Torsten Asmus

In our WCTW this Monday, we wrote that the oil market (CL1:COM) is not prepared for what's coming. The U.S. has, in essence, bailed out the rest of the world from an oil supply shortage, but that is about to come to an end. With U.S. crude storage failing to build and likely trend lower by mid-October, U.S. crude exports should fall. The combination of falling U.S. crude exports coupled with Saudi and Russia's voluntary cuts should send the physical oil market into a frenzy.

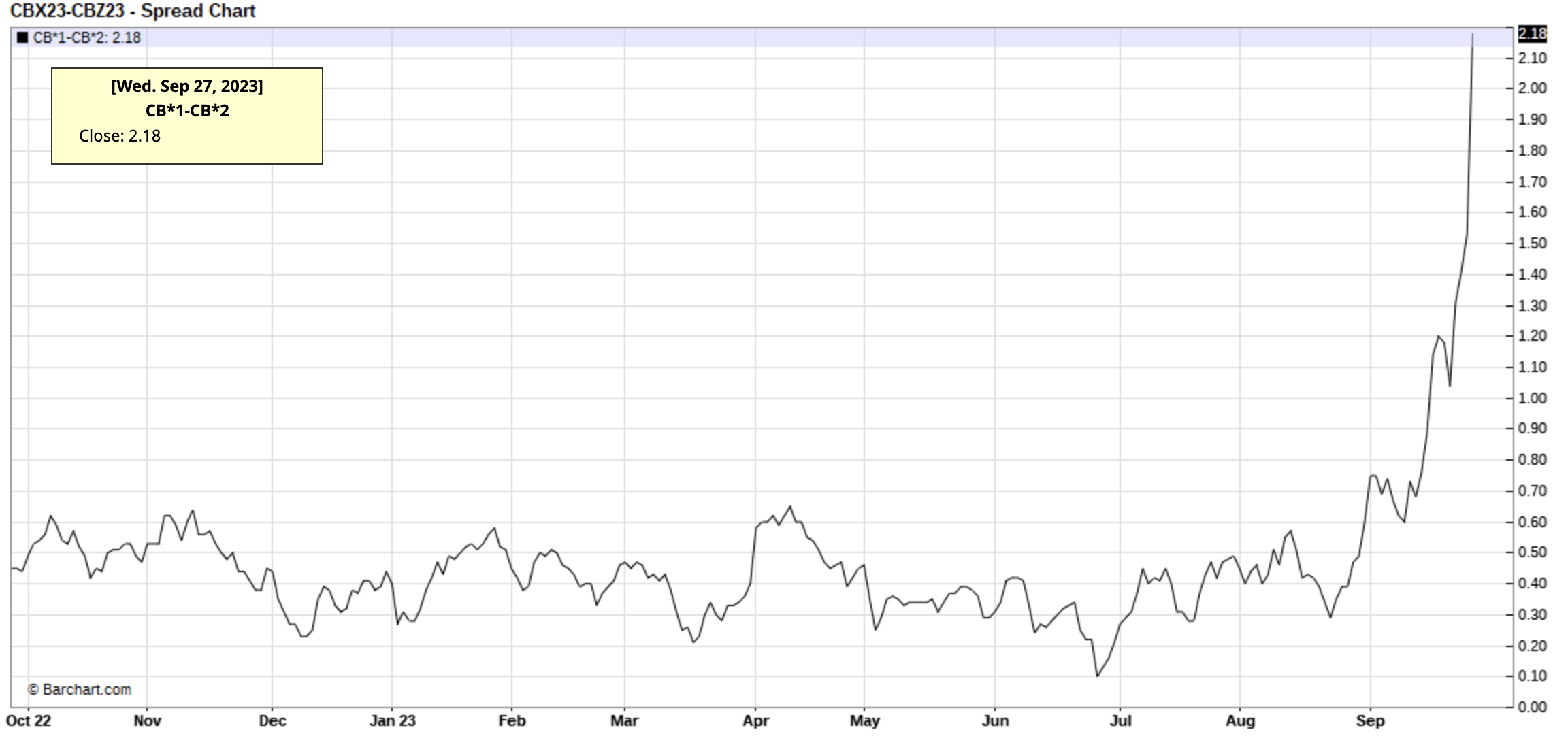

We are already seeing eye-popping backwardation, and there's more to come.

barcharts.com

If you thought March/April 2022 was bad, you haven't seen the real thing yet. We are talking about real supply cuts this time, not some fantasy potential supply drop.

What makes this time even more beautiful is that the IEA will be well behind the eight ball. As we wrote in our report two weeks ago, IEA really messed up by assuming massive builds in H1 2024. What they should've done instead is caution everyone that the market is about to get very tight. But nope, as a political outfit now more than an energy agency, it chose a completely different path, one that should inevitably lead the world into a crisis.

And similar to the path the IEA took when Russia invaded Ukraine telling the world that Russian oil production would fall by ~3 million b/d, this time around, it is preaching the exact opposite: ample supply.

But as the title of this OMF suggests, this is no time for celebration, this is no time for pats on the back, because this is only just getting started.

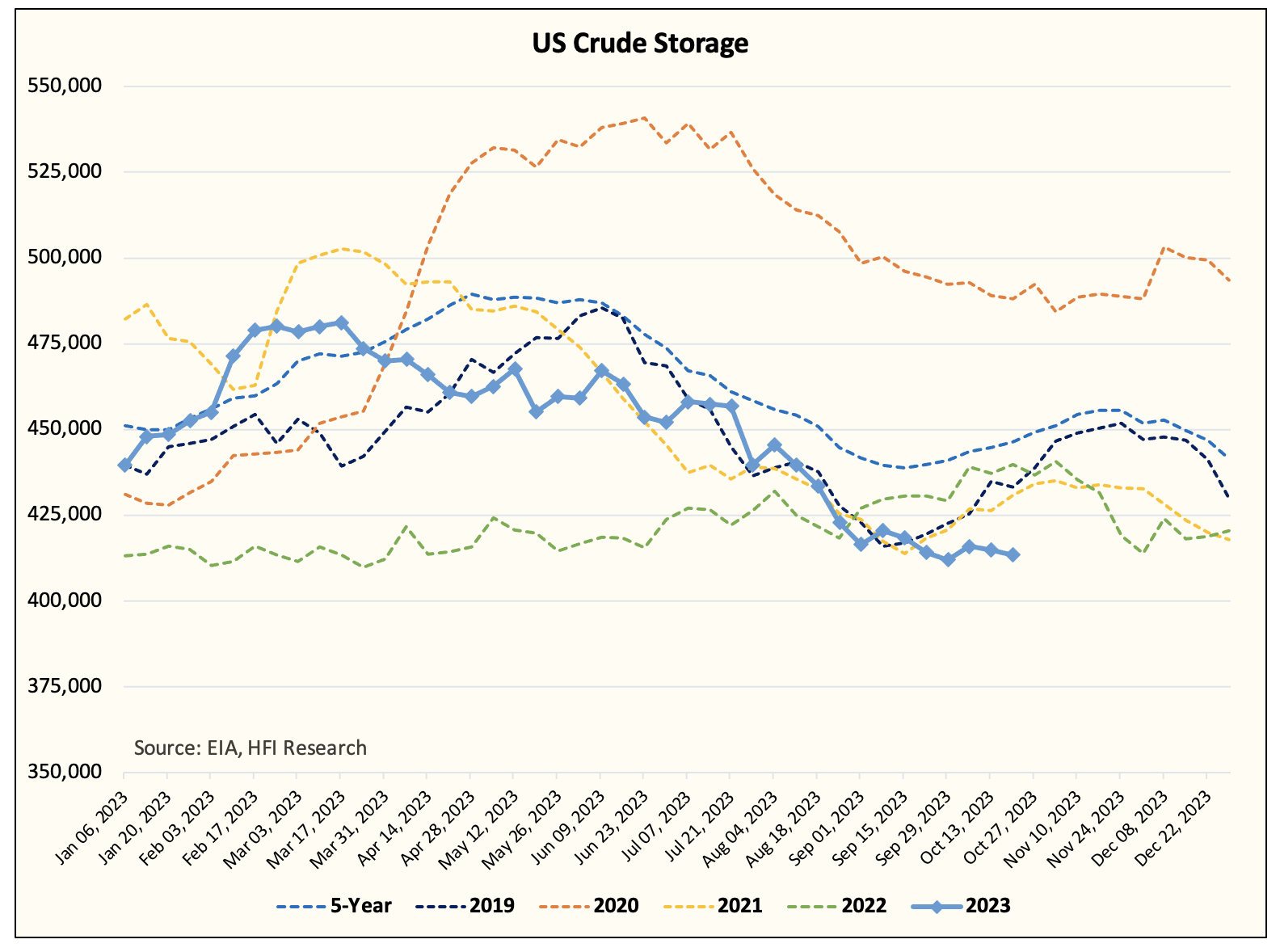

EIA, HFIR

Our latest U.S. crude storage forecast shows non-existent crude builds during refinery maintenance season. We have one last rush of U.S. crude exports and that's it. U.S. crude storage will likely stay flat to higher into year-end because U.S. crude exports will fall. This is what we expect and the end result is a much tighter global oil market environment.

So for readers trying to stay ahead of the curve, please do not expect U.S. commercial crude storage to fall well below ~400 million bbls. We are already tight and so the market will force relief one way or another.

Dominos are falling…

One of the bear factors was demand, but demand is holding up well. Unlike some of the bulls argue, we don't see demand as being robust, but it's not terrible like the bears are claiming. Refining margins will continue to remain under pressure as crude tightness gets even tighter. Bears will point to falling refining margins as a sign of demand weakness, when in reality, it's just crude tightness.

Oil, in the meantime, will continue to climb the wall of worries. Recession, high interest rates, lower refining margins, OPEC+ spare capacity, all of these things will prevent people from seeing the bigger picture, and that's that the marginal supply has all but peaked.

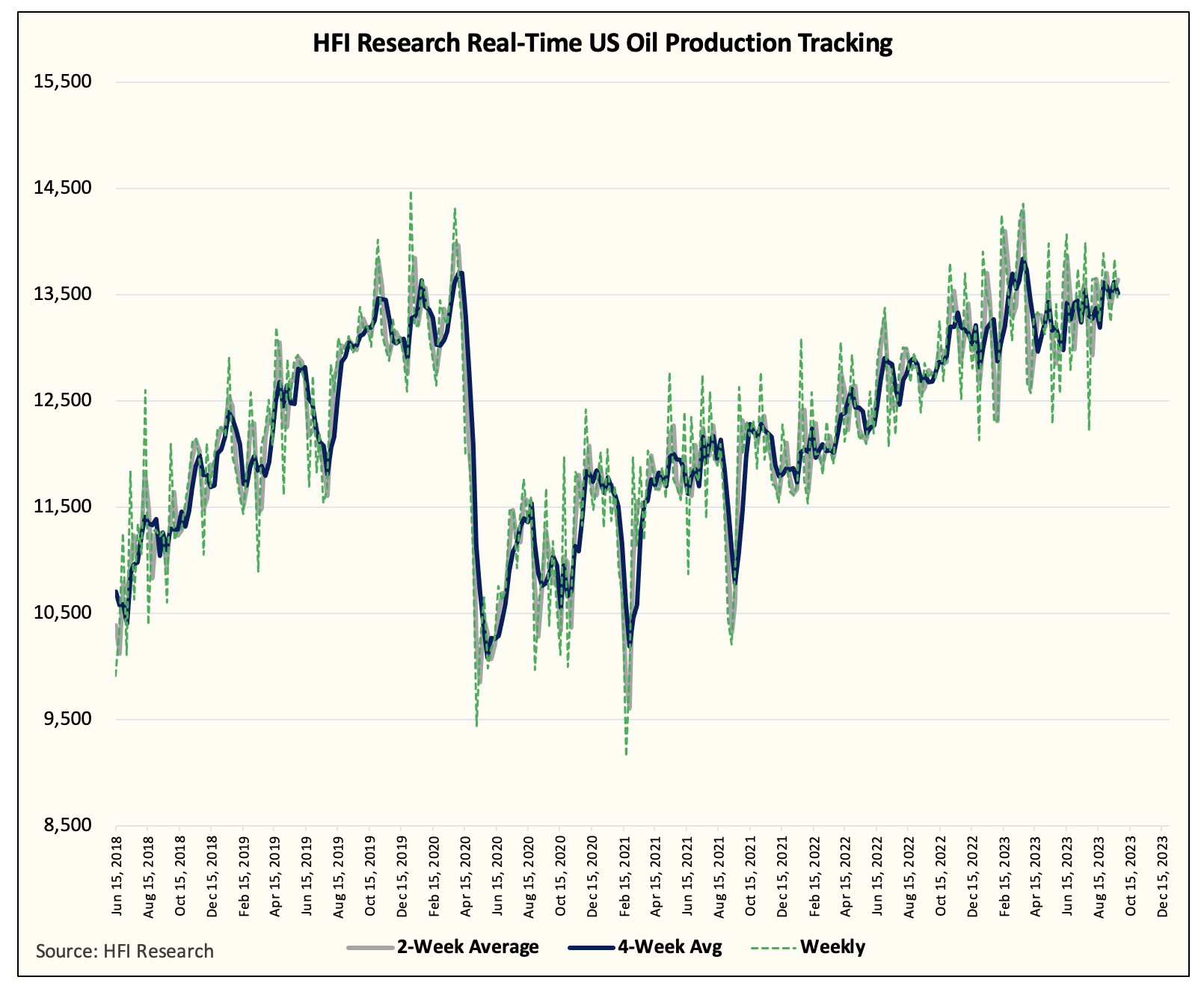

HFIR

And the U.S., being the largest growth in supply over the last decade, is all but on its last leg. The oil market is firmly in the hands of the Saudis and they can do however they please going forward.

So this is no time for celebration because it's only just getting started. Buckle up, extreme tightness in the physical market is coming.