Conditions for the broader markets look unappealing and KXI’s heavyweights have low sensitivity quotients to the benchmarks. Promotions may pick up in the food and beverage space as companies compete for shelf space. KXI’s forward earnings potential is 3x lower than a diversified basket of international stocks, and the associated forward P/E differential is very large.

iShares Global Consumer Staples ETF (KXI): Conditions Feel Right

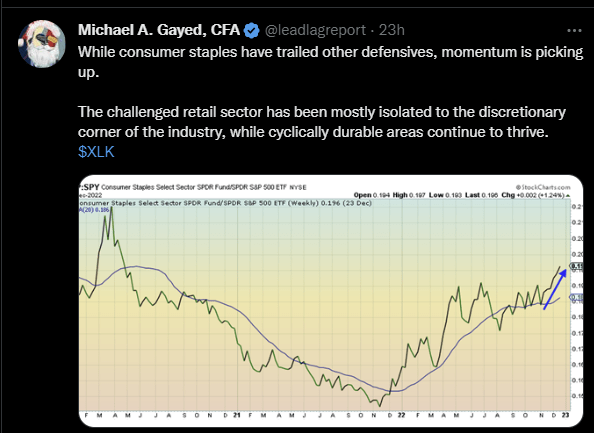

Last week, I shared some content with the Super Followers of The Lead-Lag Report Twitter account, highlighting how the consumer staples sector had been gaining ample ground over the broader markets. If you're looking to explore opportunities in this space, you may consider looking at the iShares Global Consumer Staples ETF (NYSEARCA:Original Post>

KXI seeks to cover less than 100 global stocks whose fortunes are closely linked to the production of necessities, including food and household items. On paper, even though this is perceived to be a globally exposed product, it must be noted that close to ~57% of the holdings come from the US alone. Here are some additional thoughts for those considering this product.

Key Considerations

I can appreciate that some of the younger investors may not be too keen to dabble with a product of this ilk as it is unlikely to generate much alpha when economic conditions are hunky dory. Besides, the future earnings potential too is nothing to shout home about. Data from YCharts show that KXI's holdings will typically witness earnings growth of only ~7%. This is a pittance when you consider that a diversified basket of international stocks – the iShares Core MSCI Total International Stock ETF (IXUS) – will likely witness earnings growth that is 3x KXI's figure!

However, those who've followed my writings over the years would recall that I've always stated that prudent portfolio management also involves exposing yourself to boring areas of the market that you perhaps detest, as they will likely serve as valuable parachutes when volatility picks up, and you're faced with a potential crash.

A guest on the recent Lead-Lag Live Podcast episode – Kris Sidial – stated that investors shouldn't always expect an environment where they'll only see an expansion of equity risk premiums. We may not yet have seen a pronounced volatility effect but the prospect of this coming through shouldn't be dismissed.

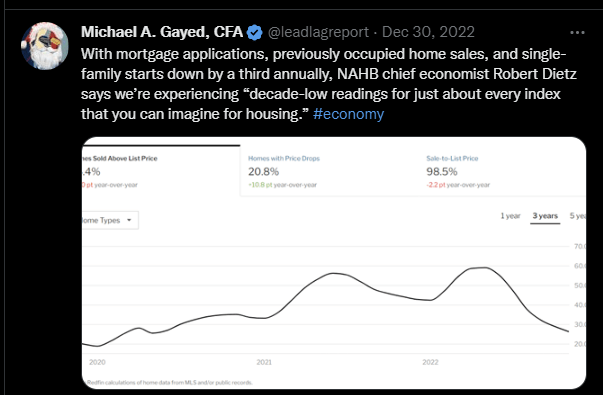

I've been positing on Twitter, how the next leg lower in stocks could well come on account of the housing market; be it housing sales, housing starts, or mortgage applications, pretty much every metric you look at suggests that your home will likely be a lot less than what you previously thought it would be. Housing is such an integral component of the economy and one's net worth, you'd have to wear blinkers to think we could have a decoupling effect, where equity markets trend in divergent fashion to the housing market.

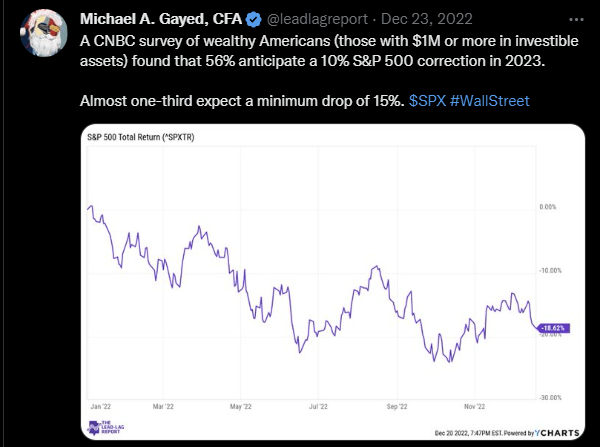

Nonetheless, it's also worth noting that a recent survey carried out amongst high net-worth individuals showed that 2023 could be another difficult year for the markets; the bulk of the respondents expect drawdowns to the tune of 10-15%.

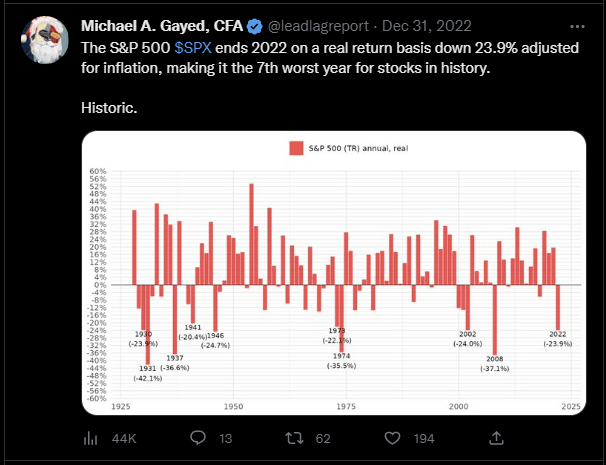

As noted in The Lead-Lag Report, last year was already one of the worst in history in real terms, and I don't know if investors can stomach a second successive year of double-digit negative returns.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

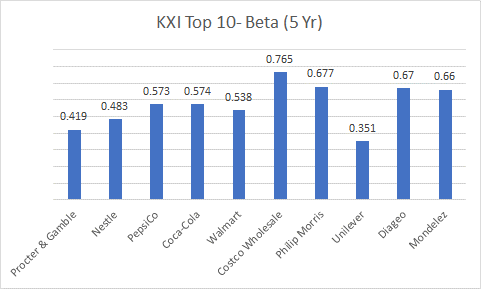

With such a sobering outlook for the broader markets, you could help mitigate the pain by gravitating towards defensive stocks that are less sensitive to the movement of benchmark indices. KXI certainly appears to have quite a few names that fit that definition; as you can see from the image below, the top 10 names of this ETF, which account for a sizeable aggregate weight of ~49%, consist of stocks that largely have betas that are significantly lower than 1x.

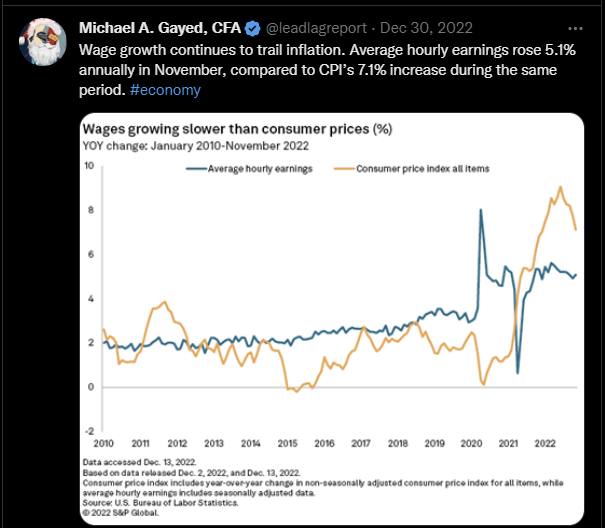

It's also well noted that the average consumer's finances are not in the best shape at the moment. For instance, in the US, the growth in average hourly earnings has been lagging the CPI for a few months now.

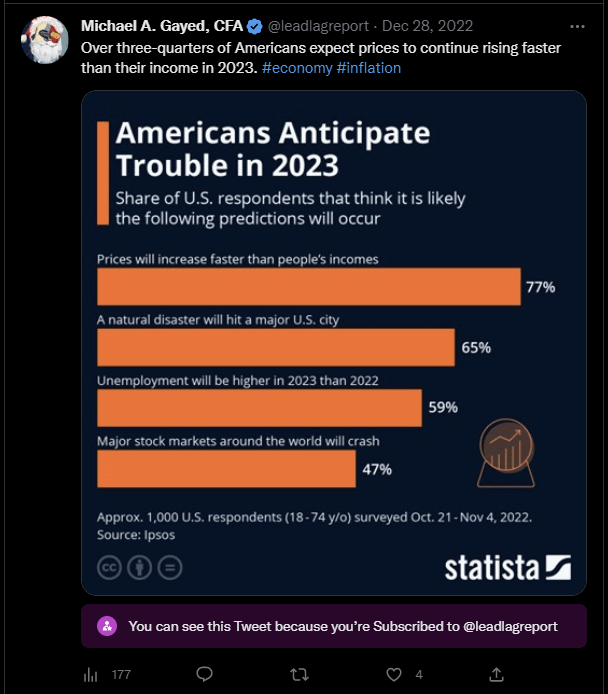

As noted in a tweet with the super followers of The Lead-Lag Report, this phenomenon is unlikely to disappear anytime soon and over 75% of Americans surveyed in an IPSOS study believe that real growth in wages will not come through.

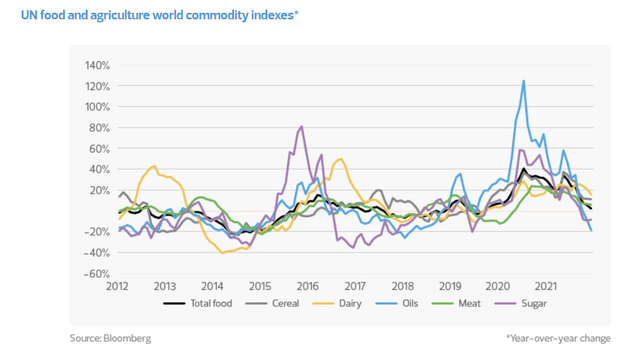

This persistent erosion in purchasing power will no doubt dampen consumers' discretionary purchases, but you'd still expect the staples portion of the household budget to still stay resilient even if price increases are passed on. Having said that, one does have to wonder if you may see more promotional activity come through in 2023 as supply chain pressures ease and competition for shelf space across grocery chains pick up. Staple stocks with strong exposure to the food and beverage segment may be in a slightly better position to engage in promotions as prices of some of the key food-based raw materials have come down quite significantly of late.

Conclusion

While the conditions for a defensive play such as KXI look encouraging, investors need to decide if they are prepared to pay a premium to own this product. When traditional safe havens such as treasuries fail to demonstrate their risk-off qualities, investors will likely show a greater eagerness for the defensive side of the equity markets.

According to YCharts, the global consumer staples ETF trades at an elevated forward P/E of almost 20x, while the diversified iShares MSCI Total International Stock ETF trades at a ~40% discount to that multiple.

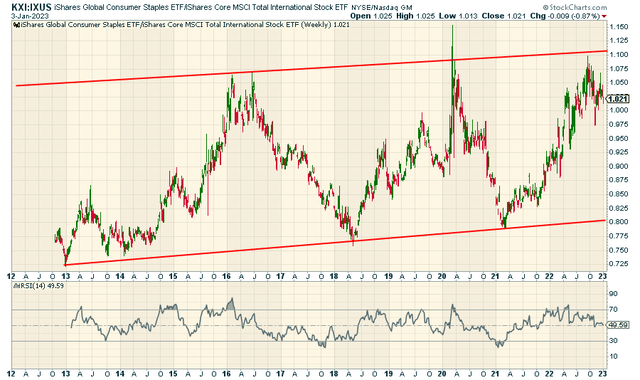

Besides, as noted in the image above, global staples still look quite overbought relative to their diversified peers from the international arena.