Fokusiert

If you live for having it all, what you have is never enough.”― Vicki Robin

My regular Seeking Alpha followers know I have been quite pessimistic on the economy and the markets for many months now. There are myriad reasons for my current pessimism. However, one of my top concerns remains the consumer, given that this segment accounts for nearly 70% of U.S. economic activity.

So, let's recap the current state of the consumer. Wages have risen just south of four percent below the rate of inflation since the beginning of 2021. Consumer spending has been maintained largely by the huge amount of excess savings from the Covid pandemic via the huge amount of stimulus and largess provided by Congress to alleviate the impacts of the lock downs and their aftermath.

Aggregate excess personal savings peaked at $2.1 trillion in August 2021. The San Francisco Fed estimated that these savings had dropped to $190 billion by June. That is roughly $85 billion a month. In July, personal savings fell by just over $145 billion to $706 billion. One key reason, July retail sales were so robust which were also helped by Amazon's (AMZN) Prime Day sales.

J.P. Morgan Equity Macro Research

This means all excess savings from the pandemic are now spent. The personal savings rate for July dropped to 3.5% from 4.3% in June. This is the lowest level since the Great Financial Crisis and down from just under seven and a half percent prior to the pandemic for those keeping track at home.

Seeking Alpha

Obviously, the outlook for consumer spending going forward is facing considerable headwinds. In addition, this is an estimated $75 billion annual headwind from the resumption of student loan repayments (after a better than 3-year taxpayer financed hiatus) that starts next month.

In order to maintain their standard of living and spending levels, Americans have increasingly turned to credit cards. Total credit card debt recently surpassed the $1 trillion level for the first time and overall revolving debt hit $1.27 trillion in July. Rising interest rates are hardly making this debt easier to service. The average annual percentage rate (APR) on revolving debt currently stands at just under 21%. Auto loans also recently hit an all-time of $1.6 trillion. The average car payment for new vehicles was a record-high $725 a month in the first quarter of 2023, an 11.5% rise from the same period a year ago.

Federal Reserve: Board of Governors

As I noted in my article ‘The Pain Arrives‘ earlier this week, this consumer stress is resulting in rapidly increasing credit card loss rates. Goldman Sachs recently reported that this rate currently stands at 3.63%. This up 1.5 percentage points from the recent bottom in September of 2021 and at the highest levels since the Great Financial Crisis. Goldman also sees credit card losses rising another 1.3 percentage points to 4.93% in 2024.

In addition, the jobs market appears to be deteriorating. Full time jobs were lost in both July and August according to the Bureau of Labor Statistics or BLS even as part time positions surged. Finally, every single monthly BLS jobs report has subsequently been revised down, not an encouraging sign.

Monthly BLS Jobs Revisions (Zero Hedge)

And as a blip on Seeking Alpha noted Tuesday, these worsening trends have played havoc on myriad consumer discretionary stock over the past month and a half including:

Torrid Holdings (CURV) -44%, Rent the Runway (RENT) -41%, Farfetch (FTCH) -35%, Overstock.com (OSTK) -33%, Dollar General (DG) -32%, Chewy (CHWY) -31%, Oatly (OTLY) -28%, Planet Fitness (PLNT) -26%, Big Lots (BIG) 24%, Sportsman's Warehouse (SPWH) -23%, BJ's Restaurants (BJRI) -23%, Dutch Bros (BROS) -22%, Savers Value Village (SVV) -21%, Duluth Holdings (DLTH) -20%, Peloton Interactive (PTON) -20%, and CAVA Group (CAVA) -20%.

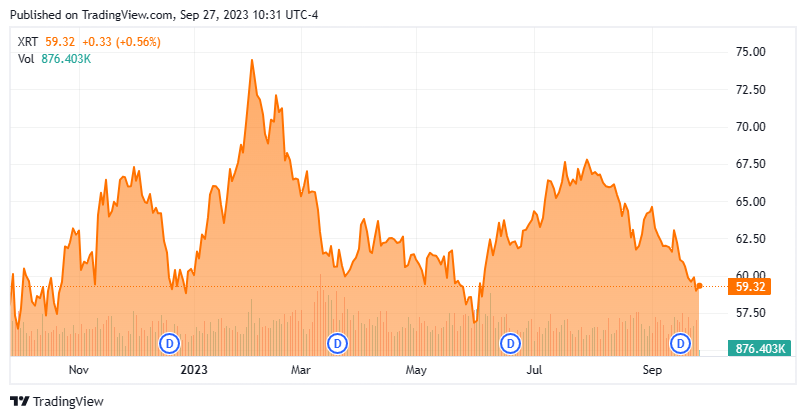

I have noticed the deterioration in consumer prospects for many quarters now. As a result, I am deeply underweight all sectors of the market that have a deep reliance on consumer spending, including retail within my portfolio. I also have built up a decent bear put spread position against the SPDR® S&P Retail ETF (XRT) over the summer. In addition to poor consumer spending prospects, retailers are facing an alarming increase in theft. According to the National Retail Federation report on Tuesday, inventory “shrink” as a percentage of total retail sales accounted for $112.1 billion in losses in 2022. This is up significantly from $93.9 billion in 2021.

Seeking Alpha

The $64,000 question I have for investors that are still bullish on the economy and the stock market is this. How can the markets and economy advance if the consumer, which accounts for approximately 70% of economic activity, is looking more and more like ‘toast‘? If one cannot give a coherent counterargument to that thesis, one probably should have their portfolio on a very conservative footing.

Ambition' is ‘greed' rebranded.”― Mokokoma Mokhonoana

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.