wildpixel

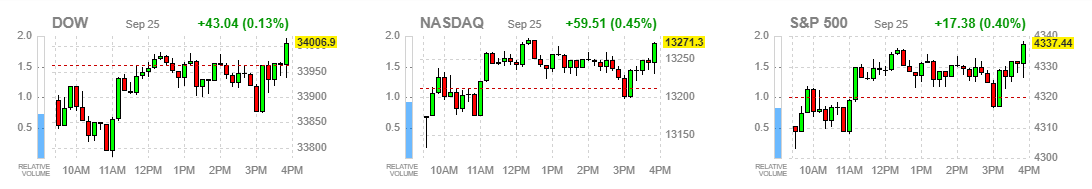

Despite rising long-term interest rates, the major market averages bounced back yesterday to end a four-day losing streak. The 10-year Treasury yield pierced 4.54%, which is a level not seen since 2007, while the dollar strengthened to its March peak. Oil prices were off modestly from their 2023 highs achieved last week. If all the bears can muster from this triple threat is a 6% pullback in the S&P 500 index, then they have their work cut out for them. That said, as sentiment wanes from the short-term pullback in stock prices, they will do their best to paint every economic data point as a negative. The truth is that these negatives are not that negative at all when looked at in the context of the overall macroeconomic picture. Don't fall victim to bearish bias.

finviz

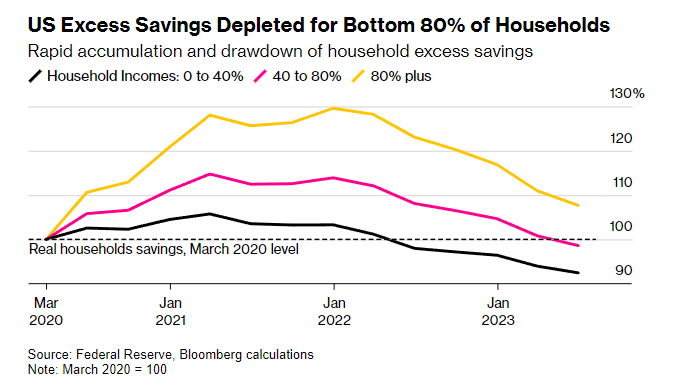

The latest fear has to do with dwindling levels of excess savings built up after the pandemic. We knew these levels were unsustainable, and most forecasted them to be depleted by the end of this year. The benefit of this fiscal largesse is that it helped consumers keep their heads above water during the 18 months of surging prices for goods and services. At the same time, this mountain of cash clearly contributed to the surge in prices, especially with respect to services. The fact that this hoard of cash is nearly depleted for most households means that it no longer serves as an inflationary factor.

Bloomberg

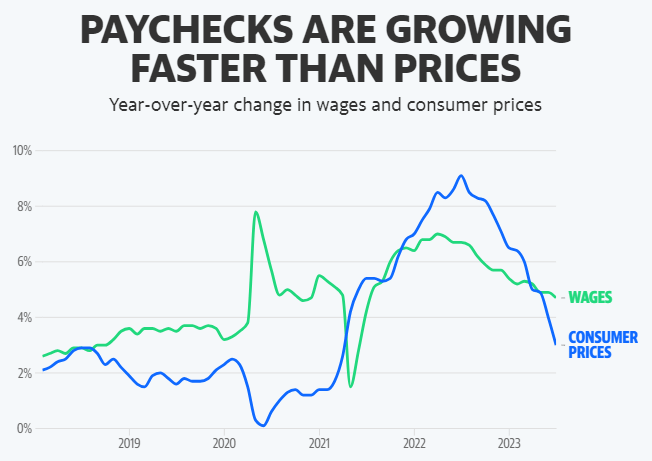

The bears would have us think that this development will put consumers on their backs moving forward and serve as a catalyst for the next economic downturn, but I opined a year ago that real wage growth would return just in time to offset depleted savings. That appears to be the case. As I mentioned yesterday, the rate of inflation has fallen below the rate of wage growth, which means consumers are realizing an increase in their purchasing power for the first time in nearly two years. Therefore, the depleted excess savings level is not so ominous after all.

Yahoo Finance

The mainstream media tends to bias its headlines on news stories in the direction of prevailing sentiment, which has grown more bearish over the past several weeks as the market has declined. This is because the goal is to garner eyeballs, which sells advertising, rather than educate and inform. As an example, there is no way to interpret the headline below other than in an extremely negative light. While it may be factually true, it is also extremely misleading in its suggestion that another financial crisis may be incubating.

CNBC

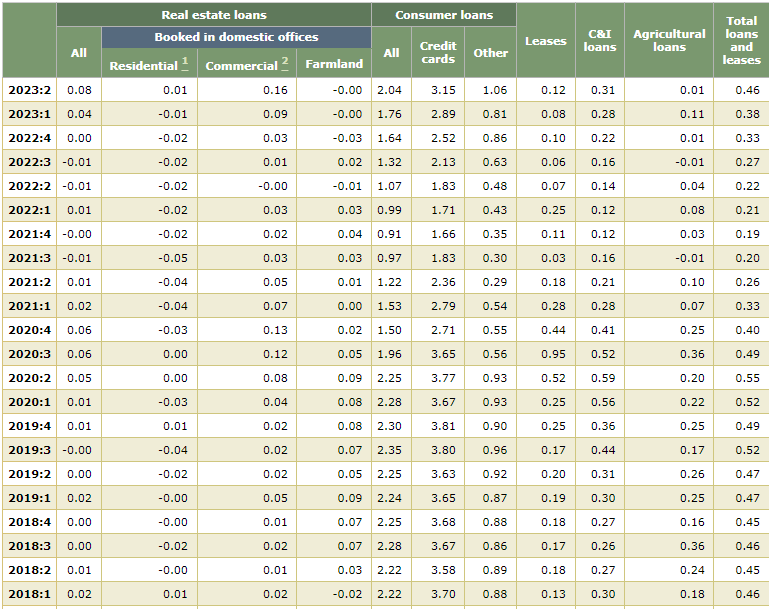

While credit card losses have risen 1.5% from their post-pandemic low in September 2001 to 3.63%, which is the most rapid pace since 2008-2009, they are not at alarming levels. In fact, they are simply back to the pre-pandemic levels we saw from 2018-2020, as the Federal Reserve data below shows.

Federal Reserve

Most economists and market strategists did not expect a bull market or the continuation of the expansion this year. Instead of aligning their outlooks for markets and the economy with the incoming data as the year progressed, many have simply pushed out bearish forecasts for both on the basis that those forecasts were not wrong but early. Therefore, as they did in March, they pounce on any news that can be interpreted negatively and embellish the details that align with their forecasts. Again, I think investors should avoid falling victim to bearish bias.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.