The article discusses my favorite ETFs and self-indexing strategies for investment in this unsure environment. Nicholas Taleb's Fooled By Randomness is a great introspective book I like to use to check my hubris.Time in the market always trumps timing the market, but be sure to protect your downside with diversification.

Watch your 6

The market has an odd feel to it. We know rates are high, we know the FED is trying to fight inflation. Yet despite all of this, the market has traded higher this year in the face of several what should be “fulcrum points” to send us lower. Watching my downside or “watching my 6” as they say in law enforcement is priority one, I achieve this through diversification. Single names have much more downside risk than ETFs or diversified strategies at this moment in my opinion.

As luck would have it over a decade ago, I stumbled upon John Bogle and his wisdom as to why a diversified index fund covering the S&P 500 would be a sure bet over time. He even went so far as to say an all-index fund portfolio, 100% leveraged should outperform almost anything as long as there is someone at the bottom to bail you out on a margin call for collateral at the bottom. I bought into this wholeheartedly and became a diversification believer. For the greater part of the last decade of investing, the Vanguard S&P 500 ETF (NYSEARCA:VOO), has made up anywhere from 50-70% of my portfolio. Only when we experienced large pullbacks broadly, did I find it worthwhile to concentrate heavily on single names.

Don't be fooled by randomness

An excellent book about market psychology is Nicholas Taleb's Fooled By Randomness. Taleb along with popular contemporary Mark Spitznagel are traders that specialize in the capitalization of black swan events. They are not so much for fundamentals, but rather finding the best ways to attack outlier events in volatility. Fooled by Randomness is an exercise in self-observation.

An introspective exploration of whether or not market winners are genius or happen to stumble upon the right events at the right time and accumulate the right assets. Taleb is a Monte Carlo simulation addict and attributes most of what some of the best investors have achieved in their lives to statistical “randomness”.

Too many millionaires next door

My favorite chapter from Fooled By Randomness is the chapter entitled “Too many millionaires next door”. It's a brief book review of the famed Millionaire Next Door by Thomas J. Stanley and William D. Danko. It points out the spartan, frugal lifestyle of the wealth accumulators living right under our noses, but hard to identify due to their knowledge of compound interest preventing them from the consumption of frivolous depreciating assets, such as sports cars and designer clothing, possibly even living in below middle-class neighborhoods.

While this is certainly a valid way to become a millionaire, Taleb poses the question, what if you accumulate the wrong assets? There are spartan, frugal investors from all over the world, they also have the same patience as the subjects in Millionaire Next Door book. However, they may have accumulated the wrong assets, which in the end became worthless or were seized by a draconian government. Taleb being of Lebanese descent, gives the example of his family members and colleagues losing everything in Lira-denominated Treasury bills, 1930s Argentinian real estate, Michael Milken-issued 1980s junk bonds, and Russian Imperial bonds bearing the signature of Czar Nicholas II.

Check you hubris at the door

All the variables in your life that had to occur to eventually lead you to the state of wealth or non-wealth accumulation at this point had greatly to do with your environment, chosen gurus, and patience. All of the variables that had to occur leading up to your accumulation of the right diversified combination of assets. I know that I have been good at picking single names, but only after a big pullback in the broader market. The problem is, do you have the patience to wait for one?

Buying a broad-based ETF or having several self-indexing strategies as I like to implement solves the issue that most of us have, the need for mental stimulation through securities analysis. We can make a call on the market or a call on a stock. If the market is getting overheated, but we also know that time in the market > timing the market leads to outperformance, then we know we should always be buying something with our available funds. Just know that there doesn't always have to be a deal somewhere, when you sniff danger, the best solution is a diversified versus concentrated call.

My favorite ETF

The Vanguard S&P 500 ETF has been the one that I originally latched on to over a decade ago and never looked back. I've never sold a share. Part of this is in large part due to my brainwashing by Warren Buffett and John Bogle and the other part was due to my inclusion of it as a mutual fund selection on the “Investment Owner's Contract” located on pg. 225 of the Intelligent Investor.

As simple as it sounds, this decision included a lot of variables. First, deciding to invest in a depressed economy circa 2012-13. Second, a superstitious personality for which such a rudimentary tool like the “Investment Owner's Contract” could hold sway. Finally, the trust in the right gurus. Warren Buffett admired John Bogle and vice versa. I bought based on both of their recommendations only after reading everything I could get my hands on regarding both of their strategies. However, I also read Robert Kiyosaki, Jim Rodgers, Ken Fisher, and Sir John Templeton. If I ended up following them in the market, where would I be?

Kiyosaki

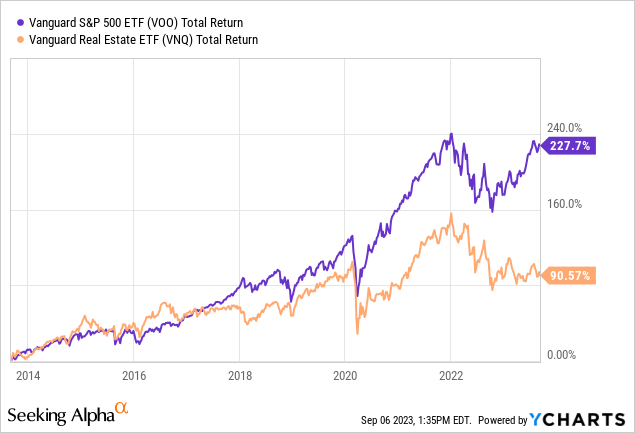

Broadly speaking, Robert Kiyosaki is almost all real estate all the time. This is in the physical sense which I do own some of as well. Let's see if I bought the Vanguard Real Estate Index Fund (VNQ) ETF instead of the S&P 500:

Wow, if I took that route over the last decade, I have been disappointed. Why didn't I listen to Kiyosaki over Bogle? That may be another element of randomness.

Jim Rodgers

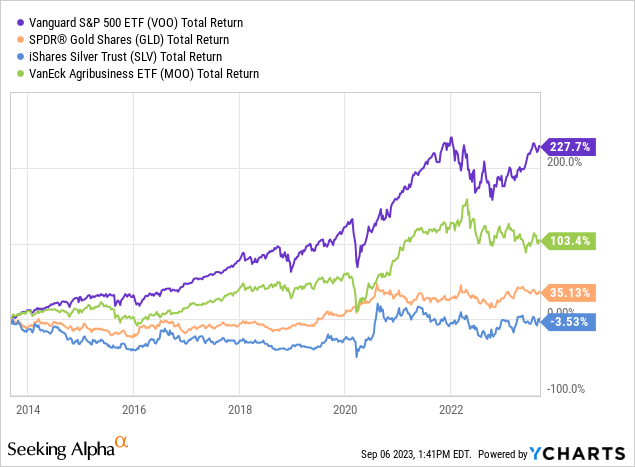

In all honesty, Jim Roger's Hot Commodities was the first book on investment I ever picked up. His theory was that in time, capitalism would cannibalize itself and we would return to a state where the farmer and the miner would once again reign supreme. What would happen if I continued to follow him?

If I had set up an even-weight basket of SPDR Gold Shares (GLD), iShares Silver Trust (SLV), and the VanEck Agribusiness ETF (MOO) I would be looking at an average 45% total return over the last decade. Thank you again randomness.

International

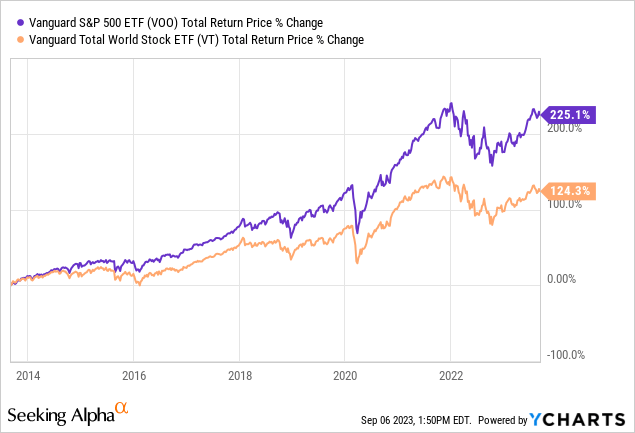

Ken Fisher and Sir John Templeton are far better orators and authors than either Kiyosaki or Rogers. Both were international investors with the argument that there's a wide world all around us that has lots of consumers that have yet to be developed into a middle class. Why not get a piece of that action too?

Looking at the Vanguard Total World Stock ETF (VT) versus the S&P 500 shows decent performance over the last decade, but still only about half as good as focusing on the top 500 US companies. The argument by Templeton and Fisher is very rational and one that leads us to the logic of “this or that will be the next XYZ US equivalent in China” with far more consumers behind it. Luckily my work at that time was comprised of frequent [almost monthly] travel to China or India.

I was able to observe how underdeveloped their capital markets were and how nearly all investors treated stocks as a corrupt trading game versus an actual investment vehicle. Certainly not a partial ownership in a business as Buffett would say. That combined with how locals joked about the tax system, kept me far far away from any broad-based investment strategies based on foreign markets.

Have you ever asked yourself why companies like Alibaba (BABA), Baidu (BIDU), or NIO (NIO) are listed on US exchanges to raise capital? Do you think the Chinese are so naive as to just not understand fundamentals, therefore not making a market for their securities? Or are they simply wiser than us? Hard to say, but to quote Keynes, “It is better to be roughly right than precisely wrong.”

Securities regulation is nearly non-existent in some of the major developing middle-class markets in the world. The SEC is the most capable investigative authority, full stop, and part of what makes the US the prime market for “near” honest business dealings and transparency. Being in that travel situation at the time of initial investment selections was also another lucky variable of randomness.

Features of VOO

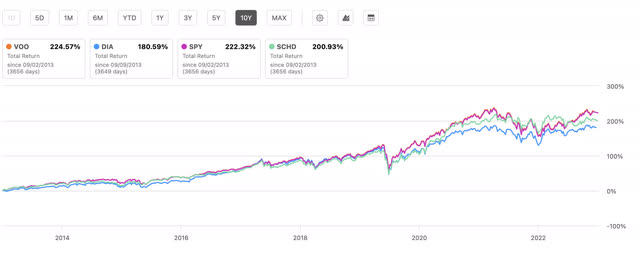

Vanguard has been known as the low-cost leader of mutual funds and ETFs for decades. That's what was my original appeal in choosing it over State Street's S&P 500 fund (SPY) as my fund of concentration. In retrospect, either would have performed well, but Vanguard's fund still holds the trophy for lowest cost broad-based US ETF:

| VOO | DIA | SPY | SCHD | |

| Fund Name | Vanguard S&P 500 ETF | SPDR® Dow Jones Industrial Average ETF Trust | SPDR® S&P 500 ETF Trust | Schwab U.S. Dividend Equity ETF™ |

| Fund Type | U.S. Equity | U.S. Equity | U.S. Equity | U.S. Equity |

| Issuer | Vanguard | SPDR State Street Global Advisors | SPDR State Street Global Advisors | Schwab ETFs |

| Inception | 09/07/2010 | 01/13/1998 | 01/22/1993 | 10/20/2011 |

| Expense Ratio | 0.03% | 0.16% | 0.09% | 0.06% |

| AUM | $339.15B | $29.72B | $413.15B | $49.25B |

Above are all the ETFs I own in large quantities, although VOO is by far the largest. I would continue to buy them all except the SPDR Dow Jones Industrial Average ETF (DIA). The Dow fund by State Street is the easiest to put together, being a price-weighted 30 stock index and having the highest expense ratio at .16%. You can recreate this strategy yourself minus any fees by buying all 30 stocks over and over again one by one. I do this as another self-indexing strategy.

I am also still buying the Schwab Dividend Equity ETF (SCHD). While I don't believe over the long run it will beat VOO if you are evenly equal weighting the two over the next decade with your dollar cost averages. The caveat is if you believe there is a greater broad market downside risk, possibly coupled with stagflation, then the accretive nature for higher dividend strategies could outperform with lump sum buy and holds in the interim until the inflation situation gains more clarity. Here are the head-to-head past decade performances of these funds:

Can VOO deliver a huge return?

Having read Christopher Mayer's 100 Baggers quite some time ago and then recently completing Thomas Phelps's 100 to 1 in The Stock Market, the astonishing feat of turning $10,000 into $1 million is a motivation that keeps me zen, in the zone to hold with less than 5% turnover per annum as the goal. The point is, we don't know what the future holds, but buying right and holding on, well diversified, should trump other strategies with a good dose of ridicule along the way by your peers who are always as smart as their last trade. They will also never be as dumb as their last trade they didn't tell you about.

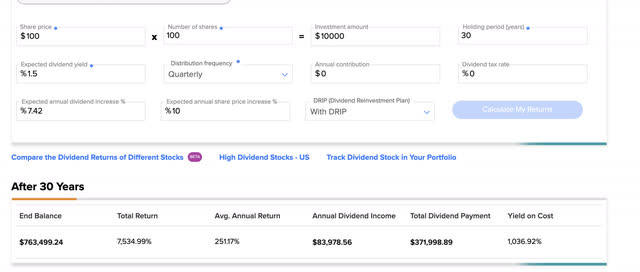

As 100 to 1 was the basis for 100 Baggers, upon completion of both you realize that the time frames were on the order of near 30 years in each case study. With that time frame in mind, the returns are not all that impressive. Let's run a 30-year analysis for VOO with the following assumptions:

- 10% average per annum CAGR.

- $10,000 starting point.

- A 1.5% dividend with a 7.42% CAGR [the trailing 10 year average for the fund.

- 30 year holding period with zero additional contributions.

Yes, with almost no thought or effort, VOO could give you a 100-bagger effect if held on DRIP for 30 years without selling shares. The point at which VOO becomes a 100-bagger is at year 31.5 with these inputs. Not bad for sitting around. You can believe this or not, but you have been placed here at this point with this knowledge set. What recipe you follow for the next decade or more will determine the outcome of your future.

Outperformance in a Black Swan

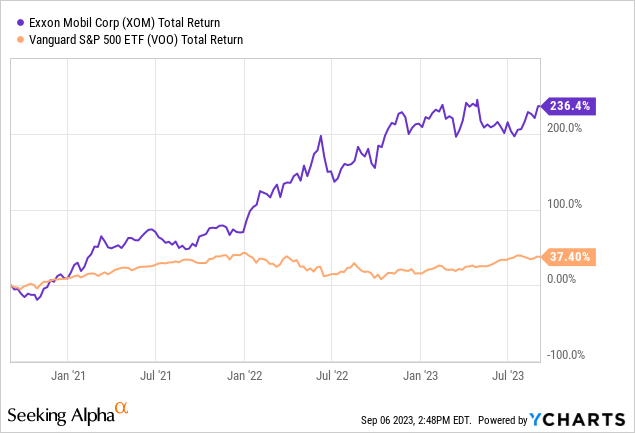

Now, here is an example of outperformance in a Black Swan event. Scooping up the most obvious blue chip at the bottom of the Covid dip is a great example of waiting until a broad market sell-off occurs before concentrating on a single name. In this case, buying Exxon Mobil (XOM) at the nadir resulted in vast short-term outperformance. It doesn't mean that Exxon, or any company is going to economically outperform the combined S&P500, but in some instances entry point > growth of equity sales or earnings.

This buy also resulted in a 10% dividend on cost that should keep pace with the total return CAGR of VOO going forward should the energy company remain nimble and be in existence during the same duration. This is an example of randomness providing an alpha opportunity. Be patient, don't think that they exist every day of the week.

Summary

I am in a holding pattern, but always investing no matter what the conditions. I tend to gravitate toward indexing when markets seem overheated. Interest rates are having a stark effect on all consumption, leaving many uncertainties in the back of my mind. Continuing to invest in broad-based US blue chip strategies is my theme for the foreseeable future unless we hit another black swan event or rates drastically move the other way.

All of us who have been in this market through the ups and downs since COVID-19 have found easy money lying under several rocks. In this case, we need to check our hubris at the door and question whether we have been fooled by randomness or have stumbled upon a stroke of genius. Covid is one of the biggest black swans of the last century and we have now re-entered a normalized capital environment where short and long-term rates have become competitive with equity returns.

Since I'm always buying, I have a strong buy on VOO, not due to the fund's valuation or momentum, but because it will protect the downside of the incessant holder. Buy right and hold on.