Buy rating recommended for abrdn Physical Precious Metals Basket Shares ETF.ETF heavily invests in physical gold and silver bars.Predicted economic recession concerns make precious metals a safe haven investment.

A Buy Rating for the abrdn Physical Precious Metals Basket Shares ETF

This analysis recommends a Buy rating for the abrdn Physical Precious Metals Basket Shares ETF (NYSEARCA:GLTR), which is a US-listed exchange-traded fund that invests in physical bullion of precious metals held in secured vaults in the UK and Switzerland.

The ETF invests heavily in physical gold and silver bars.

The Trend in the Price of Physical Gold and Silver

The price of the precious metal has been in a negative trend for the past six months, largely due to the US Federal Reserve tightening monetary policy to combat inflation by signaling the impact of an economic slowdown on the main players and financiers of the economy.

The rise in interest rates has led to the opportunity cost of investing in precious metals being perceived as too high compared to certain securities, such as bonds that are fixed interest-bearing investments, or compared to the possibility of allocation on the money market.

So, over the past 6 months, the spot price of gold (XAUUSD:CUR) fell 4.51% to $1,872.50 per ounce, while the spot price of silver (XAGUSD:CUR) fell 1.34% to $23 per ounce at the time of this writing.

The past 6 months of the spot price of gold (XAUUSD:CUR):

The past 6 months of the spot price of silver (XAGUSD:CUR)

The precious metal gave back much of the gains it made during the collapse of some U.S. regional banks, as gold and silver and the securities they backed were sought as safe havens amid fears of a banking system collapse.

The Need to Look for Precious Metals as a Safe Haven will Re-Emerge

This protective feature will soon be the reason investors should hold back gold and silver to reduce the risk of devaluation of the assets in their portfolio. There is something ominous on the horizon and the investor will take advantage of the possibility that these assets could increase in value very quickly in response to the headwinds that the next economic scenario will bring.

The upside catalyst for safe-haven gold and silver will be the economic recession resulting from the US Federal Reserve’s hawkish stance on interest rates versus inflation. This analysis predicts this and also provides some signs later in this article that the economic outlook is deteriorating.

Given that the recession will begin as early as 2024, as some economists predict, gold and silver prices are likely to be at significantly higher levels than they are now within a few months.

Economist David Rosenberg of Rosenberg Research believes the U.S. economy will almost certainly enter a recession. This event will likely highlight gold and silver’s safe-haven status as analysts at Trading Economics predict higher prices for their ounces in the near term.

Analysts at Trading Economics expect the prices of physical gold to rise 8% from current levels to $2,016.05/ounce, while physical silver prices are expected to rise 12% to $25.84/ounce within a year.

Gold and Silver Target Prices vs. the US dollar, the US Stock Market, and US Treasuries

Given this expected price development of the physical precious metal, one cannot remain indifferent when comparing it with the US dollar currency, United States Stock Market Index 500, and the short-term US Treasury Bill Rate.

As a benchmark for the US dollar, the US Dollar Index (DXY), currently trading around $105.80, is expected to rise just 5% to $111.20 in a year.

As a benchmark for US-listed stocks, the United States Stock Market Index 500, which is currently trading at around 4,317.20 points, is expected to fall by almost 11% within a year and trade at around 3,849.61 points.

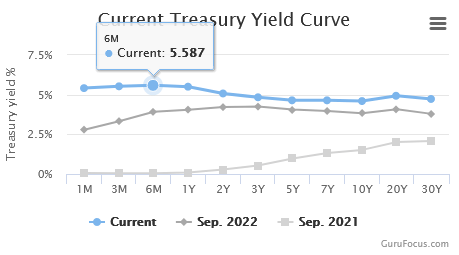

As a benchmark for what is currently the best-performing US Treasury yield according to the GuruFocus yield curve below, the 6-month US Treasury bill rate (US6M) 12-month Target return of 5.83% is well below the expected increase in physical gold and silver prices.

The shorter-term yields have been higher than the longer-term yields for several months by now. The inverted yield curve on US Treasury bonds is a strong indicator of an economic recession which is the upward catalyst for physical gold/silver prices, according to this analysis. Under normal circumstances, the U.S. Treasury yield curve would mean that shorter-term yields are lower than longer-term yields because the risk that the issuer will be unable to repay the debt increases with maturity (the longer the maturity, the higher the risk, and the shorter the maturity the lower the risk).

The Inverted Yield Curve of US Government Bonds as a Reliable Recession Indicator

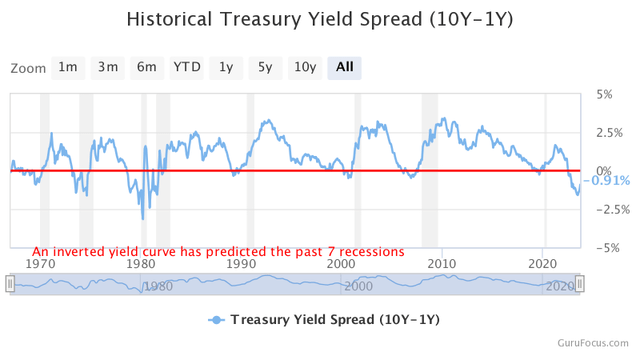

Duke professor and Canadian economist Campbell Harvey, who developed the recession indicator, which consists of comparing the yield on three-month U.S. Treasury bonds with the yield on 10-year U.S. Treasury bonds, points to a high probability of a recession as early as 2024.

This analysis recognizes the reliability of economist Campbell Harvey’s indicator in predicting the onset of an economic recession. In fact, based on another GuruFocus chart that compares one-year U.S. Treasury yields with ten-year U.S. Treasury yields, which is very close to economist Campbell Harvey’s model, we can conclude that an inverted yield curve in 87.5% of cases could predict a recession.

The Reasons to Expect a Recession

Firstly, the shock to the global economy caused by the restrictions and lockdowns to contain the spread of the coronavirus and the associated consequences for companies, such as disruptions to supply chains and inventory shortages at manufacturers.

Then the strongest inflation in 40 years, fueled by the strong recovery since the economy was freed from COVID-19 restrictions, with the war in Ukraine and the spike in energy prices in the summer of 2022 also playing a major role in the sharp rise in prices for goods and services.

To combat this record galloping inflation, the US central bank, as well as the other central banks in Canada, Europe, the UK and Australia, had to implement the most aggressively restrictive monetary policy ever implemented since the financial crisis of 2007-2008.

But despite the turbulence of the past three years, the dominant narrative across all financial market intelligence platforms remains a soft-landing scenario.

A soft landing seems to depend on the Fed being able to raise interest rates just enough to curb consumption, which is necessary to bring inflation back to the 2 percent target, but not so much that it would trigger a recession.

However, given the extraordinary nature of the global health crisis and the severity of the macroeconomic and geopolitical factors currently impacting the consumption component of the U.S. Gross Domestic Product, it would be much more reasonable to view a recession as a highly likely event for the economy.

Consumers, who make up nearly 70% of the US gross domestic product, are bearing the brunt of the above factors and are giving a signal that a recession is on the way. The low score of about 70 they just gave to the short-term outlook of their incomes, businesses and labor market conditions has in the past been associated with a recession within a year of the survey.

American consumption will continue to be weighed down in the coming months by

- Higher fuel prices due to cuts in OPEC+ oil supplies, including Russian retaliation for Western support for Ukrainian forces in the war against Russian forces.

- The resumption of student loan payments. This will compound the slowdown in US household purchasing activity as inflation remains a major concern despite effective Fed policy. After three years of forbearance over the pandemic, in October 2023 American borrowers must begin repaying their more than $1.7 trillion in federal student loan debt.

- The possible increase in unemployment as a result of successful industrial action to adjust wages to the increased cost of living. Autoworkers at Stellantis (STLA), GM (GM), and Ford (F) are striking primarily to demand higher wages to reflect the increased cost of living. The wage adjustment will have a huge impact on labor costs – the most important part of the total operating cost – and automakers may decide not to renew fixed-term contracts or be forced to resort to more precarious forms of employment to protect their profit margins. Since this issue could currently affect many more workers across sectors than just the automotive industry, the unemployment rate could likely worsen in a few months. We know about the problem because the United Auto Workers union can gain attention through a trade union dispute with automaker management, but only a small percentage of the U.S. workforce is represented by unions, about 11.3% in 2022.

- The potential government shutdown. If this happens, analysts predict it could now have a greater impact on some key public services than past and significantly restrict the way consumers spend their money.

Store looting and a sharp increase in credit card defaults, with a record $1 trillion in outstanding credit card balances, point to economic hardship and social problems in what appears to be a very uncertain future.

Recessionary behavior even in discount stores, as households suffer from high debt, expensive credit cards and increased inflation, does not fit the soft-landing scenario either.

Moreover, the US economy will miss the boost from China, where the economic cycle is struggling to get going due to the negative fallout from three years of strict measures to contain the COVID-19 virus, in addition to the severe real estate crisis, which recently led to the suspension of China Evergrande Group and its subsidiaries on the Hong Kong Stock Exchange.

In the EU, the U.S.’s second-largest trading partner, Germany’s largest economy is stagnating, raising fears that the core of the European economy will be unable to stave off a recession.

Since a recession in the US is expected and the price of physical gold and silver will benefit as they will be in demand due to their safe-haven properties, the retail investor should invest in these assets.

Invest in Bullish Precious Metals Through abrdn Physical Precious Metals Basket Shares ETF

A direct investment in physical gold and silver would be the solution. Because retail investors typically do not have the resources of an institutional investor or a bank, there are U.S. securities that offer the easiest and most cost-effective way to participate in physical metals markets.

Retail investors should consider investing in physical precious metals markets through the abrdn Physical Precious Metals Basket Shares ETF (GLTR).

Shares of this exchange-traded fund (ETF) are designed to provide investors with the opportunity to participate in platinum and palladium markets other than gold and silver through its U.S.-listed shares.

As for platinum and palladium, which are smaller holdings in GLTR’s assets under management, the price per troy ounce will continue to face higher interest rate pressures in the near term. It should then rise if the economy enters a recession in 2024, as these metals are also seen as safe haven assets against the subsequent headwinds for US-listed stocks.

Currently, platinum futures are trading at $915/oz and are expected to trade at $1,010.99/oz in a year, while palladium futures are at $1,251.50/oz but are expected to trade at $1,523/oz by the end of 2024.

However, the investor should know that this ETF is invested 62% in gold, 27% in silver and the remaining 12% in palladium and platinum, which means that the US-listed shares in this ETF are heavily influenced by the price movement of gold and silver.

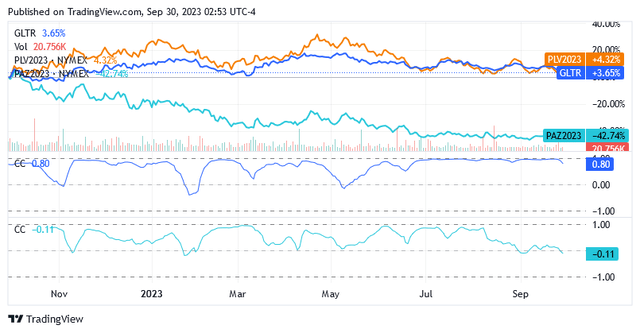

This affects the correlation between platinum futures or palladium futures prices and the ETF because GLTR in this case has significantly less pronounced coefficients than if its share price is correlated with gold or silver futures prices.

The Risk

Due to increasing geopolitical tensions, the global economic situation is significantly more uncertain today than it was a few years ago. Although it offers investors growth opportunities through safe havens such as physical gold or silver bullion, it also carries higher investment risk.

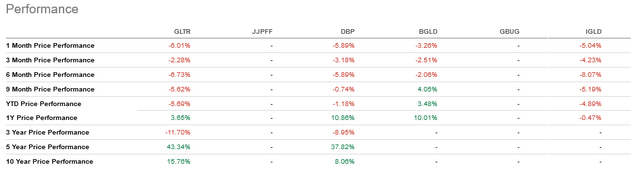

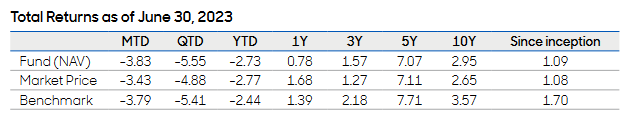

The future is becoming less and less predictable and not all retail investors can bear the risk of encountering flat or negative returns when it may be necessary to recover funds for other operations or to cover certain unexpected expenses. This might have been the situation of an investor who, after three years of allocating his money through ETFs to benefit from the change in the price of physical precious metals, was suddenly forced to withdraw the cash with a negative return of -11.70%, as the Seeking Alpha chart reports.

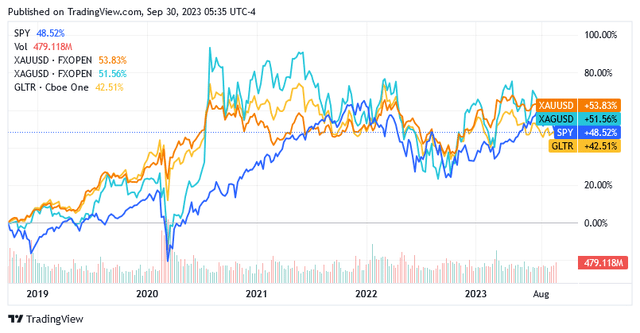

Instead of a passive attitude, the precious metal’s price cycles could actually provide a greater opportunity to beat the US stock market, which is a very fierce competitor in head-to-head battles.

Its benchmark SPDR® S&P 500 ETF Trust (SPY) was the winner even during the GLTR fund’s most successful period over the last five years.

However, the better performance of physical silver and gold assets over the past five years suggests the potential to beat the US stock market if a more entrepreneurial approach is taken with GLTR ETF. The approach would most likely also imply better control over the risk.

About abrdn Physical Precious Metals Basket Shares ETF

abrdn Physical Precious Metals Basket Shares ETF has 11,400,000 shares outstanding as of June 30, 2023.

By owning a portion of these shares in the portfolio, the retail investor can benefit from the change in the price of physical gold and silver in proportion to the share held by the trust and significantly reduce credit risk. The ETF seeks to reflect the performance of the price action of the physical precious metals less the costs of the Trust.

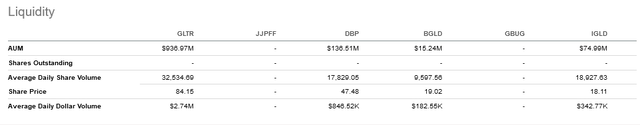

In terms of expense ratio, GLTR at 0.60% is more compelling than other products such as Invesco DB Precious Metals Fund ETF (DBP) 0.75%, FT Cboe Vest Gold Strategy Quarterly Buffer ETF (BGLD) 0.91% and FT Cboe Vest Gold Strategy Target Income ETF (IGLD) 0.85%.

How GLTR Might Perform and Why

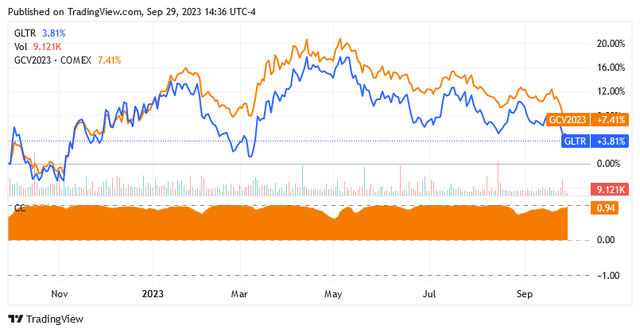

abrdn Physical Precious Metals Basket Shares ETF has a strong positive correlation with gold prices, and gold futures (yellow line) serve as a gold price benchmark in the chart below.

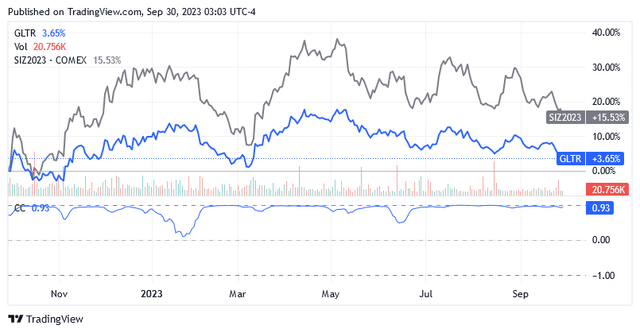

The ETF has a very strong positive correlation with silver futures as well, the silver price benchmark.

An expected rise in the price of physical precious metals will equate to positive performance by abrdn Physical Precious Metals Basket Shares ETF shares.

abrdn Physical Precious Metals Basket Shares ETF has purchased gold and silver bars, a list of which can be found here, and which are located in secured vaults at JPMorgan Chase & Co. (JPM) in London (UK) and Zurich (Switzerland). The Bank of New York Mellon Corporation (BK) is the trustee.

As of June 30, 2023, the ETF had 792 bars of gold, 605 bars of palladium, 302 bars of platinum and 11,958 bars of silver, for a total of 317,011.112 ounces of gold valued at $1,912.25/ounce, plus 63,402.23 ounces of palladium at $1,254/ounce, plus 42,268.152 ounces of platinum at $897/ounce and 11,623,741.479 ounces of silver at $22.47/ounce.

The net value of the total number of precious metal bars held in the secured vaults in England and Switzerland was approximately $984.81 million as of June 30, 2023, compared to the market value of GLTR shares of $989.06 million on the NYSE Arca Exchange. As a result, GLTR shares traded at a 0.004% premium to the net value of assets in the secured vaults on the day.

It follows that, in line with the benchmark of the ETFS Physical Precious Metals Basket Index, the market value of the shares of abrdn Physical Precious Metals Basket Shares ETF has developed in parallel with the market value of physical precious metals based on a correlation coefficient of very close to +1.

The upper limit of the coefficient correlation +1 to -1 range would be the situation where a given percentage increase in the London bullion market price of the physical precious metals corresponds to the same percentage increase in the market price of GLTR shares on the NYSE Arca Exchange.

The correlation is not +1 but very close let’s say around +0.9 on average. So, holding GLTR shares would actually benefit from the expected 8% increase in the price of physical gold and the expected 12% increase in the price of physical silver, according to Trading Economics analysts’ forecasts mentioned earlier.

Of course, past trends are no guarantee of future trends, and the current thesis assumes that analysts’ predictions will be correct if the upward catalyst of economic recession takes hold.

If the recession has the desired effects on the price of physical silver and gold, and GLTR is 90% of these two assets, the retail investor can realize a good profit by forging ahead compared to the total annualized returns of the table above.

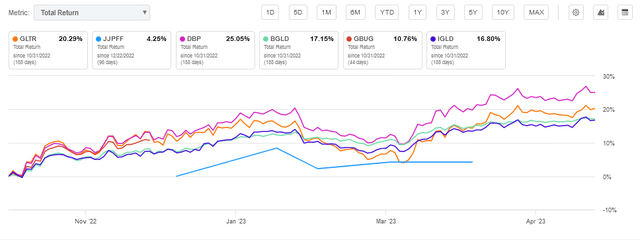

When gold prices rose about 19.5% from late October to early May 2023 on fears of an overly hawkish Fed stance and the failure of some US regional banks, abrdn Physical Precious Metals Basket Shares ETF shares delivered a total return of 20.3%, which outperformed the returns of almost all of its closest competitors.

The Valuation of ETF Shares on the NYSE Arca Exchange

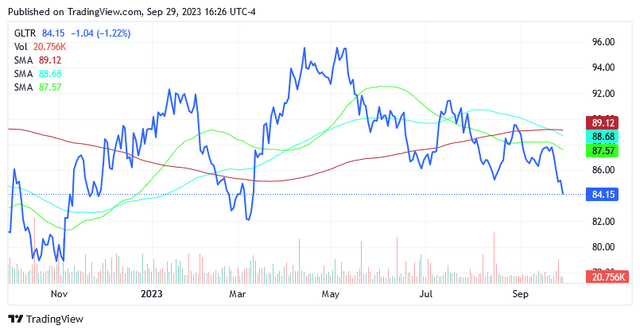

Shares of abrdn Physical Precious Metals Basket Shares ETF are trading significantly below the 200-day simple moving average of $89.12, below the 100-day simple moving average of $88.68 and below the 50-day simple moving average of $57.57.

As of this writing, shares are trading at $84.15 per unit giving it a market cap of $959.31 million versus a total value of assets under management of $978.23 million, meaning shares are trading at a 0.02% discount to the net asset value.

Shares have fluctuated between a low of $77.57 and a high of $96.05 over the past 52 weeks. Currently, the share price is below the middle point of $86.81 of the 52-week range.

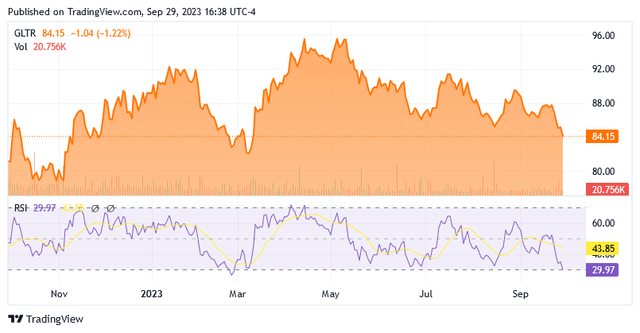

The shares of the fund have a Relative Strength Indicator of 29.97, suggesting that the shares are near oversold levels and that there does not appear to be enough room to get significantly cheaper under the pressure from higher for longer Fed interest rates.

In addition, it is necessary to pay attention to the daily trading volumes, because they are not very high and this trend can complicate the situation if the investor needs to quickly reduce his position in GLTR.

Conclusion

This analysis explains why gold and silver could experience a strong uptrend, as analysts at Trading/Economics predict.

The upside catalyst for safe haven precious metals is the expected recession, which, contrary to ongoing soft-landing propaganda, represents the most likely next phase of the economic cycle.

If the price of physical precious metals recovers significantly in 2024, around the time of the recession, it makes perfect sense for the investor to invest in shares of the abrdn Physical Precious Metals Basket Shares ETF.

The ETF offers much of the same benefit as investing in physical precious metals markets but in an easier and more cost-effective way for the retail investor. The ETF also invests in palladium and platinum, but the holdings in the secured vaults are predominantly gold and silver.

Compared to previous trends, GLTR appears to be much better positioned than most of its peers in terms of total return when gold is in bullish sentiment. Shares appear to offer an attractive entry point to participate in the upside potential.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.