J Studios/DigitalVision via Getty Images

Washington is planning to hike the tariffs on “new three” green goods imported from China; Electric Vehicles, Solar Panels, and Batteries for EVs. According to people familiar with the matter, as cited by Reuters, the Biden administration is expected to unveil higher import levies on semiconductors and other Chinese products as early as this week, along with new duties of up to 100% on Chinese electric vehicles. The decision comes after a long review of tariffs imposed by former President Donald Trump on roughly $300 billion in goods from China.

One might think this decision would directly impact the Chinese EV imports into the U.S. market. Although this is true, the reality of the situation is a bit more complex than it seems to be. This article will cover what we can expect from the Biden Administration, how China will likely respond to this tariff hike, and whether there will be an impact on U.S. automakers – positive or negative.

The Expectations Of The Biden Administration

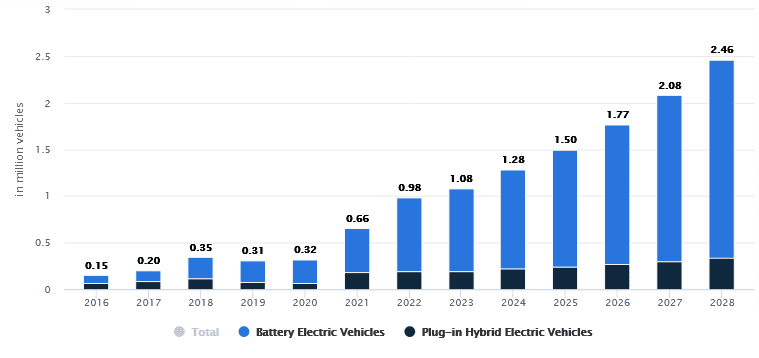

The clean energy market is expected to reach great heights in the coming years, and EVs are one of the critical components in the path to a greener future. The U.S. EV market is expected to reach a revenue of $82.8 billion in 2024, according to Statista. Given the exponential growth expected in EV sales and the key role EVs will play in helping the earnings growth of U.S. automakers, the industry would welcome a decision to hike tariffs on imported cars, especially the ones that are coming from China.

Exhibit 1: EV sales projections in the U.S.

Statista

China's rampant export growth of clean-energy goods has prompted concern in Washington. Although China does not directly sell electric vehicles (EVs) in the U.S., it does own shares in other foreign companies that do. Since China can undercut U.S. manufacturers with cheaper yet highly advanced EV models with features including Battery Technology (BYD Blade Battery and NIO Ultra-Fast Battery Swap), Autonomous Driving Features (XPeng Navigation Guided Pilot and HiPhi X Programmable Headlights), Large Touchscreens and User Interfaces, and Advanced Driver-Assistance Systems, many stakeholders are raising concerns about the future of American EV manufacturers, with some claiming it might cause extinction of U.S. made EVs. U.S. officials are working to defend a developing American clean-energy industry from China. This tariff hike can be seen as a significant milestone in achieving this goal.

The people familiar with the situation, who wish to remain anonymous, have revealed to several news outlets that President Joe Biden will announce the next steps in this strategy this week at a White House ceremony where he will impose the added duties on Chinese electric vehicles and dramatically raise taxes for other critical industries. This comes after almost two years of consideration and continuous review. The anonymous sources also state that the overall tax on Chinese EVs will increase from 27.5% to 102.5%, though the exact extent is yet unknown. Along with that, an additional 2.5% duty will apply to all automobiles imported into the U.S.

Although it's unclear if any kind of goods were spared, President Biden is unlikely to declare any decrease in tariff rates. However, it is possible some products used in the solar sector, such as machinery used in the production of solar panel components, may be excluded.

Potential Impact Of Tariff Hikes

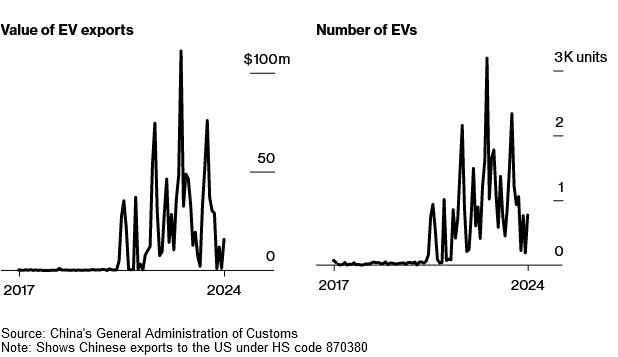

The Chinese EV sector, despite the threat posed by an increase in tariffs, may still come out unscathed with only a minimal level of impact from the new tariff hike. In 2018, during his presidency, Donald Trump imposed a 27.5% tariff on Chinese EVs. When Biden took over the White House, he extended the tariff regime which helped Washington to keep the number of Chinese EVs on U.S. roads extremely low. However, given the scale of Chinese production, officials from the Biden administration and automakers are concerned that the current policies would not be sufficient to keep Chinese EVs at bay.

Exhibit 2: Chinese EV exports to the United States

Bloomberg

However, there is a significant risk for Beijing in other markets due to the U.S. tariff hike. According to Dylan Loh, an assistant professor of politics at Nanyang Technological University in Singapore, Biden's symbolic stance against Chinese electric vehicles can create unfavorable conditions for China in markets where it has a strong market share, especially in Europe. The EU has already launched an investigation into China's state subsidies for its dominant electric vehicle industry. The speculated tariff hikes could fuel such negative cases against China.

The Solar Panel segment is also likely to experience minimal impact. Owing to current tariffs, much of the solar panel trade already passes through Southeast Asia rather than direct shipments from China. Reports suggest some manufacturers are transporting their Chinese solar equipment via neighboring countries to evade U.S. taxes. Despite U.S. manufacturers raising concerns about this situation, no action has been taken thus far to tackle it. Therefore, the effectiveness of the elevated tariffs remains questionable.

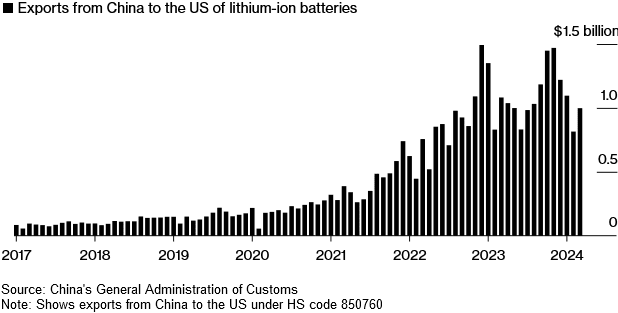

The one area where China could feel the impact is with Automobile Batteries. These exports have increased significantly over the last several years as Chinese businesses have dominated the market while U.S. businesses have found it difficult to supply the demand for batteries for electric vehicles. However, recently, a pattern of decline in Chinese batteries has been observed, meaning the inflow from China is slowing down on its own. Additionally, the new Inflation Reduction Act also makes Chinese batteries less attractive for automakers.

Exhibit 3: China's lithium-ion battery exports to the United States

Bloomberg

How Will China respond?

The trade war between the world's two largest economies has been going on for many years now. If introduced, this tariff hike would become one of President Biden’s biggest moves in the trade war with China. The actions of the U.S. are likely to violate the WTO regulations, however, and the new tariffs run the danger of escalating the two nations' trade conflicts.

The actions are “doubling the U.S.' fault,” Chinese Foreign Ministry spokesperson Lin Jian said at a press briefing on Friday in response to reports of possible new tariffs. She mentioned that economic exchanges and trade between China and the U.S. have been severely disrupted by the tariffs imposed on the country by the previous administration in Washington. Lin urged the U.S. to abide by WTO regulations. “China is determined to protect its interests and rights at all costs,” she added.

The hype around China's “overcapacity” and the rumored taxes on Chinese EVs indicate that the U.S. is stepping up trade protectionism amid China's increasing dominance in the global EV market. If this tariff hike brings about a substantial benefit to local EV makers, it would highlight that even with a 25% tariff, U.S.-made EVs failed to compete with imported Chinese EVs, confirming China's EV supremacy in other global markets. Chinese experts also believe through hefty tariffs, the U.S. can only sustain the growth of the local industry. This is something that I truly agree with.

Given the low export volume, experts predict that the total impact of the new tariffs on Chinese EVs will be minimal, as already established. Thus, raising tariffs on Chinese goods is primarily a political move intended to influence election results, according to some Chinese analysts. Both the Republicans and Democrats are exploiting the trade war to gain political advantage in the upcoming Presidential Election, according to these analysts. Donald Trump declared in March that he would impose a 100% tariff on “every single car that comes across the line” from Chinese-owned manufacturing facilities.

There are a couple of ways that China could respond to this situation. The first and most obvious way would be the Chinese government imposing tariffs on U.S. EVs. Tesla, Inc. (TSLA) and Ford Motor Company (F) have a substantial market presence in China as they manufacture and Sell EVs in China.

In retaliation, China might also target U.S. agricultural exports by boosting imports of goods like soybeans, corn, and pigs from other nations. Brazilian corn imports from China increased from zero to over $700 million per month over the last 18 months, making it China's primary supplier, a title that the U.S. held previously. This is a testament to how China could use this strategy to hurt the American economy. Also, it is important to note that only about 7% of U.S. exports went to China in 2023, down from about 10% of annual exports to China in previous years. Therefore, it is evident that the Chinese retaliation might impact U.S. export capacities. Only about 15% of Chinese exports went directly to the U.S. last year, down from around 21.1% over the past two decades.

Alternatively, China may not take any significant moves against the U.S. Since a large portion of the export trade now passes via other nations, Chinese manufacturers may hardly be affected by these U.S. tariffs, particularly if another country is exporting Chinese components to produce the final goods, such as in Vietnam or Thailand. If the U.S. attempts to extend the tariffs to these nations, it may jeopardize relations with countries it seeks to strengthen its relationship with to gain an advantage against China. Thanks to these complex international supply chain repositionings, the direct effects of tariff hikes have dwindled.

What Will Be The Overall Impact On U.S. Automakers?

In theory, higher tariffs would make Chinese EVs more expensive and less competitive with American-made EVs in the local market, providing some breathing space for U.S. automakers, particularly those concentrating on the mid-range market. However, as we discussed, Chinese EVs are already kept out of the U.S. market due to the tariffs imposed by the Trump Administration. Therefore, the additional tariffs would likely make little in terms of a sales boost for U.S. automakers. On the other hand, the total elimination of more cost-effective and highly advanced Chinese EVs could restrict consumer options, potentially slowing down overall EV adoption. For example, even with the current 25% tax, Volvo EX30, which is produced in Geely's China facility, has a starting price of about $35,000 only. Adding another threefolds of tariffs would make this model inaccessible for many U.S. consumers.

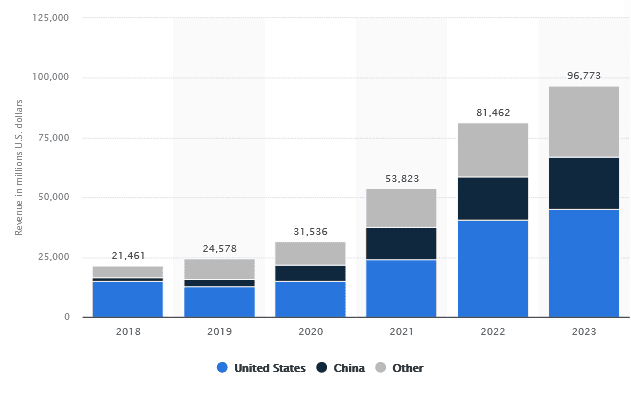

The effect on global markets is hard to decipher just yet before looking at some real-world data. In certain areas, U.S. EVs may become more affordable than Chinese versions if U.S. allies decide to join hands. However, the trade retaliation from China may make it more difficult for U.S. automakers to compete globally. If China imposes tariffs on Tesla and Ford for their EVs, it would significantly impact the sales of these companies in China, which is the most important market for EVs globally.

Exhibit 4: Tesla revenue by geographic region

Statista

The new tariffs are likely to provide U.S. EV manufacturers a protected zone. The protected zone will not push the EV automakers to effectively compete against Chinese EV makers. The U.S. cannot afford to be slower than China in developing its EV industry and introducing advanced technologies to drive the industry forward. Consumer preferences are changing, and the U.S. needs to adapt. Affordable EVs like the Chevy Bolt (starting at $26,500), which was discontinued by General Motors, demonstrate the struggles faced by American EV makers today. Elsewhere in the world, China is making long strides in popularizing affordable EVs.

Tariffs are usually not as successful as well-crafted industrial policies and subsidies in bolstering homegrown businesses. The Inflation Reduction Act's tax credits are a successful policy that incentivizes domestic manufacturing without resorting to tariffs. Tariff hikes, in my opinion, may end up harming the American auto industry more than boosting its potential.

Takeaway

The Biden Administration, according to sources, is gearing up to substantially hike tariffs on Chinese EV imports. While this sounds like a prudent strategy to boost the domestic EV industry, the findings of this analysis suggest China's global dominance of the EV sector will not be threatened by such a move. On the contrary, U.S.-made EVs may end up being poor performers in global markets, opening China to establish itself as the true leader in the EV sector.

I am monitoring new developments in this space closely as I have a stake in Ford, and I am planning to assess how a potential tariff hike could impact Ford's EV business both in the U.S. and China.