Investment Thesis

Globally persistent inflation put pressure on central bankers, particularly the Fed, to prepare markets for an accelerated pace of monetary tightening, resulting in a large sell-off throughout fixed income markets. Emerging markets debt is under significant stress since January 2022, and Russia's invasion of Ukraine only accelerated some of the trends we are seeing now. As bond prices have decreased considerably due to the selloff, some investors are now starting to be interested in the attractive yields some of these investments have to offer.

However, I personally think the outlook for emerging market debt is still uncertain and is highly dependent on future inflation and on what the Fed is likely to do about it. I don't see many indications yet pointing to the fact that inflation will be meaningfully lower in the coming months. As a result, I think it is better to stay away from any type of emerging market debt ETF at the moment.

Strategy Details

The iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) tracks the performance of the J.P. Morgan EMBI Global Core Index. The fund invests in USD-denominated bonds across emerging markets.

If you want to learn more about this strategy, please click here.

Portfolio Composition

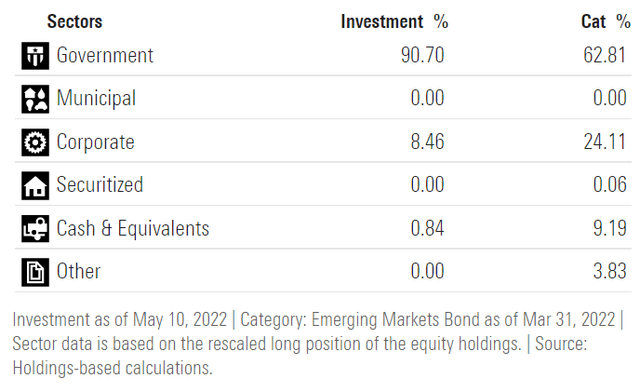

Over 90% of funds are invested in emerging market government bonds, followed by corporate bonds which have an 8.5% allocation. Government bonds are generally considered safer than corporate bonds. However, that is not always the case, especially in emerging markets when you have a rising dollar and USD denominated debt.

Morningstar

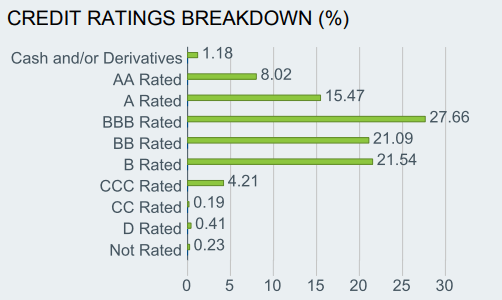

52.3% of issuers are rated BBB and above, which is considered investment grade. As a result, the risk of near-term default is limited for this category. On the other hand, 47.7% of assets are rated BB and below. These securities carry high default risk. Over 25% of the portfolio is invested in bonds rated B and CCC, which is something that I personally find risky at this moment in time.

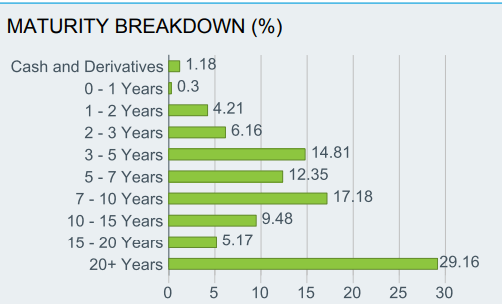

According to Morningstar, the portfolio's average maturity stands at ~13 years. Over 33% of constituents have a maturity of over 15 years which is something that doesn't surprise me since the portfolio is trying to maximize the yield.

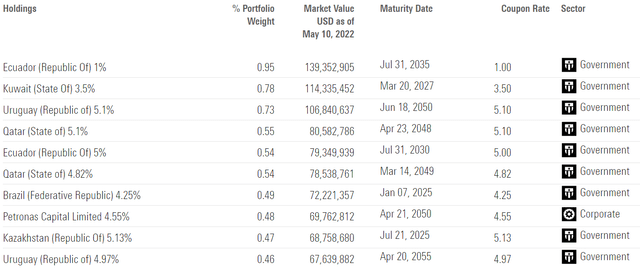

The fund currently has 588 bond holdings. The top ten holdings account for ~6% of the portfolio, with no single issuer weighting more than ~1%. All in all, EMB is very well-diversified across issuers.

Risks and Rewards

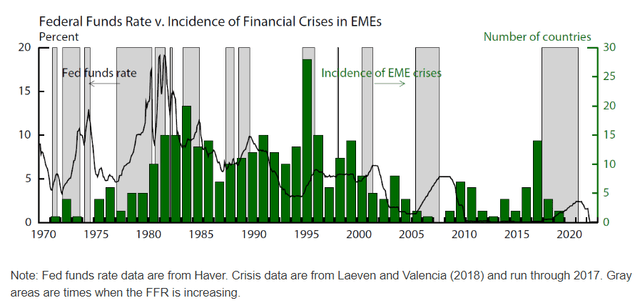

Based on data from Morningstar, the fund has an effective duration of 8, meaning that for each 1% increase in interest rates, the portfolio's NAV is expected to decrease by 8%. Central banks around the world are now raising rates and in some countries, we are seeing aggressive hiking in order to fight rampant inflation. The Fed is a particularly important piece in this puzzle as rising US interest rates are generally destabilizing for emerging market economies.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

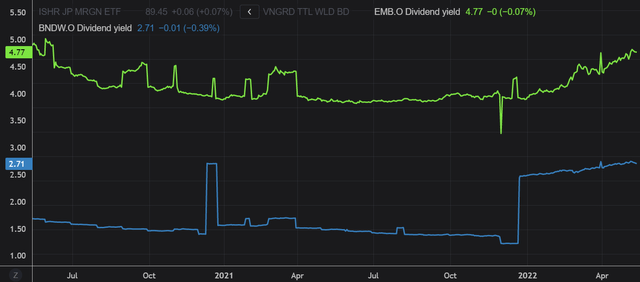

Given the above-mentioned risks, one important question is what are the benefits of holding emerging market debt today. According to iShares, EMB has a 7% average yield to maturity and a 4.8% TTM yield. If we compare EMB's TTM yield to a world bond index such as the Vanguard Total World Bond ETF (BNDW), it is interesting to note that the difference in yield is now much smaller since central banks in Europe and North America have raised rates. Therefore, the benefits of holding USD-denominated emerging market bonds are now lower.

Macro Outlook

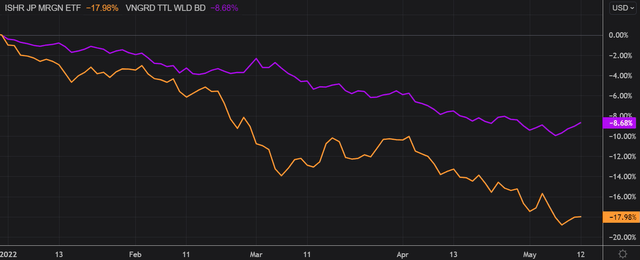

Bonds had a tough year so far as inflation fears pushed rates higher in a large number of countries throughout the world. USD-denominated emerging market debt has been particularly affected since capital is flowing back to the US, which now offers a competitive yield on its debt. This can be seen in the abysmal performance of emerging market fixed income strategies. EMB underperformed BNDW by a 9.3 percentage points margin YTD, which is very significant for a bond strategy.

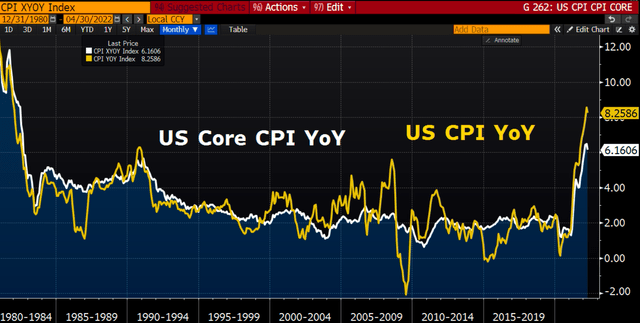

US Inflation continues to be the main culprit in my opinion for what we are seeing in the USD-denominated emerging market fixed income space. Both US YoY CPI and core CPI are at decades' highs, leaving the Fed without a choice but to proceed with raising rates and quantitative tightening. Inflation is therefore the main factor driving the recent and future rate hikes and can very well be the reason why the Fed will shift to a more accommodative policy in the future.

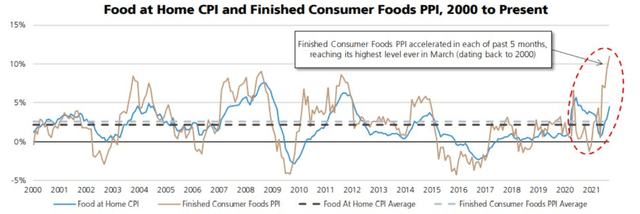

However, I personally don't think inflation will come down meaningfully in the next months. For instance, if we look at food inflation in the US, the PPI is at a record high over the last 20 years and has accelerated in each of the past 5 months.

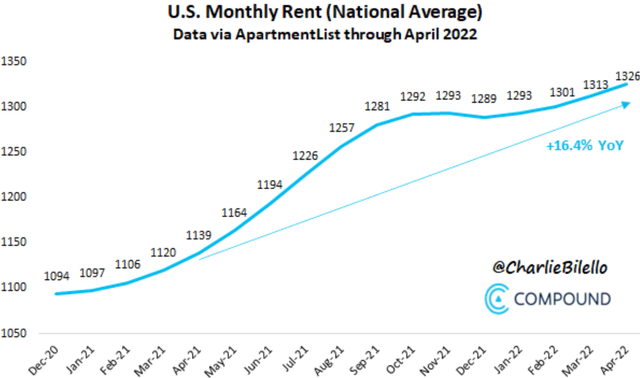

Another area where inflation is rampant is in housing, which represents 33% of the CPI index. US monthly rates aren't coming down. In fact, they have accelerated since December 2021. This puts further pressure on wages and on what the Fed perceives to be the neutral rate.

As a result, the cost of borrowing in dollars is likely to continue to increase, putting further pressure on emerging market sovereign debt. The cost to insure it has skyrocketed over the last couple of months, and this is consistent with a tightening of financial conditions that can lead to financial crises in emerging markets.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

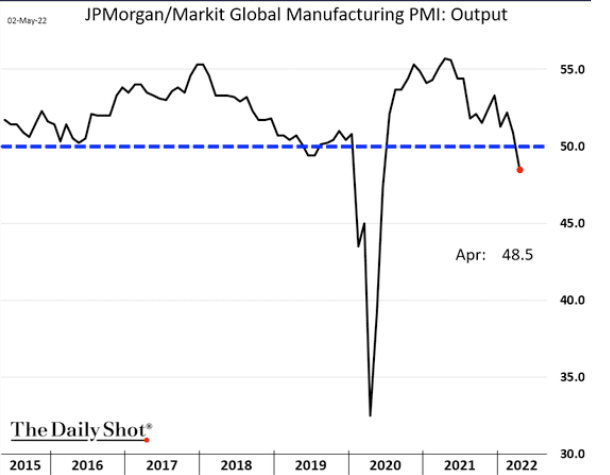

Lastly, the risks of a global recession have increased considerably, putting further pressure on EM currencies as capital is moving into safer assets like the US dollar. This risk is reflected in the Global Manufacturing PMI Output index which is in a downtrend since Q2 2021 and has reached its lowest point since the COVID-19 pandemic. A global recession would exacerbate some of the trends we are seeing today and could lead to an EM debt crisis.

Key Takeaways

Inflation is the main driver of rates for now in the US, and this had a profound impact on emerging markets debt since the beginning of the year. As we don't know yet how far the Fed will go regarding monetary tightening, I think it is hard to be bullish on EM debt at the moment, regardless of how attractive the yield is. I don't see yet signs that inflation will be much lower in the next months, which adds a lot of uncertainty and downside risk.