The Schwab 5-10 Year Corporate Bond ETF (NYSEARCA:SCHI) is quite a high-duration ETF with fixed-income instruments in the corporate credit space. Our position for some time now has been that inflation will be quite sticky. Before, we considered that it might be a reason for higher for longer, but considering Fed remarks before the turn of the year, we are considering that the Fed might be genuinely concerned about the maturity wall and other credit events in 2024 and 2025, and that the growth mandate or at least considerations of it are taking priority even if the inflation battle is not over. We think nominal rates are going to come down, but we do think that it will be due to heightened pressure on corporate income, which also concerns corporate credit, a trade that we believe right now is overcrowded.

SCHI Breakdown

Primary exposures in SCHI are industrials and financials at around 90% of the portfolio, the rest is in utilities. Half of the portfolio is BBB-rated and the other half is A-rated, so these are higher-grade credit risks.

Expense ratios are 0.03%, which is a very efficient rate and exemplifies that fixed income is best approached through ETFs for retail investors unless they have special convictions about some single issue.

Industrial and utility exposures are going to have quite a lot of fixed debt, and financials also are cyclical, and credit ratings are going to have a fair bit to do with the state of the economy. Moreover, lower rates are an income problem for financials both in terms of interest income and in the case where they have a lot of retail markets and may need to do some more reserving – thinking about credit cards and mortgages and such, in the case of credit events or in the case of a general recession.

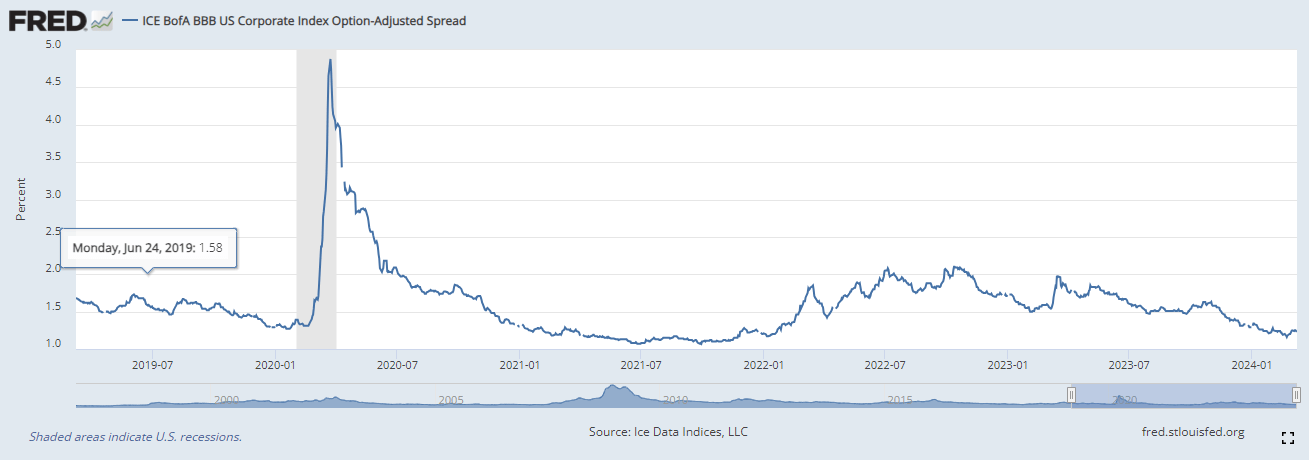

Why are we mentioning fixed-rate debt exposures and recessions? This may become a new theme in the markets, and no one is talking about it outside of restructuring-oriented advisory shops which are all waiting for a restructuring wave, which seems to be beginning, on account of maturity walls. An outsized proportion of debt will come due in 2024 and 2025, and it will update fixed rates to the much higher prevailing rates. Credit spreads are tightening on soft landing speculations, which will help these refinancings achieve better rates (a case where market optimism actually brings about positive outcomes), but we do not agree with how historically low credit spreads are despite looming maturity walls and very clear messaging from the Fed that they are concerned about the state of credit and that lagged effects are in the pipeline. Maturity walls will strain a lot of companies whose markets are also cyclical. If employment figures are affected by maturity walls, we could get some credit concerns, with credit spreads having to come up across these industries. We still think inflation will be sticky in the face of higher employment, as already evidenced in the latest CPI releases.

While our argument for some time has been that the Fed will have to combat higher inflation very seriously, the restrictive policy may see much greater transmission as companies hit maturity walls, which should give space for the cutting that the Fed is already guiding for. We think that inflation will probably not fall dramatically, for example not reaching deflationary territory or even close due to underlying effects from expectations and already-in-effect wage increases, but it should reach policy levels allowing for meaningful nominal rate decreases. SCHI’s effective duration is 6.1 years. Since there are also long-term inflationary factors, like deglobalisation, we do think that higher long-term yields are likely to be a reality, which affects SCHI due to the longer maturities of its bonds.

Bottom Line

A 5% average YTM isn’t that fantastic considering long-term inflationary factors, although it’s not bad either as this higher duration ETF will have sensitivity to a fall in short-term rates, which again could come from higher transmission of Fed policy after a substantial amount of fixed debt in the corporate world becomes refinanced at higher rates and continues to hurt net income and possibly influence staffing decisions and layoffs. The relative disadvantage of SCHI compared to Treasuries of a similar duration is just the fact that we are not that confident in the credit aspect of the ETF, and don’t feel there is value in the credit spreads, which are likely from these historical lows to go in the opposite direction of the rate policy and dampen the performance of SCHI compared to better credit-calibrated instruments.

BBB Credit Spreads (FRED)

Thanks to our global coverage, we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.