hapabapa

Moderna (NASDAQ:MRNA) and Merck (MRK) reported data regarding their cutting-edge mRNA-based skin cancer regimen that includes the former's cancer vaccine, MRNA-4157. The companies recently reported promising results from a Phase II trial, demonstrating the vaccine's efficacy in treating melanoma. The data revealed a noteworthy 49% reduction in the possibility of cancer recurrence or death when MRNA-4157 was combined with Merck's immunotherapy Keytruda, compared to those receiving Keytruda alone. The 49% risk reduction was up from the 44% reductions reported around a year ago but also demonstrated a 62% decrease in the risk of “distant metastases” or death compared to those on Keytruda alone. This sustained effectiveness underscores the potential of the vaccine-Keytruda combo and is one of a few pipeline programs that are demonstrating that Moderna has more to contribute beyond their COVID-19 vaccine, Spikevax.

I intend to provide a brief background on Moderna and MRNA-4157. In addition, I will discuss the significance of this program and how it could impact Moderna's bullish outlook. Finally, I go over how this has influenced my views on MRNA, and my updated game plan for managing my position as we head into 2024.

Background on Moderna

Modern is now a household name for specializing in messenger RNA ((mRNA)) technology. The company's revolutionary approach involves using synthetic mRNA to instruct cells to generate specific proteins, offering an adaptable platform with implications across numerous therapeutic areas. Moderna gained credit for its hasty response to the COVID-19 pandemic, developing one of the primary authorized vaccines, Spikevax.

Beyond COVID-19, the company continues to invest in developing vaccines for other infectious diseases, such as influenza, RSV, Zika virus, and cytomegalovirus.

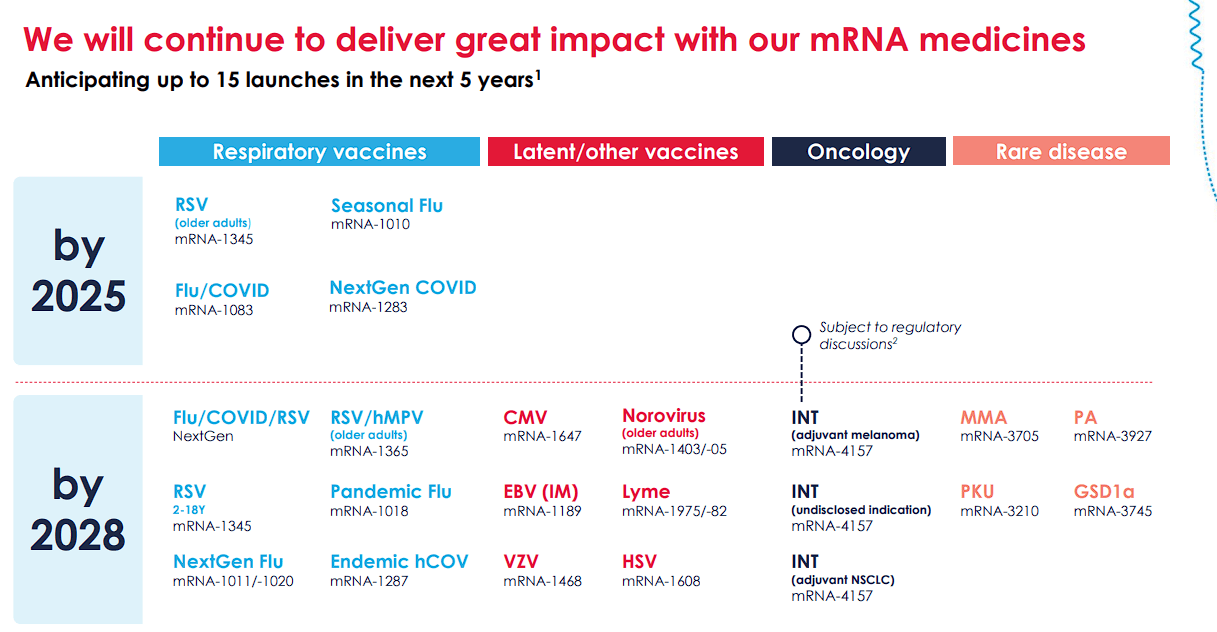

Moderna Expected Pipeline Launches (Moderna)

Moderna's mRNA technology holds promise for addressing rare genetic disorders by providing a platform for the development of targeted therapies, including cardiovascular indications that include programs targeting rare genetic disorders that lead to cardiovascular issues.

Moderna's incursion into oncology focuses on personalized cancer vaccines and innovative immunotherapies. The company's mRNA-based cancer vaccines are engineered to stimulate the patient's immune system to recognize and attack cancer cells, potentially providing a novel and effective approach to cancer treatment.

MRNA-4157

Moderna's oncology efforts have gained substantial interest with the development of MRNA-4157, an innovative cancer vaccine that is designed as a single synthetic mRNA encoding up to 34 neoantigens. The selection of these neoantigens is based on the unique mutational signature of the DNA sequence from the patient's melanoma tumor. Upon administration, the algorithmically engineered neoantigen sequences are translated within the body through natural cellular processes, facilitating antigen processing and arrangement critical for adaptive immunity. Moderna refers to this as Individualized Neoantigen Therapy (INT), which is a personalized approach that targets neoantigens, which are unique proteins generated by mutations in the tumor's DNA. One could say INTs are vaccines or immunotherapies, but much like a vaccine, they essentially prompt the immune system to recognize and attack what is not wanted in the body… in this case, it is the cancer cells bearing these neoantigens. The prospective benefit of INT therapy is that it enhances the precision and effectiveness of a cancer treatment by leveraging the unique genetic characteristics of each patient's tumor.

In conjunction with Merck's immune checkpoint inhibitor, Keytruda, the combination therapy aims to boost the body's capability to combat melanoma.

The journey of MRNA-4157 began with a Phase II clinical trial that had already posted solid data with participants experiencing a 44% reduction in the likelihood of cancer recurrence or death when treated with the combo therapy. The recent update from the Phase II trial showcases an even more impressive 49% reduction in the possibility of cancer recurrence or death, affirming the sustained efficacy of MRNA-4157 when combined with Keytruda.

This progress has not only prompted a boost in MRNA's share price but has also fueled speculation about the vaccine's potential for accelerated regulatory approval, given its current Breakthrough Therapy designation from the FDA. As MRNA-4157 progresses into a Phase III trial, its trajectory holds promise not only for Moderna but also for leveraging mRNA technology in oncology.

If successful, the MRNA-4157/Keytruda tag team would be a major step forward in how to treat melanoma and open the door to other indications.

Life Beyond Spikevax

While Moderna has been seen as a textbook example of medical innovation, it faces a critical challenge with the declining sales of the vaccine that launched them into the public eye, Spikevax. Initially celebrated as a pivotal player in the global response to the pandemic, the company is grappling with the unavoidable fading demand for COVID-19 vaccinations.

The decline in Spikevax sales can be attributable to several factors. Primarily, the rapid global vaccination efforts have led to a saturation point, with a significant portion of the population already vaccinated. Indeed, we now know that COVID-19 vaccinations will require annual boosters or updated shots for new variants. Still, over 72% of the world's population (as of March 2023) has received at least one dose of a COVID-19 vaccine series, with over 80% in first-world countries. As a result, the ongoing demand for booster shots and primary vaccinations has diminished, impacting the revenue stream generated by Spikevax.

Furthermore, the emergence of new variants and the subsequent development of variant-specific vaccines have added complexity to the vaccination milieu. Governments and health organizations are expanding their vaccine portfolios, opting for a mix of vaccines, which has contributed to a decrease in the exclusive reliance on a single vaccine brand like Spikevax.

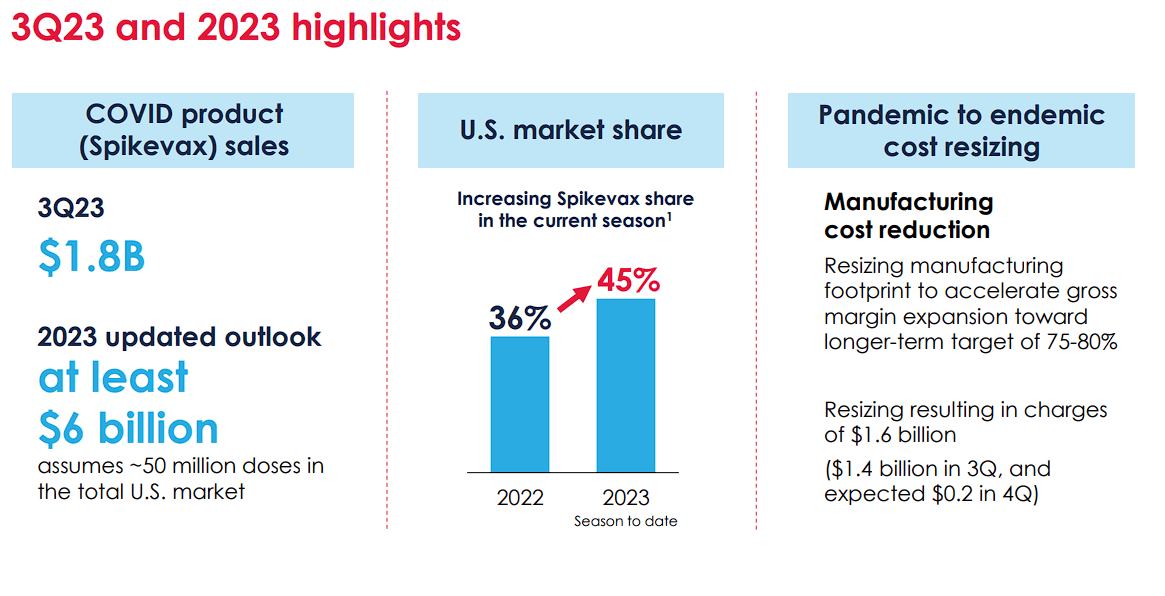

Yes, any sales of Spikevax should be celebrated by investors and the company's short-term benefits of being a preferred vaccine by governments and health organizations have provided Moderna with a mountain of cash, along with name recognition. Furthermore, Moderna has reported that Spikevax sales have recorded $1.8B in Q3 with their projection to be at least $6B for 2023. Moreover, Spikevax has gained market share thus far in 2023 over 2022.

Moderna Spikevax Q3 Sales and Market Overview (Moderna)

So, we have to acknowledge that Moderna is still reliant on Spikevax and should be a cornerstone product for years to come.

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” L x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

However, Moderna's long-term success will be dependent on their ability to pivot from a pandemic-driven revenue model to sustained growth through its diverse portfolio, including innovative therapies like MRNA-4157. Moderna needs to show that the diversified nature of their R&D efforts positions the company to leverage its expertise in mRNA technology across various therapeutic areas, mitigating the impact of shifting trends in pandemic-related vaccine demand.

Luckily, the company has their RSV vaccine (MRNA-1345) heading toward the FDA finish line with a PDUFA date in April of 2024. This should give MRNA a nice boost in the second half of 2024, however, it is unknown if the RSV sales will help offset the Spikevax sales fade.

As a result, the success of MRNA-4157 becomes even more crucial as it holds the potential to at least partially offset some of the declining sales of Spikevax and reaffirm Moderna's bull thesis. Although MRNA-4157 in melanoma might not be enough to immediately offset the COVID-related revenue out of the gates, I must point out that melanoma is a large market that is still growing. According to Merck's press release, global diagnoses reached nearly 325K in 2020. In the U.S., skin cancer is among the most prevalent cancer types, with an estimated ~100K new melanoma cases and roughly 8K connected deaths in the U.S. in 2022. So yes, melanoma is a big market opportunity. Moreover, melanoma requires novel therapeutics with five-year survival rates anticipated to be 60.3% for stage III and 16.2% for stage IV.

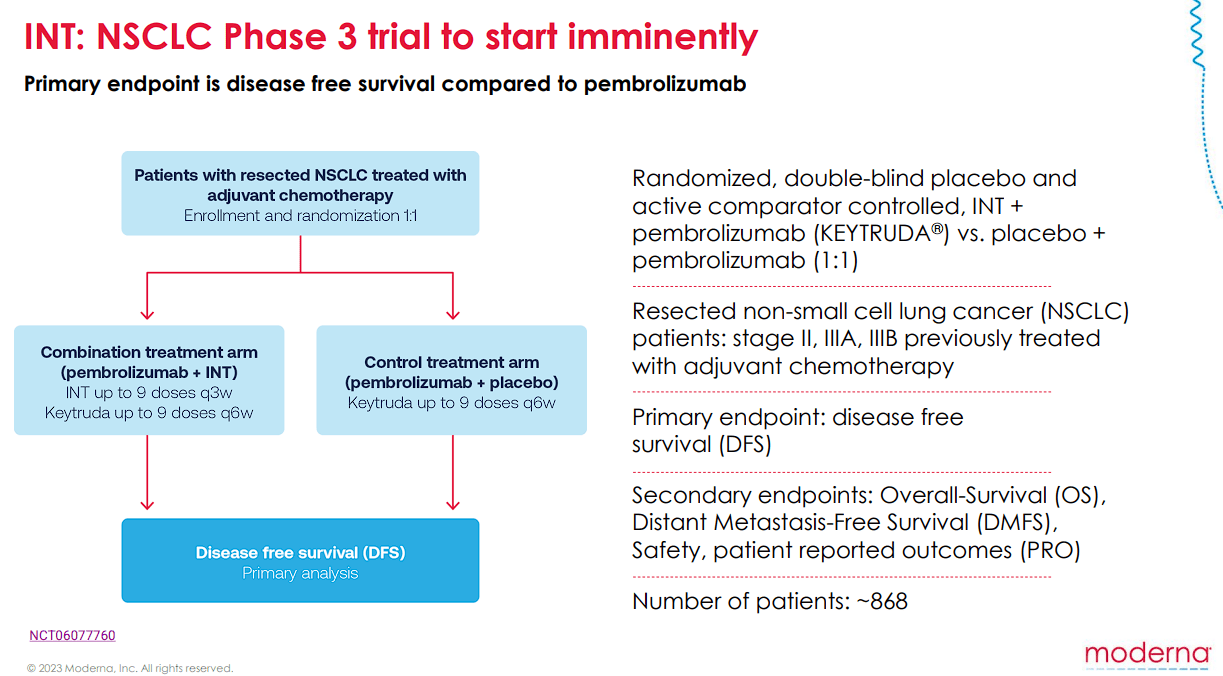

Not only would this combination would be a big step forward in how we approach the treatment of melanoma, but it should bode well for the use of INTs in other indications. The company is taking this approach with Keytruda in NSCLC, which is ready to start a Phase III trial.

Moderna NSCLS Phase III Trial Overview (Moderna )

So, Moderna should have plenty to offer in the coming years including the potential launch of their RSV vaccine in 2024 and a potential COVID plus flu combo vaccine in 2025. These product launches along with their efforts to resize their manufacturing footprint is expected to help them get to breakeven in 2026. Looking beyond that, Moderna's late-stage pipeline includes six Phase III assets, with a focus on respiratory programs, oncology, and potential regulatory discussions for accelerated approval based on strong data. Overall, their mRNA platform is expected to be responsible for up to 15 launches in the next five years.

So yeah, I think Moderna's future is promising, but the market is going to gauge the company's ceiling by how well MRNA-4157 can lead their efforts outside infectious disease and into oncology.

Some Concerns

While MRNA-4157's results are promising, caution is warranted due to the possibility that the FDA might prefer data from a larger trial before deciding on accelerated approval, especially considering mixed results in patients with specific mutations thus far. I do not doubt that MRNA-4157 will make it through the FDA, but I believe the market has set the bar high for this program considering the two companies involved. So, we could see a strong impact on the share price if the FDA decides to hold off on the accelerated approval designation.

Another crucial concern to consider is the underlying challenges tied to the decline in sales of Moderna's primary revenue source, Spikevax. Certainly, I have already covered this, but investors should consider the possibility the demand for Spikevax dries up in 2024, pushing the company's goal of hitting breakeven in 2026. Moderna's pipeline and R&D efforts are not cheap and produced a Q3 Net loss of $3.6B compared to net income of $1B in 2022. Thankfully, Moderna finished Q3 with $12.8B in cash and investments, with the expectation to have a cash balance of about $9B at the end of 2024 and roughly $6B-$7B in 2025. Then, Moderna expects to launch five new products to move them to breakeven in 2026. So, any setback in the pipeline or financially that moves that breakeven point back can put the ticker into the doldrums as investors fear dilution and elevated cash burn.

Considering these risks, I am keeping my MRNA conviction level at 3 out of 5 and the ticker will remain in the Compounding Healthcare “Bioreactor” Growth Portfolio.

My Plan

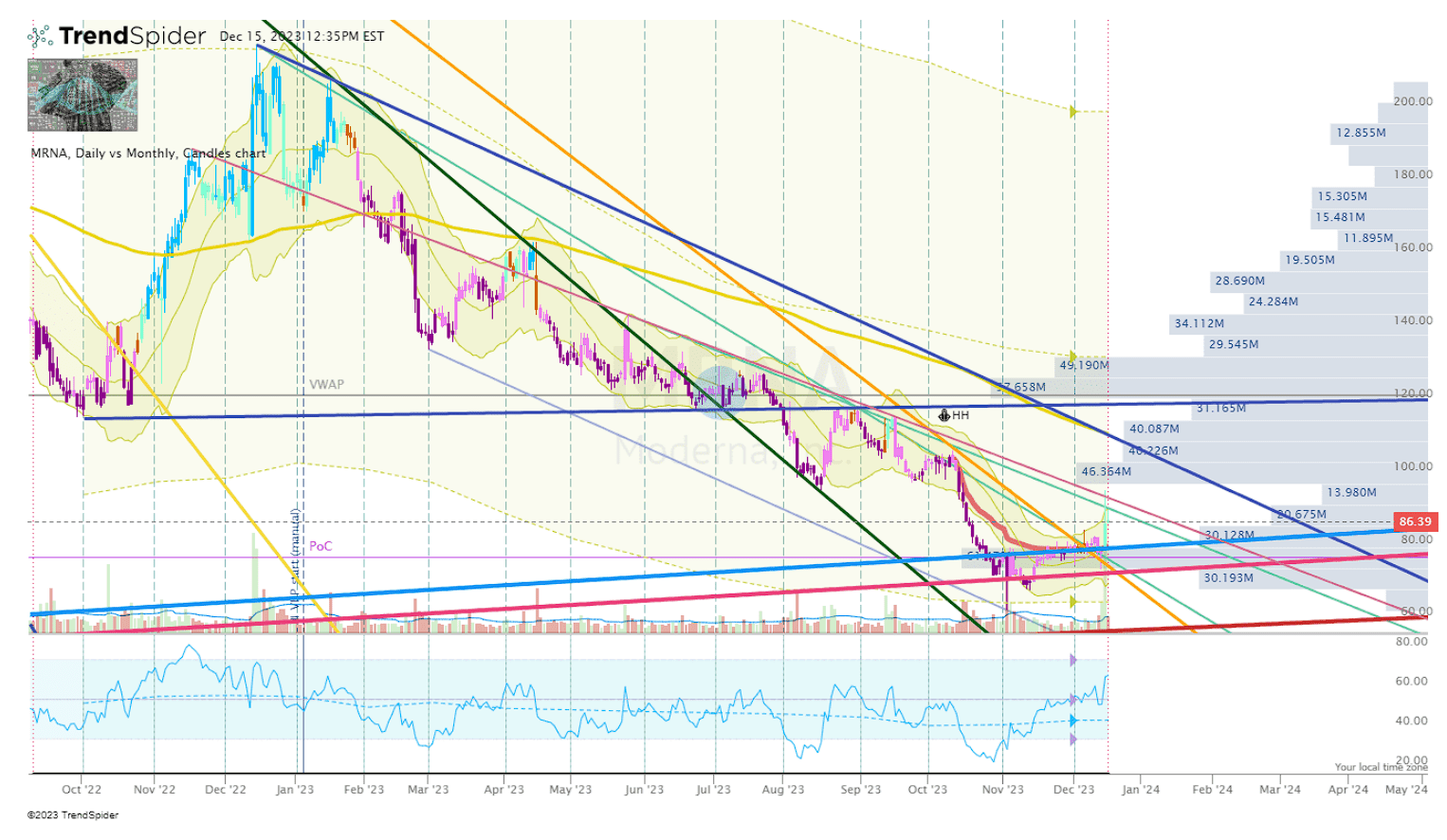

Like most of my growth tickers, MRNA has not been on the top of my watch list over the past few months as I have targeted discounted dividend tickers and speculative healthcare names that have experienced unjustified selloffs. Following the recent data release, I am taking a closer look at MRNA and it appears to be good timing if you look at the Daily Chart.

MRNA Daily Chart (TrendSpider)

The share price just broke a long-term downtrend ray and is still sitting above a long-term uptrend ray. In addition, the share price is above the anchored-VWAP from the proximal-high and we have seen a bullish divergence in the RSI. This encouraged me to add the position, however, I am going to keep a close eye on MRNA as we close out 2023 to see if we get a potential retest of the support. If the ticker does confirm support, I will make another small addition before the first of the year. However, I believe Moderna is not going to make a rapid return to its previous highs soon, so, I am going to keep the ticker near the top of my “Bioreactor” watch list for 2024 and anticipate making at least a few additions if the share price remains under my Buy Threshold.

Long term, MRNA will remain in the Bioreactor growth portfolio for the foreseeable future in anticipation the company can move beyond infectious diseases with their mRNA technology and can hit their goal of breakeven in 2026.