ronstik/iStock via Getty Images

We have seen this question being asked repeatedly, recently. Frankly, it surprises me, because when I look broadly at the economy, I see a lot that’s wrong. As far as I can tell, this is more a political question than an economic question- but it has elements of both economics and politics. The unemployment rate is near a 50-year low. And the economy has been surprisingly resilient if we focus on GDP growth rates. But inflation has been high and while it is ratcheting lower, it is still ‘inflation’ (a lower – and still too-high – rate of increase). It is not a reduction in prices. The cumulative increase in prices since January 2020 is a gain of about 19%. That’s a lot of elevation for a central bank that promised a 2% target – hitting that target would have produced net price gains of about 6% in this horizon (i.e., 19% ≠ 6%).

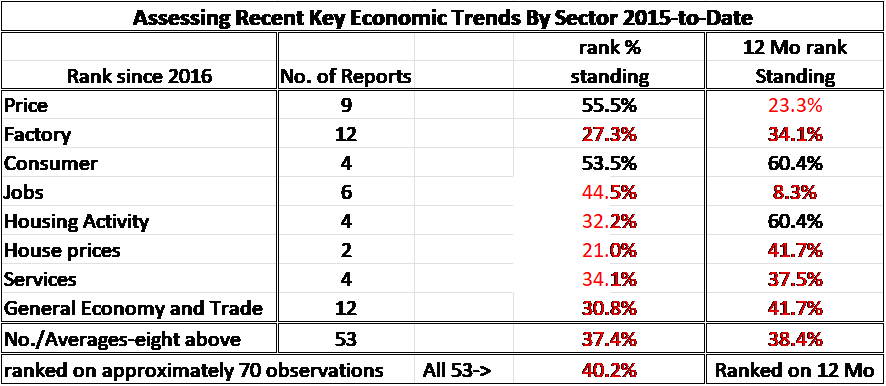

Inflation is clearly one reason for consumers feeling bad. But it’s not the only reason. The table below filters through 53 different economic series ranking their performance since January 2015. The data generally are presented as year-on-year rates of growth except for diffusion indices (that are ranked based on levels) and the unemployment rate (for example, which is given an inverse rank, so that a low unemployment rate scores a high jobs category ranking).

53 Key economic series ranked from 2015 to date (Haver Analytics and FAO Economics)

This table makes it quite clear that on data since 2015, most of the categories have standings (based on their level or growth rates) on these concepts that are below their nearly nine-year median values (medians occur at a 50% standing). Looking at the underlying 53 series, only 15 of them are above their medians on this timeline (and five of those are not good news because they are price metrics). All the moaning about how bad people feel despite how well the economy is doing is misplaced – at least in my view and in the view of these data. If you assess the stock market performance, most of the market gains are a special set of several stocks (WSJ). On balance, there are some widely watched indicators (DJIA, S&P-500, NASDAQ, GDP, Unemployment) – and that’s not a shaky group of indicators either – that have performed well. But there is no real robustness behind it. The economic and stock market performance has been remarkably hollow.

Surveys poll people not data

When we look at economic or political polls, they are polling people, not stock indices, not GDP numbers, but the men and women in the street, on the line, in the economy. It’s not surprising that they do not feel good about things.

This is in part a cautionary note to be selective in how to vet and assess ‘opinion.’ Make sure you are polling the right thing for the answer you are seeking. Of course, we look for aggregate measures to simplify the assessments of this huge, unwieldy, economy. But we are mindful of what such aggregations do to data and what flaws they might introduce by leaving out some important aspects.

Recent years’ polls that have targeted political opinion executed by seasoned experts have become inaccurate. Polls may not even be a worthwhile endeavor.

Does GDP tell anyone how you feel?

How people ‘feel’ is about a lot more than just economic data…Society is wracked over all sorts of issues related to how race is treated as well as other characteristics such as sex, sexual orientation, religious groupings, and more. There are conflicts engendering bitter feelings over how the Covid crisis was managed as well as over issues like climate change. Border problems, and seemingly unconstrained immigration, are helping to create political and economic tensions in the economy and society. Do you really want to judge ‘how people feel’ from GDP and unemployment statistics? Does the ‘misery index’ (unemployment rate plus inflation rate) really tell you anything? And, at the same time, can you use such a narrow set of factors to decide where and how to invest? Things are changing and it’s not just about the jobs and GDP growth logged today.

What happens when the science you ‘trust’ no longer supports you?

Climate change, which is clearly in train, is gaining more dispute over the question of what is causing it. The carbon hypothesis has been criticized in a well-argued and widely distributed book, “Unsettled,’ written by a senior scientist from the Obama Administration (see also this report Here). The book presents clear evidence of how carbon models have failed to forecast or even to track recent climate events, having consistently predicted higher temperatures than we have experienced – so how can we trust carbon to forecast or to base future policy on? Yet, much of the economy is being reoriented away from carbon (coal, oil, and even gas) to electricity even though wind and solar are not sufficient as sources to replace carbon. This disconnect is, I believe, another reason for the angst in the economy about what policy is doing- basically policy does not make sense. It is not supported by evolving science. Most disturbingly, without some significant changes or breakthroughs, it is not even sustainable.

California Dreamin’

California, on the cutting edge of much of this change, has so much demand shifted to the electric grid the authorities urge electric car owners not to charge them during the day (here). A recent WSJ article (here) follows an electric semi-trucker, documenting the efficiency losses from these trucks when compared to diesel. Where will our power come from if we keep this up? How long until electricity overcomes its hurdles if at all? Plenty of angst here…

The move to eco-electrification is well underway. But it is still a movement in its infancy and not yet viable or sustainable. For cars, subsidies still rule. Electric cars are too expensive for most even though they are being mandated for the future in California. The cost of EV repairs (here) appears higher and may have a lot more risk on the high side as well. This is not a seamless transition. Wealthy people seem to like electric vehicles, but there are myriad issues: batteries do not seem wholly safe, the cars are bad in the cold, they have limited range, their batteries will die…then what – more angst. In Europe, Volkswagen has committed mega-resources to try to develop a popular electrical car to compete with carbon-based vehicles, with little success (here).

Where do I plug in and where does the cord lead?

The real question around electricity is where will it come from? There is also a question of how it gets delivered since the electric grid in the US is in bad shape. The President’s push for all this is under the banner of being green, but as an operable policy there are a lot of missing pieces; it can’t be green if it does not function. And there are questions of whether calling it ‘green’ is correct. What does ‘green’ mean- especially if the carbon hypothesis is wrong?

A.I. is not warm and fuzzy

There is also change being driven by AI that is still speculative. All this changing puts pressure on people by unsettling the job market. Such disruptions may pay dividends in the long run but for now, there is disruption and disruption often is painful. I expect that is being reflected in consumer polls as well.

Don’t gloss over obvious issues

We don’t have to think very hard to understand why people, when polled, do not give policy as conducted by the Fed or by government very high marks. There is also a growing disconnect with our foreign policy interventions because they have become so costly and then there are others angry over the policies we do support overseas. When we poll people, we get a range of reactions to conditions and events that go well beyond the simple economic variables some think should dominate.

It’s not the industrial revolution but it is a societal revolution

It is a very disruptive and divisive time in America. And yet we have issues that need attention. How the country addresses these issues (or, if it chooses to ignore them…) will impact the economy, growth, and investment strategies. We can look at societal issues. We can look at longer-lived policies that divide us more or less along political lines. We can look more closely at economic developments. But remember, if you invoke ‘science,’ science is a process of changing findings and with inherent conflicts. Science is a ‘work in progress,’ it is wisdom growing and accumulating and refining itself; it is ever-changing. Technology seems to not have brought us together but to have compartmentalized and sorted us into various online communities and caused the media to align with one camp or the other to appeal to it and generate revenue. And with stay-at-home workers, that isolating factor may be intensifying – a shift with clear economic impact if it continues. So, what happens to your behavior when you do not meet people face-to-face daily or do so only rarely? Do your interactions and connections with them stay the same…or not? Bankers have always said the most important thing is to ‘know your customer.’ How will you ever know your client if you never meet him or her?

What is clear is that we should not place much reliability on these broad macroeconomic data so many want to put front and center as the arbiters of how we ‘should feel.’

Bob Dylan was right! And he continues to predict the future well…

Sometimes you can cut yourself on ‘Occam’s Razor.’ The simplest explanation, revered as it may be, can be very misleading. The world is not simple. The planet is not simple. And many things are changing.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.