According to the issuer, the iShares U.S. Transportation ETF (BATS:IYT) seeks to track the investment results of an index composed of U.S. equities in the transportation sector, primarily in the airline, railroad, and trucking niches. All of IYT's holdings are in the cyclical industrial sector, so owning the fund is an explicit sector wager.

The fund is one of the most popular ways to play what is known as the “Dow Theory” which posits that market confirmation between uptrends in the Dow Jones Industrial Average and the Transportation Average implies upside potential for the broad market. In this case, both the Dow and the Transports are not looking so bad compared to long-duration tech names which remain well below their 2022 highs. But let's take a closer look at IYT.

The fund has assets of more than $800 million and a tight 30-day median bid/ask spread of just 5 basis points. With an annual expense ratio of 0.39%, it is not the cheapest index fund you'll find, but its strong liquidity and high tradeability make it an ideal product to trade and own longer-term. The average volume is actually not that high for the ETF at just 137,000 shares in the last month as of March 3, per iShares.

The fund holds 49 positions and pays a 1.25% yield with a somewhat high standard deviation of 27% (compared to about 20% for the S&P 500). The forward P/E ratio is 15.0 on the fund's factsheet, below the S&P 500's 17.7 FY1 operating earnings multiple, so there's solid value in IYT.

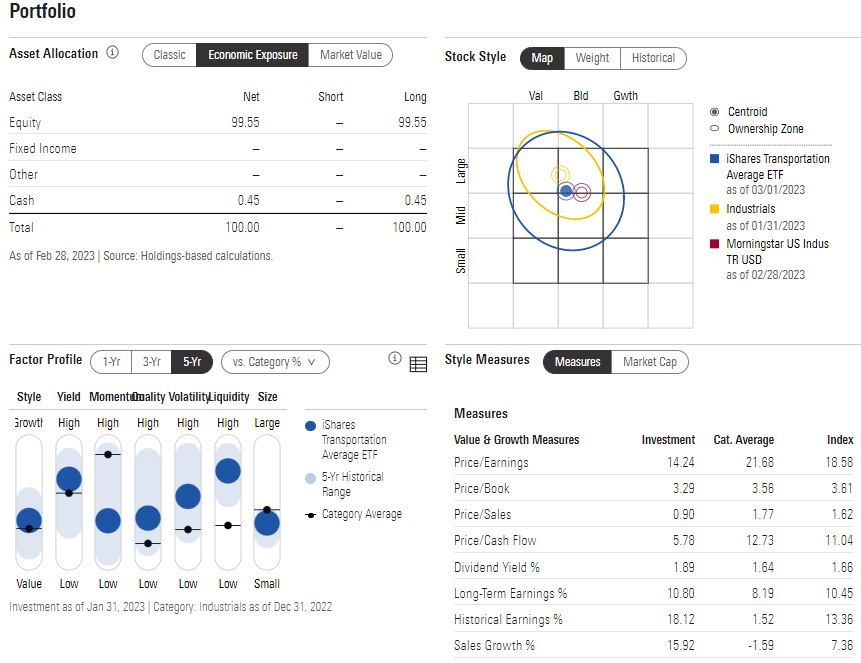

Digging into the portfolio, Morningstar reports that it's near the middle of the Style Box, but technically a large-cap blend fund while being on the borderline with a mid-cap value ETF. The fund is listed as a bit low on the momentum scale, but recent price action has been more favorable in my view which I will detail later. I see value in the fund given the earnings growth outlook coupled with the below-market P/E.

IYT Portfolio & Factor Profiles

Morningstar

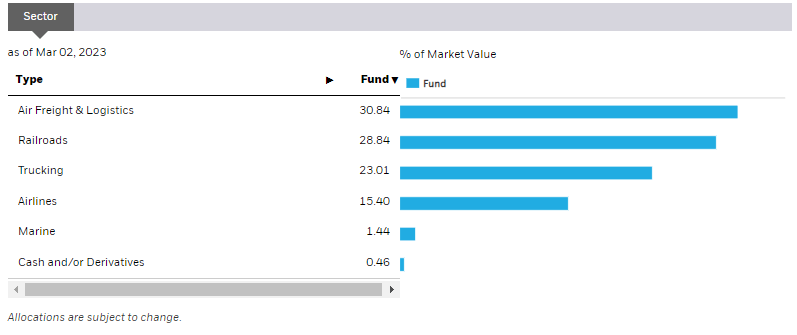

IYT's portfolio is concentrated. More than one-third of the allocation is in UPS (UPS) and Union Pacific (UNP). Keeping tabs on those two firms is important when deciding on a long-term position in the ETF. 73% of total assets are in the top 10 holdings while turnover is high at 72% annually. The four industries illustrated below are the main drivers of returns.

IYT Industry Breakdown

iShares

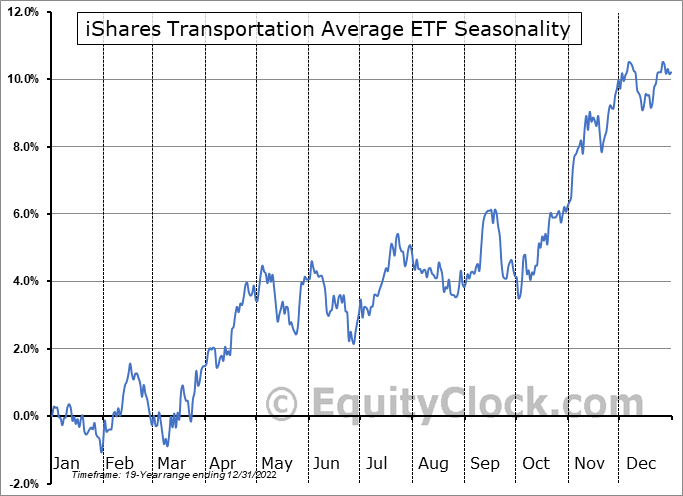

Seasonally, now is just about the best time on the calendar to scoop up shares of the transports. Equity Clock's data shows that early to mid-March is often the start of a rally through April before a Q2 consolidation. Now is also when IYT commonly outperforms the S&P 500.

IYT: Bullish Seasonal Trends

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

Equity Clock

The Technical Take

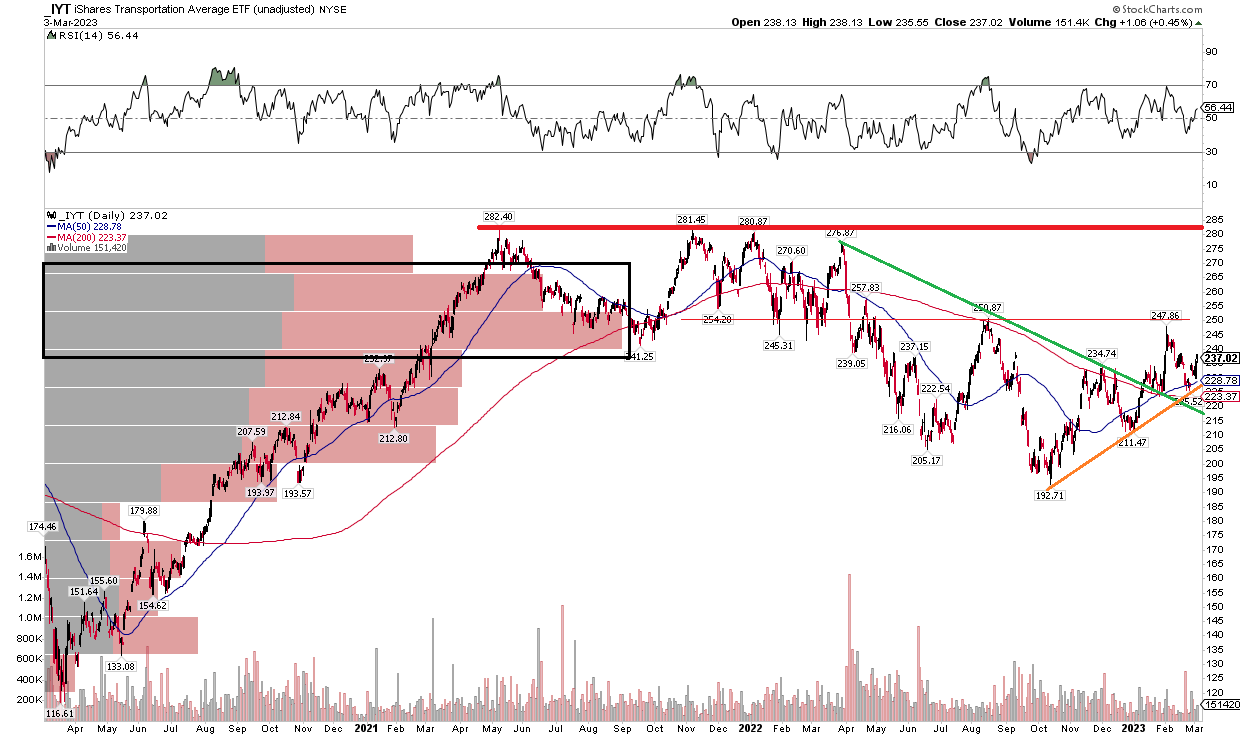

With a good valuation and favorable seasonality, the chart is also encouraging. I see a bearish to bullish reversal unfolding. Notice in the graph below that shares are now in a multi-month uptrend off the October low. I see resistance around $250, though, as a high amount of volume by price is seen in the $240s up to $270, so that could make rallies tough on the bulls. Still, the downtrend off the April 2022 peak has been broken and retested, so I think the broader trend higher plays out. Long here with a stop under the turn-of-the-year low seems solid.

IYT: Bearish to Bullish Reversal, Resistance Near $250

Stockcharts.com

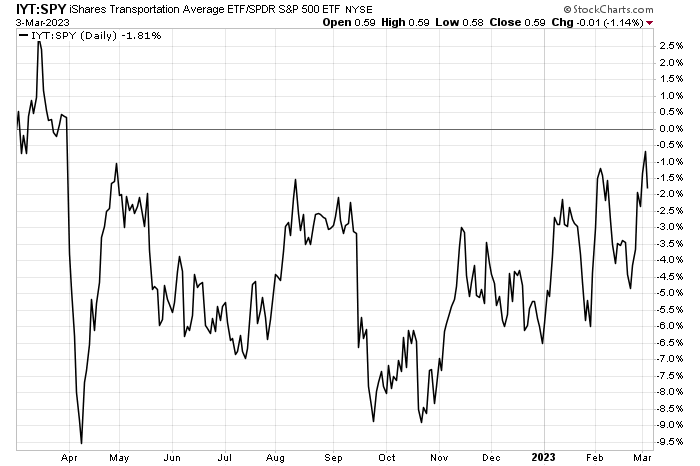

IYT Relative Strength Off Since October

Stockcharts.com

The Bottom Line

I like the transports here for their relative absolute and relative strength in the last few months. The valuation checks out, and while it is a concentrated portfolio, the group boasts positive fundamental and technical trends.