The iShares 0-5 Year Investment Grade Corporate Bond ETF tracks an index of short-duration investment grade corporate bonds.SLQD has little duration and credit exposure, and thus generates little in terms of returns.SLQD has historically delivered modest returns and has not beaten inflation, making it an unattractive investment option.

With interest rates at decade highs, many analysts have been making the case for investments in credit. One of the most compelling arguments have been made by Howard Marks in his recent memo, “Further Thoughts On Sea Change”.

While I agree with Mr. Marks that prospective returns on some credit instruments are attractive and I have been recommending term credit funds like the Invesco BulletShares 2026 High Yield Corporate Bond ETF (BSJQ) for investors to ‘lock in’ equity-like returns, I do not believe the iShares 0-5 Year Investment Grade Corporate Bond ETF (NASDAQ:SLQD) is one such investment.

Simply put, the SLQD ETF may be too conservative for its own good. It primarily invests in short-duration investment grade corporate bonds. With little duration and credit risks, the SLQD ETF generates little returns. In fact, it has generated only 1.6% p.a. since inception, less than that of inflation.

For investors seeking credit exposure, I recommend they look elsewhere.

Fund Overview

The iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD) provides exposure to short-term U.S. investment grade corporate bonds. The SLQD ETF tracks the Markit iBoxx USD Liquid Investment Grade 0-5 Index (“Index”), an index that measures the investment performance of U.S. dollar-denominated, investment grade corporate bonds with remaining maturities of less than 5 years.

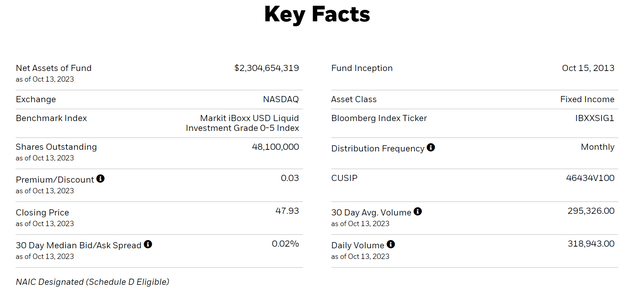

The SLQD ETF has $2.3 billion in assets and charges a low 0.06% expense ratio (Figure 1).

Portfolio Holdings

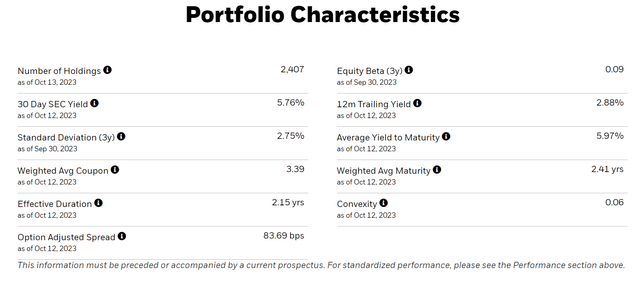

Figure 2 shows the overall portfolio characteristics of the SLQD ETF. The fund holds over 2,400 securities with average yield to maturity of 6.0% and effective duration of 2.2 years.

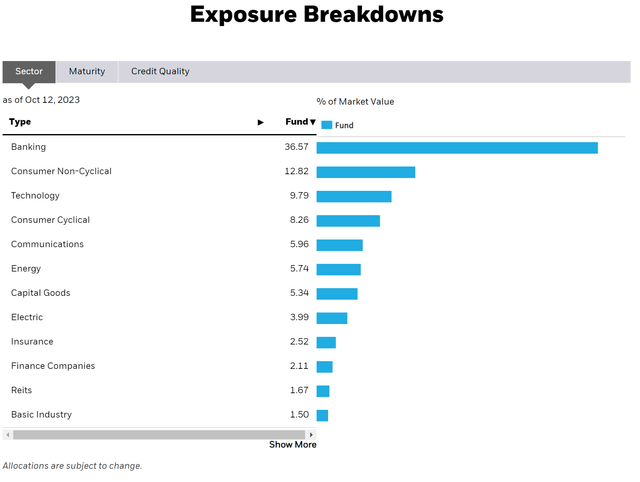

The SLQD ETF is heavily exposed to credit exposure from the Financial sector, which account for 36.6% of the portfolio. Consumer Non-Cyclical is the distant second largest sector with 12.8% exposure while Technology is third at 9.8% (Figure 3).

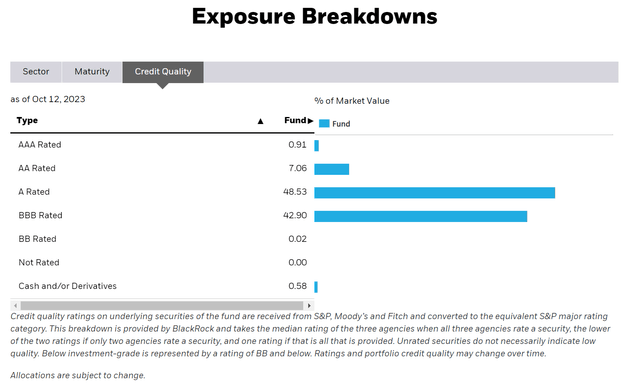

Securities held in the SLQD ETF are primarily A-rated and BBB-rated, accounting for 48.5% and 42.9% of the portfolio respectively (Figure 4).

Returns

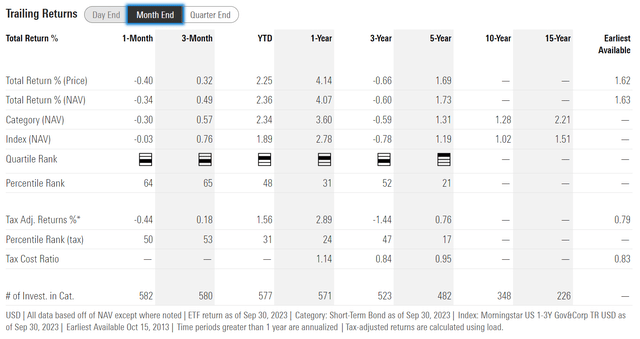

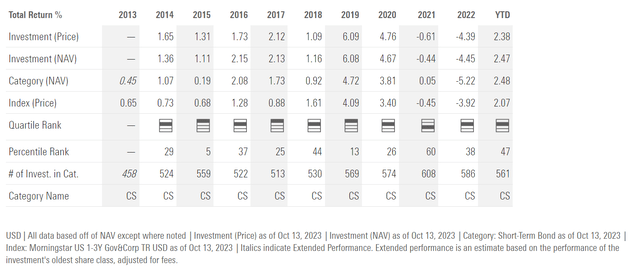

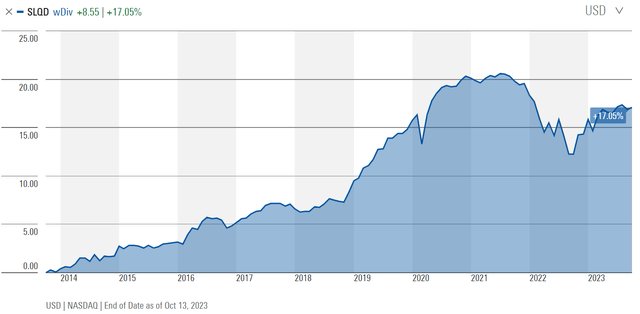

Historically, the SLQD ETF has delivered very modest returns, with 3 and 5 year average annual returns of -0.6% and 1.7% respectively (Figure 5).

On an annual basis, the SLQD ETF’s total returns have ranged from -4.5% in 2022 to 6.1% in 2019 (Figure 6). SLQD was able to avoid the steep losses experienced by other bond funds in 2022 due to its relatively low duration of 2.2 years. At the same time, its short-duration, conservative investment grade portfolio have not allowed the SLQD ETF to generate any substantial returns over the prior decade.

Distribution & Yield

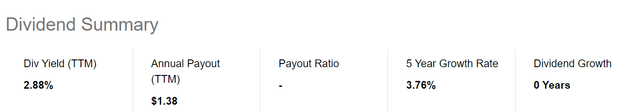

The SLQD ETF pays a modest 2.9% trailing distribution yield (Figure 7). SLQD’s distribution is paid monthly.

No Good Reason To Own SLQD

Looking at the macroeconomic environment, I find it difficult to come up with a reason why investors should own the SLQD ETF. Let me go through some economic scenarios to explain why.

First, if investors are bullish on the economy, then that means inflation may stay elevated for longer due to stronger demand, and the Federal Reserve may have to keep interest rates ‘higher for longer’. In this scenario, higher interest rates may prove to be a headwind for the SLQD ETF and any fund with duration exposure.

In a ‘higher-for longer’ scenario like the one we have experienced for most of 2023, the best place to be is in floating rate investments that do not have duration exposure. For example, the iShares 0-3 Month Treasury Bond ETF (SGOV), an ETF that invests in 3 month treasury bills, has outperformed the SLQD ETF by 2% YTD 2023 (Figure 8).

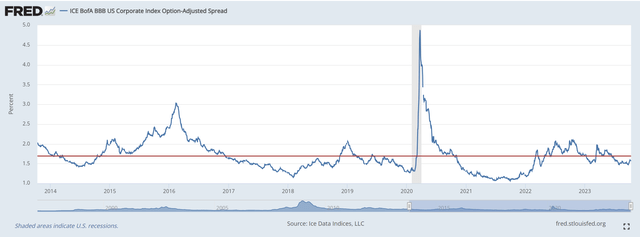

On the other hand, if investors expects the economy to weaken, then credit spreads should widen to reflect weakening economic prospects, which could be detrimental to credit sensitive investments like the SLQD ETF. In fact, current investment grade BBB-credit spreads remain very tight at just 156 bps, below the 10-year average of 169 bps (Figure 8).

Finally, if investors expect the economy to slip into a recession in the coming months, then credit spreads should widen dramatically. For example, from Figure 8 above, BBB-credit spreads widened to 3% in 2016 during the global growth scare episode that occurred without a U.S. recession. In the 2020 COVID recession, BBB-credit spreads widened to over 4%.

Although interest rates should fall in a recession scenario as investors anticipate the Federal Reserve will cut interest rates to stimulate the economy, SLQD’s limited duration exposure may not offset the declines from dramatically wider credit spreads.

Long-Term Performance Does Not Beat Inflation

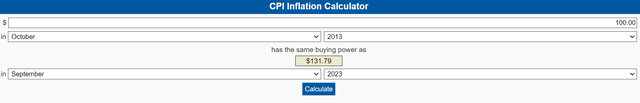

In fact, if we take a step back and consider SLQD’s long-term performance, we can see that SLQD’s annual average return of 1.6% since inception is less than that of inflation. Since SLQD’s inception in October 2013, the CPI index has increased by a cumulative 31.8%, or 2.8% p.a. (Figure 9).

On the other hand, SLQD has only delivered cumulative returns of 17.1% since inception (Figure 10).

So investors owning the SLQD ETF over the long-term will have lost to inflation.

Conclusion

The iShares 0-5 Year Investment Grade Corporate Bond ETF is a passive ETF giving investors exposure to short-duration investment grade corporate bonds with maturities less than 5 years.

Overall, I do not see any compelling reason why investors should own this ETF. If interest rates continue to rise due to a strong economy, then SLQD may underperform floating rate investments. If the economy weakens, then the SLQD may suffer from widening credit spreads. In the event of a recession, SLQD’s modest duration exposure may not offset the potential losses from widening credit spreads.

Overall, SLQD’s 1.6% average annual return since inception has not been sufficient to offset inflation. I would personally see credit exposure elsewhere.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.