts may have damaged some of the corn and especially cotton crops.

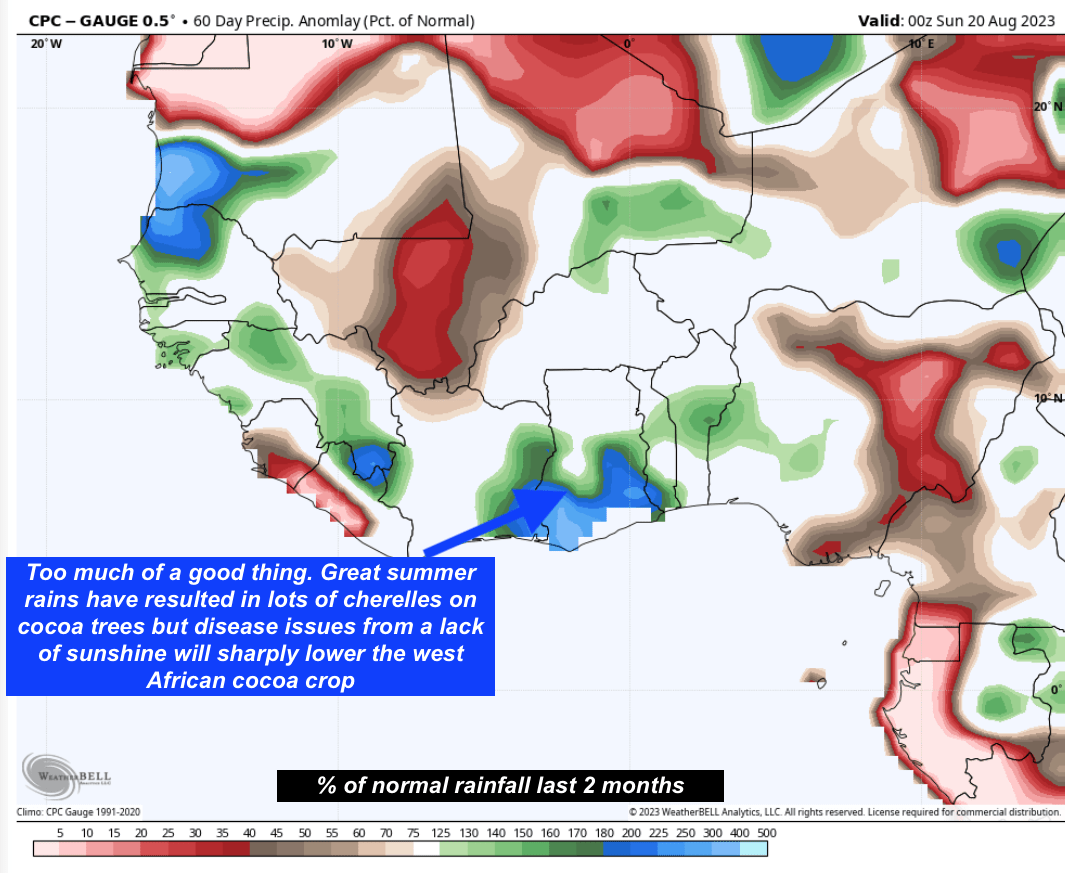

D) Record warm oceans creating too much rain for the West African cocoa crop where disease issues have helped prices rally 10% more in the last 2 months.

E) Wet September weather in northern Brazil could cause some harvest delays or sucrose dilution to the sugar crop and cause an early bloom for coffee that is not wanted

How El Nino will affect global weather into September (www.climatepredict.com)

Here are 4 companies that could potentially benefit from or see higher prices during El Niño weather events:

- Archer-Daniels-Midland (ADM) – This agricultural commodities processor and trader tends to benefit from rising agricultural commodity prices caused by El Niño.

- Ineos (private company) – A major manufacturer of palm oil substitute ethanol. El Niño conditions can boost demand and pricing for ethanol.

- Tractor Supply Company (TSCO) – This retailer selling agricultural equipment and supplies to farmers may see increased sales as farmers look to offset El Niño related crop damage.

- Campbell Soup (CPB) – With agricultural yields reduced, food prices often rise, boosting revenues for processed food companies like Campbell’s that use ingredients like wheat, corn, and palm oil.

Other potentials include fertilizer companies like Mosaic (MOS) which may see increased demand, as well as agricultural equipment companies like Deere (DE) that could benefit from increased sales. Commodity trading firms like Cargill, Louis Dreyfus, and Glencore may also capitalize on volatility from El Niño.

Here are four commodities that are most influenced by El Nino:

A) Natural Gas: (NYSEARCA:UNG), (KOLD): A warm late summer and fall could help natural gas prices temporarily get out of the doldrums. However, a warm U.S. winter will probably be a bearish aspect to prices again by November/December.

B) Sugar: (CANE): While this market has too big of a long position, reduced crops from drought in India and Thailand will likely keep this market above 20 cents for the rest of the year.

C) Wheat: (WEAT): Wheat prices have been in the doldrums due to global harvest pressure, weak demand, and Russia/Ukraine’s crop bigger than expected. However, recent floods in China’s growing areas, drought in Australia, and lower crops in Canada and the U.S. Plains will mean higher prices by the fall.

D) Coffee: There is no longer an ETF for this market. I have been bearish on coffee for months on my prediction that the Brazil drought would break close to a year ago and a potential big 2024 crop. However, certain El Nino events can cause wet September weather and too much of an early bloom. This could set a short-term floor in this market.

E) Oilseeds: Palm oil and oilseed supplies can be hurt though I expect decent 2024 Brazilian and Argentina crops for corn (CORN) and soybeans (SOYB).

F) Cocoa: Disease issues from too much rain have hurt the West African crop helping prices to rally 15% in the last few months. Traders will be watching for a potential Harmattan Wind this winter that may take prices to all-time highs.

Too wet for cocoa (WeatherWealth newsletter)

Conclusion:

Cotton Best Weather Spider (WeatherWealth newsletter)

Developing a portfolio of various commodities makes sense during an El Nino event. Usually, it is the soft commodities most affected. The problem right now with a lot of commodities, is the heavy long position by speculators in the midst of a stronger dollar. A strong dollar is often bearish to commodities.

Look, for example, how all the weather and crop signals are bullish to cotton due to crop problems in China, Texas, and perhaps India soon, while the economic score is bearish (-4) due to a slowdown in the Chinese economy.

Other markets such as cocoa, sugar, coffee, and oilseeds are more resilient to global economic conditions during El Nino and should see higher prices in the weeks and months ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.