Bond yields are rising across the board. FDHY is a particularly strong, high-yielding bond ETF, and a buy. An overview of the fund follows. This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory.

FDHY: Strong High-Yield Corporate Bond ETF, 7.4% Yield, Solid Performance Track-Record

The Fidelity High Yield Factor ETF (NYSEARCA:FDHY) is an actively-managed high-yield corporate bond ETF. FDHY has one of the highest dividend yields in its peer group, with the fund currently yielding 7.4%. The fund's dividends have seen strong growth these past few months, as the Federal Reserve hikes rates to combat skyrocketing inflation. Overall fund performance is quite good too, with the fund outperforming its index since inception. FDHY's strong, growing dividend yield and good performance track-record make the fund a buy.

FDHY – Quick Overview

FDHY is an actively-managed high-yield corporate bond ETF. The fund's holdings are almost all non-investment grade corporate bonds. These are relatively risky securities, issued by comparatively weak companies with low credit ratings. Default rates are higher than average, and tend to spike during downturns and recessions, causing prices to drop. Expect above-average losses for a bond fund when times are tough.

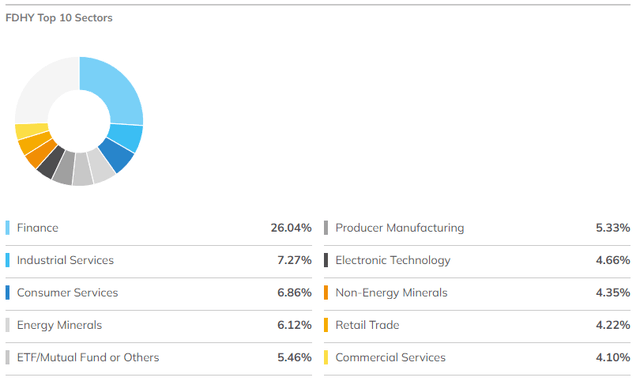

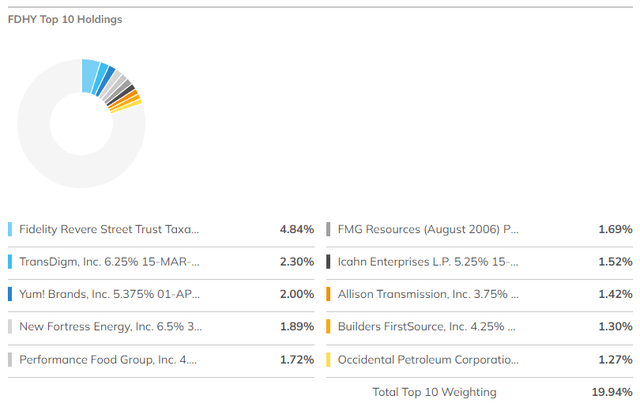

FDHY invests in a diversified portfolio of high-yield corporate bonds, with investments in over 400 securities from all relevant industry segments. Importantly, the fund is not overweight energy, which is sometimes the case for high-yield corporate bond funds (lots of risky energy issuers). Concentration is about average, with the fund's top ten holdings accounting for 20% of its value.

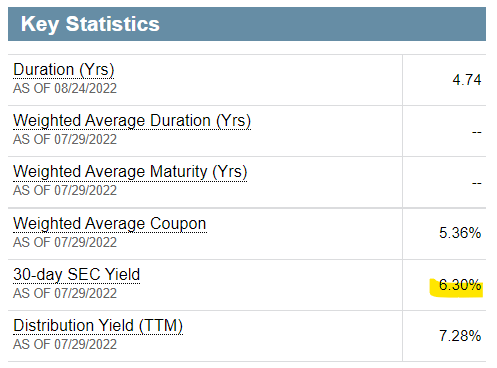

FDHY sports a duration, a measure of interest rate sensitivity, of 4.6. This is an average figure, so the fund should experience average losses from rising interest rates, and average gains from decreasing rates.

In general terms, FDHY seems reasonably well-diversified for a high-yield corporate bond fund. There is, however, no meaningful diversification / investment in other bond sub-asset classes, including treasuries, investment-grade corporate bonds, or municipals. Exposure to these other asset classes would be ideal, but can be achieved through investments in other funds.

Let's now have a look at the fund's positives and negatives.

FDHY – Positives

Strong Dividend

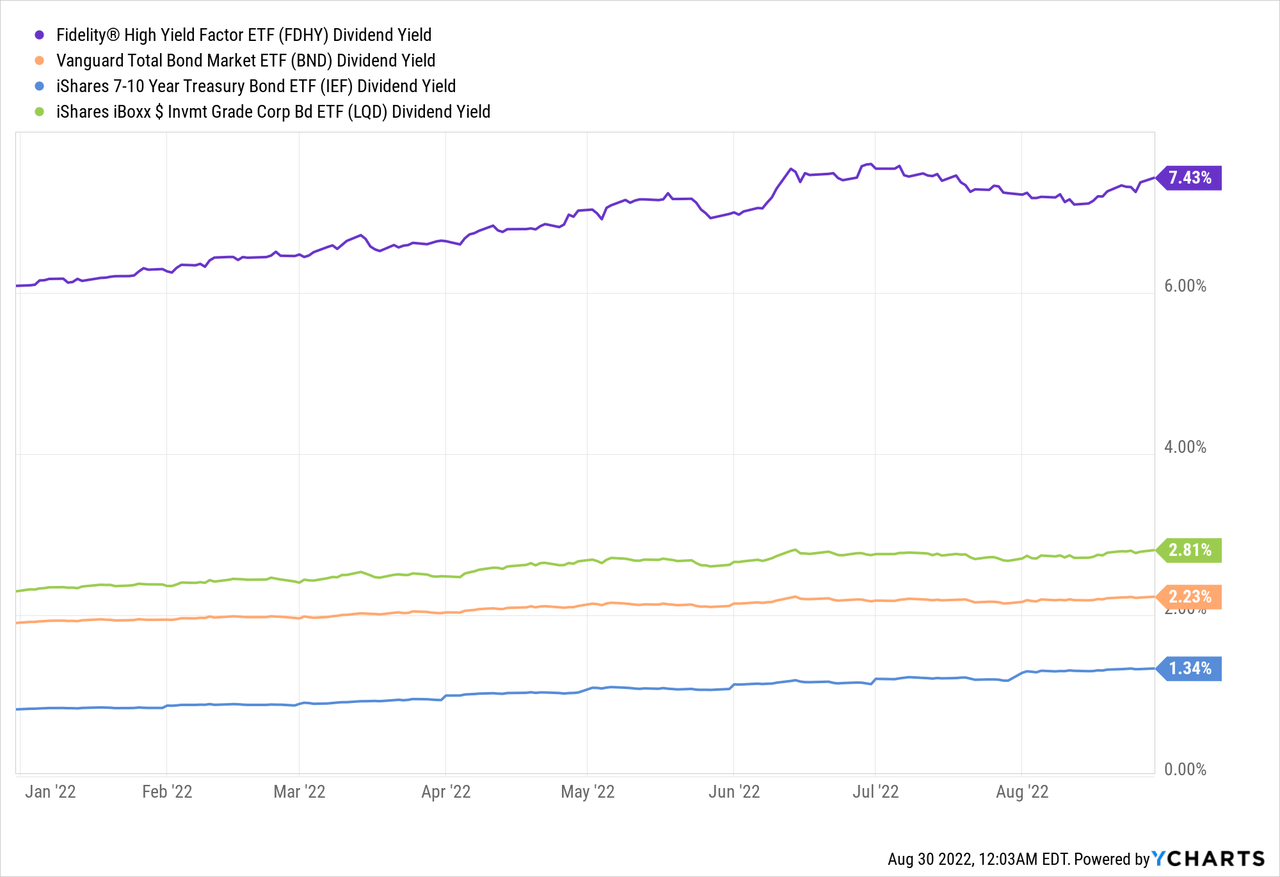

FDHY focuses on non-investment grade corporate bonds. As these are relatively risky securities, their coupon and interest rates are quite high, resulting in strong income and yields for investors. FDHY itself yields 7.4%, a strong yield on an absolute basis, and significantly higher than the average bond index fund.

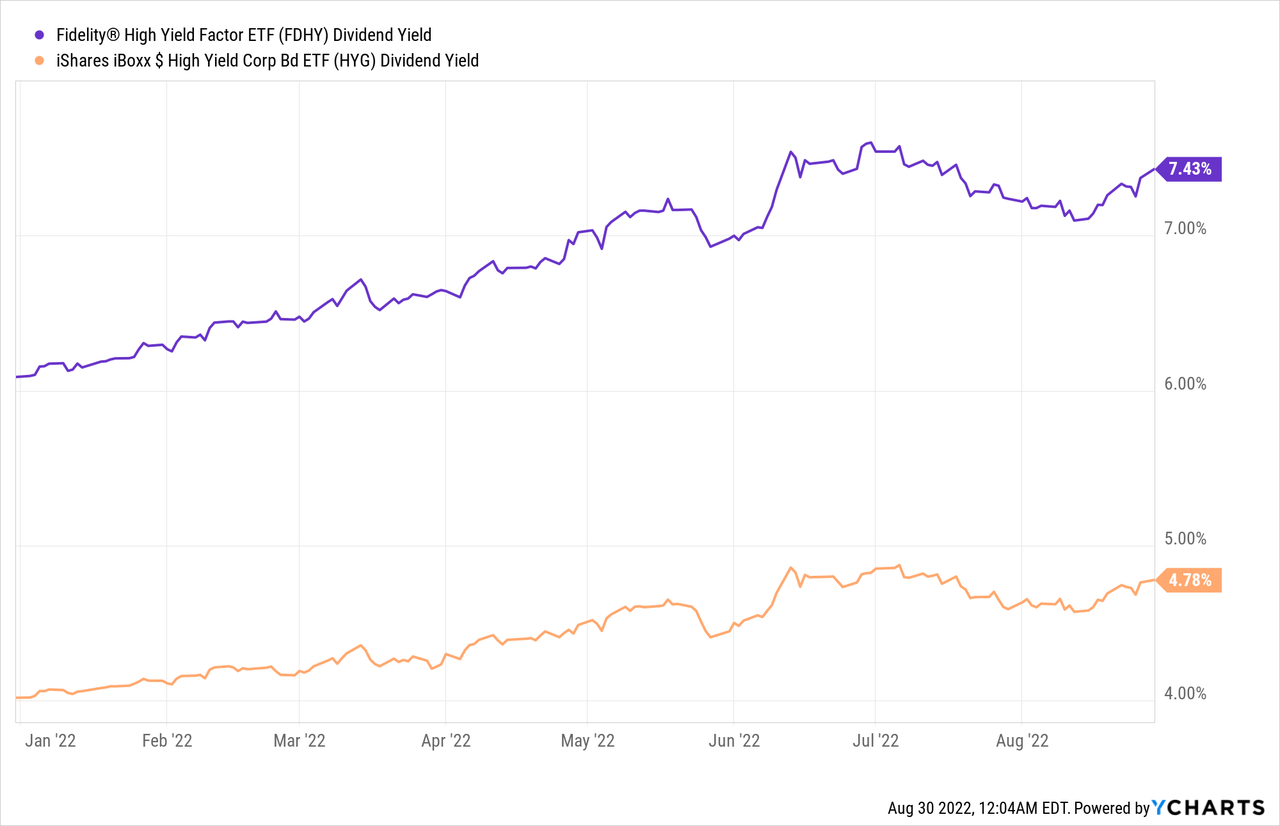

FDHY's yield is also materially higher than the high-yield corporate bond average of 4.8%. In fact, the fund is the second-highest yielding bond in its peer group. Only the High Yield ETF (HYLS) yields more, with a 7.7% yield. HYLS, however, has seen several dividend cuts, capital losses, and underperformance since inception, shortcomings not shared by FDHY.

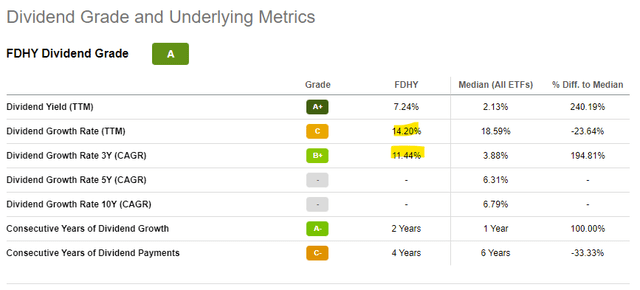

FDHY's dividend growth track-record is also reasonably good, with the fund growing its dividends at a double-digit annual growth rate for the past three years. Growth is accelerating, as the Federal Reserve embarks on an aggressive regime of rate hikes, to combat unprecedented inflation.

On a more negative note, as is common for ETFs, FDHY's dividends are somewhat volatile, so it is sometimes difficult to differentiate between dividend growth and dividend volatility. Still, growth has been strong enough and consistent enough that we can be certain that the fund's dividends are, in fact, growing.

FDHY's dividends are mostly covered by underlying generation of income. As per the fund's management team, the fund had a SEC yield of 6.3% as of June 2022. SEC yields are a standardized measure of a fund's short-term generation of income, including interest rate payments, dividends, fees and expenses, but explicitly excluding return of capital distributions, capital gains, and the like. So, if the fund generates 6.3% in income, it can sustainably maintain a dividend yield of 6.3%. The fund currently yields 7.4%, so dividends are almost covered by income.

No products found.

As an aside, SEC yields were a bit higher in prior months, around 7.0%. It is unclear to me these suddenly dropped, but as SEC yields are a short-term measure of income, short-term volatility is common. Under these conditions, small dividend cuts are likelier than hikes, although dividends should remain higher than they were earlier in the year / during 2021.

FDHY's strong, growing, 7.4% dividend yield is a significant benefit for the fund and its shareholders.

Strong Performance Track-Record

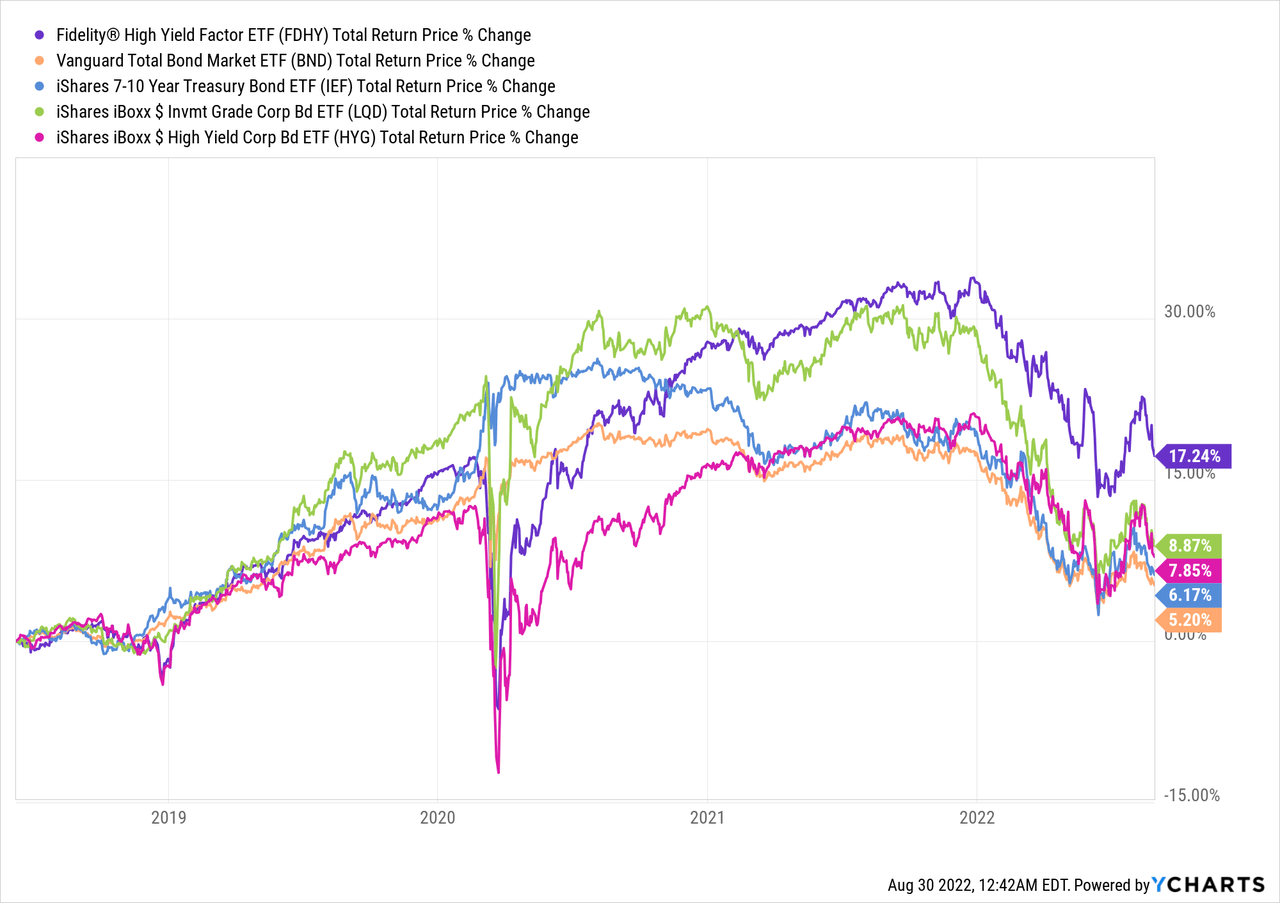

Strong yields sometimes come at the expense of capital preservation and total returns, but that is most definitely not the case for FDHY. The fund has moderately outperformed relative to its peers since inception, and weathered the onset of the coronavirus pandemic and the current inflationary environment reasonably well. Although it is not an outstanding performance track-record, it is a good one, and definitely better than average.

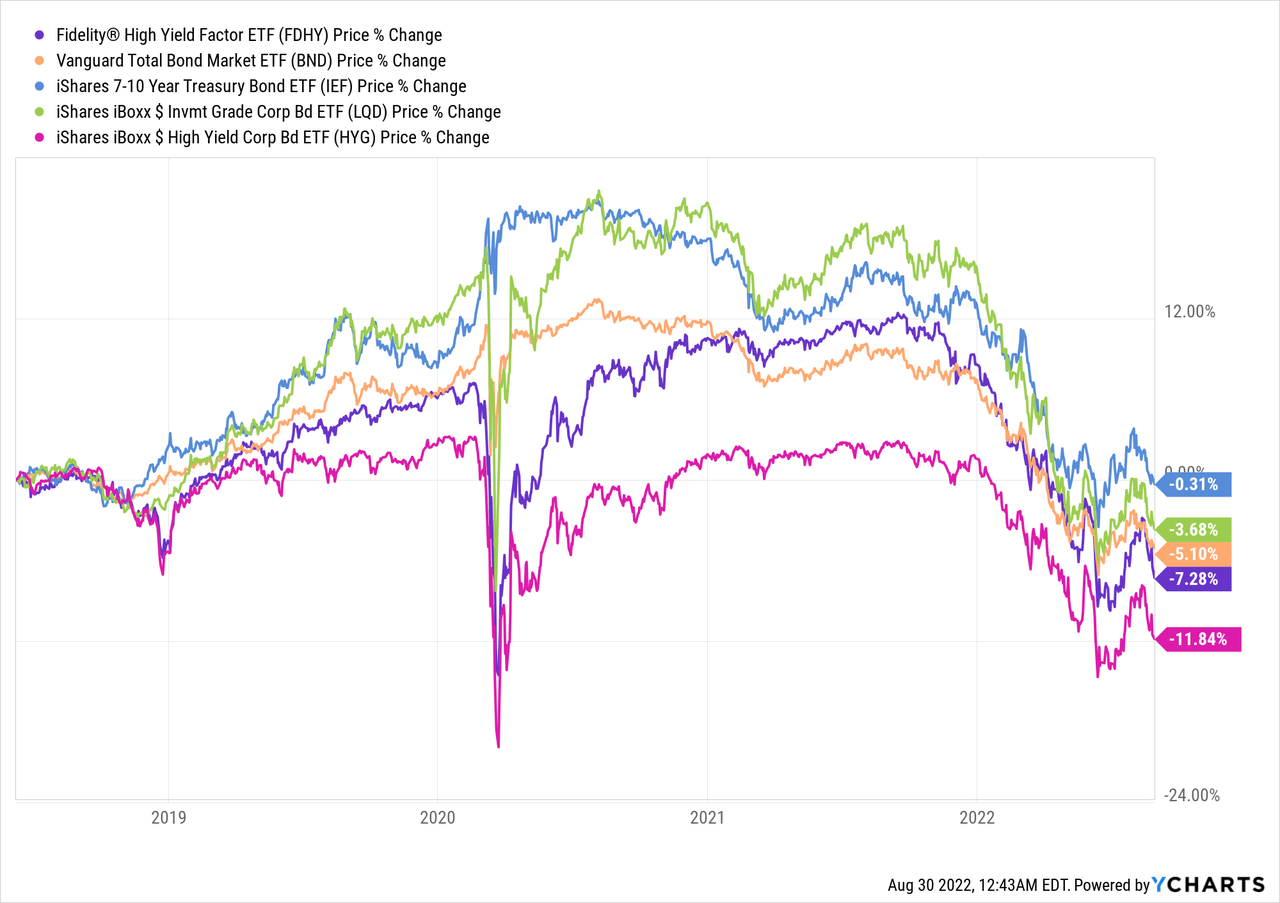

FDHY's share price had seen steady growth until 2022, in which skyrocketing interest rates sent rates up and bond prices down. Still, capital losses have not been all that significant, and have been lower than average for a high-yield corporate bond fund.

In my opinion, and taking into consideration the above, the fund does a reasonably good job in preserving shareholder capital. Higher interest rates have taken a toll, but that has been the case across the aboard, and bond prices will almost certainly recover in the coming years, as economic conditions stabilize, and as bonds are repaid, in full, at maturity.

FDHY – Negatives

Risky Holdings

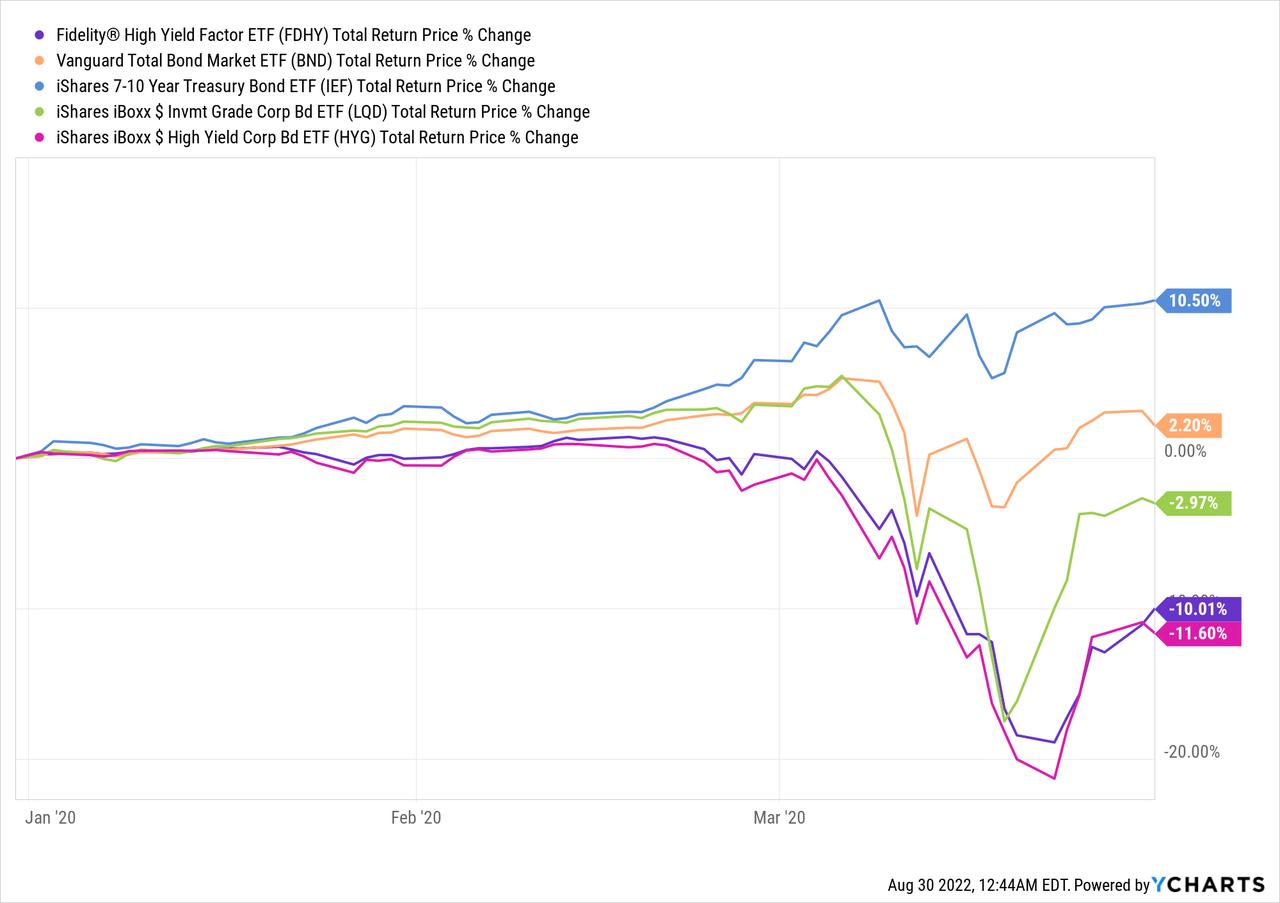

FDHY focuses on non-investment grade corporate bonds. As mentioned previously, these are relatively risky securities, with above-average default rates. Bond repayments are somewhat dependent on economic conditions, some issuers will default during recessions and downturns, so bond prices are dependent on economic conditions too. Investors should expect significant, above-average losses when times are tough, as was the case during 1Q2020, the onset of the coronavirus pandemic. FDHY suffered losses of around 10% during said time period, higher than most bond index funds, but similar to the average high-yield corporate bond fund.

No products found.

FDHY's relatively risky holdings are a negative for the fund and its shareholders, and make the fund a broadly inappropriate investment for more conservative income investors and retirees. In my opinion, at least.

Relative Lack of Data

FDHY is administered by Fidelity, which provides investors with most relevant information concerning the fund, but some information seems to be lacking. Importantly, I was unable to find detailed, up-to-date information about the credit ratings of the fund's underlying holdings. As we know the fund focuses on high-yield corporate bonds, and considering the fund's performance track-record, we have a reasonably good idea of the fund's overall level of risk. Still, detailed credit rating information would have been ideal, especially because the fund is actively-managed. Perhaps the fund's credit profile has materially changed these past few months. We wouldn't know, as the fund does not provide us with this information.

Conclusion

FDHY's strong, growing dividend yield and good performance track-record make the fund a buy.