BlackJack3D

There's more to AI than Nvidia. This is why the Robo Global Artificial Intelligence ETF (NYSEARCA:THNQ) is an interesting way for investors to access artificial intelligence and robotics. What I like about the fund is that it's very well diversified, making it a pure thematic play beyond the idiosyncratic aspect of just a select number of stocks in the space.

THNQ seeks to track the ROBO Global Artificial Intelligence Index. This index aims to track companies that generate a significant portion of their revenues from the AI market. THNQ offers a diversified strategy for investors, providing exposure to the very best public companies from around the globe, irrespective of their size and location. The fund serves as an excellent platform for investors to capitalize on the expected growth in AI and robotics, sectors that are transforming virtually every industry across the globe.

An Overview of the Fund

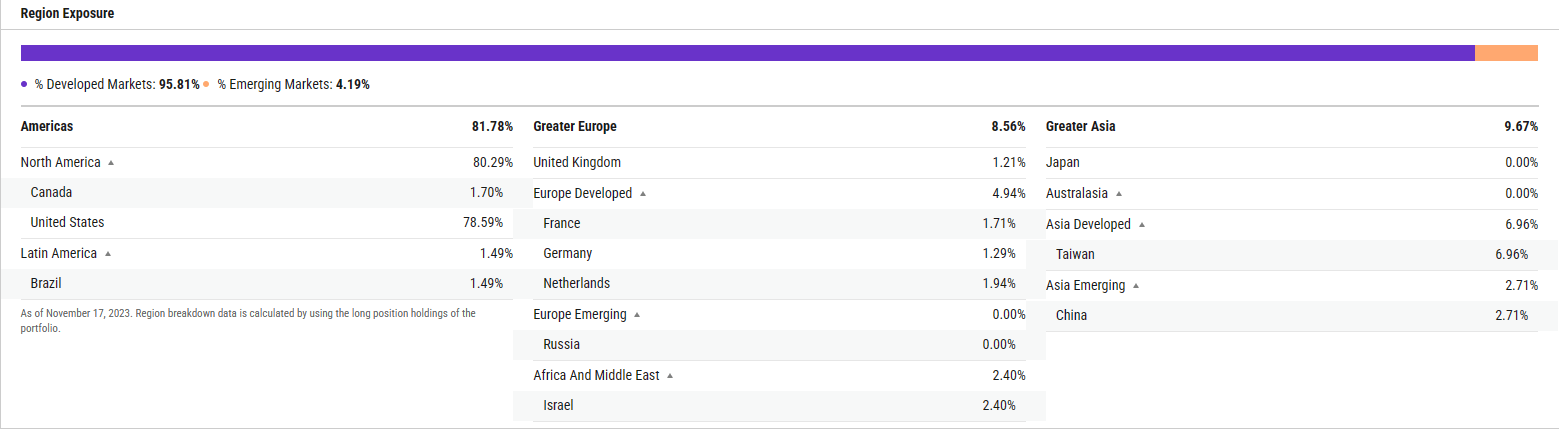

THNQ strives for a balance between growth and value, focusing on companies with strong business models and positive cash flows. The fund is rebalanced on a quarterly basis to ensure it consistently holds the most innovative and promising companies in the AI and robotics sectors. The ETF is not limited to technology companies; it also includes firms from the consumer cyclical, communication, and healthcare sectors, among others. Geographically, THNQ's holdings are diverse, with significant exposure to non-U.S. markets, particularly in Europe and East Asia.

ycharts.com

Top Holdings

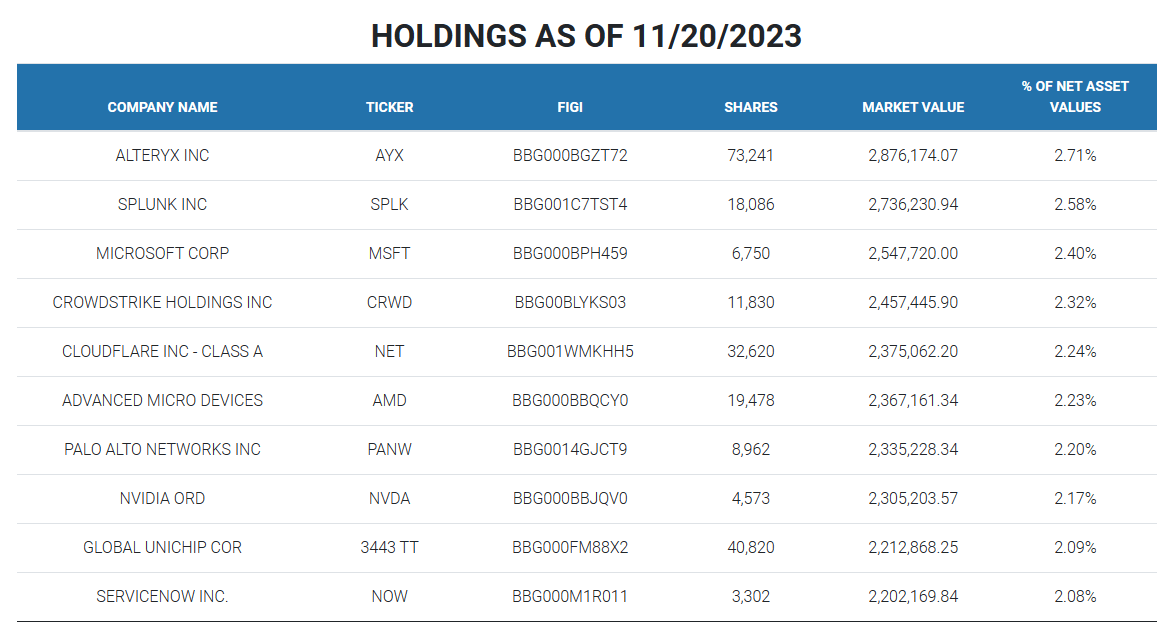

I mentioned at the start of the writing that this is a well-diversified fund. No holding currently makes up more than 2.71% of the fund, and crowd favorite Nvidia is currently ranked 8 in the top 10. Again – I very much like this. It makes this a far more nuanced and diversified way of playing AI than other products where Nvidia is the biggest holding.

roboglobaletfs.com

Sector Composition and Weightings

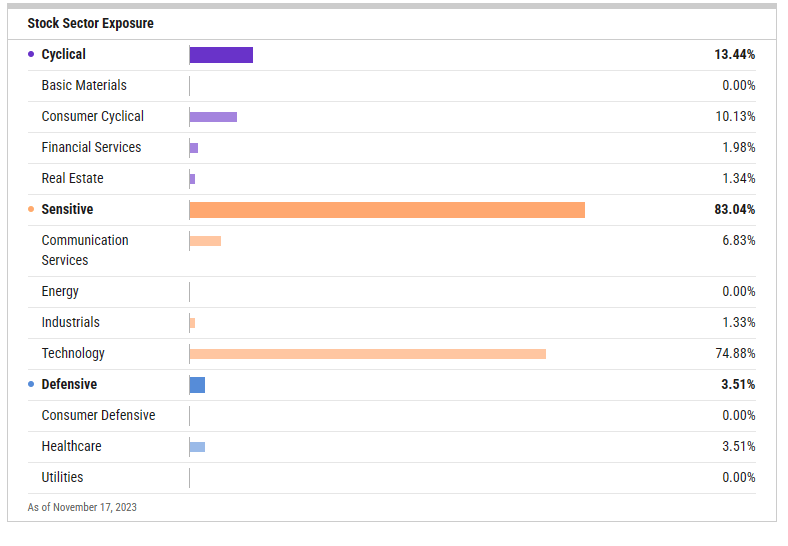

The sector composition of THNQ is diverse, ensuring that investors gain exposure to various segments of the economy. As you'd expect, the majority of the fund is in the Technology space, but it's not a pure tech fund in that it does have stocks from non-tech groups.

ycharts.com

Peer Comparison

When comparing THNQ to its peers, it's important to note that it outperformed the TrueShares Technology, AI & Deep Learning ETF (LRNZ) which is another fund in the space. LRNZ is considerably less diversified with top holdings having more concentration risk than THNQ.

stockcharts.com

Pros and Cons of Investing in AI and Robotics

Investing in AI and robotics comes with its share of advantages and potential risks.

On the positive side, these sectors are experiencing unprecedented growth due to advancements in technology and increasing adoption across different industries worldwide. Furthermore, AI and robotics offer substantial potential for innovation, making them attractive sectors for forward-thinking investors.

On the flip side, investing in AI and robotics also carries risks. These include regulatory uncertainties, privacy concerns, and potential job displacements due to automation. Moreover, these sectors are highly competitive, requiring constant innovation and substantial capital expenditure.

Conclusion

Personally, I think THNQ is a solid avenue for investors looking to gain exposure to the rapidly growing fields of AI and robotics. It's well diversified, and if you believe that AI is unstoppable, despite relatively weak performance as of late, this becomes a good fund to access the trend.