With a higher interest rate environment, yield investors are looking for low-risk ways to make a high yield.Mortgage-backed securities offer a high single-digit yield for potentially no risk.The call premium on MBS is at a multi-year high.Buying new MBS issuances is a way to take advantage of the high call premium.

The Chase For Yield

The era from 2008 to 2020 saw the lowest interest rates in history and many asset allocators were chasing for yield but also taking excessive risks in the process. Myself and many others often call it the era of “return-free risk”. Post 2020 though, we’ve returned to a risk-free return environment, which provides many opportunities for yield investors.

With many long-duration bond funds which were previously perceived as low-risk, such as TLT, down 50+% from their highs, there’s a large opportunity for yield investors to purchase long-duration fixed-income assets with a significant real rate of return.

A market where investors can get a high single-digit return with no risk is the MBS market.

MBS Basics

Most investors are familiar with the basics of what MBS are, but for those who aren’t, I’ll give a quick high-level overview.

Mortgage-backed securities were created by the Housing and Urban Development Act in 1968. The idea was that banks could package up and sell mortgages at a slight premium to what they underwrote them at to get capital to make more loans. Then investors in the secondary market would have a way in which to participate in what was long thought of as a low-risk asset class.

The classic MBS is pass-through in that it completely passes through all principal and interest payments.

CMOs are another type of MBS which is categorised according to different maturities and credit ratings, which are referred to as tranches.

Most retail investors will focus on pass-through MBS.

Due to the subprime mortgage crisis, many investors who don’t have a full understanding of this market have been concerned about investing in it. What many of these investors don’t know is that there are two primary MBSs: agency-backed MBS and private-label MBS.

Private-label MBS are mortgages that are non-conforming, meaning they don’t adhere to the government guidelines and because of that have no government backing; examples are jumbo loans or commercial mortgages.

With agency-backed MBS there are two types: Fannie Mae & Freddie Mac which are now private sector firms but are government-sponsored enterprises; and Ginnie Mae which is wholly owned by the US government, hence any agency MBS from Ginnie Mae is completely risk-free.

When most refer to MBS they are referring to Ginnie Mae Agency MBS and that is what we will be referring to in this article. Since it is risk-free if held to maturity, its yield is equal to that of a US Treasury plus a call premium as mortgages can be refinanced when rates go lower.

High Call Premium On MBS

Since mortgages can be refinanced, they have a built-in call option, giving them a treasury bond premium.

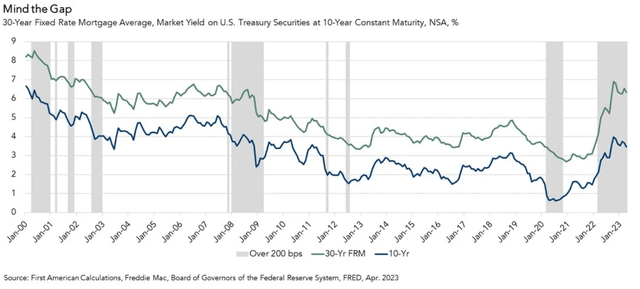

Below is a chart that shows mortgage rates relative to the US 10-year note:

The areas highlighted in grey are when the spread between the two is over 200 basis points.

The above chart goes till Q1 2023. Since Q1 2023 the spread between mortgage rates and treasuries has widened. At the time of writing, the FRED says the average 30-year fixed Rate is at 7.49%, and in many locales, the 30-year fixed rate on an FHA loan has gone above 8%. Compare this to the current 10-year treasury at 4.79%. This has brought the spread to 3%.

A spread of 3% is very wide, and it’s essentially the market’s way of saying that many market participants are paying a large premium to make a bet on lower rates. This is why, as rates have gone higher, the call premium has gotten larger.

Another key thing to remember is that the yield curve is inverted on the front end and has a slight steepening from the 10-year to the 30-year. If the yield curve normalizes by steepening across the whole curve, then both the 10-year and 30-year would be above the Fed Funds Rate, which is at 5.5%. In that situation, we could potentially see both the 10-year and 30-year above 6.5%. And if we add the current call premium on it, then mortgage rates could be at 9.5%.

Why The Call Premium Is Overpriced

In my opinion, the call premium is very overpriced.

There are really only two ways I see the tail risk on rates playing out.

1. Growth is more robust than expected, unemployment continues to stay low, and inflation stays elevated. In this case, we could see the right tail risk of rates going a lot higher than expected.

2. We see a collapse in growth leading to higher unemployment and the Fed reacting by going back to a zero interest rate policy.

Of course, there is a more probable in-between scenario too.

The main reason such a large call premium exists is because many in the market believe that rates will go lower so those with mortgages will refinance at lower rates, hence MBS will get their principal back early with no upside.

The issue with this view is that it presumes that housing prices will stay the same. For example, if you bought a home worth $1mm with an 80% LTV mortgage of $800k at a high interest rate and later on rates went down, you could look for refinance, but the appraisal could come back and say that your home is only worth $500k then, so a new 80% LTV mortgage with a lower rate would only be $400k. In this case, even if you wanted to refinance, you wouldn’t be able to unless you had 400k of cash to put in.

Scenario number two, which involves the left tail risk on rates playing out, would also likely result in far lower housing prices due to a severe recession.

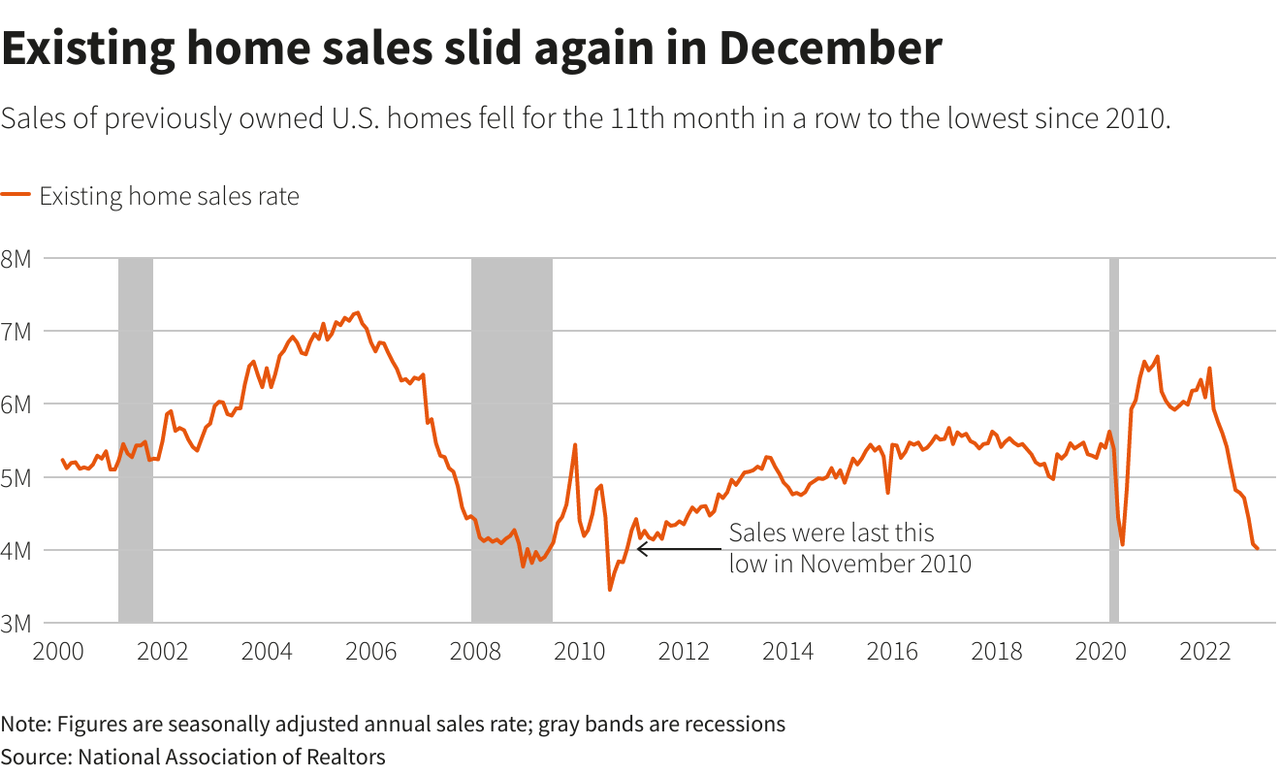

About two weeks back, I wrote an article on XHB. The gist of the article was that the current housing market is being driven by low volume, so the pricing isn’t accurate. The low volume is because buyers are weary of buying due to high prices or can’t they simply afford it, and sellers don’t want to sell as they’ve locked in low rates. This means that there is little volume in the residential housing market, making for what has been a frozen market.

An argument I made in the XHB article was that if rates come down, we would see housing prices come down. This is because homeowners who are locked in a low rate don’t want to sell thus letting go of a low-rate mortgage, but if rates went down then they would sell, hence bringing more housing inventory.

This is why I believe if rates go lower so do housing prices, and that means homeowners won’t refinance into a lower rate as they have negative equity on their homes. For this reason, I find the call premium on MBS to be overpriced.

Purchase Individual Pass-Through MBS Over The MBB ETF

There are a few issues I have with the iShares MBS ETF (NASDAQ:MBB). The first is that not all of the MBS that the fund holds is Ginnie Mae Agency MBS, which as we discussed earlier is the only true risk-free MBS.

The second and biggest reason why I don’t like MBB is that its weighted average maturity is 8.38 years. This means that the average mortgage that MBB has exposure to will mature in 8.38 years.

Shorter duration mortgages are those that have been issued many years back when rates were lower, so those mortgages have very little call premium. The mortgages with the most call premium are the newest issuances at the highest rates. For the reasons that I mentioned previously, I would prefer those new mortgages, since I think the risk of those mortgagors refinancing is low relative to older mortgagors who have a lot more equity in their homes and a lower cost basis.

This is why I think it’s best for investors to directly purchase new issuances of pass-through MBS.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.