Virtus InfraCap U.S. Preferred Stock ETF seeks yield and capital appreciation through preferred securities of U.S. mid to large-cap companies. PFFA uses external leverage to enhance yield potential and has the ability to activate option overlay strategies.

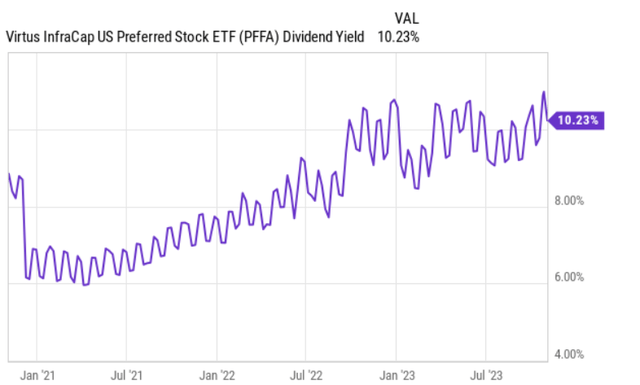

The fund has a concentration in the real estate sector but offers diversification at the security level. Currently, PFFA offers historically attractive entry points for yield-seeking investors, where the monthly dividend yield has reached 10%. This has happened due to multiple contraction that is associated with duration risk.

Virtus InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA) seeks to, primarily, generate yield and, secondarily, capital appreciation by allocating in preferred securities that are issued by U.S. mid to large-cap companies.

The underlying security selection process is based on active approach, where the Management through both quantitative and qualitative analysis cherry-picks the right securities.

What is quite specific to PFFA is the presence of additional external leverage that is used to enhance the yield potential. The stipulated amplitude of the external leverage is between 20 to 30%, where the precise target weight is determined by the Management's decision. Currently, 25% of the total assets are funded with additional borrowings.

As a last PFFA-specific item is the possibility for the Management to activate option overlay strategies or make opportunistic short positions to hedge interest rate risk. Yet, by looking at the two most recent holdings list, there were no derivative instruments in place. So in the context of PFFA alpha potential, option strategies do not play a notable role.

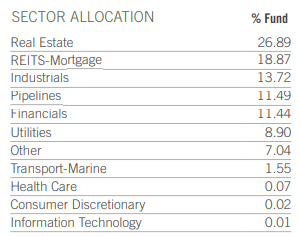

If we take a look at PFFA's holdings, we see a bit of concentration in the real estate sector:

Roughly 45% of the assets are placed in real estate and mortgage REITs. The remaining share is nicely distributed among industrials, pipelines, financials, utilities and other sectors.

Yet, on a security level there is greater diversification applied:

Here the largest bets are not so heavily skewed towards real estate segment.

Thesis

In my opinion, there are a couple of reasons why it is worth considering PFFA in income-seeking investor portfolios.

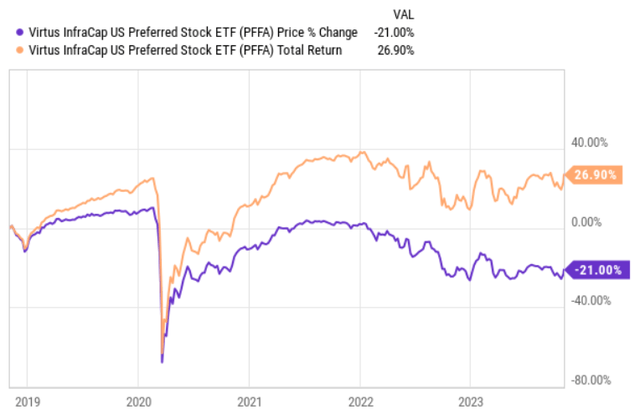

Since the outbreak of the pandemic, PFFA has lost a notable chunk of its market capitalization. Because of the further pressures stemming from a more aggressive monetary policy, PFFA's share price continues to be depressed, trading 21% below the level where it was 3 years ago.

At the same time, if we measure PFFA's performance on a total return basis, the results are significantly more positive. Adding back dividends to the return equations, PFFA is up by 27%.

This speaks of two things: first, PFFA is down thus providing an interesting entry point from the valuation perspective, and, second, current income is the key driver of PFFA's performance.

The chart above captures the story pretty well, where the PFFA's share price (valuation) is depressed, which, in turn, creates a historically attractive entry point for yield-seeking investors. This is a nice moment, where the decline in market capitalization levels has been purely multiple driven.

In fact, PFFA has managed to increase the underlying dividend by a couple of cents per share over the 2020 – 2023 period.

What is also appealing about PFFA is the fact that all the allocations are made into securities, which rank higher up in the capital structure than equities.

Preferred instruments per definition provide better safety and predictability for investors than common equities. For example, to suffer a cut on the preferred distributions, companies have to first exhaust the cash flows that initially were directed towards satisfying equity holders. Plus, before initiating (or resuming) any dividend payments to shareholders, preferred investors have to be serviced first. Moreover, in practice, payments to preferred investors consume a relatively minor chunk of the cash flows that are directed to shareholders or bondholders making them less attractive targets for saving measures.

In PFFA's case there is also a benefit that many preferred stocks in which the Fund has invested are reaping the benefit of conversion to a floating rate. This way some of the underlying instruments contribute to a greater flow of investment income to the Fund that can help either help offset any struggling securities or headwinds from higher costs on the external leverage end.

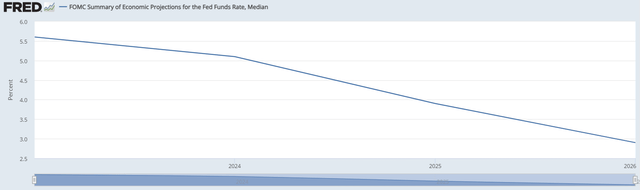

Finally, PFFA carries an inherent exposure to duration risk, which against the backdrop of prevailing interest rate dynamics offers an interesting bet for investors.

Now, one of the key reasons why PFFA has dropped so much (from the price return perspective) is because of its or preferred security sensitivity to the interest rate changes. Since preferred securities have very limited cash flow growth component and their maturity profiles tend to be very long (sometimes even perpetual), it introduces an automatic bias towards duration risk. As we can see from the chart earlier above, starting from 2022, PFFA's price assumed a steady downward trajectory despite the Fund's ability to grow the underlying dividend.

Currently, the market is pricing in a gradual normalization of interest rates starting from 2024. Each incremental drop in the interest rates should boost the valuations of preferred securities in a similar fashion as when the rates moved up. In such case, investors could expect not only the attractive 10% coupons but also meaningful returns from the capital appreciation.

Granted, it is inherently rather risky to rely on macro-level forecasts and especially where the interest rates will go over the foreseeable future, but, as of now, the odds are certainly in favour of experiencing some rate cuts rather than further increases.

The bottom line

PFFA offers a historically attractive yield, where the 10% monthly dividend is supported by a portfolio of diversified preferred securities.

PFFA is able to offer this high dividend mainly because of the recent multiple contractions and growing cash flows due to preferred stock conversion to floating distributions. Importantly, while the PFFA's valuation decreased, the Fund managed to slightly increase the distribution levels, thus confirming the resiliency of preferred instruments.

A major reason why the PFFA has declined so much is the exposure to duration risk. Going forward, the path of future interest rates is clearly skewed towards a gradual normalization, which should, in turn, enhance preferred valuations.

The key risk, however, for PFFA investors would be further interest rate hikes by the Fed. In that case, we would see two sources of negative impact: (1) further multiple contractions due to the elevated duration risk / exposure, and (2) higher cost of financing that is associated with the external leverage that the Management has assumed in order to enhance the yield potential. In the latter instance, there could also be a risk of suffering from a slight dividend cut.

All in all, PFFA is an attractive income play with a solid potential of registering additional returns via capital appreciation.