Vanguard High Dividend Yield ETF is a diversified investment portfolio focused on high-quality dividend stocks.The ETF offers a low expense ratio, strong long-term returns, and a decent dividend yield of 3.1%.The fund is broadly diversified across all sectors of the economy and includes top holdings in leading companies.

Vanguard High Dividend Yield ETF (NYSEARCA:VYM) is an attractive choice for passive income investors that want to invest in a broadly diversified investment portfolio that focuses on high-quality dividend stocks.

Vanguard High Dividend Yield exchange-traded fund has a very low expense ratio and has done a great job tracking its underlying index, the FTSE High Dividend Yield Index, since the fund’s inception in 2006.

Taking into account the ETF’s robust diversification across all sectors of the economy, strong long-term returns based on net asset value, a low expense ratio, and a decent dividend yield of 3.1%, I think passive income investors that want to prepare for their retirements may want to consider buying Vanguard High Dividend Yield ETF.

An Investment In Vanguard High Dividend Yield ETF Comes With A High Degree Of Diversification

Vanguard High Dividend Yield ETF is an equity-focused ETF in the large-cap/value category. The ETF has $49.9 billion of assets under management, which is slightly more than Schwab U.S. Dividend Equity ETF (SCHD) had: SCHD manages a total of $49.7 billion on behalf of its investors.

Vanguard High Dividend Yield ETF seeks to track as its benchmark index the FTSE High Dividend Yield Index, which measures the investment return of companies with high dividend yields.

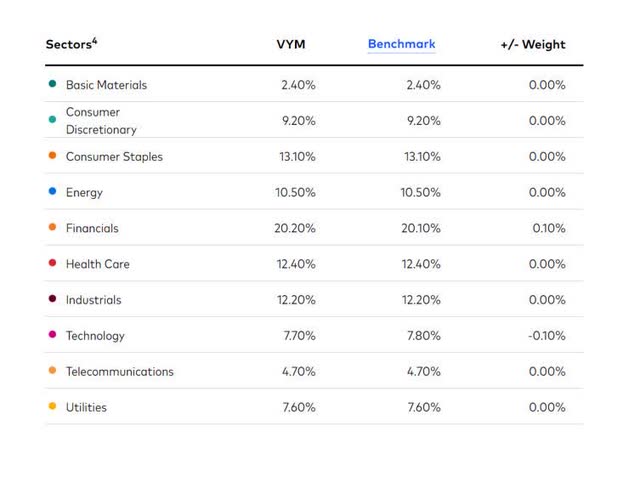

In my view, the biggest benefit of investing in Vanguard High Dividend Yield ETF is the fund’s diversification. Vanguard High Dividend Yield ETF is broadly diversified and includes investments in all sectors of the economy, including Financials (which have the largest portfolio weighting of 20.2%).

With that being said, the Vanguard High Dividend Yield ETF has exposure to cyclical sectors in the economy such as Energy, Industrials and Basic Materials, which makes Vanguard High Dividend Yield ETF overall a cyclical bet on the U.S. economy.

Since the fund has produced double-digit returns over the long term, however, I would think VYM is a particularly good choice for buy-and-hold passive income investors that desire very little turnover in their investment portfolios.

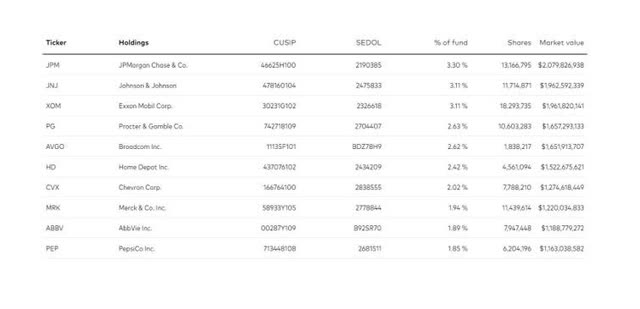

The largest individual position in Vanguard High Dividend Yield ETF’s portfolio, as of July 31, 2023, was financial powerhouse JPMorgan Chase (JPM) which had a portfolio weighting of 3.30%. Other top holdings include Exxon Mobil Corp. (XOM), Merck & Co (MRK), AbbVie Inc. (ABBV) and Johnson & Johnson (JNJ) which are leaders in their respective industries and have long-term track records of growing their dividend pay-outs. Though the ETF is overweight in the Financials sector, Vanguard High Dividend Yield ETF is a bet on the growth of the U.S. economy as a whole and not just on one particular sector.

Expense Ratio And Long-Term ETF Performance

There are two reasons for passive income investors to own Vanguard High Dividend Yield ETF, besides the obvious benefits of investing in a broadly diversified, highly liquid ETF.

- Vanguard High Dividend Yield ETF has a very low expense ratio of 0.06%; and

- Vanguard High Dividend Yield ETF has managed to deliver solid double-digit returns, based on net asset value, since the fund’s inception in 2006.

Passive income investors often underestimate the role investment fees and expenses play and the impact they have on long-term returns. Generally speaking, the lower the fees an investment fund charges, the higher the long-term compounding potential that works to the benefit of passive income investors.

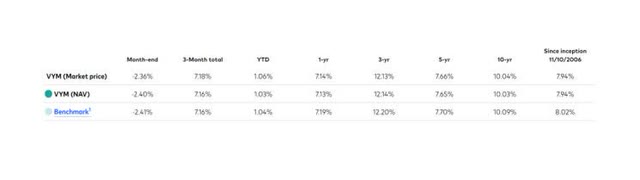

The ETF produced, since its inception, an average annual net asset value return of 7.94%, almost matching the benchmark index return of 8.02% (implied tracking error of -0.08%). The lower the tracking error (the difference between actual portfolio performance and benchmark index performance), the more effective a passive income vehicle is. In my view, Vanguard High Dividend Yield ETF is effectively managed.

Vanguard High Dividend Yield ETF’s Net Asset Value

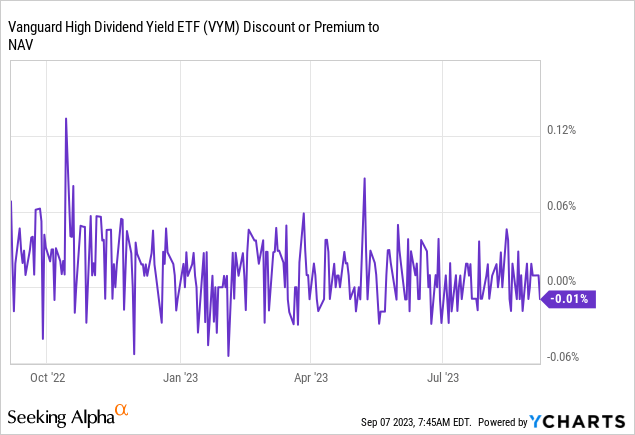

As an ETF, Vanguard High Dividend Yield ETF tends to trade very close to its net asset value. The last reported net asset value from Vanguard High Dividend Yield ETF, as of September 1, 2023, was $108.02. Based on Vanguard High Dividend Yield ETF’s net asset value report from last Friday, the ETF’s shares trade at a minuscule 0.01% premium to net asset value, which is about in line with the ETF's long-term history.

What Is The Risk With Vanguard High Dividend Yield ETF?

There is, of course, no guarantee that Vanguard High Dividend Yield ETF will perform as well as it did in the past. The fund, due to its over-weighting of the financial sector, may perform better or worse in different market environments. Presently, growth stocks are making a comeback, while dividend stocks have been falling a bit out of favor.

Personally, taking into account the decline in inflation that has happened in the last year, I think a diversified, large-cap, equity-focused ETF should do well in the long term.

My Conclusion

Vanguard High Dividend Yield ETF seems to me to be an attractive choice for passive income investors that want to directly invest in a broadly diversified portfolio made up of high-quality dividend stocks that have a history of dividend growth.

Vanguard High Dividend Yield ETF is thus particularly suitable for investors that want to prepare for retirement without bothering constantly with the task of portfolio rebalancing.

The ETF’s shares are trading at a minuscule premium to net asset value, and the expense ratio is low at 0.06%. The tracking error (the difference between ETF returns and the returns of the underlying benchmark index) is also relatively small. With a 3.1% dividend yield, I consider Vanguard High Dividend Yield ETF a solid buy for passive income investors.