Shopify (NYSE:SHOP) shares plunged by 20% after its Q1 2024 earnings report revealed a surprising loss, as well as offering weak guidance amid increased expenditure on marketing. The stock is down over 35% from its 52-week-high.

Although I believe there was another concern in Shopify’s earnings call related to AI. With the generative AI revolution well underway now, companies are keen to demonstrate to investors how promising their latest AI features are to drive future revenue and profit growth. Although Shopify executives’ brief mention of AI on the last earnings call raises concerns in my opinion.

While Shopify’s long-term growth opportunities remain promising, I am downgrading SHOP stock to a ‘hold’ rating amid the lack of AI-driven growth visibility from the executive team.

In the previous article, we discussed how Shopify continues to take market share from competitors across small/ medium-sized businesses, as well as large enterprises, thanks to Shopify’s top execution capabilities acknowledged by Gartner. We also covered how the commerce giant has savvily re-designed its organizational structure to buoy its workforce to innovate and deploy faster, which is essential to stay ahead in the ongoing AI race. In this article, we will discuss Shopify’s AI-related endeavors, and how well-positioned the company is to defend its moat.

The AI-related concern in Shopify’s earnings call

All eyes are on how software companies like Shopify can leverage the power of generative AI to innovate new products, create new streams of revenue and drive profitability.

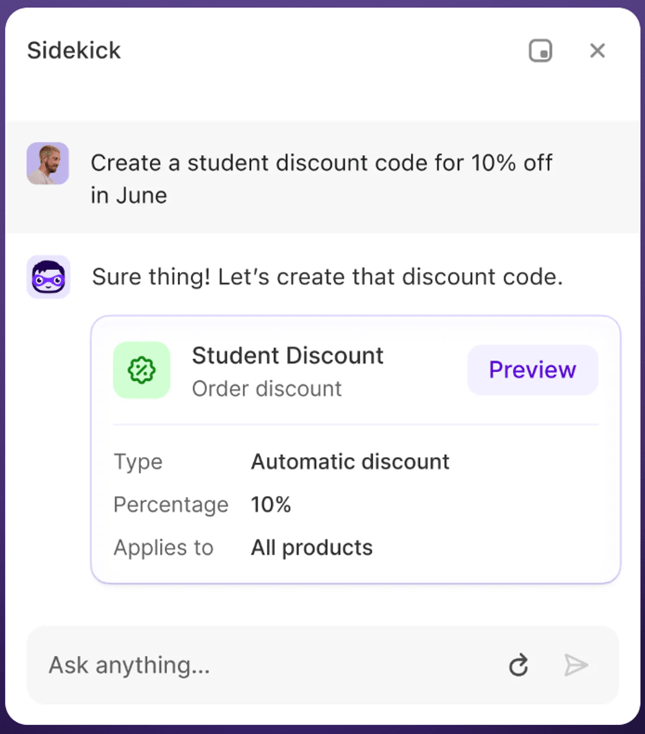

Last year, the commerce-software provider rolled out some generative AI-powered features collectively regarded as ‘Shopify Magic’, which includes automated creations of product descriptions, website page content and email drafts for its merchants. Shopify had also introduced an AI-powered personal assistant offering called “Sidekick” last year, which helps merchants with any queries they have while setting up/ running their businesses. The company has started making it available to select merchants which sign up for early access.

However, over the past few quarters, Shopify executives' remarks on earnings calls have lacked insights into whether/ how effective these new AI features have been at yielding improved results for merchants.

In fact, on the Q3 2023 Shopify earnings call several months ago, analyst Matt Pfau from William Blair had even asked the following question relating to Shopify's AI features:

“I wanted to just ask on the AI features that you’ve recently released. And if you’ve noticed a discernible benefit to your business from these as customers have begun to leverage them, and then also any learnings on how to potentially monetize some of these features?”

But the executives did not share any statistical insights or customer feedback relating to the new AI features.

Moreover, more recently on the Q1 2024 Shopify earnings call, President Harley Finkelstein lightly touched upon the opportunities with AI for merchants:

Touching briefly on AI. Our unique position enables us to tap into the immense potential of AI for entrepreneurship and our merchants. Currently, the most practical applications of AI are found in tools that simplify business operations and enhance productivity, all of which we've been developing deeper capabilities with our AI product suite, Shopify Magic.

They have been talking about the promise of AI-related advancements for several quarters now, without offering valuable statistical insights relating to Shopify Magic, and this is concerning.

After all the buzz around the possibilities with generative AI in 2023, investors in 2024 are eager to see real indications of revenue/ profit growth going forward.

Executives on certain other company earnings calls have been boastful about AI-related statistical insights, or even the rate of customer uptake of/ positive feedback on any new generative AI-powered features.

For example, on the Q1 2025 Salesforce earnings call, CEO Marc Benioff offered the following insights relating to the company's AI features:

we're seeing this incredible momentum with our Data Cloud, our fastest growing organic and our next $1 billion cloud. It's the first step to becoming an AI enterprise.

…

Einstein is generating hundreds of billions of predictions per day, trillions per week. Now, we are working with thousands of customers to power generative AI use cases with our Einstein Copilot, our Prompt Builder, our Einstein Studio, all of which went live in the first quarter. And we've closed hundreds of Copilot deals since this incredible technology has gone GA.

The fact that this key rival of Shopify is able to offer revenue-based insights and other usage statistics is impressive.

Chief e-commerce rival Amazon (AMZN) has also been rolling out various AI features for sellers on its platform, and CEO Andy Jassy shared on the Q1 2024 Amazon earnings call that:

Already, over 100,000 of our selling partners have used one or more of our GenAI tools

Meanwhile, Shopify has offered no insights into how many merchants have used tools from Shopify Magic, how many merchants have signed up for early access to “Sidekick”, or whether they are seeing more merchants becoming Shopify subscribers since introducing these AI-powered features. The lack of AI insights in Shopify executives' remarks are not as aggressive as other companies' disclosures.

In my opinion, this is concerning, especially given the fact that top rivals are already able to offer statistical insights relating to their own AI features.

Furthermore, major advertising companies, Google and Meta, have also been rolling out various AI-powered tools to help advertisers/ merchants on their platforms sell more products to consumers. This includes features like automated product descriptions and image editing tools. Executives from both GOOG and META have been able to share positive insights regarding performance improvements for merchants selling on their platforms.

For example, Alphabet Chief Business Officer, Philipp Schindler, mentioned on the Q1 2024 Alphabet earnings call that:

In February, we rolled Gemini into P-Max. It's helping curate and generate text and image assets so businesses can meet P-Max asset requirements instantly. … We're also driving improved results for businesses opting into automatically created assets, which are supercharged with Gen AI. Those adopting ACA see an average 5% more conversions at a similar cost per conversion in Search and Performance Max campaigns.

Now, in my opinion, there is a good likelihood that Shopify would have surveyed its own merchants and ran tests internally to study the performance outcomes of its new AI-powered tools. In fact, this is a company that commissioned its own study into how Shopify compares against rivals like Salesforce Commerce Cloud and Adobe Commerce in terms of ‘total cost of ownership’ for large enterprise customers (more on that later). And Shopify executives frequently highlight on earnings calls how their own payment solution ‘Shop Pay’ improves conversion rates for merchants, backed by statistics.

So keeping this in mind, I believe Shopify is likely to have conducted surveys/ studies as to whether its new AI features improve productivity for its merchants, and whether its automated product descriptions/ image editing tools improve conversion rates.

The fact that Shopify executives have not been offering any insights into performance attributes of its generative AI-powered tools possibly suggests that these features may not be meaningfully improving merchants’ productivity/ conversion rates yet.

This is concerning from two perspectives.

Firstly, if Shopify’s AI tools continue to underwhelm its merchant base, it would undermine the value proposition of the Shopify platform. Shopify’s AI features like automated product descriptions and product image creation are also offered by the largest advertising platforms, Google and Meta. Hence if third-party AI tools work better than the services offered by Shopify to help sellers advertise their products, these merchants could become less dependent on Shopify in the era of AI. This could hinder the company’s ability to raise subscription prices again in the future, undermining revenue and profit growth potential for shareholders.

Secondly, with the AI revolution in full swing, tech investors will increase their capital allocation towards stocks that offer a convincing AI-led growth story, and pull away capital from stocks that are less likely to be beneficiaries of generative AI. Therefore, if Shopify’s earnings calls continue to lack insights into how AI is improving merchant performance and growing monetization opportunities, the stock could struggle to participate in the broader AI rally.

Reasons to remain bullish on Shopify shares

Now that we have covered the concerns relating to the lack of statistical insights regarding Shopify's AI-powered services, there are reasons to remain bullish on Shopify’s AI-driven growth opportunities over the long term. While President Harley Finkelstein did not offer any statistical insights into Shopify Magic, as per the citation earlier, he did go on to say that:

we're just scratching the surface of what's possible as we're still in the nascent stages of understanding the vast potential that AI hold for businesses and commerce.

Finkelstein's remarks suggest that Shopify is still in the nascent stages of figuring out how to leverage the power of AI to drive growth, whereas competitors have already started monetizing AI-related services, as mentioned earlier. So the lack of statistical insights regarding the AI features rolled out so far is still concerning in my opinion.

Nonetheless, I am not giving up on Shopify's AI-related opportunities over the long term. The generative AI-powered possibilities through the Shopify platform remain massive.

Now even though the executives did not offer any further insights into what kind of new AI features they are currently working on; we can certainly try to determine the direction of its AI innovations based on industry-wide trends.

The next AI wave is cultivating around the concept of “AI agents”, with the introduction of Google’s “Project Astra” at the recent I/O event, and Meta CEO Mark Zuckerberg also disclosing on the company’s last earnings call that the next evolutionary step of its Meta AI chatbot will be towards agentic capabilities, which would complete more complicated and multi-step tasks for users.

As mentioned earlier, Shopify had introduced its own AI assistant for merchants last year called “Sidekick” and is currently available to limited merchants in early access.

Shopify

Shopify will presumably be working on advancing the capabilities of ‘Sidekick’ towards more agentic capabilities as well, helping merchants set up and manage their businesses more easily, and offering valuable personalized guidance whenever needed.

Now the question is, how will Shopify monetize such features?

If the software giant makes such agentic capabilities accessible as part of current subscription plans, they would not be generating any additional revenue from the feature. Given that Shopify just raised subscription prices last year, the company is unlikely to hike fees again any time soon.

On the other hand, a savvier monetization strategy would be to get merchants hooked onto using the Sidekick assistant for everyday management tasks and commerce advice, and then try to upsell these merchants towards the “agentic” version of Sidekick with more advanced capabilities, for an additional fee. This would create a more appealing path towards AI-driven revenue and profit growth for Shopify shareholders.

The point is, the AI-driven growth opportunities are certainly there. Although how Shopify ultimately decides to monetize advanced AI features remains to be seen, and will partly depend on how competitors and other major players in commerce monetize their own AI-powered services.

Keep in mind that serving more complicated tasks through a potential “agentic” Sidekick would also incur higher cloud computing costs for Shopify. Therefore, strong pricing power is essential to be able to cover the higher serving costs and sustain/ expand profit margins for shareholders.

Although speaking of effective cost management in the face of tight competition, the software giant had commissioned an external consulting firm to study and compare the “Total Cost of Ownership” [TCO] across the leading commerce platforms in North America, including “Shopify, BigCommerce, Salesforce Commerce Cloud, Adobe Commerce (Magento), and WooCommerce”.

On the last earnings call, President Harley Finkelstein shared that:

following our leadership rankings in IDC and Gartner last year, an independent study recently validated that Shopify's total cost of ownership is up to 36% better than competitors in the enterprise space. This study proves that our unified commerce platform offers exceptional value and cost savings that only Shopify can offer. And in turn, we pass on the economies of scale we capture to our merchants, saving them money.

Now aside from the largest competitors, there has also been talk of new entrants potentially entering the market that are natively generative AI-focused from the ground up, and backed by venture capital firms that are hungry for AI exposure. These may threaten to take market share from Shopify.

That being said, Shopify’s size yields economies of scale, which the company has decided to pass onto customers in the form of more competitive pricing. Although this has two downsides.

One, Shopify not absorbing the cost savings themselves means no profit margin expansion for shareholders from economies of scale benefits. Two, Shopify passing on the cost savings in the form of lower prices to fend off competition could mean slower top-line revenue growth, which is unappealing for growth stocks.

However, on the positive side, the ability to offer lower prices should also enable the company to attract more merchants to the platform, which would in turn support revenue growth. Shopify’s lower “total cost of ownership” makes it increasingly difficult for new entrants and existing rivals to compete with the commerce giant for new customers. New-age competitors in the era of generative AI would have to price more competitively, making it more difficult for them to turn a profit.

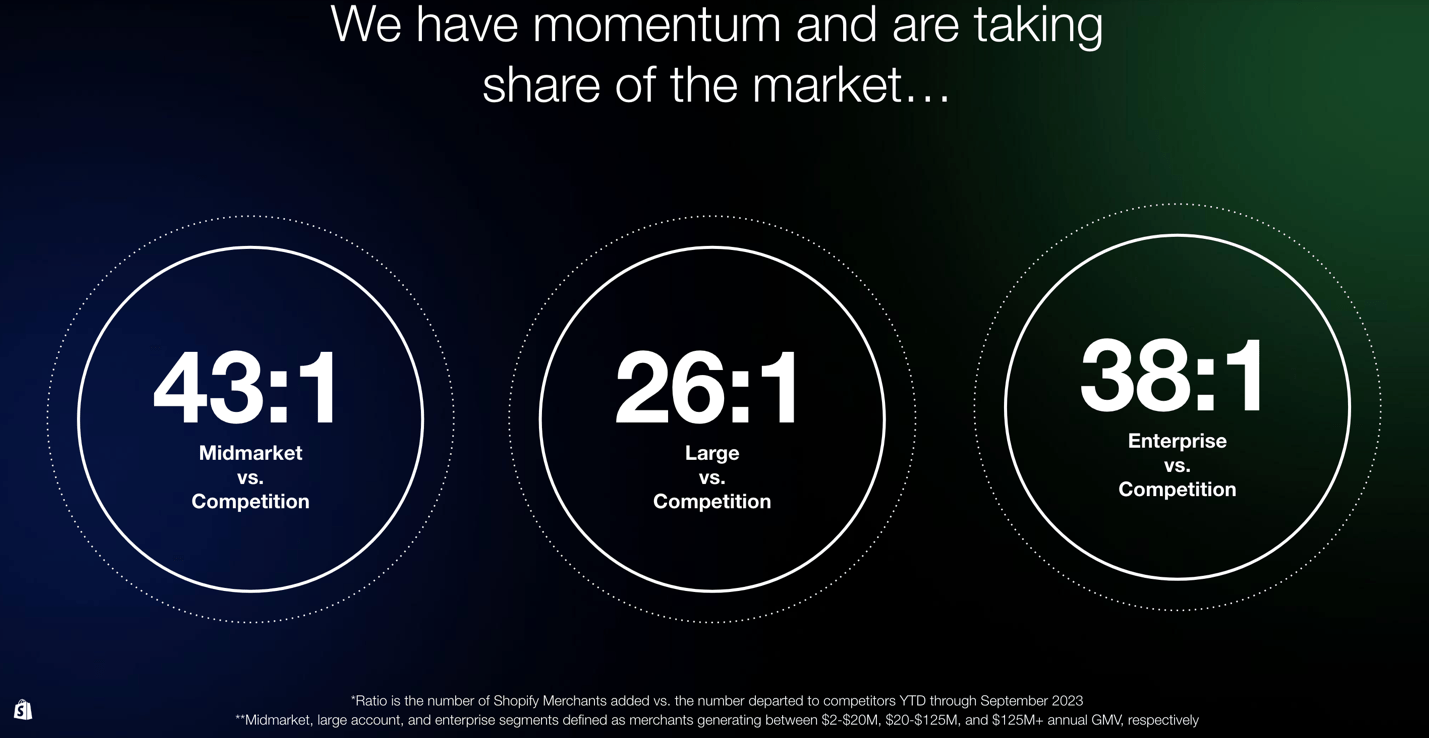

Moreover, as Shopify revealed during its investor day, the software giant continues to take market share across all business sizes.

Shopify Investor Day Presentation 2023

Hence, the company is certainly succeeding at delivering a market-leading commerce-software platform in a cost-effective manner to continue taking market share from competitors.

In fact, when Shopify raised subscription prices last year, they gave enterprises on the ‘Plus’ subscription plan the option to commit to three-year contracts at their existing prices. Thereby enabling them to avoid the price hikes, while committing to the Shopify platform for at least three years. On the last earnings call, CFO Jeff Hoffmeister had given the following update:

As of today, the majority of our existing Plus merchants have chosen to commit to three-year contracts at existing 2023 rates, a clear testament to the exceptional value that we provide and the trust and confidence our merchants place in us

This is a clear signal that enterprises are committing to Shopify for the long term.

Moreover, generative AI-powered assistant/ agent services and automations will make website-building/ software management platforms increasingly sticky, as the AI-powered systems become well-ingrained in each company’s data and offer improved responses over time with greater usage, while also benefitting from imbedded memory capabilities.

Therefore, it’s a smart move to encourage enterprise customers to commit to Shopify over the next three years amid the AI revolution. As a result, these larger merchants are more likely to use and become accustomed to Shopify’s advanced AI solutions, such as a potential agentic “Sidekick” assistant, through Shopify and stick to the platform over the long term.

Furthermore, the software giant is focusing on attracting more businesses onto the Shopify platform through increased performance marketing. Again, this is a wise move to entangle as many businesses as possible into the Shopify ecosystem in the early stages of the AI revolution. As the AI capabilities continue to advance and merchants become accustomed to using AI-powered services from a particular software provider like Salesforce or Adobe, it will become much harder to encourage these merchants to migrate to Shopify, inevitably slowing Shopify’s market share penetration going forward. Therefore, locking more merchants into the Shopify platform is a wise move for the long term.

Additionally, a growing merchants base is also conducive to a growing database, which can be leveraged to train better AI models than competitors for automating tasks and providing assistance. This could further foster Shopify’s moat over the long term.

Risks to the bull case for Shopify

Shopify has yet to prove it can win in the era of generative AI: Given the lack of positive insights that Shopify has been able to share relating to Shopify Magic tools, I believe there is a risk that future AI-powered services like potential agentic services through “Sidekick” may also not yield strong performance improvements. This would undermine the company’s ability to optimally monetize its AI features and deliver revenue/ profit growth for investors.

Shopify may not optimally monetize AI: Shopify may not charge additional fees for AI solutions, and just make it part of existing subscription plans. The Shopify Magic tools are already accessible to merchants at no additional cost, and the “Sidekick” assistant is also expected to be included as part of current subscription plans.

Looking forward, if Shopify’s next AI-advanced features (such as potential agentic services) are also made freely accessible to current merchants, the company will not see any uplift in revenue/ profits over the next few years, undermining the appeal of SHOP stock for tech investors.

That being said, other major tech companies are charging additional subscription fees for their own AI-powered assistants, such as Microsoft charging additional fees for “Copilot” to Office 365 users, and Google charging premium subscription fees for access to “Gemini Advanced”. Therefore, this enables Shopify to also charge additional fees for any new agentic assistants in the future, creating new sources of revenue.

Shopify financials & valuation

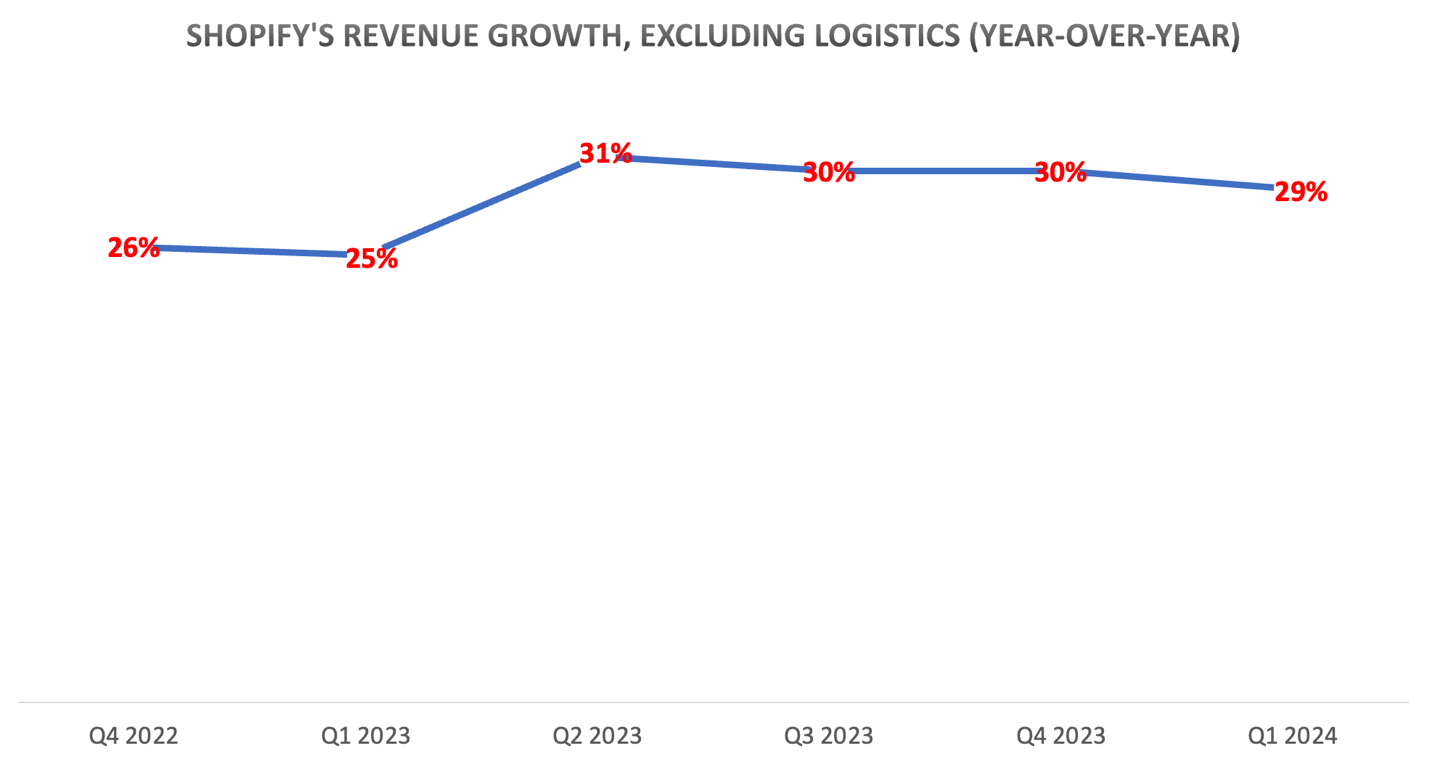

Shopify’s top-line revenue growth rate, excluding the impact from the sale of the logistics business in Q2 2023, has been around 30% over the past year.

Nexus, Data compiled from company filings

However, what spooked the market was the guidance for Q2 2024, both in terms of revenue and expense growth expectations.

On the last earnings call, CFO Jeff Hoffmeister said that the company expects revenue growth of “low to mid-20s”, excluding logistics, as the company begins to lap the effects of the subscription price increases last year. Now this would mark a notable slowdown from the near 30% growth rate the company has been delivering over the past year thanks to the subscription fee hikes. Hence, it is not surprising that the stock price took a beating of around 20% following the announcement.

Additionally, Hoffmeister also highlighted that operating expenses would increase year-over-year:

For the second quarter, the two primary drivers of the operating expense dollar increase over Q1 are marketing spend and our Summit event, which will happen at the end of June with Summit being the primary driver of the increase.

Now the Summit event is a temporary factor driving the expense increase in Q2. Although certain market participants also expressed concern over the marketing spend increase.

However, President Harley Finkelstein proclaimed on the last earnings call that:

Back in Q3 2022, … we began a wave of new marketing tool production and tightened our payback guardrails even further. Our initiatives have successfully driven significant improvements in both new merchant acquisition and CAC in core performance marketing, our largest component of marketing investment. Comparing Q3 2022 to Q1 2024, new merchant acquisition has grown 180%, while CAC has improved almost 60%. You can see why we're investing heavily and why we feel confident in our future and our growth in 2025 and beyond.

Hence, Shopify is backing up its increased marketing spend with a proven track record, assuring investors to trust management’s judgement here. If Shopify’s increased investments in marketing pay off, it should indeed accelerate top-line revenue growth in 2025, which would be a bullish development for the stock.

As mentioned earlier, Shopify is wise to increase marketing spend at this early stage of the AI revolution to lure as many businesses as possible into the Shopify ecosystem, as continuous advancements in AI-powered services and capabilities will likely drive increased loyalty towards software platforms.

Although with regards to AI, Shopify’s lack of positive insights into the performance attributes of its current suite of AI tools remains concerning in my opinion, as the proficiency of AI features will play a key role in determining the value proposition of software platforms and companies’ abilities to retain/ attract new customers going forward.

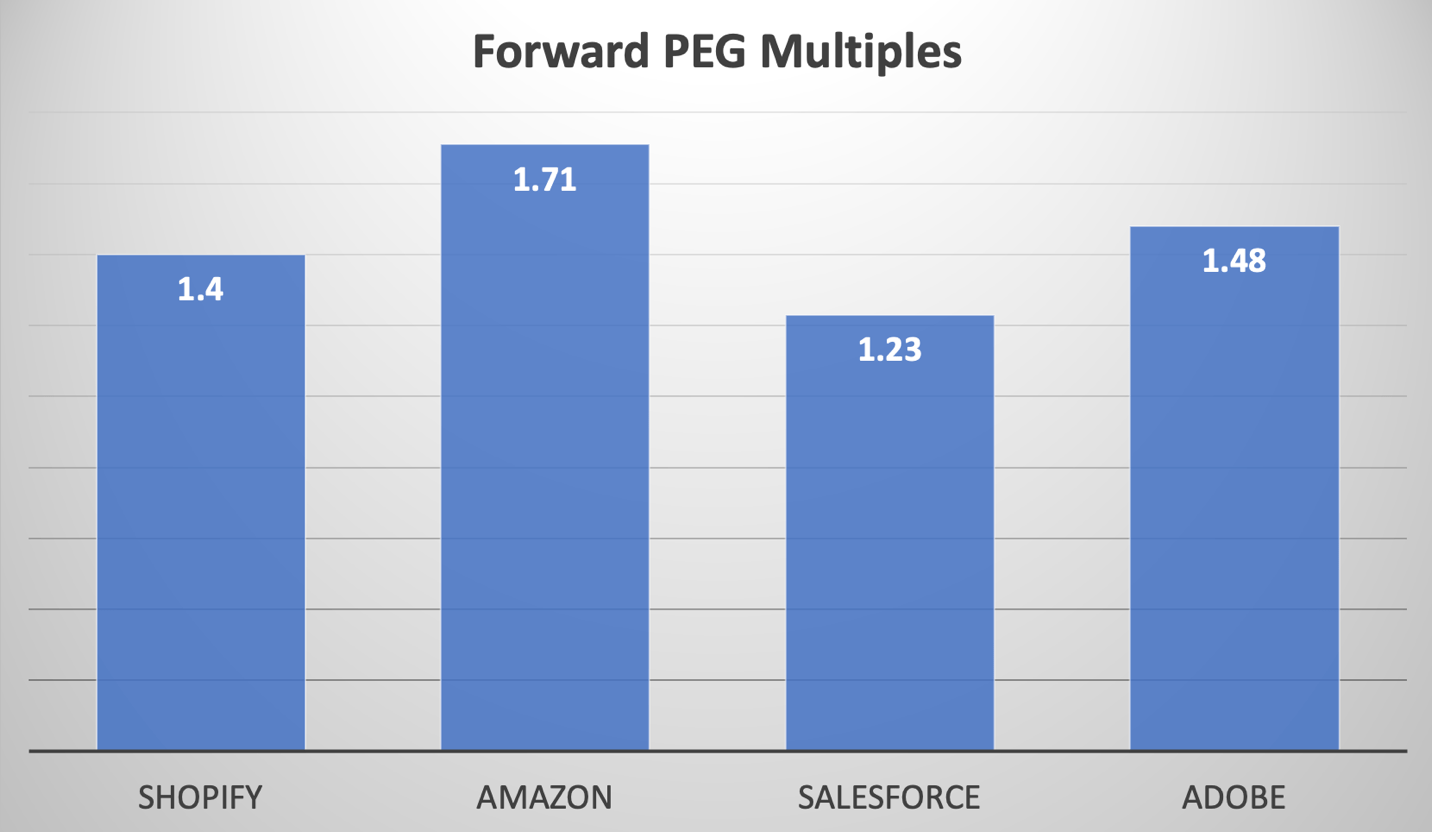

Now in terms of Shopify stock’s valuation, it currently trades at a forward PE (non-GAAP) multiple of over 62x. Although keep in mind that growth stocks with high future growth expectations tend to trade at higher forward earnings multiples.

That’s why the forward Price to Earnings to Growth (forward PEG) ratio offers a better assessment of a stock’s valuation, as it adjusts the forward PE multiple for the projected EPS growth rate going forward. Shopify’s EPS FWD Long Term Growth (3-5Y CAGR) is expected to be 44.25%. The chart below compares the forward PEG multiples of Shopify against Amazon and two of the largest commerce-software providers.

Nexus, data compiled from Seeking Alpha

Even though Shopify trades at a similar forward PEG multiple as the two other commerce-software providers, note that both Salesforce (CRM) and Adobe (ADBE) have EPS FWD Long Term Growth (3-5Y CAGR) projections that are below 20%.

Hence, from the perspective of a growth investor, SHOP stock is more attractively valued relative to future growth expectations.

Now relative to Amazon shares, Shopify stock seems cheaper on a forward PEG basis.

However, consider the fact that Shopify has a market cap of $78 billion, generating a mere $132 million in net income last year. While Amazon’s market cap is a staggering $1.89 trillion, generating $30.4 billion in net income in 2023.

Therefore, while Shopify’s EPS FWD Long Term Growth (3-5Y CAGR) rate of 44.25% is attractive to growth investors, Amazon’s expected growth rate of 23.45% off a much larger income base is more impressive.

Furthermore, while both Shopify and Amazon’s e-commerce business have yet to prove that generative AI innovations will be beneficial to top and bottom-line growth, the AI revolution is a tailwind for Amazon’s AWS cloud computing unit already, which comprises the majority of the tech giant’s profits.

Hence, it makes sense for the market to assign a premium valuation to AMZN stock relative to SHOP shares.

In order for Shopify stock to participate in the AI-driven bull market, the company will need to convince investors that it can truly leverage the power of AI to drive future revenue and profit growth.

But for now, I am downgrading the stock to a ‘hold’, while continuing to hold my long-term position in the stock.