RoschetzkyIstockPhoto/iStock Editorial via Getty Images

Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT) is a sector-specific fund that focuses on companies that derive a significant portion of their revenues from either lithium battery technologies or battery storage solutions.

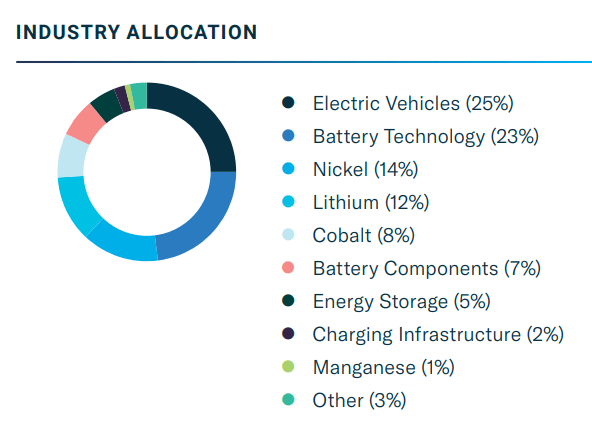

The fund includes a mix of companies that are involved in different stages of the lithium industry. For example it includes companies that mine materials used in batteries such as nickel, lithium and cobalt as well as companies that serve as end-users of such products such as producers of electric vehicles and companies that are engaged in energy storage.

BATT Industry Breakdown (Amplify)

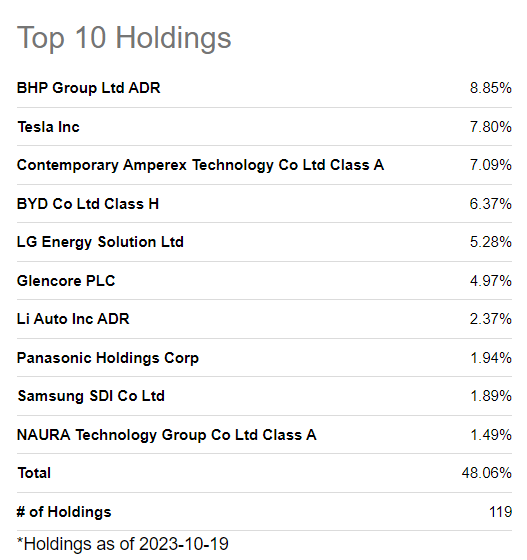

Thus, you see a good mix of companies ranging from BHP Group (BHP) to Tesla (TSLA) in this fund's top holdings. The fund's holdings appear to be global as it holds BHP from Australia, BYD (OTCPK:BYDDF) from China, Glencore (OTCPK:GLNCY) from Switzerland, Panasonic (OTCPK:PCRFY) from Japan and Samsung (OTCPK:SSNLF) from Korea as some of its largest holdings. This gives investors a nice global exposure to the lithium and energy industry from both global perspective as well as process perspective as it includes companies ranging from material miners to producers of EVs. This might be beneficial and allow investors to benefit from the growth of the industry as a whole. If the fund only had material miners, it would miss out on producers of high-end technologies and if it only had those companies and lacked miners, the fund might have suffered from effects of rises in commodity prices but this set up allows it to hedge for commodity prices while taking advantage of growth that may come from high-end technology developers.

Top 10 Holdings (Seeking Alpha)

There is a huge global shift towards using more battery usage and this is not limited to electric vehicles either even though EVs happen to be the poster child of this change. Apart from the rapidly growing EV market, we are also witnessing a boom in usage of a variety of electronic devices that are powered by a lithium battery as well as a rise in energy storage which require huge amounts of large batteries. Also, we are likely to start seeing more types of vehicles beyond cars that make use of electric power such as semi trucks, boats, aircraft, buses and heavy machinery which will use even more energy than cars and need much larger batteries.

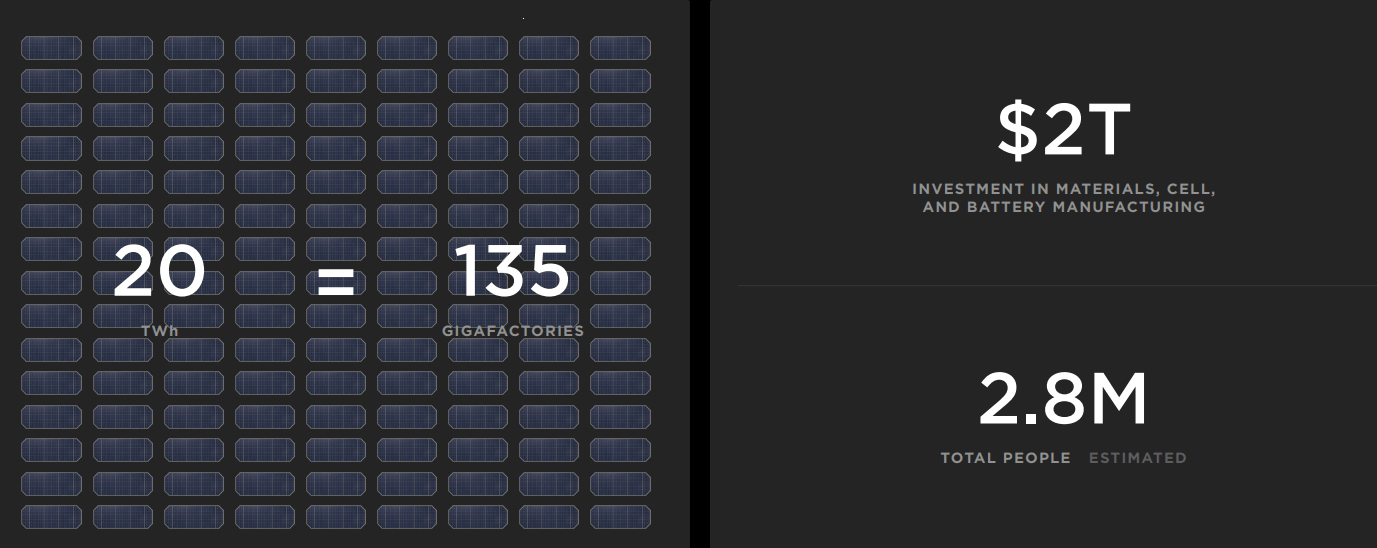

Tesla estimates that companies will have to invest $2 trillion in battery manufacturing just to meet the current demand and much more to meet future demand. It's almost impossible for anyone company to make such a large investment but we already know that multiple companies across the world from Panasonic to Samsung (as well as many Chinese companies) are already ramping up their battery investments in a significant way. Mining companies will also have to step up their efforts to mine materials needed by the industry. As technology gets better, batteries are likely to get more efficient and more affordable which means that material prices might also stabilize.

Investment needs for battery manufacturing (Tesla)

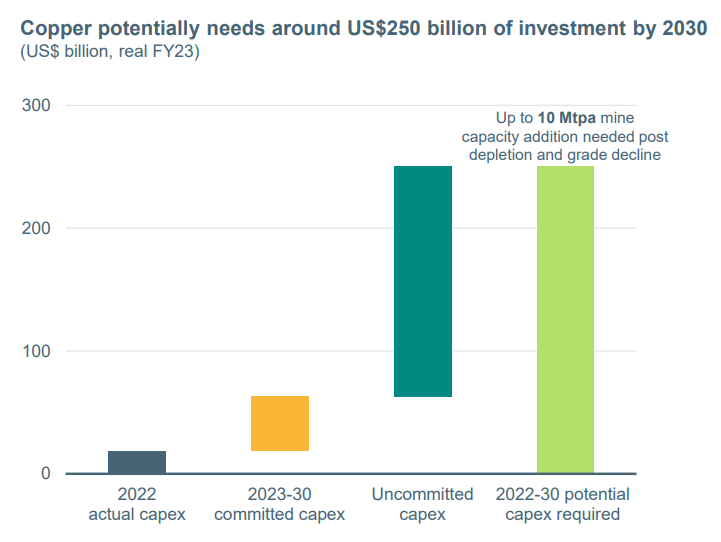

As one of the largest mining companies in the world BHP predicts that there will be a pretty large need for additional materials such as copper between now and 2030 driven by population growth, higher urbanization, shift to electrification and very little actual capex has been committed towards this goal. Mining companies will have to invest $250 billion between now and 2030 just to increase copper production to meet future needs.

Future Capex Gaps (BHP)

A lot of the materials being used in battery technology are also known as rare materials which don't exist in huge abundance and it can be rather expensive to extract those resources. Also a large amount of those rare materials might exist in geographical locations that might have an unfavorable political environment such as suffering from regional instability or having fragile relationships with the rest of the world due to a variety of reasons. This can pose as a risk for this industry as a whole as it heavily depends on having easy and affordable access to those rare materials as well as well-functioning uninterrupted supply chains that may span across multiple countries. There are also efforts to reduce usage of rare materials in battery usage and Tesla seems to have made some progress in this field.

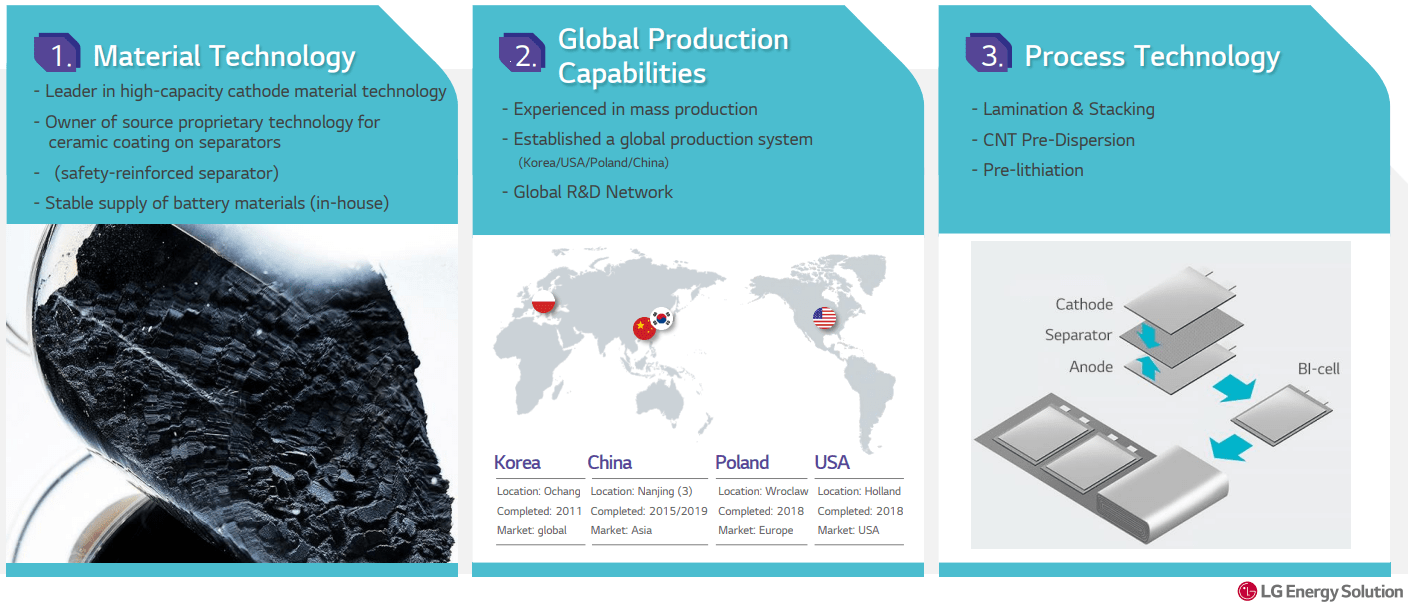

LG Energy sees further possible advancements in this industry's future and puts these into three categories. The company sees an improvements in material technology in terms of materials being used, production capacities with addition of new plants and factories and advancements in process technology to make batteries more efficient.

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” L x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

Battery tech improvements (LG Energy)

So there are both opportunities as well as risks associated with this industry but we are definitely seeing a secular growth trend globally for the next couple decades. On one side we will see higher demand for batteries and energy storage and on the other side we will see improvements in efficiencies which could make it so that less materials are needed to reach the same productivity. This could also go the other way where material costs skyrocket due to inflation, global instability and political factors which could derail some growth of the industry but the fund is invested in mining stocks which might act as a hedge.

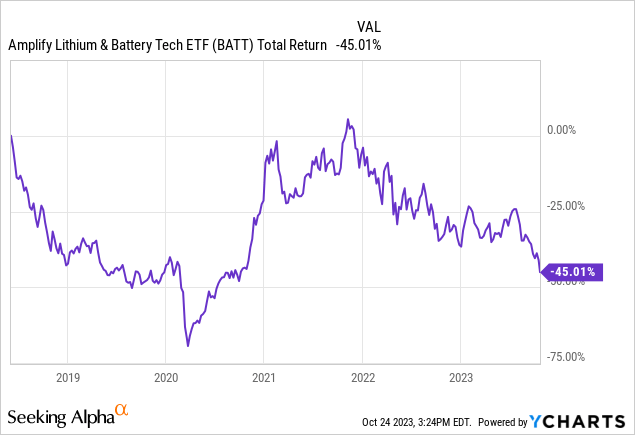

Despite all the future promises and advancements in battery industry, the fund's performance so far has been pretty poor. At one point the fund's price was down as much as -75% and now it's down -45% since inception. Some people will see this poor performance and stay away from the fund altogether while others may see it as a buying opportunity since the fund and its holdings sold off pretty significantly already.

Data by YCharts

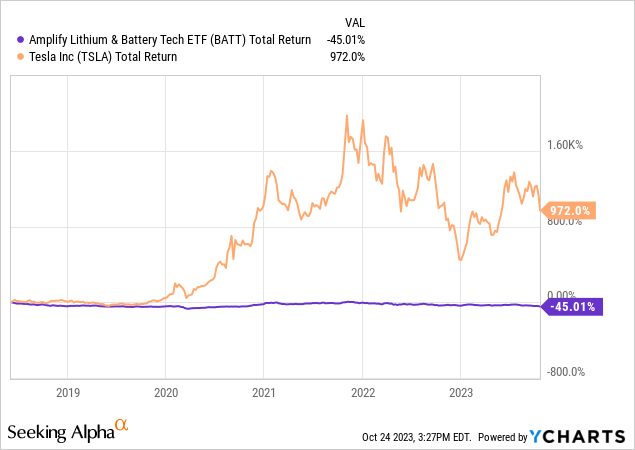

The fund's poor performance could have been driven by some of its foreign holdings. One of the fund's biggest holdings is Tesla which is up close to 1000% since the fund's inception even though the stock is down significantly from its 2022 high. Some of the fund's foreign holdings suffer from both being down significantly as well as currency risk since the US dollar has been getting stronger in recent years.

Data by YCharts

Another point of concern is that the fund has an expense ratio of 0.59% which is on the higher end of things. If the fund was outperforming I would understand paying this much for expenses but when a fund underperforms in such a significant way, the expense ratio looks pretty steep.

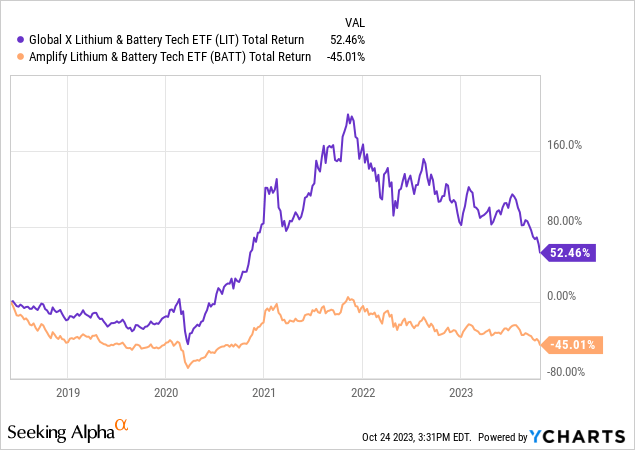

If investors would like to get exposure to Lithium and Battery industry there may be better funds out there. One such example is Global X Lithium & Battery Tech ETF (LIT) which is underperforming BATT by a pretty large margin. Since BATT's inception LIT's total return is up 52% versus BATT's being down -45%. At one point LIT's total return was as high as 160% before last year's bear market started so it looks like the better fund.

Data by YCharts

There is definitely money to be made in battery and energy storage business and this industry is still in early stages of a multi-decade secular growth but this fund doesn't seem like the best place to take advantage of this trend as it's been underperforming horribly since inception. Investors should still invest in this sector but probably use a different fund such as LIT.