Alibaba Group Holding Limited (NYSE:BABA) is undervalued by looking at traditional financial metrics. The “elephant in the room” for this stock is the political risk associated with investing in Chinese equities. BABA has been a primary target in the Chinese government's crackdown on corruption and private company ownership. This article will discuss the political risks involved and evaluate whether BABA is a stock worth considering.

Thesis: BABA is a Risky Asymmetric Bet against the current Chinese political leadership

BABA, like other Chinese stocks, is not suitable as a long-term investment. Political risk, considering the current economic policies and political stance of the Communist Chinese Party (CCP) is simply too high. The market has been correctly discounting this risk, proving bulls wrong time and time again.

In this context, the fact that the stock is dirt cheap by any traditional financial metric simply doesn't matter. A stock can be cheap, but if the company's leadership is indifferent or actively discouraged by politicians from rewarding (foreign) shareholders, there is no viable investment story.

The only reason to invest in BABA right now is to bet on a change in current Chinese economic policies. Personally, I don't recommend this because political risk is nearly impossible to quantify. Therefore, I rate the stock as a SELL.

Yes, BABA is dirt cheap but it doesn’t matter

Looking at any financial metric traditionally used to value a publicly listed company, BABA is dirt cheap. The company has a P/E ratio of just above 9 at the time of writing, compared to a P/E of 41 for Amazon.com, Inc. (AMZN) and a 49 P/E for MercadoLibre, Inc (MELI).

The company is also very profitable. It generated the equivalent of roughly $ 10 Bln in Net Income in 2023. More recently, BABA has beaten Q1 expectations both in terms of Revenue as well as in Earnings. While BABA is not growing revenue as it used to (or with numbers in line with other tech companies), it is still growing both top and bottom line – most recently with a 5% growth in revenue in Q1.

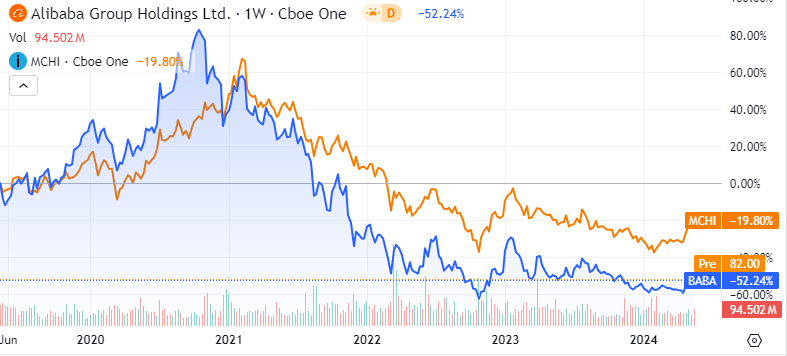

Many articles on SeekingAlpha focus on the fact that BABA is priced very attractively as a key reason to invest in the company. This is absolutely true, but it is also meaningless. The company has delivered solid financial results over the past four years, yet the stock has lost 50% during that time and is down more than 70% from its historical peak. Clearly, there's more at play than just financial metrics.

What's affecting BABA is political risk. That’s why I believe the key focus for considering a position in BABA today should be on political risk, not the company's financial results. That's precisely what I will explore in the next sections.

The Elephant in The Room: Political Risk

I believe the best approach to understand political risk for BABA is presenting a timeline of events related to the CCP’s economic policies and attitude towards Chinese private companies.

The picture that will emerge from the next paragraphs is of a country that first embraced globalization, friendly relations with the West, and capitalism. Then, it gradually reversed these policies, becoming increasingly focused on nationalism, a new world order, and a Chinese 2.0 version of communism blended with capitalism.

I won’t comment on how these decisions might affect China’s future as a country. However, for foreign shareholders, this paradigm shift makes BABA and other Chinese stocks not investable.

BABA stock vs. Chinese Stock Market (Seeking Alpha)

Dengism and China in the 1980s and 1990s

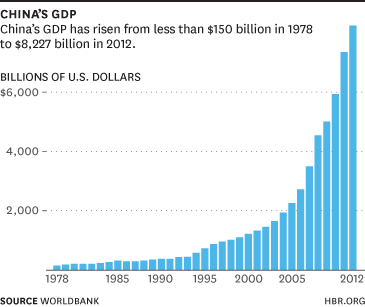

China’s economic success story started in the early 1980s with the leadership of Deng Xiaoping. His theories, which later became known as Dengism, started from fundamentally acknowledging the relative failure of Maoism given the poor state China was in at the turn of the 1980s.

Deng Xiaping decided to focus on pragmatic and market-oriented policies to drive economic growth. Key theories included the “socialist market economy,” which combines socialist principles with market mechanisms, and the focus on “reform and opening up,” promoting foreign investment and private enterprise. Dengism advocated for gradual modernization, prioritizing economic development and improving living standards while maintaining the Communist Party's political control.

As a result of Dengism, China enjoyed a massive economic development in the 1980s and 1990s. It is estimated that more than 700 Million people were lifted out of poverty as a result of Chinese economic growth.

China's GDP Growth, 1978 to 2012 (World Bank, HBR.org)

The VIE structure as a way to open China to the West

For foreign investors to participate in what de jure was, and still is, a communist country, the Variable Interest Entity (VIE) structure was introduced in 2003. This is a legal framework used by Chinese companies to circumvent restrictions on foreign ownership in China. Under the VIE structure, a Chinese company creates an offshore entity – often in the Cayman Islands – that enters into contractual agreements with the Chinese operating company, giving the offshore entity control over the domestic firm's profits and decision-making.

Still to date, foreign shareholders like US-based readers can only invest in Chinese stocks via a VIE Structure. The most obvious risk with this structure is that China could easily force a local company to cut ties with the offshore legal entity. There is no legal framework within China that allows foreign ownership of local assets, nor foreign shareholders are protected according to local law.

While the VIE structure was not seen as an issue when it launched, I believe today it does represent an added level of risk in the context of escalating tensions between China and the West, and the 180 degree turn that the current leadership of the CCP is doing on Dengism.

Xi Jinping and the return of “Common Prosperity”

Xi Jinping was voted into power by the CCP in 2013, following nearly three decades of China’s outstanding economic growth. In 2017, Xi Jinping hinted for the first time at what he defined as “a new way of socialism”. In a nutshell, the CCP leader emphasized the need for strong government intervention, a rejection of Deng’s economic policies, and the start of a “new era” for China. At that time, the market for Chinese equities hadn't fully discounted this political risk. I believe this was because Xi Jinping’s words were seen mostly as propaganda, and the markets didn't expect substantial changes in China.

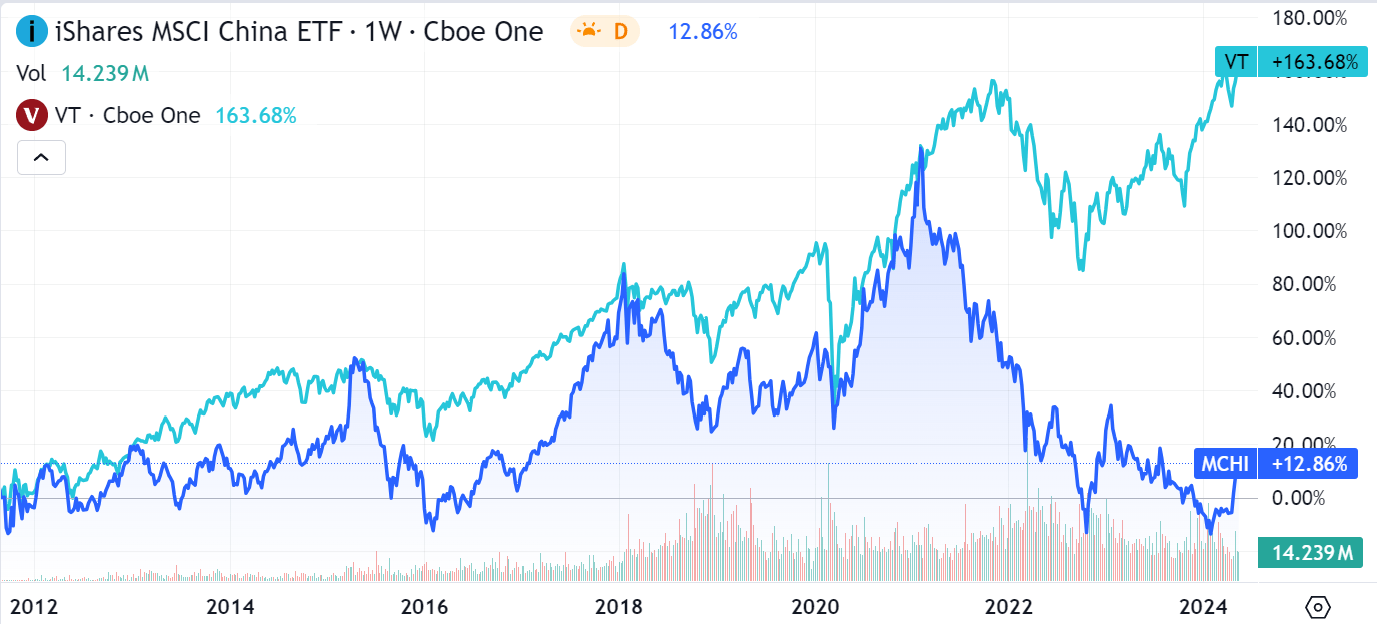

However, in 2020, Xi Jinping’s economic plans suddenly became very clear when the CCP asserted how the government needed more control over private companies in the country. While the COVID pandemic was used as an excuse for these interventions, I believe markets finally came to the realization that China was becoming uninvestable. Chinese equities started severely lagging behind global equities exactly as of 2020.

Chinese stocks have collapsed since 2020 (Seeking Alpha)

Shortly after, in 2021, Xi Jinping doubled down, asserting how private companies should have as their first priority “common prosperity”, an ideological concept tracing back to the early days of Mao’s China.

The situation has not changed from 2021, but only worsened. Xi Jinping and the CCP have kept signaling continuity on their new policies. In late 2023, Xi Jinping urged once again private firms to be “rich and loving” in pursuing prosperity for all.

Additionally, China’s relationship with the West is as tense as ever. China is closing its diplomatic and economic ties with Russia, and recently has been targeted with new tariffs by the Biden administration in the USA.

Impact on BABA

BABA was one of the companies that most suffered from the slow 180 degrees turn from Dengism to Xi Jinping’s revival of “common prosperity”. As a prominent Chinese Tech stock, with strong international backing, BABA was made an example of by the CCP.

The company was under a long investigation and it ended up being fined the equivalent of $ 2.8 Billion and forced-split into different legal entities, following a landmark Chinese antitrust case. Unlike the US or most Western countries, the Chinese judiciary system has no independence whatsoever from the Chinese government, as prescribed by the Chinese system of unified power. There is no doubt in my mind that this antitrust case had little to do with actual antitrust laws, and everything to do with sending a signal to Chinese companies that they need to comply with the CCP’s economic policies.

Jack Ma, the eclectic founder of BABA, has also effectively disappeared from the public eye since 2020, except for a brief appearance via video call in 2021. He is not alone, joining a plethora of other Chinese corporate executives that have disappeared from the public in the last five years.

Shareholders’ focus matters, and BABA has a fiduciary duty to the Chinese government, not to shareholders

I believe shareholders' focus is one of the most important, yet often overlooked, factors in evaluating an investment thesis. I prefer buying an expensive company with a great track record of prioritizing shareholders' returns over a cheap company with no focus on shareholders.

In the case of BABA, the company’s management is mandated by the Chinese government and legal framework not to prioritize foreign shareholders. In this context, the company's performance doesn't matter. Even if BABA were to exceed all expectations in profitability, foreign shareholders wouldn't have priority access to those profits. The priority goes to the CCP and their “common prosperity” projects.

When the CCP explicitly says that BABA needs to put “common prosperity” before shareholders’ returns, management has no choice but to follow through.

China has been heavily promoted as the protagonist of a new world economic order, including by prominent personalities like Ray Dalio. I believe this contributes to the “blindness” of China bulls on the dire state of what investing in China as a foreign shareholder is.

In my view, China remains uninvestable. It is governed by a totalitarian regime that can make people disappear if they don't follow its direction. As Western investors, it's easy to overlook this reality, but it directly impacts BABA’s top management. Their careers and lives are at stake.

BABA is an asymmetric bet on Chinese economic policies

I see BABA today as an asymmetric bet. The company itself is solid, very profitable and enjoys a reasonable moat in eCommerce and the Cloud in China. If the CCP suddenly changes its political direction, re-opening its doors to globalization and the West, this stock could do a 10X return from current levels. That’s because the sole reason why BABA is so cheap from a valuation perspective has to do with political risk, not company metrics.

I usually like asymmetric bets, as I described in my recent article about Palantir, which I also see as an asymmetric bet. However, in the case of BABA, this bet doesn't depend on the company’s performance, management, or market adoption of its services. It depends solely on the direction of China's economic policies in the coming years. Political risk is by definition the most difficult and unpredictable to foresee, so my recommendation is to avoid BABA.

I would rather bet on politics in Brazil than in China

If I were to invest in a stock to bet on a country’s politics, I would rather look at Brazil than China. Specifically, I would consider Petróleo Brasileiro S.A. – Petrobras (PBR). Petrobras, Brazil's government-owned national energy company, is heavily influenced by politics and often used for electoral purposes. Recently, the newly established government fired the company CEO, and profitability has plunged due to political pressures to keep fuel prices low in Brazil. As a result, Petrobras trades at just above a 4 P/E and pays a 7.3% dividend.

I prefer betting on Petrobras because Brazil is a democracy, offering regular, timely opportunities for leadership and policy changes. Unlike China, Brazil also has a Western-like legal framework, an independent judiciary, and strong governmental institutions. As a cherry on top, Petrobras pays an enticing dividend. Although the dividend has historically been unreliable, it still offers a decent return while waiting for the next election.

Risks to my thesis

The main risk to my thesis is that BABA pays off as an asymmetric bet. If the CCP decides to turn its policies back to globalization and openness with the West, BABA is set to disproportionately benefit from this. While I am not weighing on what are the chances this happens, I also believe the market by now has discounted a dire situation for China going forward, therefore a lot of upside exists.

Another risk is that BABA slowly recovers over time, with the market having priced in already the worst case scenario. While this has not happened – and BABA has been on a steady, slow decline for the past four years, we might have reached the bottom for its valuation.

Another consideration relates to the dividend policy of BABA. BABA’s current dividend yield, at 1.2%, is hardly enticing considering the current high interest rate environment for the USA. However, the company might decide to start paying a juicer dividend, as a way to reward foreign shareholders without necessarily going against the CCP. If that were to happen, a high dividend might make BABA a more appealing play, in the context of betting on the CCP to eventually change its course as far as economic policies go.

Conclusion

I believe many China and BABA bulls choose to turn one blind eye (or two) to political risk in the country. However, China remains a totalitarian government that has no reason whatsoever in protecting the interests of foreign shareholders. Political tensions between China and the West are also growing, most recently with US tariffs imposed on a series of Chinese exports.

BABA has faced significant pressure from the CCP as they shift towards a “common prosperity” economic plan. However, if the CCP returns to Dengism and globalization, BABA stands to gain significantly from current prices. This potential for growth makes BABA an asymmetric bet on the CCP's economic policies. However, due to the unpredictable political landscape, this is not a bet I would recommend anyone take.