PixelsEffect

Investment action

Based on my current outlook and analysis of Hyatt Hotels (NYSE:H), I recommend a buy rating. I expect H to see continuous recovery in both leisure and corporate travel. On top of that, I expect H to continue experiencing pricing growth as there is a lack of hotel supply in the near term. Altogether, revenue should see healthy growth in the near term, accompanied by improving margins.

Basic information

The business does not require a deep introduction as it is a renowned name in the hotel industry, known for its many brands such as Grand Hyatt, Andaz, Alila, and Park Hyatt, just to name a few. The Hyatt business is available across most parts of the globe but has the majority of its revenue-generating hotels in the US (77% of FY22 revenue). The business is also primarily tied to the tourism industry; as such, like many other hotel players, it saw its financials crippled during COVID (revenue fell by more than 50% in FY20). Things have recovered since then, when Hyatt saw a total of $6.5 billion in revenue over the TTM vs. $5 billion in FY19 (pre-covid).

Review

H is flourishing in the midst of a challenging global macroeconomic environment. Excluding cost reimbursements, the company generated $933 million in revenue, surpassing the consensus estimate of $925 million. Significantly, when delve into the factors driving this growth, there is a remarkable 14% increase in System-wide Revenue per Available Room (RevPAR), reaching $148.39, while Net package RevPAR for AMResorts surged by an impressive 20.1% to $195.4. Given the sustained strength of the business, I am optimistic about H near-term prospects.

Given that the majority of H's business relies on the Americas region, it is crucial to understand the current dynamics. Positive growth and momentum have been observed, which is encouraging. Demand for leisure travel remained strong in the Americas region in 2Q23, while demand for business travel increased, especially at the region's large convention hotels. The comment that business travel is improving is key here, as performance has severely lacked the pace of leisure travel recovery. With business travel returning, I am confident that H's near-term performance is going to be strong. With an increasing mix of business travel, I expect H to see accelerating RevPAR growth. Remember that RevPAR is already above 2019 levels, so with the return of business travel (at an above COVID level), we should see an acceleration in growth given the easy comp (business travel performance was weak last year).

So I think as flight patterns start to change and shift and business travel continues to elevate. And all the visa restrictions that we are seeing for outbound Chinese travel start to alleviate and so forth. Bank of America Securities Gaming and Lodging Conference

Similar patterns of improvement were observed in other parts of the world. Greater China's RevPAR increased by 6% year over year, contributing to a broader recovery across the Asia-Pacific region. Increased airlift and robust international demand benefited Western Europe. Leisure tourism and price advantages helped ALG maintain its momentum. It's important to keep in mind that the strong US dollar was a major factor in the fact that EBITDA did not increase at the same rate. Hence, on a like-for-like-basis H's business is showing signs of steadfast recovery.

In my opinion, the pricing situation will remain favorable to H. Given the current slowdown in hotel construction, I anticipate that average daily rates will continue to rise for the foreseeable future. Hotels will benefit greatly from the shortage of rooms as well as the rising demand from business travelers and tourists from emerging economies like China and India.

Yes, I mean vacations is going gangbusters, departures were about flat to last year. That's the result of the normalization of seasonality, but we had unit net revenue growth of 10%, because pricing is really strong and our mix is very weighted towards five-star versus four-star. 2Q23 call

H's business is also gravitating towards a more asset light model, while growing. H's pipeline grew by 2,000 rooms to 119,000 in 2Q23, up from 117,000 in 1Q23, and the number of rooms in ALG hotels grew by 656 in the same time period. Importantly, management is still committed to liquidating its real estate holdings in pursuit of a target of around $2 billion by the end of 2024. With $721 million in sales as of 2Q23, we can expect a $1.3 billion cash infusion within the next 18 months. I agree with management that a higher margin business model and more cash for dividends or buybacks would benefit the company and its shareholders if it moved in an asset-light direction.

Valuation

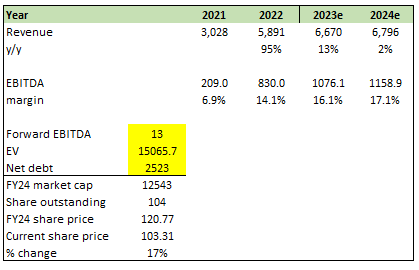

Author's work

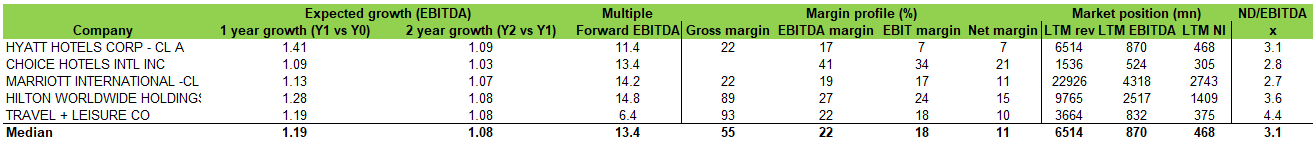

I believe H can grow at a high rate (13%) for FY23, as I expect the continuous growth in volume (room bookings) to be further driven by growth in pricing (ADR). That said, growth should see a slowdown in FY24 due to a tough comp in FY23 (which grew on top of the 95% growth seen in FY22). Consequently, I also expect EBITDA margins to expand to historical levels of high teens as increases in price and room utilization come with high incremental margins. If H were to perform as I expected, I believe the market will rerate the stock back in line with peers' multiples (EV/NTM EBITDA) of 13x. With my model, my price target is $120.

Author's work

Risk and final thoughts

Growth is ultimately dependent on hotel bookings, which are driven by travelers (leisure and corporate). Anything that will stop this flow of bookings is a risk to the business. As such, I believe a repeat of COVID or anything alike will significantly threaten the sustainability of H's business model if it goes on for an extended period of time (imagine COVID lockdown was for 5 years).

In conclusion, I recommend a buy rating for H based on my analysis. I anticipate continued growth in room bookings and pricing, supported by a current shortage of hotel supply. This positions H for healthy revenue expansion and improved margins in the near term. The return of business travel, coupled with strong leisure demand, bodes well for H, especially in the Americas region. With RevPAR already surpassing 2019 levels, the resurgence of business travel is expected to accelerate growth. Industry trends also support H's pricing outlook, as a slowdown in hotel construction and rising demand from business and emerging-market tourists should boost average daily rates.