In short

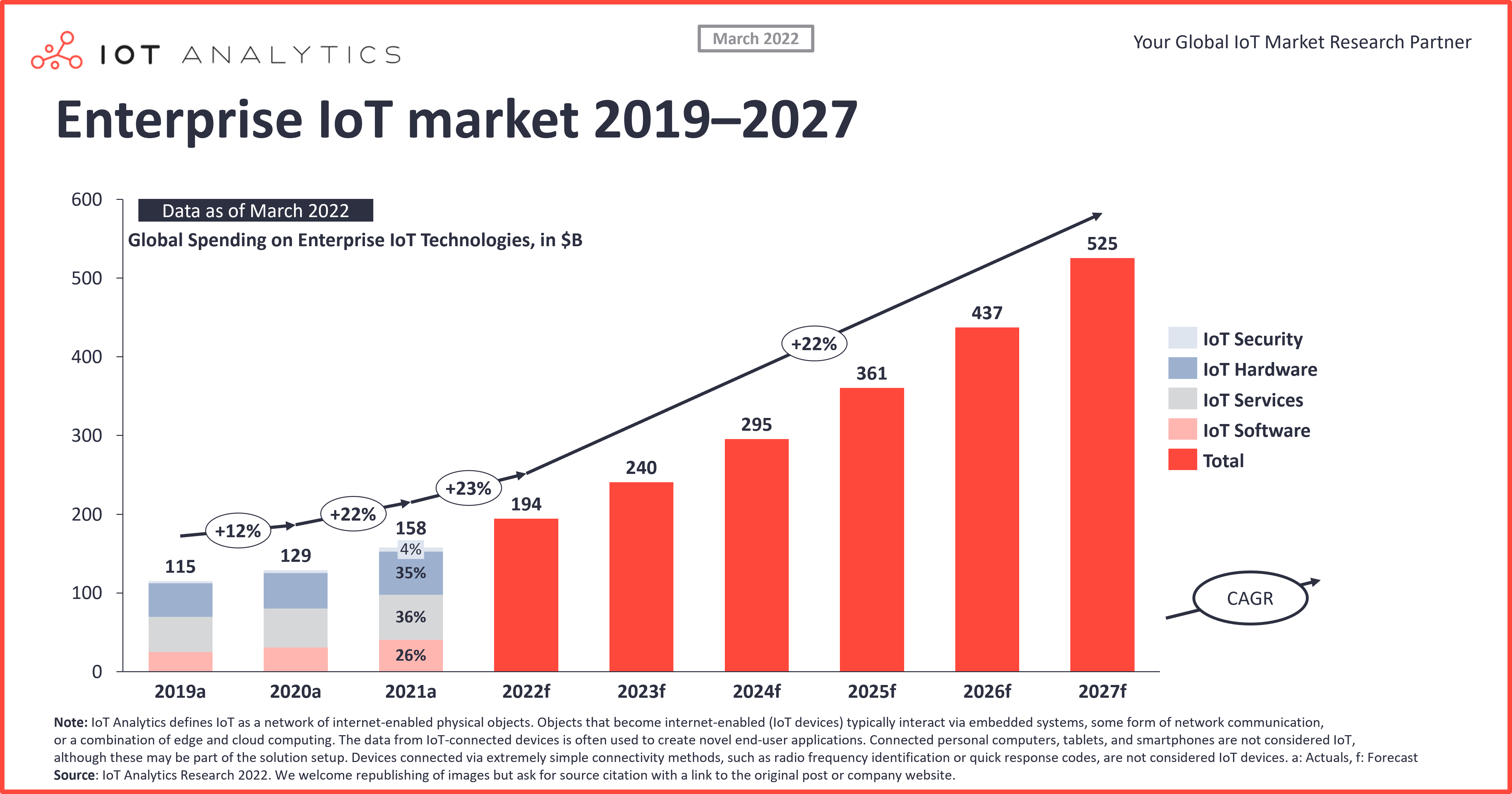

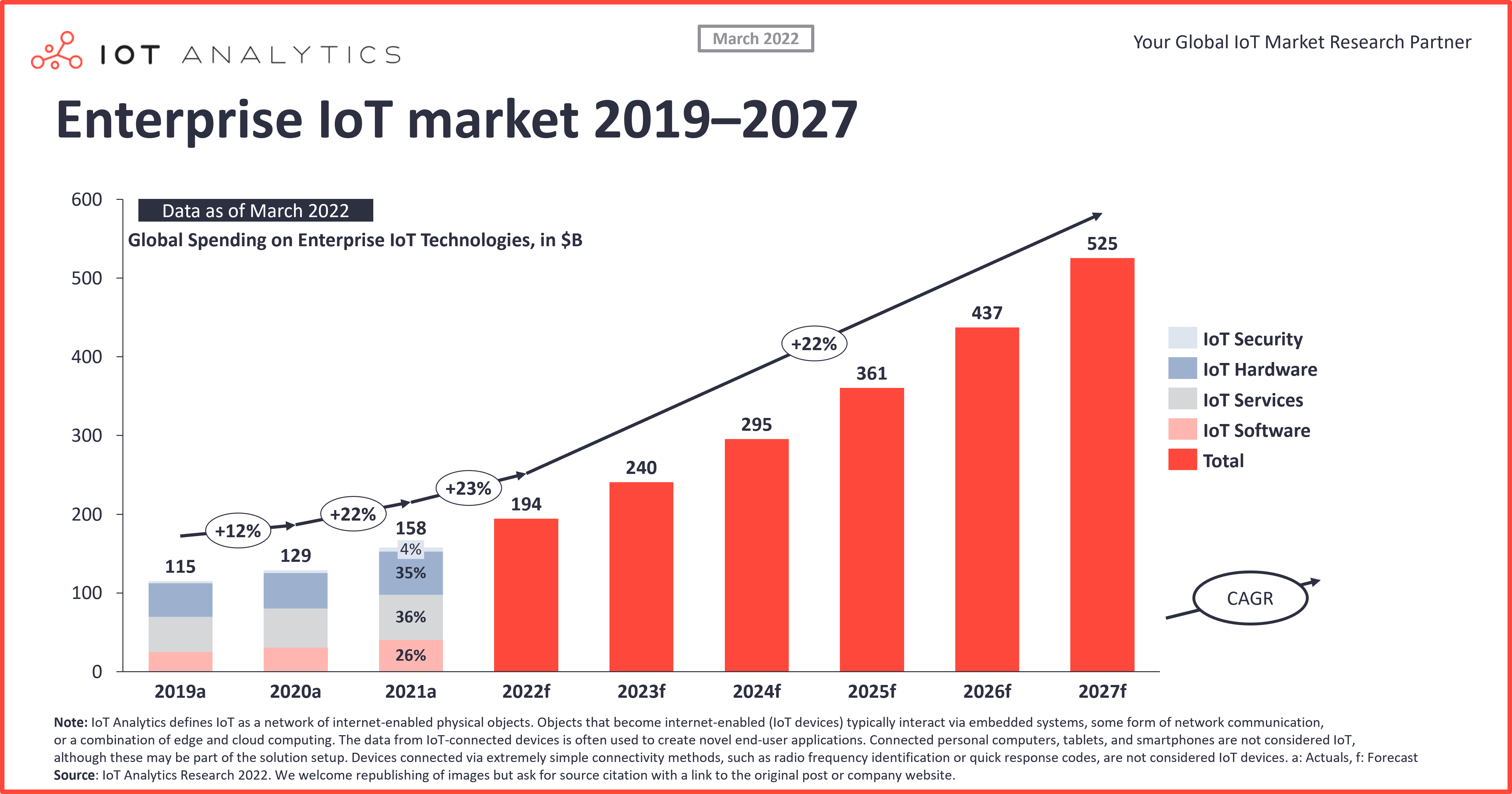

- Overall enterprise Internet of Things (IoT) spending grew 22.4% in 2021 to $158 billion.

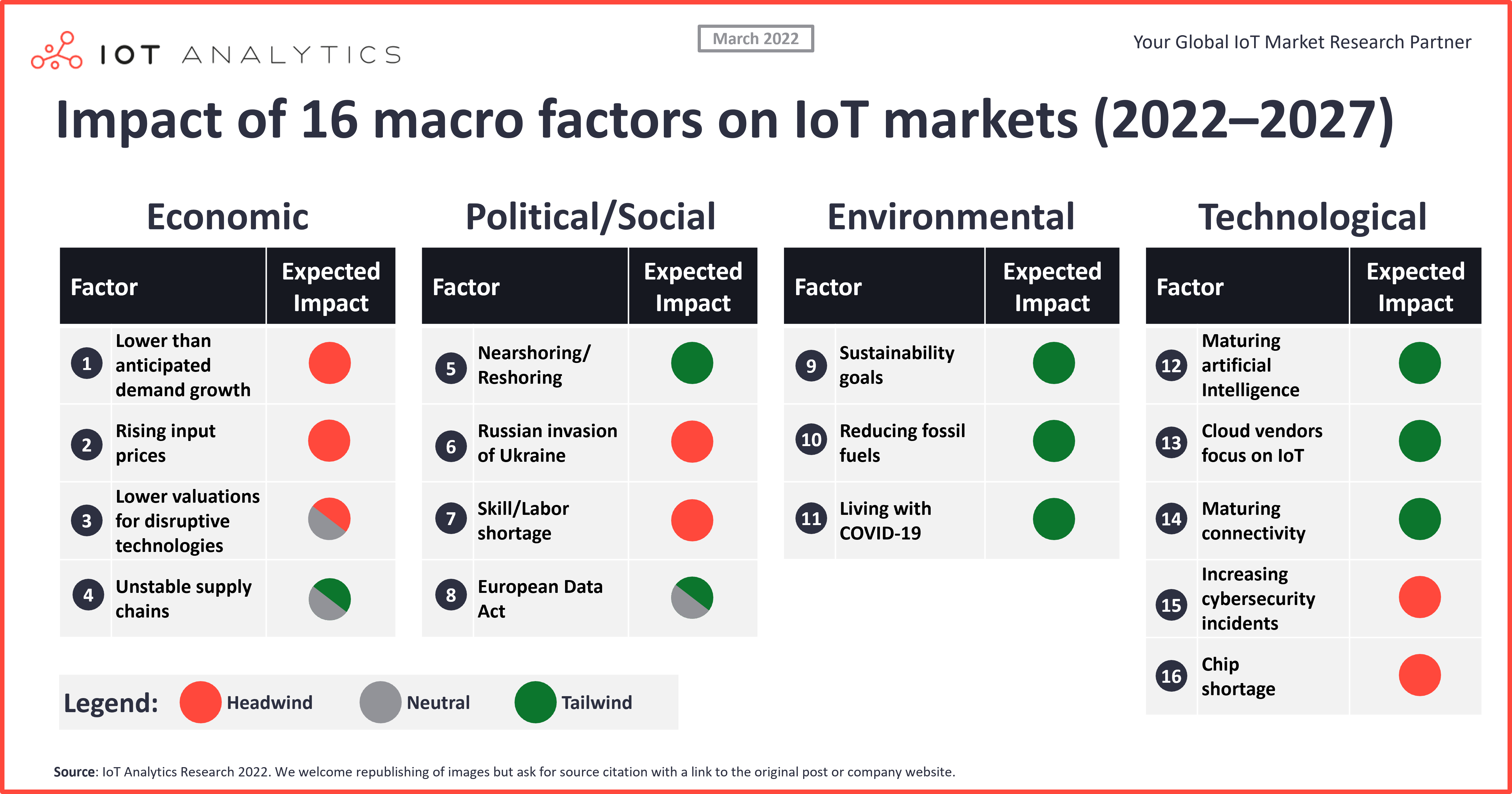

- Key macro tailwinds for the IoT market size going forward include maturing technologies such as AI, 5G, and cloud as well as the role that IoT plays in reaching sustainability goals.

- Key macro headwinds include rising input prices, intensified skill/labor shortages, and the ongoing chip shortage.

Why it matters

- Having an eye on macro developments is crucial to forecast industry growth and opportunities.

- The IoT market has been surprisingly resilient in uncertain times.

The enterprise IoT market grew 22.4% to $157.9 billion in 2021, according to the March 2022 update of IoT Analytics’ Global IoT Enterprise Spending Dashboard. The market grew slightly slower than the 24% forecasted last year due to several factors, including a slower-than-anticipated overall economic recovery, a lack of chipsets, and disrupted supply chains. North America was the fastest-growing region in 2021 (+24.1%), and process manufacturing was the fastest-growing segment (+25%).

At this point, IoT Analytics forecasts the IoT market size to grow at a CAGR of 22.0% to $525 billion from 2022 until 2027. The five-year forecast has been lowered from the previous year. A number of growth headwinds have had a much more profound impact than previously anticipated, namely supply shortages and disruptions (most notably chip shortages which are now expected to extend well into 2024 and possibly even beyond) and labor shortages, especially for sought-after software jobs. Despite the lowered growth projections, IoT remains a very hot technology topic, with many projects moving into the rollout phase. The number of connected IoT devices is expected to reach 14.5 billion globally by the end of 2022 (Note: An update of the connected device forecast is expected shortly).

As part of our forecasting (and also our upcoming State of IoT 2022 report), we took a deeper look into how the IoT growth trajectory is influenced by major macro trends in the areas of economics, political developments, environmental factors, and technological advances.

Here are 16 macro factors influencing the IoT market:

Economic factors

1. Lower than anticipated demand growth

In its January 2022 World Economic Outlook, the International Monetary Fund (IMF) forecasted a GDP growth of 4.4% in 2022 after a 5.9% growth in 2021. Compared to October 2021, IMF economists had already lowered the growth outlook for 2022 by half a percentage point after higher inflation, rising COVID-19 cases, and overall supply chain issues became apparent. Overall business confidence and the recovery in private consumption are weaker than previously expected, which will further affect economic activity. After the Russian invasionof Ukraine, the IMF noted in a blog post, “The conflict is a major blow to the global economy that will hurt growth and raise prices.” The IMF is expected to decrease its forecast once again in its next outlook.

2. Rising input prices

Inflation is sharply increasing in most economies. Rising prices for energy, raw materials, and food have started to hit businesses. Investment bank Goldman Sachs stated it is increasingly concerned about inflation and raised its inflation forecast for 2022. Because rising input prices have a negative effect on profits, companies have limited room to invest, which has a negative effect on new technologies, such as IoT. Nonetheless, there is a silver lining for IoT. A recent IoT Analytics report found that IoT use cases related to improving a company’s operations are among the most adopted. As margin pressure due to inflation increases, companies will look to IoT as a tool to improve operations and invest in cost-saving activities. The effect of high inflation on IoT may thus have a cushion. However, the overall impact of this benefit will not be strong enough to outweigh the negative economic implications of rising input prices.

3. Lower valuations for disruptive technologies

Central banks around the world are expected to increase interest rates substantially in the coming months to fight inflation. This increase is bad news for high-growth technology firms and startups because it puts their overall company valuations under pressure. Valuations of VC-funded companies are already down 20% this year, according to some insiders. It might get harder for market-disrupting business ideas and technologies to collect fresh funding in the future.

4. Unstable supply chains

Supply chain disruption rose as a concern throughout 2021 due to a number of factors, including COVID-19 lockdowns, container shortages, and the blocked Suez Canal. By the end of 2021, the topic was identified as the #1 topic CEOs talked about in their earning calls.

The chipset supply chain in particular is of major concern for companies (see #16—chip shortage), but many other supply chains are significantly impacted, including those for timber, bicycles, and medical equipment.

Interestingly, supply disruptions are a major tailwind for some IoT initiatives. CEOs are investing heavily into smart solutions that make supply chains more resilient (e.g., track-and-trace IoT solutions or warehouse automation).

Bottom Line:

Three economic headwinds and one economic tailwind have been identified for the coming years. The ability of governments and central banks to mitigate the disruptions and engineer a soft landing will largely determine the ultimate impacts.

Political, social, and legal factors

5. Nearshoring/Reshoring

As a result of unstable supply chains, many companies are moving from a single-source supplier strategy to a multiple-source strategy to provide more options in case of a future disruption. At the same time, governments have started to push to reshore production to mitigate the effects of increasingly shaky supply chains. The Biden administration recently announced that by 2029, a product labeled “Made in America” will need to contain 75% US-made parts—up from 55% today. Europe sees a similar tendency for reshoring and nearshoring. Considering the comparably high labor costs in the US and Europe, companies need to invest into state-of-the-art manufacturing facilities and Industry 4.0 to stay competitive. This drive will lead to investments into new, state-of-the-art manufacturing facilities in countries with relatively high average wages.

6. Russian invasion of Ukraine

The semiconductor industry had started to stockpile raw materials before the Russian invasion of Ukraine as a reaction to repeated shocks and mostly recently as a reaction to Russian troops amassing near the Ukrainian border. However, since large shares of neon and palladium are produced in Russia and Ukraine, the semiconductor shortage is expected to get worse if the war goes on for too long, thereby impacting the IoT market.

In general, the invasion of Ukraine adds to global insecurity regarding supply chains, prices, and security. The sanctions on Russia are expected to have limited effects besides limiting the growth of the IoT market size in Russia. Some Russian technology companies, such as Kaspersky, or companies that are backed by Russian financiers (e.g., Truphone, which is backed by Abramovich, a Russian-based oligarch) are likely to feel the effects. The German Federal Office for Information Security, for example, issued a public warning urging Germans and German companies not to use any of Kaspersky’s services.

7. Skill/Labor shortage

The skill shortage is getting more tense. Companies have difficulty hiring enough skilled employees and supplying the internal knowledge to move ahead with digital transformation and AI, IoT, and cloud projects. IoT Analytics tracks online job ads to understand the skill shortage and related trends. Between July 2021 and March 2022, job ads mentioning “Artificial Intelligence” grew by 50%, with “Internet of Things” (+41%) and “Cloud” (+30%) also growing extremely quickly. Moreover, a recent study published by Inmarsat identified a lack of in-house skills as the top barrier to IoT deployments.

8. European Data Act

The European Data Act, which is likely to go into effect in 2023, could have positive implications for competition in the tech space. The European Commission is planning to introduce a directive allowing customers (businesses and consumers) to switch between different cloud data-processing services providers and establishing safeguards against unlawful data transfer. Moreover, it would allow users of connected devices to gain access to data they generate, which as of now are mainly accessible by manufacturers. End users would then be allowed to share that data with third parties, which could offer additional services. This opportunity could help startups and other actors grow their customer base.

Bottom Line:

Two political/social/legal headwinds and two tailwinds have been identified for the coming years. Reshoring activities might put further pressure on the already existing skill/talent gap.

Environmental factors

9. Sustainability goals

More than 300 global companies (including Mercedes-Benz, Schneider Electric, Uber, Microsoft, Unilever, and Infosys) have committed to The Climate Pledge, an Amazon-led initiative asking companies to reach net-zero carbon emissions by 2040. To reach this ambitious goal, companies will need to measure and reduce carbon emissions in the coming years. Sustainability-focused use cases, such as IoT-based energy management, renewable energy management, and connected HVAC, are expected to be in high demand. Software tools are also required to measure sustainability footprints and achieve ESG goals.

Extreme weather events, such as those already witnessed in early 2022 (e.g., storms and floods in Northern Europe and the UK, tropical storms in East Africa, and winter storms in the Northeastern US) will ensure climate change continues to get attention and will lead to further investments into energy efficiency and carbon neutrality to limit the effects.

10. Reducing fossil fuel dependence

Governments, companies, and individuals are increasingly moving to alternative energy sources. Major automotive company Ford has doubled down on the electrification of its fleet. The British Government pledged to increase the number of electric vehicle (EV) charging stations by ten times by 2030. Moreover, heavy industries and transportation are looking to hydrogen to replace fossil fuels. Saudi Arabia is set to begin a $5 billion green hydrogen project in March 2022. The project aims to use wind and solar energy to produce more than 650 tons of hydrogen a day through electrolysis. The increase in EVs and EV charging infrastructure and investments into new and greener energy sources in all major economies will likely trigger investments into smart grid and smart city solutions and a general increase in IoT spending from the energy industry.

11. Living with COVID-19

Although vaccination efforts have resulted in billions of administered doses, the world has moved from a narrative of “ending COVID-19” to “living with COVID-19.” In many parts of the world, COVID-19 cases are on the rise again. China even introduced fresh lockdowns, while the rest of the world continues to open up. The high share of the vaccinated population (in most advanced economies) and the seemingly less dangerous Omicron variant mean COVID-19 is now less deadly than the flu in England. However, the high case rate and fear of new lockdowns will further fuel growth of spending on some IoT use cases, such as remote asset monitoring and control. Smart desk tracking and air quality monitoring will likely become more common in modern office buildings going forward.

Bottom Line:

All three identified environmental factors are considered tailwinds for IoT investment. It will be interesting to see whether companies and governments meet their ambitious goals in the coming years and decades.

Technological factors

12. Maturing artificial intelligence

A 2021 survey on IoT adoption showed that only 16% of companies have fully adopted AI as part of IoT projects, while 70% are rolling it out or have a pilot. The importance of AI for the IoT is still increasing. The availability of new software tools, the development of simplified AI solutions, the infusion of AI into legacy applications, and advances in AI hardware are expected to boost the Artificial Intelligence of Things (AIoT), and we estimate that the AIoT market will reach $102.2 billion by 2026.

13. Cloud vendor focus on IoT

As enterprise workload migration to the cloud continues, the three main hyperscalers—Microsoft, AWS, and Google—continue to invest significantly in IoT. They enable communication services, offer industry-specific services, and implement digital twins as a core element of their IoT cloud. In many ways, the hyperscalers have become the backbone of the IoT, and their continued strong commitment is expected to boost overall IoT market size growth for years to come.

14. Maturing Connectivity

5G was the single-most discussed topic at Mobile World Congress 2022, as the fair is getting more enterprise focused. Alongside 5G, a number of more mature connectivity technologies have been introduced in recent years, including LPWAN, single pair ethernet, Wi-Fi 6, and low-orbit satellite IoT. The ability to get more powerful connectivity at lower prices continues to fuel the IoT market and is bringing new concepts to customers, such as the ability for enterprises to set up their own private 5G networks.

15. Increasing cybersecurity incidents

The number of cybersecurity attacks has been high for a couple of years. Headlines about high-profile security incidents are frequent, emphasizing the problem. Toyota had to suspend production in 14 Japanese plants after a supplier suffered a cyberattack, leading to a missed production of 13,000 units. After a ransomware attack in mid-2021, Colonial had to shut down its entire gasoline pipeline network for the first time in its history. The world’s largest meat supplier had to halt production after a cyberattack. These examples showcase the risks facing the IoT and will be headwind for the industry for some time to come (while being a tailwind for those offering cybersecurity solutions).

16. Chip shortage

In 2021, 20 million cellular IoT chips were missing due to a global supply shortage. The shortage continues to be the most significant pain point for the semiconductor industry and many of its customers. At MWC 2022, we learned that chip lead times of 40–50 weeks have become the new industry average, that redesigning and pre-ordering chips with an upfront payment has become a standard business practice for the industry, and that the industry is unable to determine whether the demand surge for chips reflects panic or the new normal. According to a survey conducted by Avnet, 85% of engineers expect longer lead times in the next 18 months. With lead times still increasing, many IoT projects will not be feasible given rising prices and limited supply. The shortage is likely to limit growth in 2022 and 2023 at least. However, in the long run, investments into additional capacities could increase the supply and lead to lower prices. Intel recently announced an investment of €80 billion (~$89 billion) into R&D, “state-of-the art packaging technologies,” and manufacturing. The European Union is investing billions to reach the goal of “having 20% of [the] global chips market share by 2030.”

Bottom Line:

Two technological headwinds and three tailwinds were identified. Technological developments are usually always tailwinds for technology markets (and thus IoT market size), but we are in a peculiar situation in which the demand for chipsets has become so large that the supply shortage will limit the rollout of IoT projects for at least the next two years.

More information and further reading

The Global IoT Enterprise Spending Dashboard covers IoT spending data for 100+ countries, 75+ industries, and 9+ tech stack elements. For the first time, the dashboard also gives a breakdown of software spending for 40+ IoT use cases.

The IoT Analytics IoT Enterprise Spending Dashboard is an interactive and comprehensive market data tool that presents IoT Analytics’ ongoing coverage of IoT markets and specifically the enterprise IoT market size and IoT enterprise spending. The dashboard, which is updated every six months, offers a holistic view, with over 1.6 million data points and detailed drill-down options organized by tech stack, verticals, use cases and regions/countries. It is available exclusively for our subscription customers.

This product includes IoT end-user spending data from 2017 to 2027 across:

- 100+ countries from seven world regions

- 10 types of technology stack elements

- 11 IoT segments

- 75+ industries (based on International Standard Industrial Classification Revision 4)

- 40+ use cases (incl. operations use cases, connected product use cases, city & infrastructure use cases, supply chain use cases)

Access to the full version starts at $2,000 per month and will enable you to:

- Gain a holistic understanding of all IoT markets in one user-friendly tool

- Receive semi-annual spending data updates

- Slice and dice the data according to your individual needs

- Use the data as a basis to calculate a reliable business case for all of your IoT projects

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

Related articles

You may also be interested in the following articles:

- The rise of industrial AI and AIoT: 4 trends driving technology adoption

- The case for a $2 trillion addressable public cloud market

- 10 IoT technology trends to watch in 2022

- 6 IoT adoption trends for 2022

- Number of connected IoT devices growing 9% to 12.3 billion globally, cellular IoT now surpassing 2 billion

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.

The post Global IoT market size grew 22% in 2021 — these 16 factors affect the growth trajectory to 2027 appeared first on IoT Analytics.