Thesis

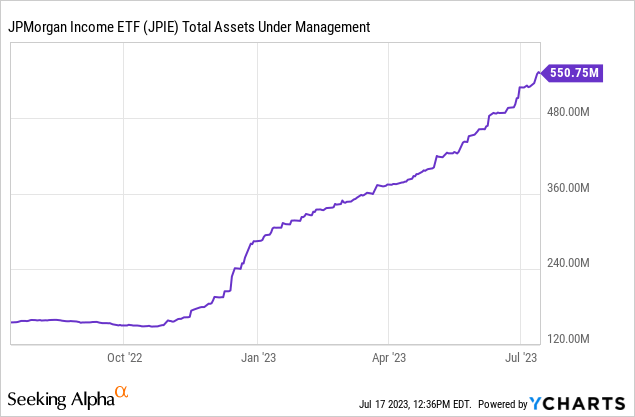

BlackRock Flexible Income ETF (NYSEARCA:BINC) is a new fund from BlackRock. The vehicle was just launched in May 2023, and is an active exchange traded fund. BINC has current income as its primary objective, and has a multi-sector approach. The fund seems to be the BlackRock answer to the popular JPMorgan Income ETF (JPIE), which we covered here. JPIE has seen a spectacular increase in assets since October 2022:

Data by YCharts

This is not a coincidence, with short term and intermediate investment grade fixed income exposing all-in yields in excess of 5% for very little market and credit risk.

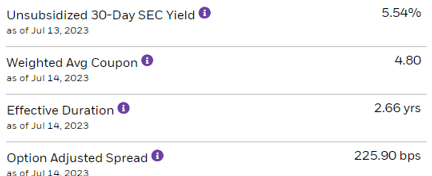

Launching multi-sector fixed income funds in today’s environment makes sense, since managers can build portfolios yielding in excess of 5% with reduced market and credit risk. BINC is a testament to that, with a low duration of 2.6 years, and an overweight investment grade portfolio that gives the fund a 30-day SEC yield of 5.5%:

Fund Metrics (Fund Website)

Please note the large option adjusted spread for the BINC portfolio, which gives us a sense of the alpha generation capabilities for the fund. As a reminder OAS represents a spread over risk free rates after adjusting for embedded optionality:

The option-adjusted spread (OAS) is the measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option. Typically, an analyst uses Treasury yields for the risk-free rate. The spread is added to the fixed-income security price to make the risk-free bond price the same as the bond. The option-adjusted spread (OAS) measures the difference in yield between a bond with an embedded option, such as an MBS or callables, with the yield on Treasuries.

Source: Investopedia

Since the fund just IPO-ed we do not have any analytics here such as Sharpe ratios, standard deviations or other measures of volatility. We would likely revisit this name after a year worth of data to see how its risk return profile tallies out. BlackRock is aware of the lack of analytics here, and is marketing the fund around its main portfolio manager, Rick Rieder:

Why BINC? Direct access: to harder-to-reach fixed income sectors through an experienced investment team led by Rick Rieder, Morningstar’s 2023 Outstanding Portfolio Manager*

Time will tell how BINC’s performance is going to compensate investors for the risk taken, but it is definitely a good idea to go long AAA fixed income at this stage of the macro cycle, and we have written numerous articles regarding our ‘peak rates’ thesis for 2023.

Analytics

- AUM: $0.1 bil.

- Sharpe Ratio: n/a (3Y).

- Std. Deviation: n/a (3Y).

- Yield: 5.5%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income Multi Asset

- Duration: 2.66 yrs

- Expense Ratio: 0.5%

Holdings

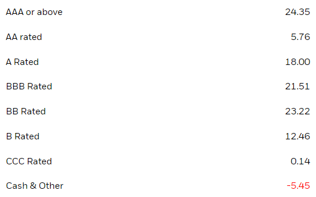

The fund owns a predominantly investment grade portfolio:

Ratings (Fund Website)

We can see from the above parsing that only roughly 35% of the portfolio is sub investment grade, with most of the names actually ‘BB’ in the high yield sleeve. Moreover the fund is bar-belled towards AAA names via MBS bonds.

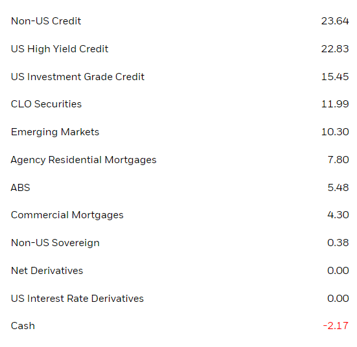

From an asset type perspective, the fund contains a multitude of sleeves:

Composition (Fund Website)

The fund has a large sleeve allocated to Non-US Credits, with US High Yield coming in second from an allocation standpoint. The vehicle is extremely diverse, containing CLOs, EM bonds, ABS securities and commercial mortgages. Looking into detail at its collateral pool, the fund does contain some names in local currencies, and uses FX hedges to take out the currency risk.

Conclusion

BINC is a welcomed addition to the fixed income universe with rates above 5% on the short end of the curve. The fund seems to target securities with short maturities, having an overall portfolio duration of only 2.6 years versus JPIE at 4 years. BINC contains an eclectic mix of assets, including EM bonds and CLO securities. The fund generally targets investment grade paper, which makes up roughly 65% of its collateral. This exchange traded fund is an active one, with the manager free to make changes as it sees fit, rather than follow a specific index based composition. This approach comes with a 0.5% expense ratio, which is on the high end. The fund currently yields only 5.5%, despite its portfolio composition. We lack analytics here since the fund was just issued in May 2023, but from a pure yield perspective we are not very attracted by BINC at the moment. With short term treasuries funds like the iShares® 0-3 Month Treasury Bond ETF (SGOV) yielding in excess of 5% with no credit risk, we are hard pressed to see why we would purchase BINC here for only 50 bps more in yield but with significantly more credit risk to be had. We are in a wait and see mode for BINC given its high expense ratio and moderate yield, and would like this fund more once its dividend yield is at least 100 bps over short end treasuries.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.