Thesis

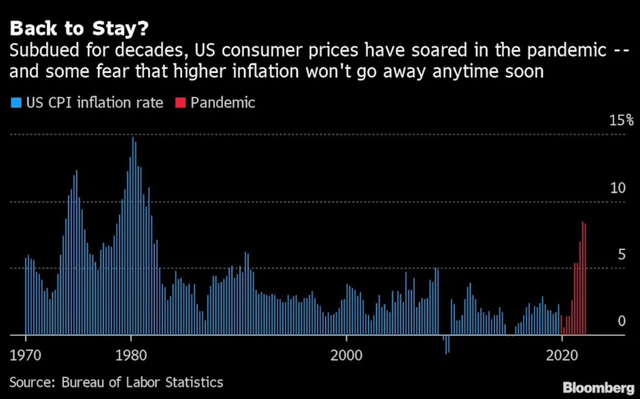

Russia's invasion of Ukraine aggravated many supply chain problems originally caused by the pandemic. The war brought with it worldwide shortages of vital commodities and is leading countries to ban the export of some basic foodstuffs. Last month, Indonesia banned the export of palm oil, and just this week, India banned the export of wheat. Consequently, inflation has surged to its highest level since the early 1980s.

Bloomberg

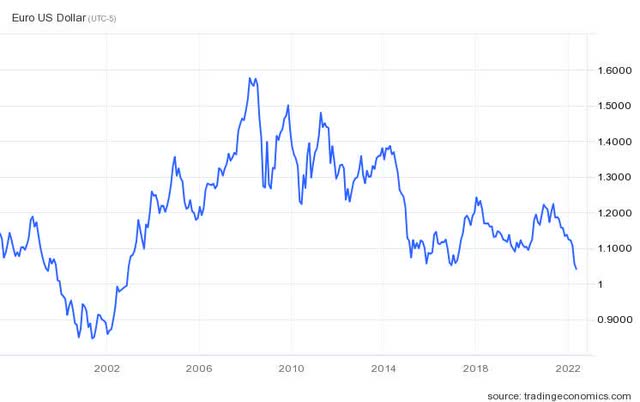

Of the world's major central banks, the Federal Reserve has been the most aggressive in responding to the erosion of purchasing power. The contrast between its hawkish stance and the much more dovish approaches of the BOJ, ECB, and PBOC has caused the Dollar Index to surge, climbing to levels not seen since the early 2000s.

tradingeconomics.com

In this article I'll go over the reasons why these trends are likely to continue during the months ahead. Investors wishing to gain greater exposure to the US dollar's rise can do so through the Invesco DB USD Bullish ETF (NYSEARCA:UUP).

Europe

One of the largest contributors to the dollar's sustained strength will be persistent weakness in the Euro. The war in Ukraine has negatively impacted all of the economies which make up the European Union. A decade of questionable energy policies, especially in Germany, has resulted in most of the EU being heavily dependent on Russian energy.

Efforts are being made at correcting the problem, and these have even resulted in a rare sight in German politics, that being the government cutting red tape in order to expedite the buildout of LNG terminals. However, although this new sense of urgency will help speed up the buildout of new energy infrastructure, the process will still take time. Meanwhile, Europe will continue to face high energy prices and high rates of inflation.

Reinforcing this trend is the European Central Bank's continued pursuit of an expansionary monetary policy, even after the Fed ended its Quantitative Easing (“QE”) program and began raising rates. In a recent speech Christine Lagarde, the ECB's President, indicated that the ECB could begin raising rates “weeks” after the end of its QE program. However, that program is only scheduled to end in Q3.

But beginning on June 1, the Fed has plans to begin letting up to $47.5 billion of treasury bonds and MBS mature every month in order to reduce its balance sheet. That means that, at the end of Q2 and possibly beginning of Q3, depending on the ECB's timing, the ECB could be expanding its balance sheet while Fed officials are shrinking theirs. This could result in the euro, which is already at multi-decade lows relative to the dollar, declining even further relative to the greenback.

tradingeconomics.com

Asia

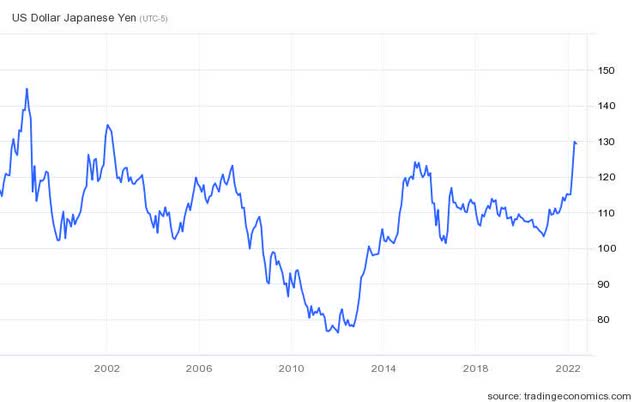

The situation is not much different in Asia. Similar to the Euro, the Yen has also fallen to 20-year lows relative to the dollar. Japan, a country long in the grips of deflation, has recently begun seeing price surges as energy and raw-material costs jump. Since the war began, the price of petroleum and coal have risen over 30 percent, and this week wholesale price inflation was reported at a record 10% for the month of April.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

tradingeconomics.com

However, in spite of this data, the Bank of Japan's Governor, Haruhiko Kuroda, has resisted modifying the BOJ's dovish stance. He expects commodity driven inflation to push consumer price inflation toward the central bank's 2% target, and has ruled-out the BOJ joining the Fed and ECB in moving to a tighter monetary policy. Continued dovishness will likely see the Yen fall further in value relative to the dollar as the Fed tightens.

The USD Bullish ETF tracks the value of the U.S. dollar relative to a basket of the six currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. It does not include the Chinese Yuan, as China's currency is pegged to the U.S. dollar and is subject to capital controls. However, given the size of China's economy and its centrality to the global economy, a discussion of its currency is warranted.

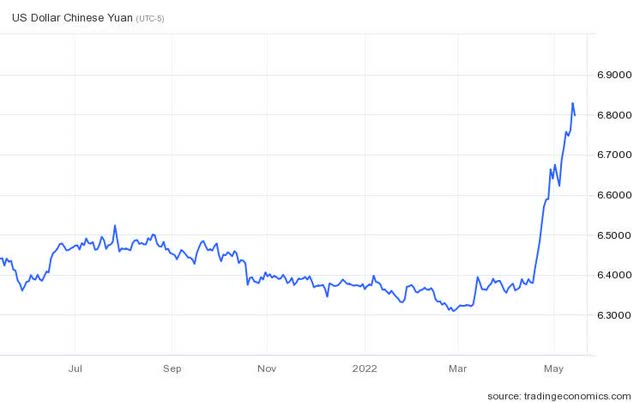

The country is especially relevant given the convulsions its economy is currently experiencing. Much of the country is locked-down as the government attempts to deal with outbreaks of Covid-19. The closure of factories has aggravated inflationary problems as supply chain snarls have gotten worse. Goods that are usually produced in China and exported to the world are either not being made or are stuck in a port.

However, many market commentators predict that as China begins to open up again, those problems will eventually diminish. And while this is true, China's biggest pre-lockdown problem will still remain, that being its imploding property bubble. In fact, the Covid-19 lockdowns have served to aggravate this slow-moving meltdown. April property sales had their sharpest decline since 2006 with YoY sales falling over 46%. China's economic deterioration has led the currency to depreciate over 6% relative to the USD in the past month.

tradingeconomics.com

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

If the decline in China's property sector continues to gain momentum, it could lead to further devaluation of the Yuan relative to the U.S. dollar. Chinese investors rushing to the safety of the greenback could lead the dollar to appreciate against most currencies.

Conclusion

Both geopolitical and monetary forces that are pushing the dollar higher show no signs of abating. That means that the recent rise of the dollar should continue into the months ahead and make UUP one of the few high probability plays in a very turbulent market environment.

Risk

This thesis would be invalidated by a sudden drop in the rate of inflation. If inflationary pressures were to decline to the point where the Fed could adopt a much more dovish stance, the dollar would probably reverse course and begin falling relative to most major currencies.