Désirée Russeau/iStock via Getty Images

Last week the Federal Reserve came out with its new forecast for the U.S. economy. The results turned out to be very close to what the Fed's statistical goals are: 2.0 percent inflation and 4.0 percent unemployment.

The picture for economic growth was not so strong, with real GDP growing by 1.8 percent. The growth is positive without any dip into negative territory.

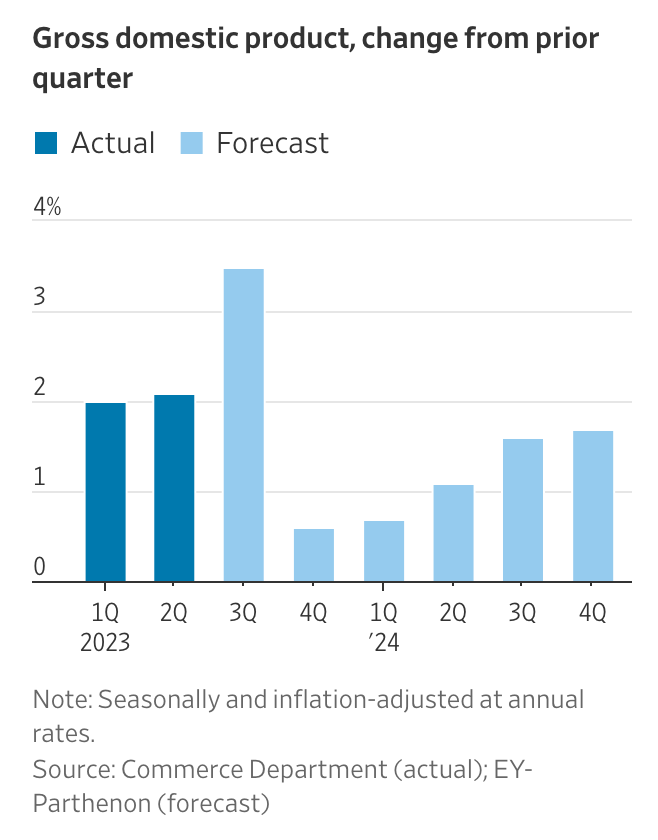

Now, we see the picture drawn for us from the Commerce Department.

Here is the latest look from the Commerce Department.

Gross Domestic Product (Commerce Department)

Not that these are not year-over-year data… these data represent quarter-to-quarter changes, annualized.

S0, the Commerce Department shows a very strong result for the third quarter of 2023, greater than 3.0 percent, followed by two quarters around 0.5 percent…but not negative…and then growth rates exceeding 1.0 percent, even up to 1.5 percent.

The Commerce Department is not showing a recession, but it suggests that 2024 is not going to be a very strong year. And, it is an election year.

This is not to say that the Biden administration is not trying to “pump up” the economy to produce stronger results for 2024.

As Ruchir Sharma writes in the Financial Times, “post-pandemic expenditure by Biden amounts to the most ambitious expansion of government since Franklin Roosevelt.”

Since 2021, there has been nearly $8.0 trillion in new spending, much of it going to support the president's “new American industrial policy.”

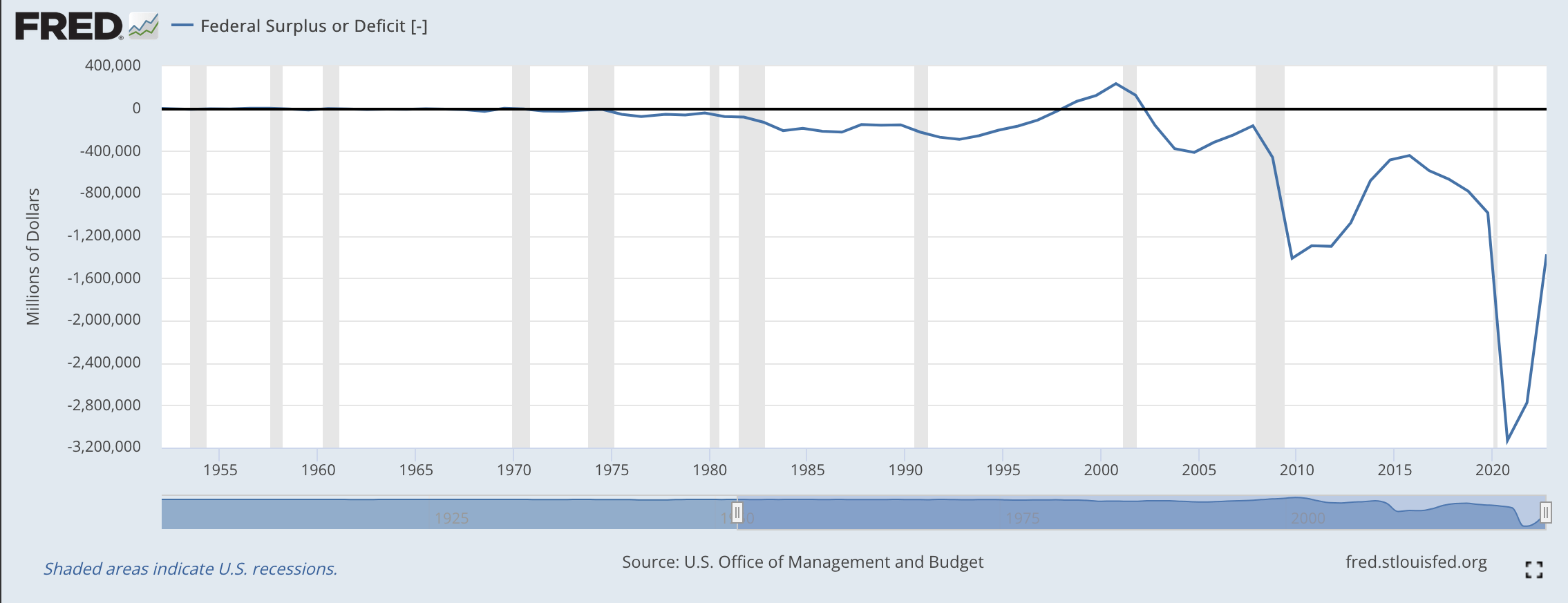

But, since the first of this century, the federal government changed the nation's financing plan.

Whereas most of the time since World War II, the government ran deficits that seemed large at the time, but looking back seem very responsible.

Deficit or Surplus (Federal Reserve)

Richard McKenzie writes in the Wall Street Journal that:

“From George W. Bush on, every president has rediscovered the political value of Keynesianism under the banner of George Gilder's catchphrase 'emergency socialism.' They rationalized unconstrained federal spending as a remedy for existential crises…. President Bush and Obama justified their hundreds of billion in deficits on the grounds that the world was on the brink of financial collapse. Presidents Trump and Biden rationalized their trillion-dollar deficits as a necessary corrective to a public-health crisis.”

It looks as if the government has no constraints on its fiscal behavior at all.

And, this applies to both Republicans and to Democrats. Neither party can be exempted from blame.

And, all this is taking place while the Federal Reserve has been following a policy of “quantitative tightening,” the effort to reduce the size of the Fed's securities portfolio. In the past 18 months, the Fed has reduced the amount of securities it holds outright by about $1.1 trillion.

So the Fed is acting in a way that increases the amount of federal debt the financial markets must carry.

That is where we are today.

But, what do the forecasts of the Federal Reserve and the Commerce Department show us?

They show us that U.S. economic growth is going to remain very tepid for the near term. As we saw during the economic recovery following the Great Recession, many analysts did not like the rate of growth that was achieved.

Looking forward, many analysts are still concerned about the rate of growth the economy is expected to achieve.

Well, there is a supply-side explanation for the slow growth… the rate of growth of labor productivity is very, very low. As long as the growth of labor productivity remains so low, real economic growth will continue to be tepid.

That is where your federal government has brought us.

And, it looks like this modest growth period will last for an extended time as the U.S. economy moves forward.