The JPMorgan Income ETF is a low-cost, unconstrained bond fund that aims to deliver current income and capital gains.With bond yields the highest in years, bond investing is starting to look interesting for many investors.JPIE has impressively been able to outperform its benchmark and a similar fund from PIMCO in both 2022's bear market and so far in 2023.

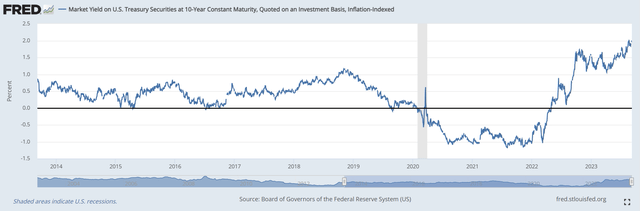

Recently, bonds have gotten a lot of attention as long term yields are starting to look attractive for many investors, with 10 year real yields now approaching 2.0%, the highest in over a decade (Figure 1).

While investors can easily buy individual stocks in their brokerage accounts, buying bonds is more challenging as the market is more opaque and there are far more fixed income issuers than stocks. The most common way for investors to access the bond market is via bond funds.

This article reviews a low-cost, unconstrained bond fund from JP Morgan, the JPMorgan Income ETF (NYSEARCA:JPIE). The JPIE ETF is an active ETF that opportunistically invest in different subsectors of the bond markets while dynamically managing credit and interest rate risk.

Although the JPIE ETF was only launched in late 2021, it has impressively outperformed the aggregate bond index since inception and a similar unconstrained bond fund from bond powerhouse PIMCO.

I am tentatively rating the JPIE ETF a buy, and look forward to reviewing this fund's performance in the coming years as the manager seems to have a knack for navigating challenging market environments.

Fund Overview

The JPMorgan Income ETF is an active ETF that provides investors with income from opportunistically investing in a portfolio of diverse debt securities. The JPIE ETF's mandate gives the investment manager flexibility to shift the fund's allocations depending on market conditions.

The JPIE ETF has $600 million in assets and charges a 0.41% net expense ratio.

Portfolio Holdings

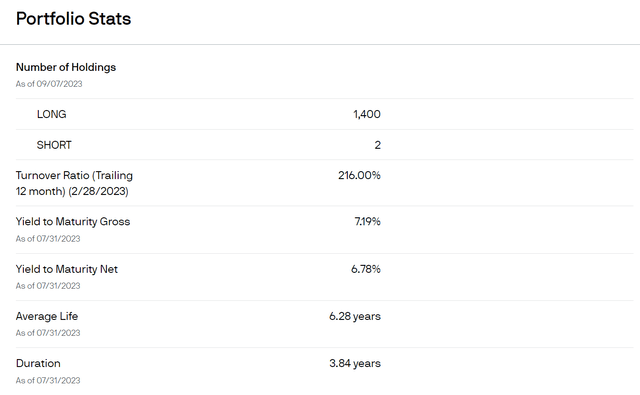

As of July 31, 2023, the JPIE ETF holds approximately 1400 positions with a portfolio yield to maturity of 6.8% and portfolio duration of 3.8 years (Figure 2).

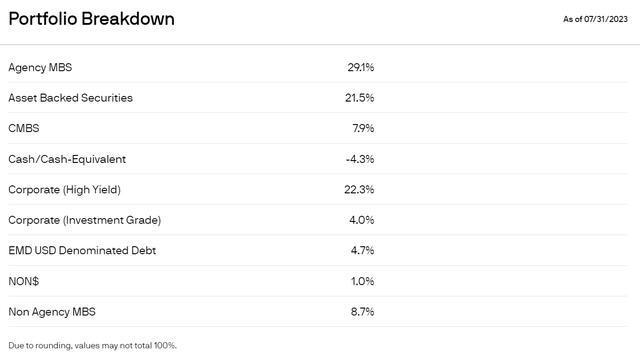

The JPIE ETF's largest sector allocation is Agency MBS (29.1%), followed by high yield bonds (22.3%), Asset-backed securities (21.5%), Non-agency MBS (8.7%), and CMBS (7.9%) (Figure 3).

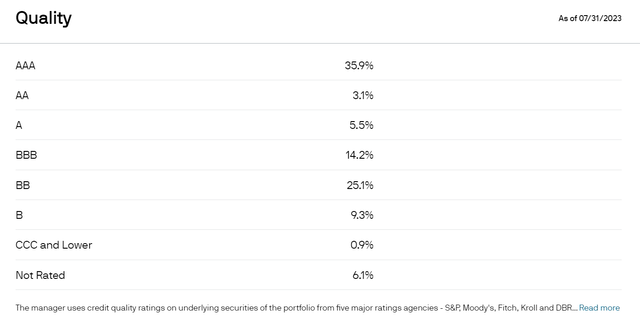

Figure 4 shows the fund's credit quality allocation. 58.7% of the JPIE ETF is investment grade (>BBB), with the biggest allocation being AAA-rated securities at 35.9%. The fund also has significant high yield holdings, including 25.1% of the portfolio rated BB and 9.3% rated Single-B.

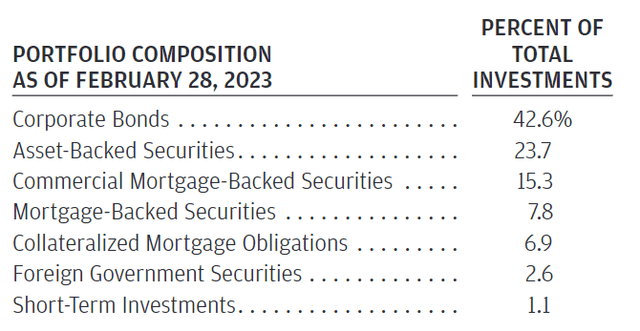

Investors should be aware that given the JPIE ETF's flexible mandate, its sector and credit quality allocations can change quite a bit from period to period. For example, as of February 28, 2023, the fund had a much larger weighting in corporate bonds of 42.6% (Figure 5).

Returns

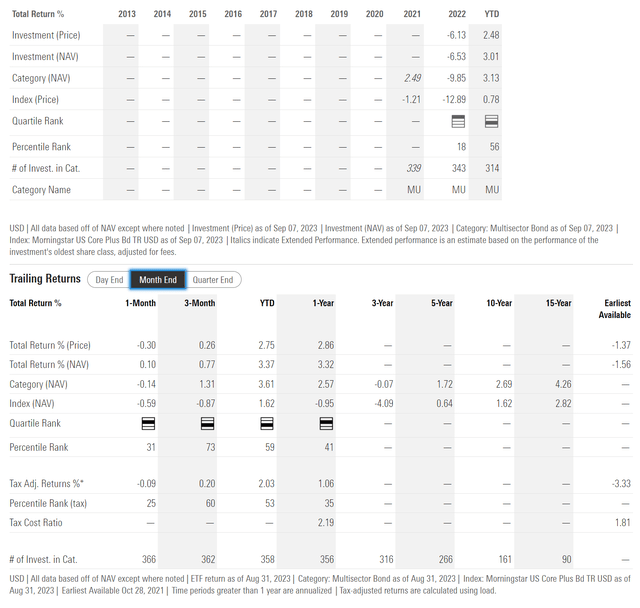

The JPIE ETF is a relatively new fund, having only been launched in October 2021, so it does not have a long operating history. So far, performance on an absolute level has been modest, with 1Yr return of 3.3%, and since inception average annual total returns of -1.6% to August 31, 2023 (Figure 6).

However, compared to its benchmark, the Bloomberg U.S. Aggregate Index, the JPIE ETF has outperformed (Figure 7). I believe most of the JPIE's outperformance can be attributed to its shorter duration of 3.8 years versus the Benchmark, which has a 6.2 year duration, as modeled by the iShares Core U.S. Aggregate Bond ETF (AGG).

Distribution & Yield

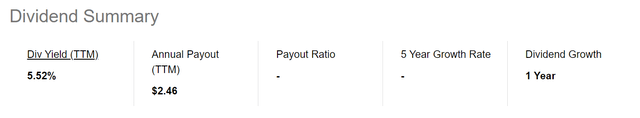

The JPIE ETF pays an attractive monthly distribution with trailing 12 month distribution yield of 5.5% (Figure 8).

How Does JPIE Compare Against BOND?

In a prior article, I had recommended investors looking for an active bond fund to consider the PIMCO Active Bond ETF (BOND). Since the days of Bill Gross, PIMCO has made a name for itself in bond investing, so comparing the JPIE ETF to PIMCO's BOND ETF, with both being unconstrained active bond funds, seems appropriate.

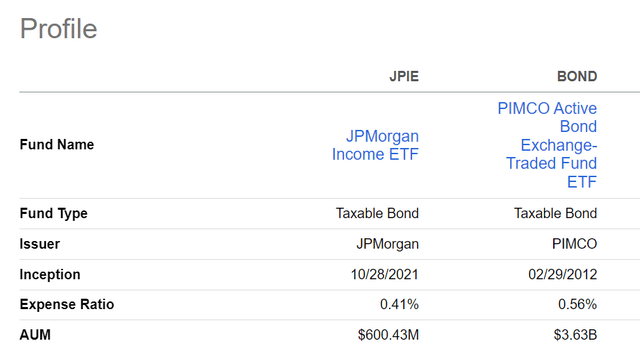

Comparing the two funds' fund structure, we can see that JPIE is slightly cheaper, with an expense ratio of 0.41% compared to BOND's 0.56% (Figure 9). PIMCO's BOND ETF has a lot more assets than the JPIE ETF, which is understandable since the BOND ETF has been around for more than a decade.

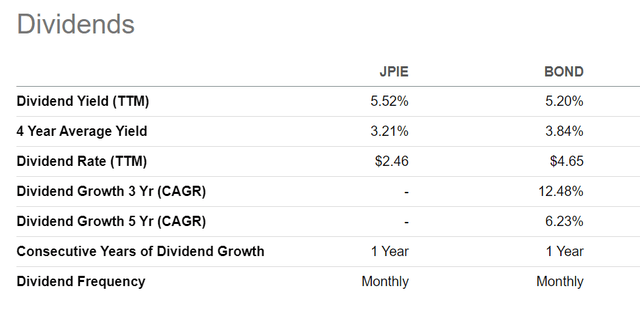

In terms of distribution, JPIE also comes out slightly ahead, with a trailing 5.5% yield vs. 5.2% for BOND (Figure 10).

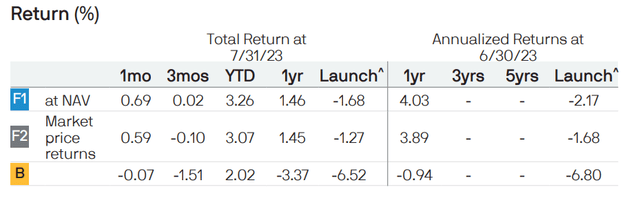

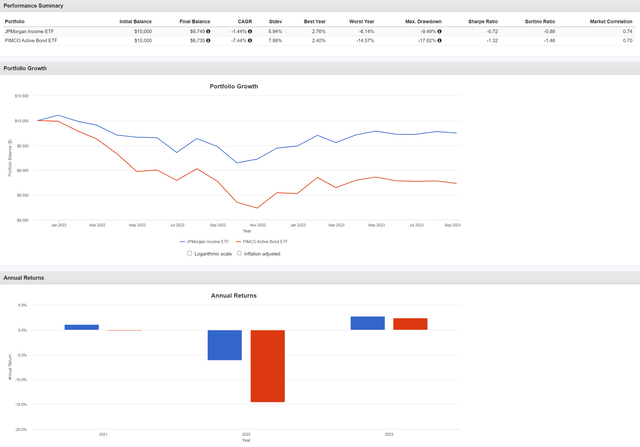

Finally, in terms of returns, the JPIE ETF is also superior, with CAGR returns from November 2021 to August 2023 of -1.4% compared to BOND's -7.4% (Figure 11).

Impressively, JPIE outperformed the bond experts at PIMCO in both 2022 (-6.1% vs. -14.6%) and YTD 2023 (2.8% vs. 2.4%).

While JPIE's track record so far is short, I am quite impressed by management's ability to navigate the challenging macro environment for bond investing.

Reading the manager's commentary, apparently JP Morgan's team had correctly predicted that a transition from Quantitative Easing to Quantitative Tightening would lead to a decline in financial assets, and thus had been able to avoid the worst of the 2022 bond declines.

Heading into 2023, management believed that markets were entering another period of transition and duration may be beneficial. So far, the call to buy duration in 2023 has yet to work, as bond yields are trading near 2022's highs. However, the JPIE ETF has delivered a modest return YTD, so kudos to management for generating positive returns despite the macro headwinds.

Conclusion

In summary, the JPMorgan Income ETF is an active bond fund with an unconstrained mandate that can dynamically adjust the portfolio's duration, credit quality, and sector allocation to deliver superior risk-adjusted returns.

So far in its short history, the JPIE ETF has impressively outperformed PIMCO's active BOND ETF. I am tentatively rating the JPIE ETF a buy for those seeking active bond management, as the managers at JP Morgan appear to be navigating the current volatile macro environment extremely well.