Sakorn Sukkasemsakorn

Investment Thesis

Energy Fuels (NYSE:UUUU) is well positioned for higher uranium prices. Energy Fuels' prospects will be led by sustainably higher uranium prices.

For now, the company isn't in full operation. But when the uranium prices reach $60 per lb and stay there, Energy Fuels will be able to rapidly increase their production.

But best of all, there are reasons to believe that investors have already started to reappraise the whole nuclear energy sector. What investors have come to understand is that nuclear will not displace renewable energy.

Think of it like this, when the wind isn't blowing or the sun isn't shining as brightly, nuclear energy can step in rapidly to provide the additional power required. It's akin to having a backup generator in your home that activates when your primary power source encounters limitations.

In this manner, nuclear power ensures a consistent and dependable electricity source, even when nature's elements exhibit unpredictability. Therefore, it's not about supplanting other energy sources but rather serving as a support system, filling in the gaps when necessary, and ultimately contributing to a steady and sustainable energy supply.

With all this in mind, let's get to the positives and negatives of investing in Energy Fuels and why now is a good time to pick up cheap shares here, as this company's prospects come out of a prolonged winter of hibernation.

Rapidly Improving Nuclear Market

Over the past year, there has been a growing realization among policymakers about the vital role of nuclear energy in the journey toward achieving net-zero emissions. This marks a significant shift from the stance of the previous five years when many nations had turned away from nuclear power.

Today, the perception of nuclear energy has undergone a profound transformation. Nuclear power, often categorized as a clean energy source, holds a unique position in the transition towards more sustainable electricity generation. It distinguishes itself with its minimal greenhouse gas emissions and its ability to provide a consistent and dependable energy source. Unlike certain renewable sources such as wind and solar, nuclear power generation is not subject to intermittency; it can supply electricity continuously, making it an invaluable complement to these renewable sources.

Nuclear energy is highly scalable, cheap, flexible, and best of all? Carbon-free.

A notable advancement in the nuclear energy sector is the emergence of Small Modular Reactors (”SMRs”). These compact nuclear reactors offer numerous advantages, including flexibility in deployment and scalability. SMRs can be employed to provide variable nuclear energy, adapting their output to match fluctuating energy demand.

This characteristic makes them exceptionally well-suited to collaborate with intermittent renewables like wind and solar, which generate electricity based on environmental conditions. When renewables generate surplus energy during peak periods, SMRs can operate at reduced power levels or temporarily shut down, conserving fuel and minimizing waste. Conversely, when renewables produce less power, SMRs can swiftly increase output to ensure a stable energy supply, thereby enhancing grid reliability.

Moreover, SMRs' capability to provide variable nuclear energy aligns seamlessly with the objectives of achieving a more sustainable and diversified energy mix.

As the world strives to reduce carbon emissions and transition to cleaner energy sources, the combination of intermittent renewables and adaptable nuclear power from SMRs can contribute significantly to a more resilient and environmentally responsible energy landscape.

Nuclear energy, particularly with the assistance of SMRs, can serve as a reliable partner alongside all other energy sources.

Why Invest in Energy Fuels?

During Energy Fuels' Q2 '23 earnings call, Energy Fuels highlighted its unique position as part of the ”electrify” everything movement.

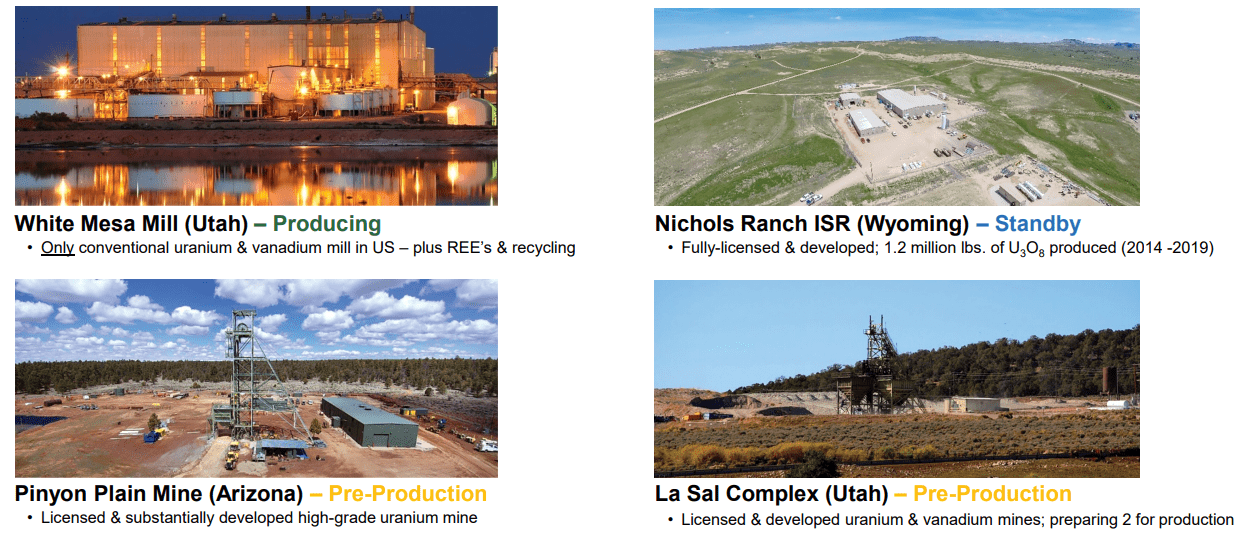

Recall, that Energy Fuels stands out for its ability to advance uranium, vanadium, rare earth production, and medical isotopes simultaneously, all while maintaining a strong balance sheet with zero debt.

Furthermore, Energy Fuels' Q2 results show the company holds approximately 1.2 million pounds of uranium and approximately 900,000 pounds of vanadium.

That being said, I must make it clear, that Energy Fuels, like other American uranium producers, is not running at full capacity.

UUUU Q2 2023

They have a new mine that will come into operation probably in early 2024, but for all intents and purposes, the business is waiting for higher uranium prices to seriously ramp up production.

I do not know what Energy Fuels' exact cost basis is, but I believe that it's similar to Uranium Energy Corp. (UEC). They both would require uranium prices to stay above $60 per lb for them to produce uranium in earnest.

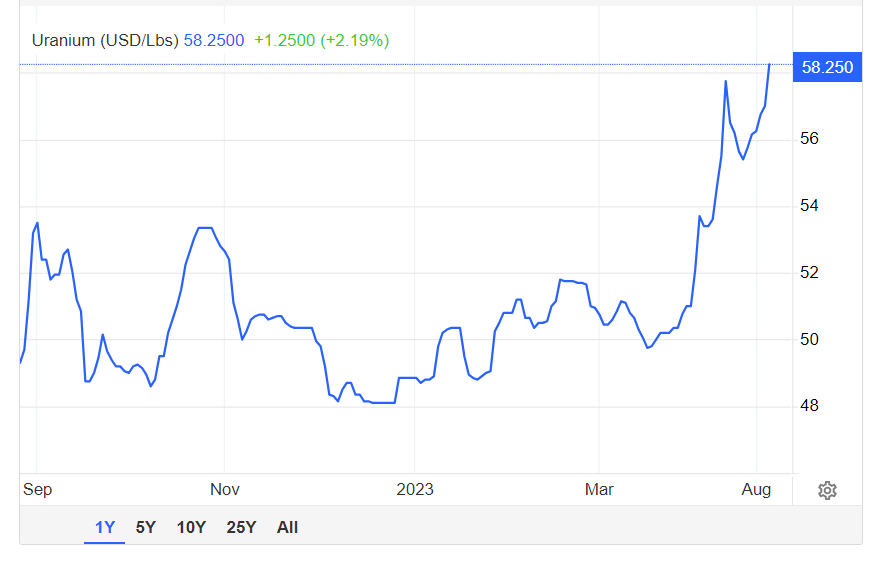

Trading Economics

That being said, as you can see above, in the past few months uranium prices have gone from $52 per LB to $58. At this rate, by the end of 2024, uranium prices will be high enough, that it won't only be Cameco (CCJ) that will be able to profitably get uranium out of the ground. But the whole sector will suddenly become very interesting.

Note, the reason why Cameco is already profitably able to produce uranium is not only due to its low-cost basis but more importantly, because they hedged out their uranium volumes. And that works both ways.

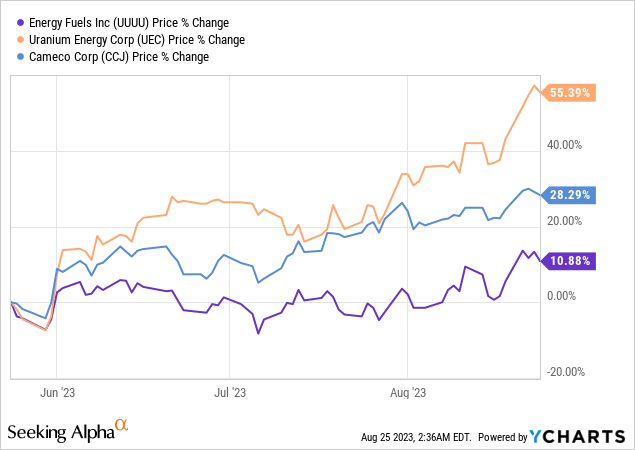

Moving on, for uranium investors, it always feels like jam tomorrow. However, I believe that unbeknownst to many investors, the uranium sector has already started to gather some attention.

Data by YCharts

As readers may recall, Energy Fuels, alongside three other US-based companies, was selected to help the US government increase its uranium reserves. This is part of a bubbling theme that has dissipated from headlines in the past year, the need for countries to strengthen their energy security.

Other recent highlights include Energy Fuels' uranium sales to a major U.S. nuclear utility, generating about $4.3 million at a gross margin of around 46%.

Although Energy Fuels consistently reminds investors that it's well positioned as an important player in the rare earth materials market, producing the most advanced materials in the United States, this company's prospects are firmly tied to uranium. Put another way, what will make or break this company's future will be higher uranium prices in the near and medium term.

The Bottom Line

I'm confident in Energy Fuels' prospects, especially with the potential for sustained higher uranium prices on the horizon. While the company isn't operating at full capacity presently, it's poised to expand rapidly when uranium prices reach and hold steady at $60 per lb.

Investors are recognizing that nuclear energy complements renewables rather than competing with them. Nuclear power offers a stable and reliable energy supply with minimal greenhouse gas emissions, making it an ideal partner for intermittent renewables.

Energy Fuels stands out with its diverse capabilities, including uranium, vanadium, rare earths, and medical isotopes, all while maintaining a robust, debt-free balance sheet. With uranium prices on the rise, the company's future looks promising, making it a compelling investment opportunity. Their guidance indicates plans to sell around 560,000 pounds of uranium at an average price ranging from $58 to $60 per pound for the year, reflecting their confidence in the industry's brighter future.

This is a good time to get involved with this stock.